Tenancy Agreement For Commercial Property

Description

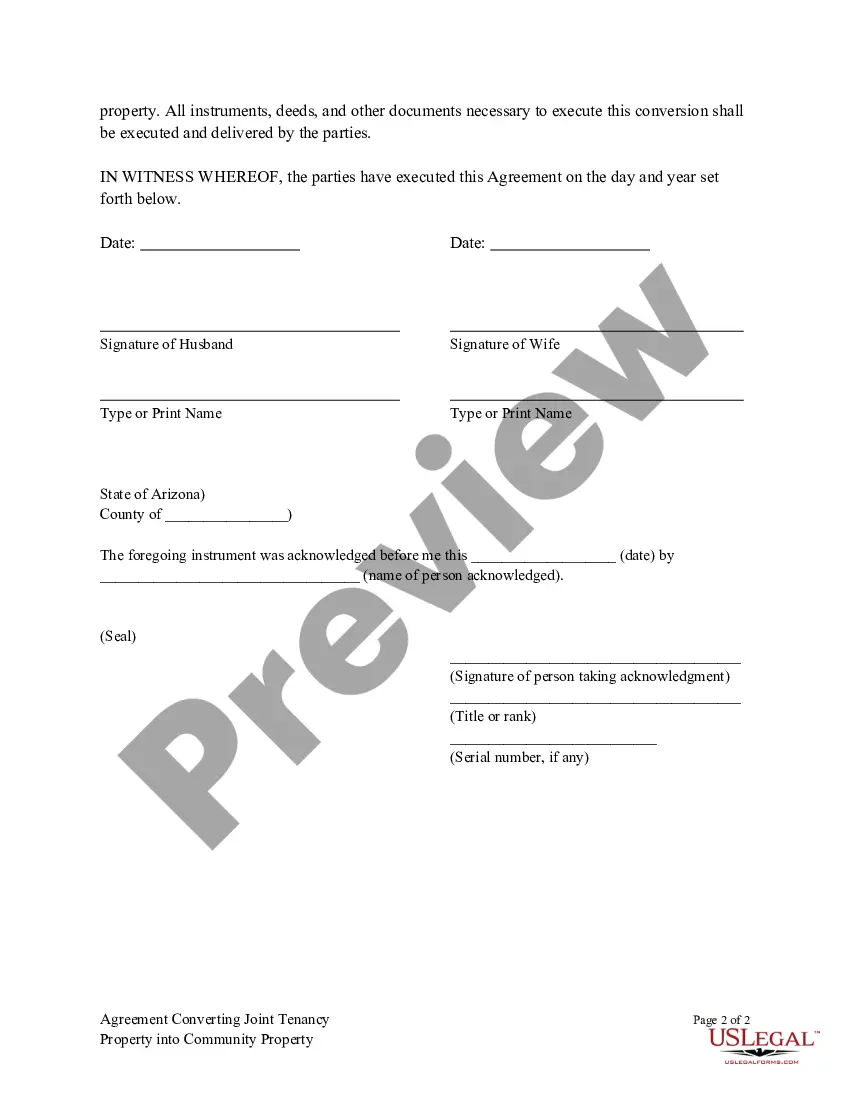

How to fill out Arizona Agreement Converting Joint Tenancy Property Into Community Property - Deed?

- If you're a returning user, first log in to your account to download your form template. Ensure your subscription is active; if not, renew it based on your selected payment plan.

- For first-time users, begin by reviewing the preview and description of the tenancy agreement for commercial property. Confirm it's appropriate for your specific requirements and compliant with local laws.

- If adjustments are necessary, utilize the Search tab to locate a more suitable template. If you've found the right form, proceed to the purchase stage.

- Select the appropriate subscription plan by clicking the Buy Now button. You'll need to create an account for full access to the library resources.

- Enter your payment details, either through credit card or PayPal, to complete the order.

- Once purchased, download your tenancy agreement for commercial property and save it on your device. You can access it anytime via the My Forms section of your profile.

With US Legal Forms, you gain access to an extensive library of over 85,000 legal forms, allowing you to quickly and effectively manage your documentation needs.

Streamline your legal processes today—explore the service and secure your essential forms with US Legal Forms!

Form popularity

FAQ

You absolutely can lease-to-own commercial property. This strategy allows you to occupy the space while working towards ownership, making it a feasible option for many business owners. A comprehensive tenancy agreement for commercial property is essential to protect both parties' interests and clearly state the terms of the lease-to-own arrangement. Utilizing platforms like uslegalforms can streamline the creation of these agreements to ensure clarity and compliance.

Yes, you can lease to own a commercial property, provided both parties agree to the terms. A well-structured tenancy agreement for commercial property will outline the specifics of how the ownership transfer works. It is vital to ensure that the agreement is clear on payment terms and conditions for the transition to ownership. Consulting with legal experts can help you navigate this process smoothly.

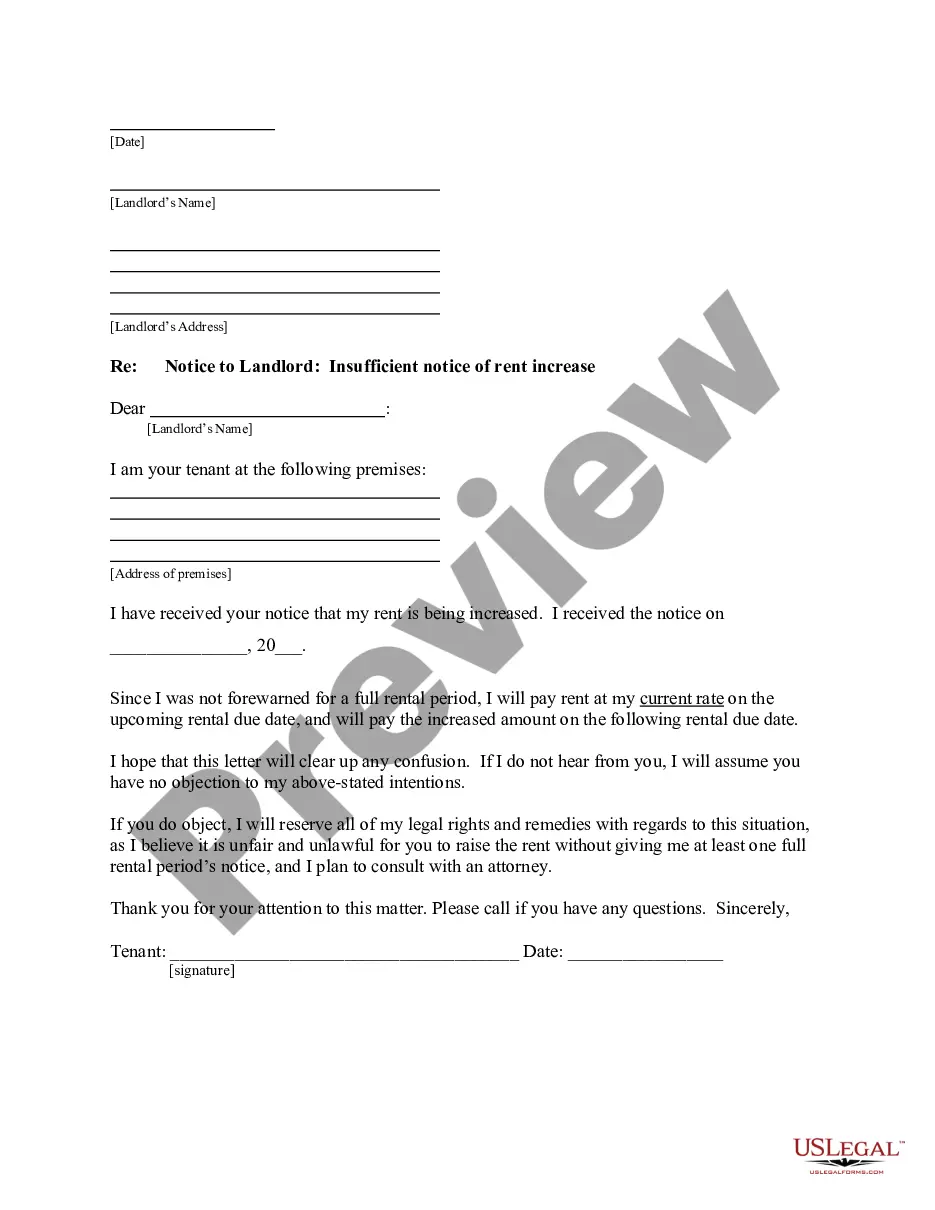

To find a commercial tenant, start by advertising your property effectively. Utilize online platforms and local listings that target business owners looking for space. Ensure that your tenancy agreement for commercial property is appealing and clearly outlines the benefits for tenants. Building relationships within your community can also enhance your chances of securing the right tenant.

One downside to a lease-to-own agreement for commercial property is the potential for higher overall costs. While it may seem appealing to secure a property through this method, you may end up paying more than the market value over time. Additionally, complications can arise from failing to meet the terms outlined in the tenancy agreement for commercial property, leading to potential loss of investment. Understanding the full implications of such agreements is crucial.

In most cases, a commercial lease agreement does not need to be notarized to be legally binding. However, notarization can provide added protection and evidence of the parties' agreement. If you want certainty with your tenancy agreement for commercial property, consider consulting legal resources or platforms like US Legal Forms for assistance.

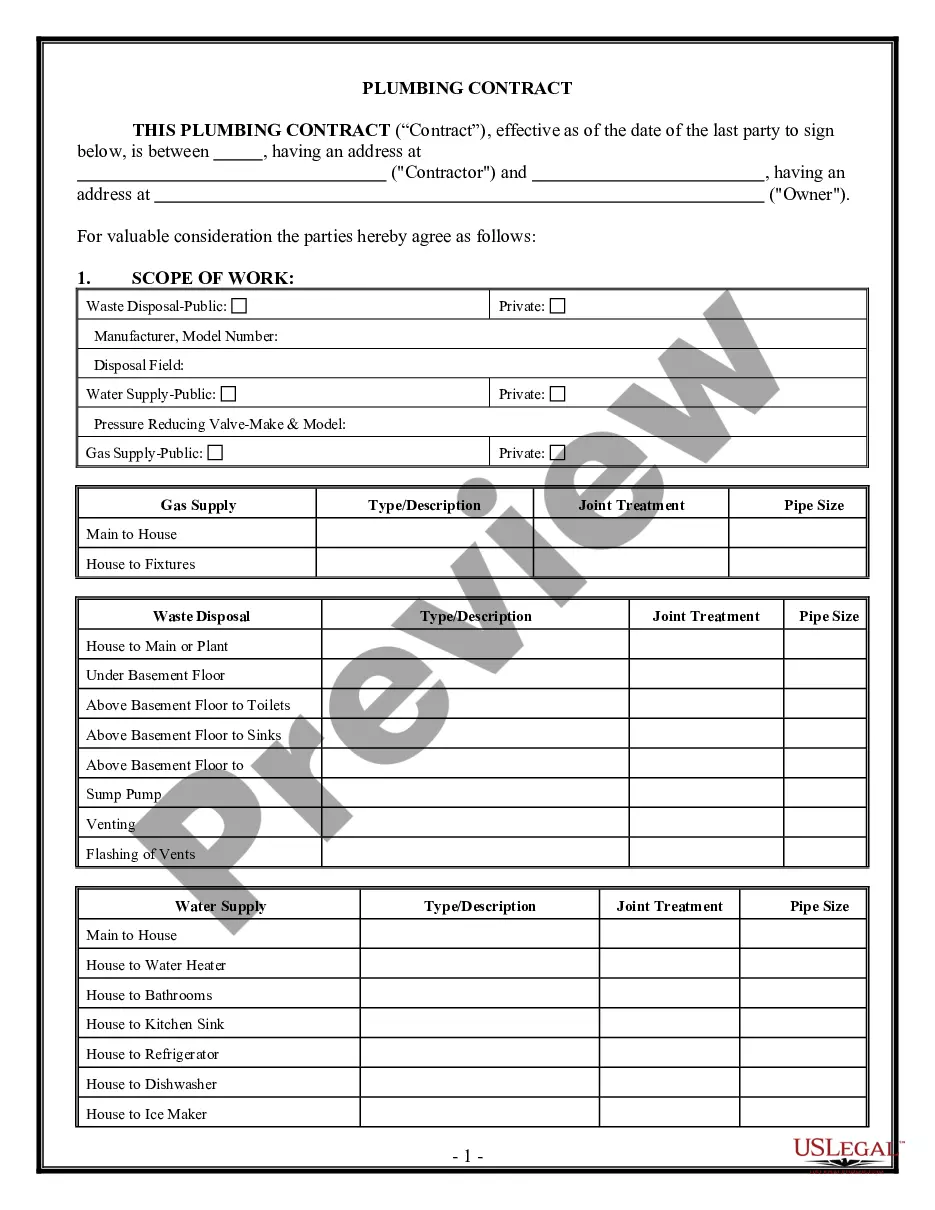

When writing up a commercial lease, include important sections such as property description, lease term, rental payments, and maintenance responsibilities. Use clear and concise language to avoid misunderstandings, and ensure that you define key terms specifically related to your tenancy agreement for commercial property. Utilizing forms from US Legal Forms can help guide you through this process.

To write a letter of intent for a commercial property, start by outlining the key terms you wish to negotiate, such as rent and lease duration. Clearly state your interest in the property and provide relevant details about your business. Be sure to express your intention to draft a more comprehensive tenancy agreement for commercial property following acceptance of your letter.

To transfer a commercial lease to a new owner, you typically need to review the lease terms to ensure that transfers are permitted. You will then communicate with the landlord to seek approval for the transfer. It’s essential to create a formal written agreement documenting the transfer, particularly for a tenancy agreement for commercial property, to protect all parties involved.

A lease can be valid even if it is not notarized, as long as it contains the necessary terms and is signed by both parties. A tenancy agreement for commercial property does not generally require notarization to be enforceable. For additional peace of mind, consider using US Legal Forms to draft a comprehensive lease that meets local legal requirements.

If an agreement is not notarized, it can still be effective as a tenancy agreement for commercial property, depending on the laws in your state. Notarization adds an extra layer of authentication, but it is not typically required for the agreement to be valid. Nonetheless, having a notarized document can help if disputes arise in the future.