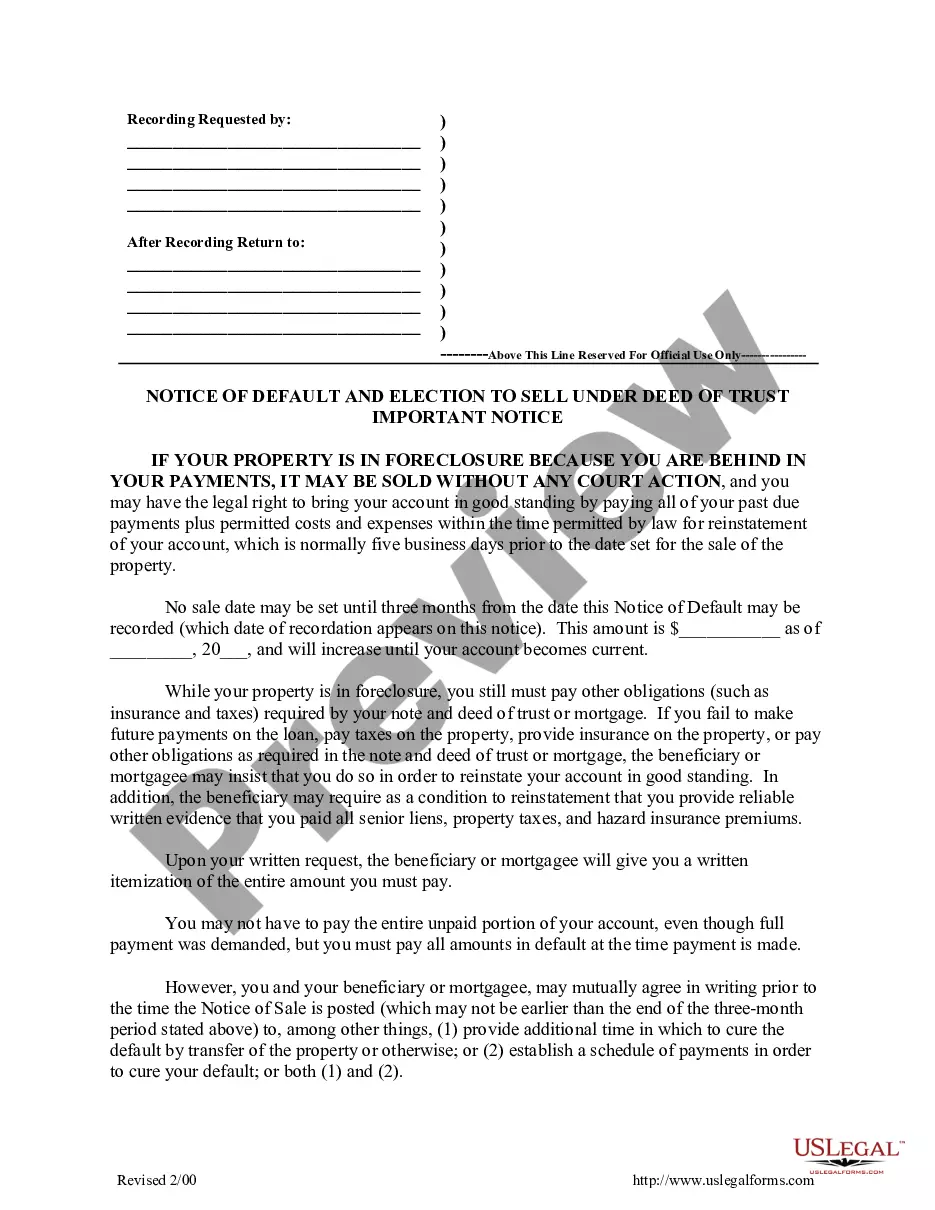

California Notice Of Default Foreclosure

Description

How to fill out California Notice Of Default And Election To Sell Under Deed Of Trust?

It's clear that you can't transform into a legal expert instantly, nor can you discover how to swiftly prepare a California Notice Of Default Foreclosure without possessing a targeted skill set.

Assembling legal paperwork is an extensive undertaking necessitating specific education and expertise. So why not entrust the formation of the California Notice Of Default Foreclosure to the specialists.

With US Legal Forms, one of the most comprehensive libraries of legal documents, you can locate everything from judicial papers to templates for office correspondence. We recognize how vital it is to comply with federal and state statutes and regulations. That’s the reason all templates on our platform are tailored to specific locations and are current.

You can regain access to your forms from the My documents section whenever you wish. If you’re a current customer, you can easily Log In and locate and download the template from the same section.

Irrespective of the purpose of your documents—whether it’s financial, legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Find the document you need by utilizing the search box at the top of the webpage.

- View it (if this feature is available) and review the accompanying description to verify if the California Notice Of Default Foreclosure is what you're seeking.

- Restart your search if you require a different template.

- Create a free account and select a subscription plan to acquire the template.

- Click Buy now. Immediately after the transaction is finalized, you can download the California Notice Of Default Foreclosure, fill it out, print it, and send or mail it to the required recipients or organizations.

Form popularity

FAQ

Once you submit a request to enter default in California, the court will review your application. If approved, the default is entered, and the opposing party may lose the ability to defend against your claims. Understanding the consequences of this step is essential for those navigating a California notice of default foreclosure.

30 days after contact, lender can record a Notice of Default You have 90 days from the date that the Notice of Default is recorded to ?cure? (fix, usually by paying what is owed) the default. You can use this time to try to negotiate a loan modification or repayment plan.

A notice of default is the critical and longest step in the California foreclosure process. It's filed by the lender to let the borrower know that they are proceeding with nonjudicial foreclosure, and sets the time table for repayment if the borrower wishes to avoid foreclosure and keep the home.

California notice of default key facts and timelines You are at least three payments and 120 days behind in your mortgage. Your lender has contacted you in person or by telephone at least 30 days before the notice of default is filed.

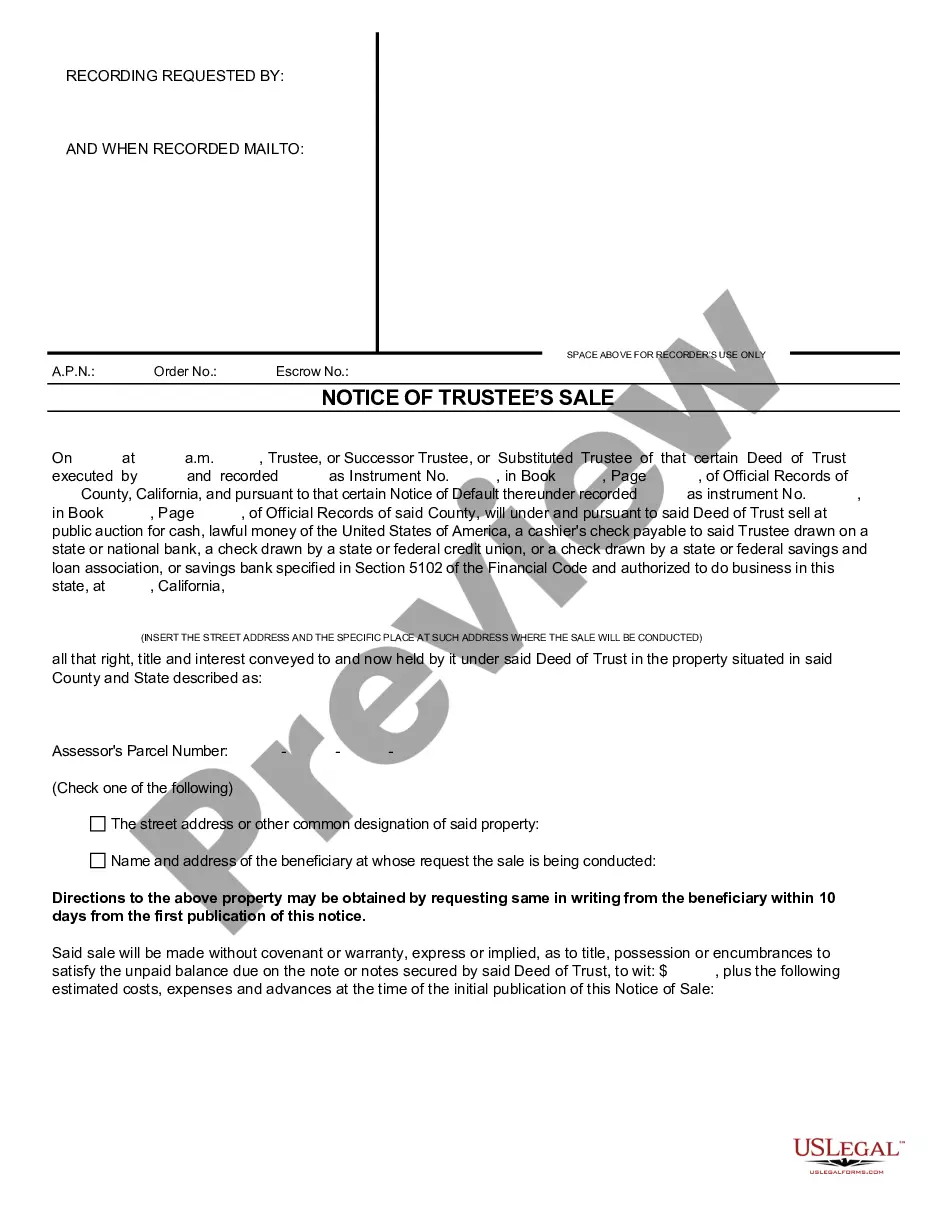

You have 90 days from the date the Notice of Default is recorded to pay what you owe to the lender. If you pay the amount on the Notice of Default, the lender cannot sell your home. Notice of Trustee Sale ? If you don't pay within 90 days, a Notice of Trustee Sale will be recorded against your property.

A notice of default is a public notice that a borrower is behind on their mortgage payments. (Also known as being in default on their loan.) It's typically filed with a court and regarded as the first step in the foreclosure process.