Enhanced Bird Husband For The Future

Description

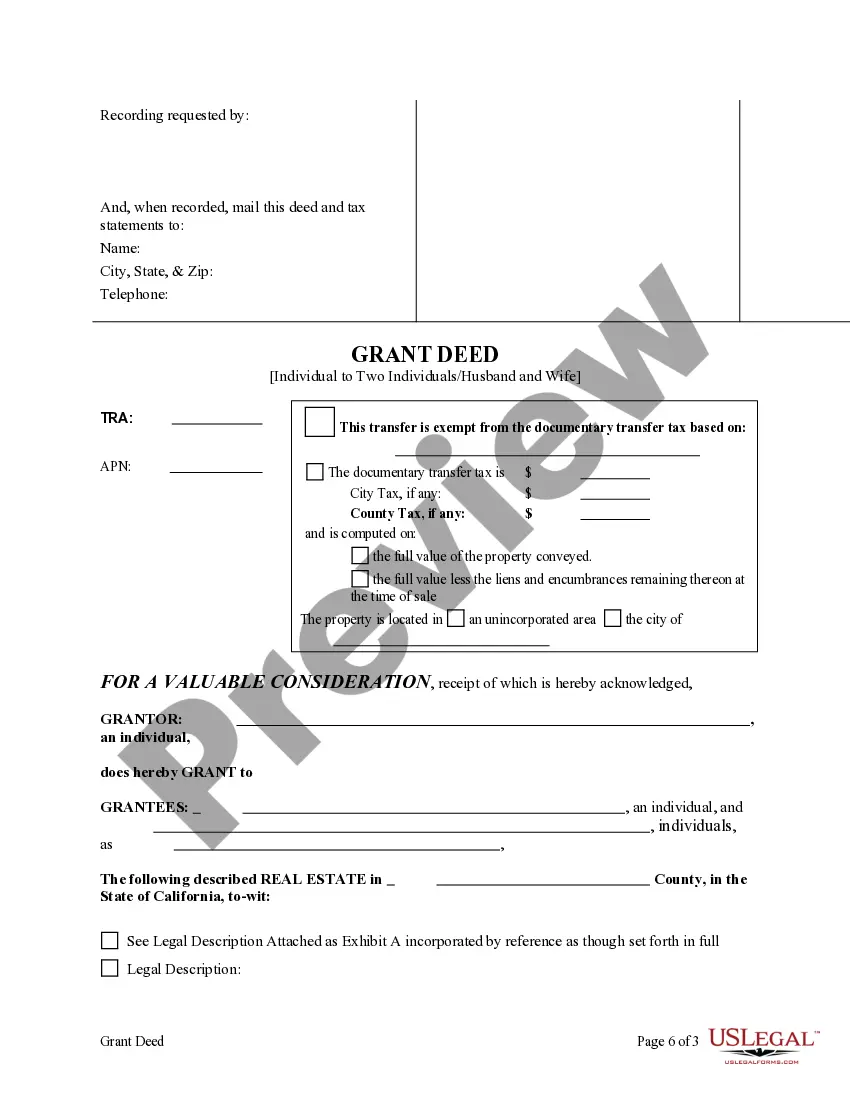

How to fill out California Enhanced Life Estate Or Lady Bird Grant Deed From Individual To Two Individuals Or Husband And Wife?

- If you are already a user, log in to your account to download the required form template. Ensure your subscription remains active; otherwise, renew it according to your plan.

- For first-time users, start by checking out the Preview mode and form description to ensure you select the right document that complies with your local laws.

- If the initial form doesn't meet your requirements, utilize the Search tab to find another template that suits your needs better.

- Once you've found the appropriate document, click the Buy Now button and select your preferred subscription plan. You'll need to create an account for access to the library.

- Complete the purchase by providing your payment details via credit card or PayPal.

- Finally, download the form and save it on your device. You'll also find it accessible in the My Forms section of your profile whenever you need it.

By utilizing US Legal Forms, you gain access to vast resources that simplify the often daunting process of legal compliance for bird ownership. With over 85,000 forms and expert assistance, ensuring your bird husbandry methods are legally sound has never been easier.

Start your journey to responsible bird ownership today with US Legal Forms!

Form popularity

FAQ

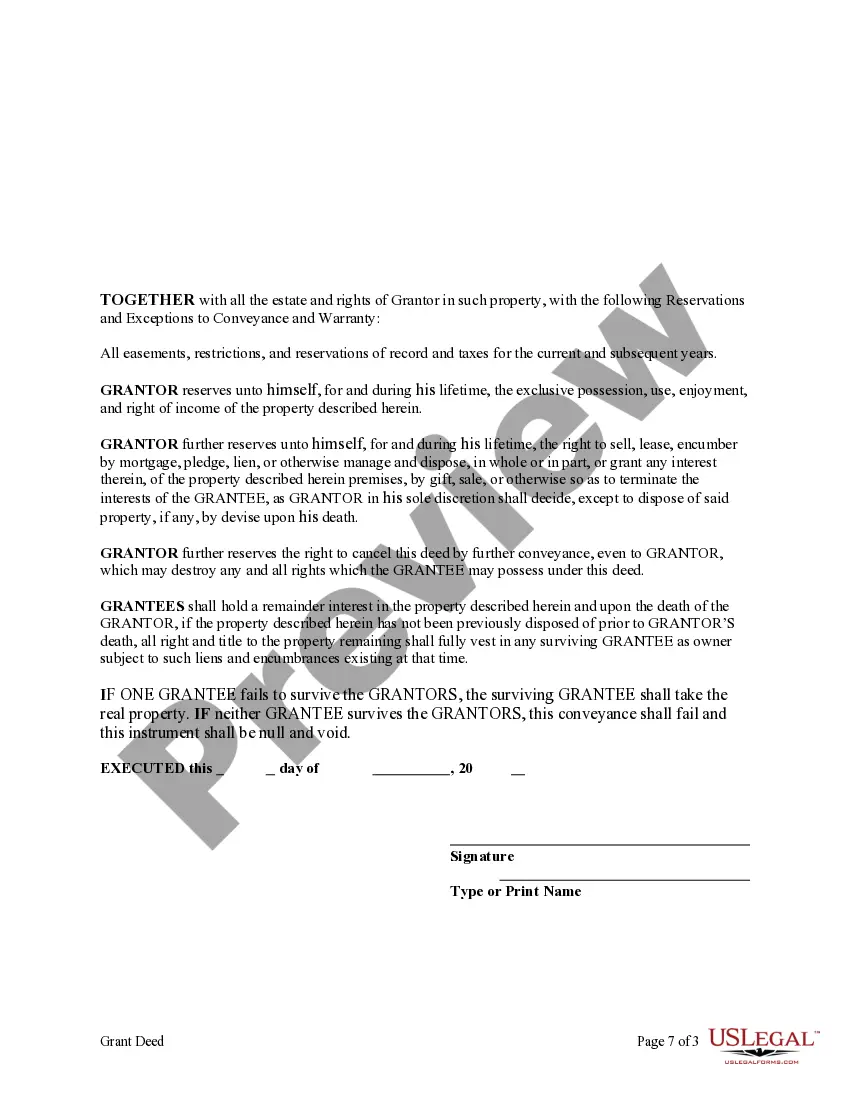

Some disadvantages of a lady bird deed include the limited ability to revoke it without consent from beneficiaries and potential interference with Medicaid eligibility. Additionally, if not properly executed, it can lead to disputes among heirs or unintended tax consequences. Being forewarned about these potential issues can empower property owners to make more informed decisions, and US Legal Forms offers resources to clarify these matters.

A lady bird deed does not directly avoid inheritance tax, as taxes are determined by estate value and configuration at the time of death. However, it can help reduce the value of the estate subject to taxes by effectively transferring ownership before the death of the owner. Tax planning is a vital component of estate management, and utilizing tools from US Legal Forms can aid in navigating these complexities.

A lady bird deed itself is not considered inheritance, as ownership of the property remains with the original owner during their lifetime. However, upon the owner’s death, the property automatically transfers to the named beneficiaries, making it an efficient form of estate planning. This method allows property owners to bypass probate, which is often a lengthy and costly process. For more insights on this topic, US Legal Forms can be an excellent resource.

Yes, an enhanced life estate deed is essentially the same as a lady bird deed. Both terms refer to the same legal instrument that allows property owners to maintain control of their assets during their lifetime while facilitating a seamless transfer upon death. This arrangement is popular for its flexibility and direct benefits in estate planning. For more clarity and options, you can explore information and documents available on US Legal Forms.

A lady bird deed does not inherently avoid inheritance tax, as tax implications depend on various factors, including the value of the estate and the relationship of beneficiaries. However, it does allow for a step-up in basis for tax purposes, which can reduce taxable gains when heirs sell the property. Understanding the nuances of tax laws is crucial, and tools provided by US Legal Forms can guide property owners through this process.

One downside of the lady bird deed is the potential impact on Medicaid eligibility. If the property is gifted to heirs using this deed, it could affect qualifying for Medicaid benefits or long-term care. Moreover, since property owners cannot change their mind once this deed is executed without consent from beneficiaries, it entails some risks. To navigate these complexities, consider consulting resources from US Legal Forms for informed decisions.

The enhanced life estate deed offers several benefits in Florida, including the ability to retain ownership and control of the property during one's lifetime. This deed simplifies the transfer of property upon death, avoiding probate and saving time and costs for heirs. Additionally, the enhanced life estate deed provides protection from creditors, which is an appealing factor for many property owners. Utilizing US Legal Forms can make it easier to access the necessary legal documents.

The best deed to avoid probate is often the enhanced life estate deed, commonly known as the lady bird deed. This option lets property owners retain control over their assets during their lifetime while ensuring a smooth transfer to beneficiaries upon death. By using this deed, individuals can effectively plan their estate and ensure their wishes are honored without lengthy probate processes. For more detailed guidance, US Legal Forms can provide essential resources.

Writing about your future husband should reflect your genuine feelings and aspirations. Start by jotting down his qualities, what you admire, and the future you envision together. This exercise can solidify the image of an 'Enhanced bird husband for the future' and inspire positivity in your relationship journey.

Walkaway husband syndrome refers to a situation where a partner, often the husband, withdraws emotionally or physically from a marriage. This syndrome can pose significant challenges to relationships, but understanding it can help you foster stronger bonds. Utilizing guidance around the 'Enhanced bird husband for the future' may help couples address these issues proactively.