Child Support Modification Arizona Withholding Limits

Description

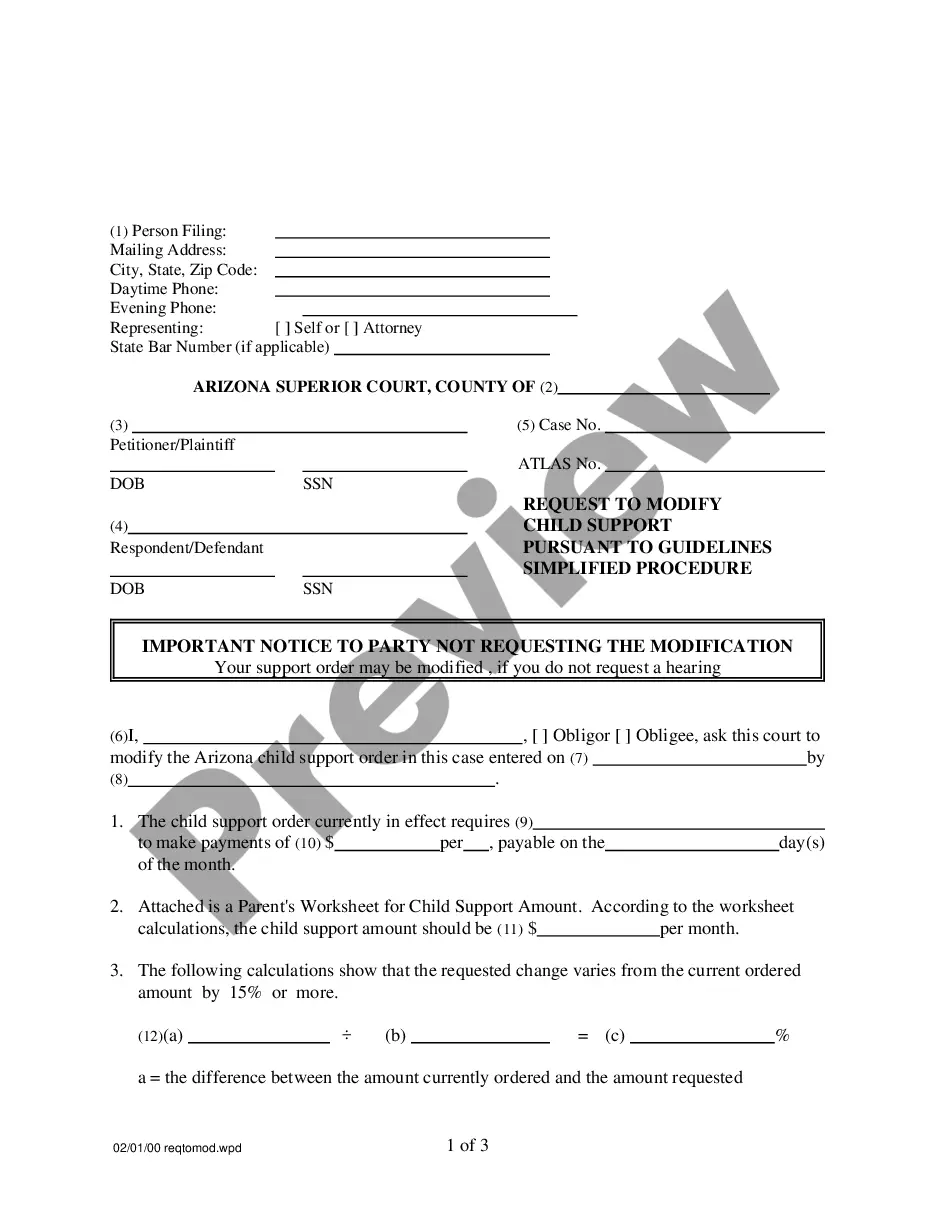

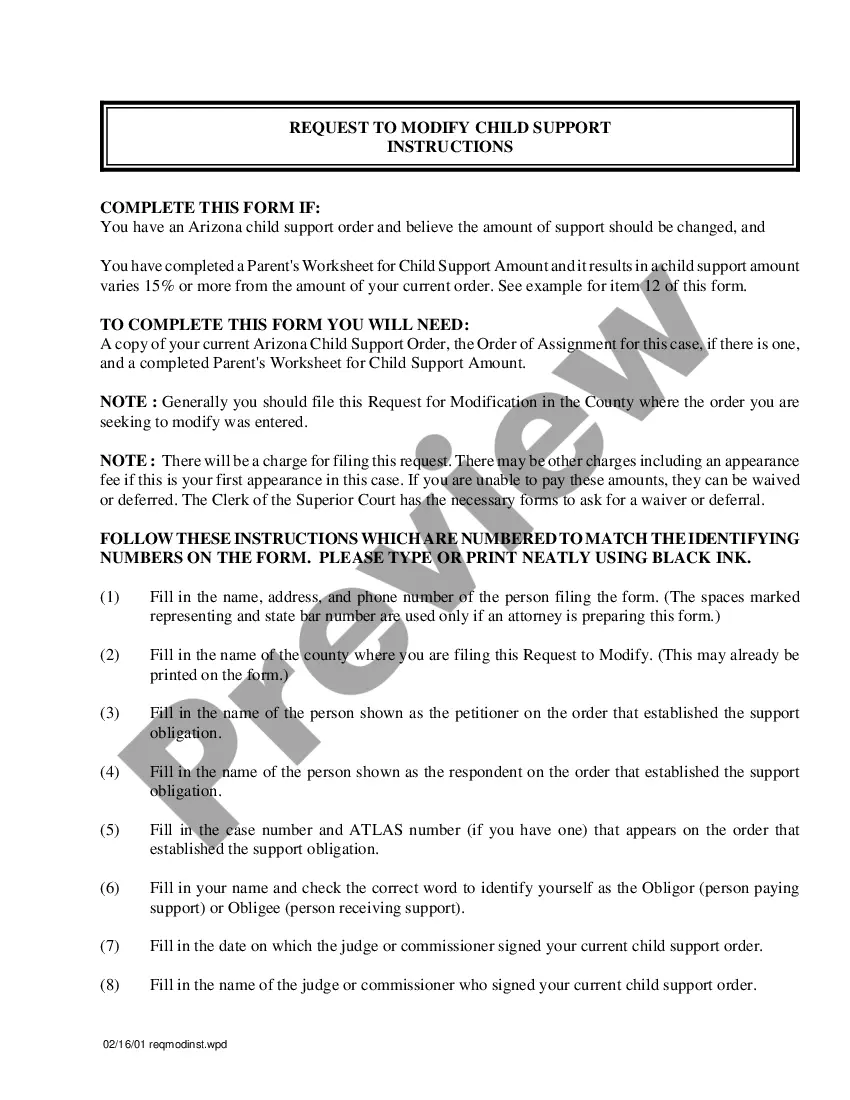

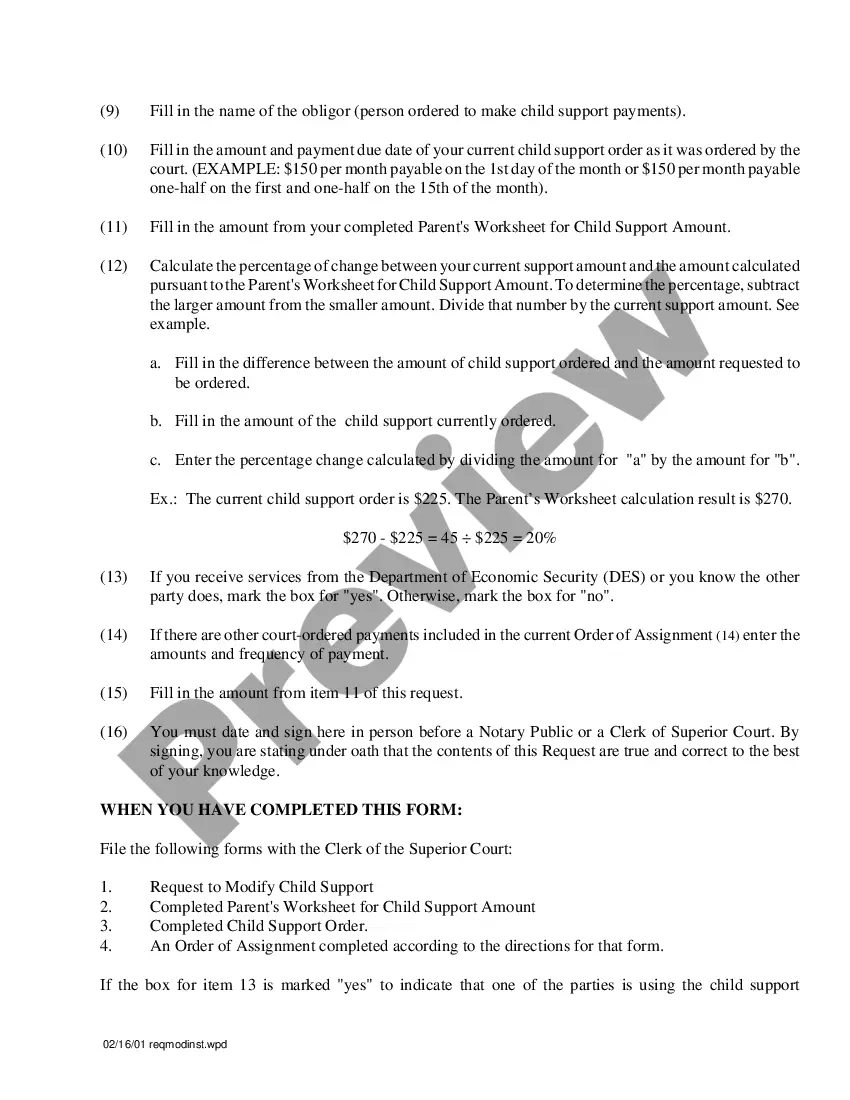

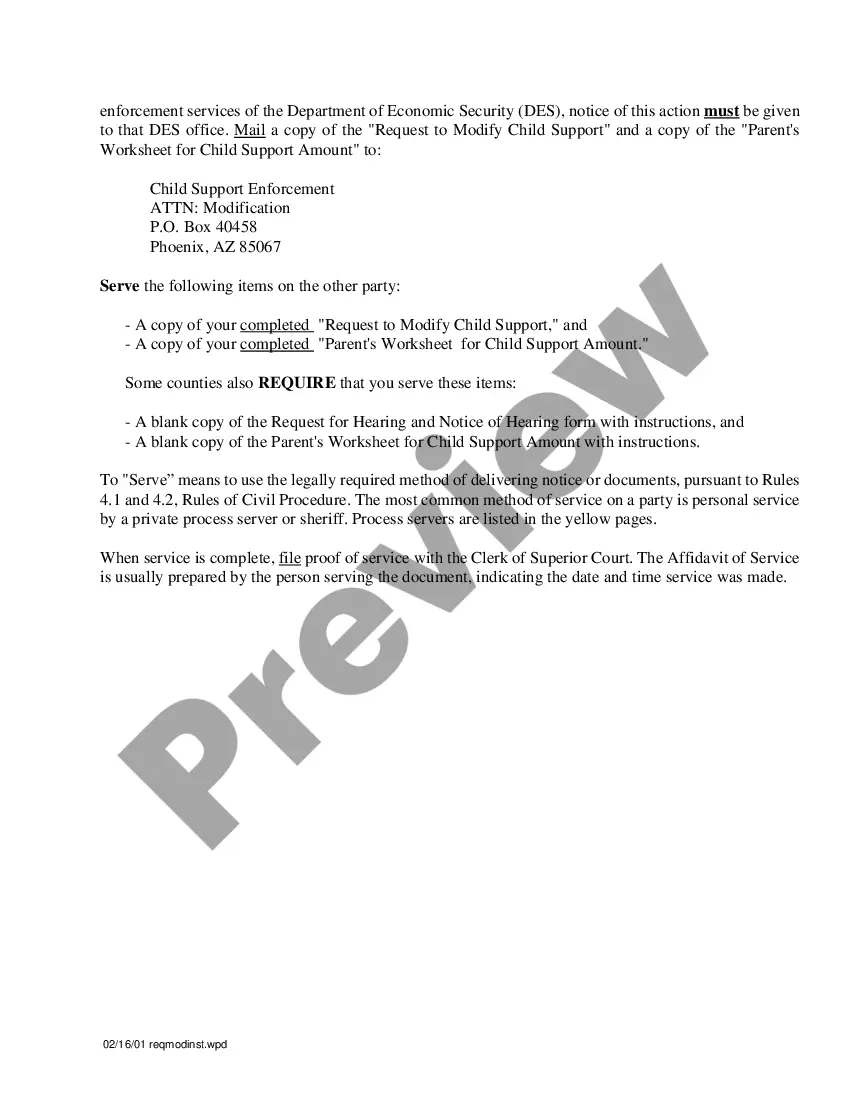

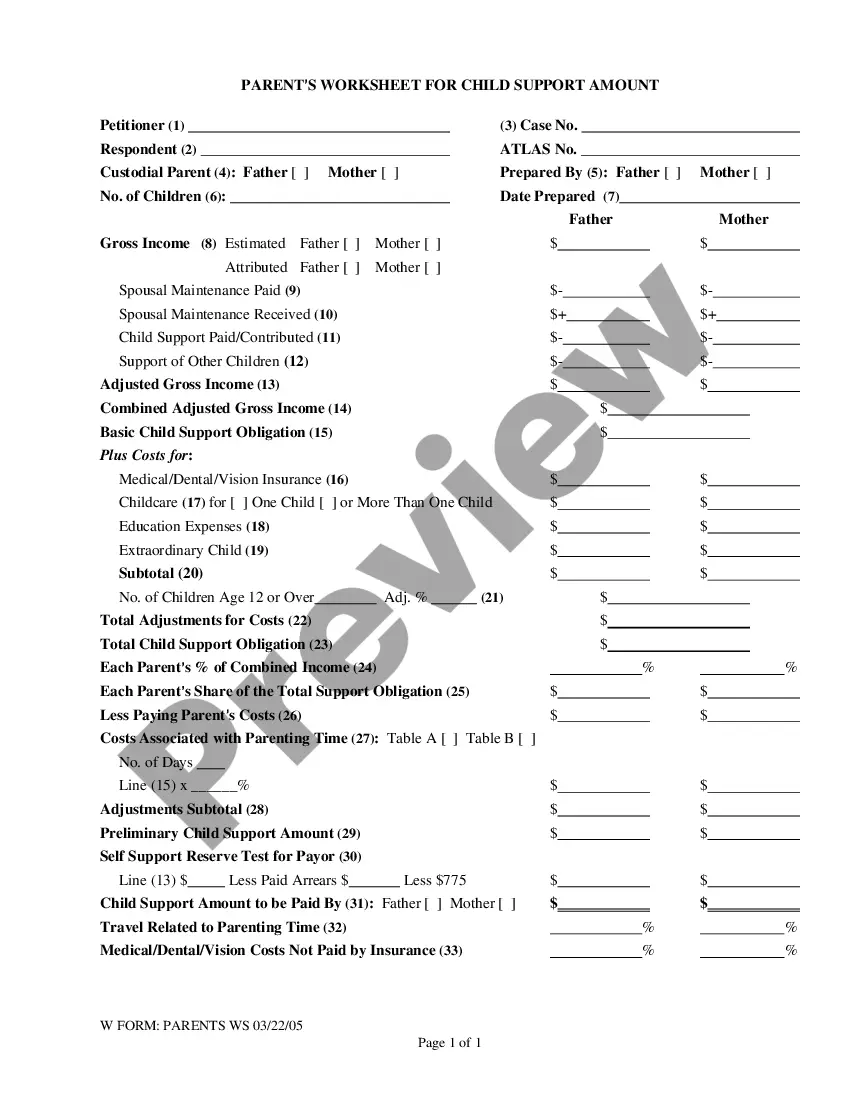

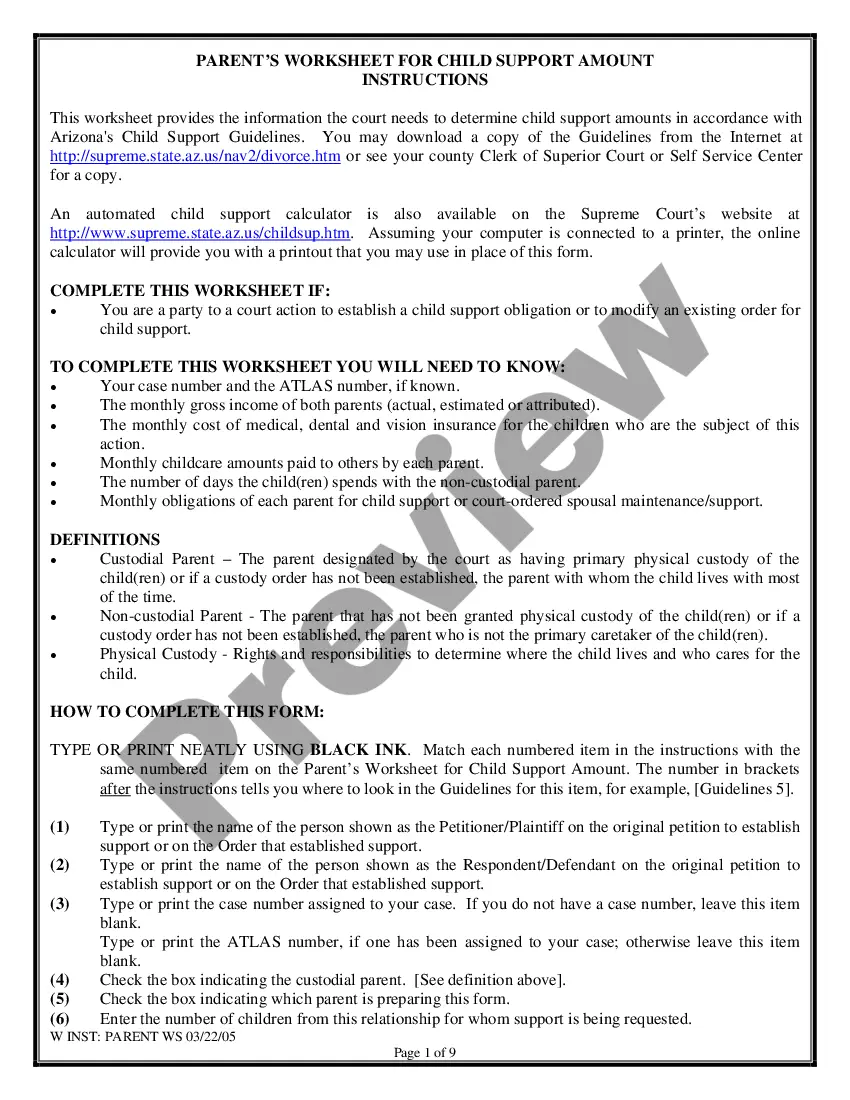

How to fill out Arizona Child Support Modification?

Legal papers management can be overpowering, even for the most knowledgeable specialists. When you are looking for a Child Support Modification Arizona Withholding Limits and do not have the a chance to commit trying to find the correct and up-to-date version, the procedures can be nerve-racking. A strong online form library could be a gamechanger for everyone who wants to deal with these situations effectively. US Legal Forms is a industry leader in online legal forms, with over 85,000 state-specific legal forms available anytime.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms covers any requirements you may have, from individual to organization papers, all in one place.

- Use innovative resources to complete and deal with your Child Support Modification Arizona Withholding Limits

- Gain access to a resource base of articles, instructions and handbooks and resources connected to your situation and requirements

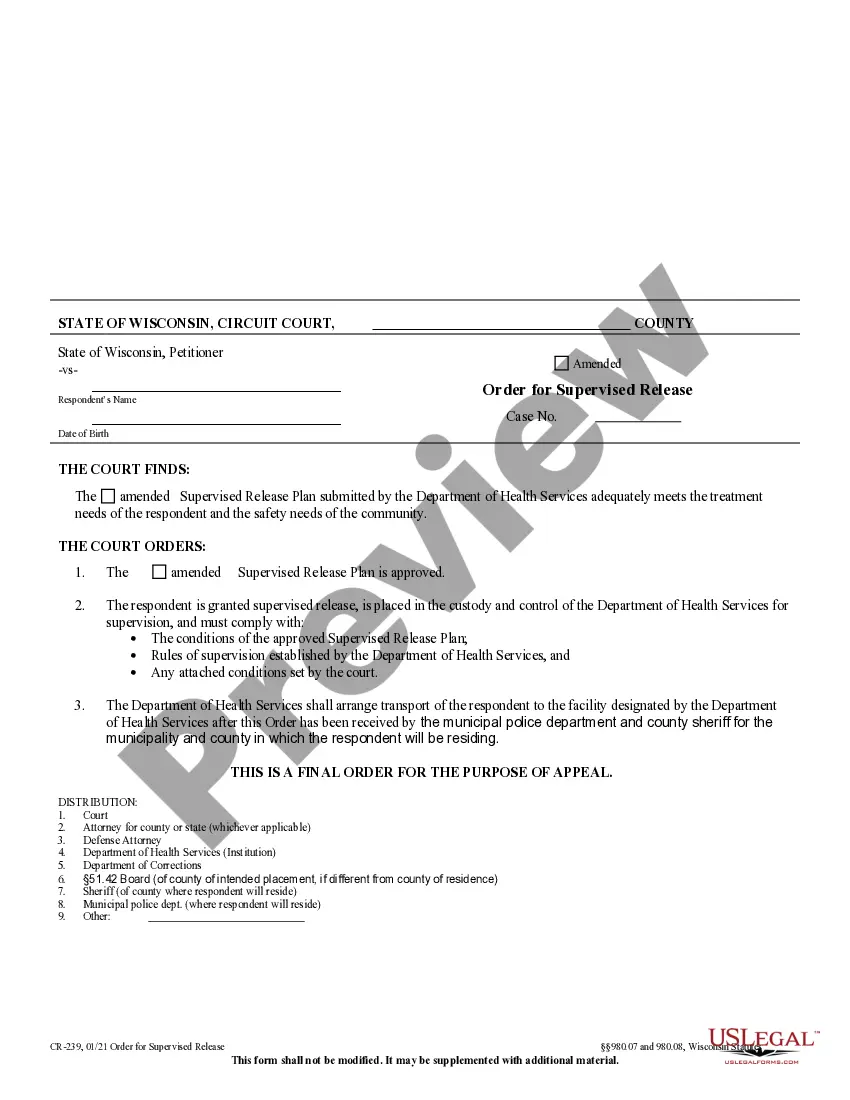

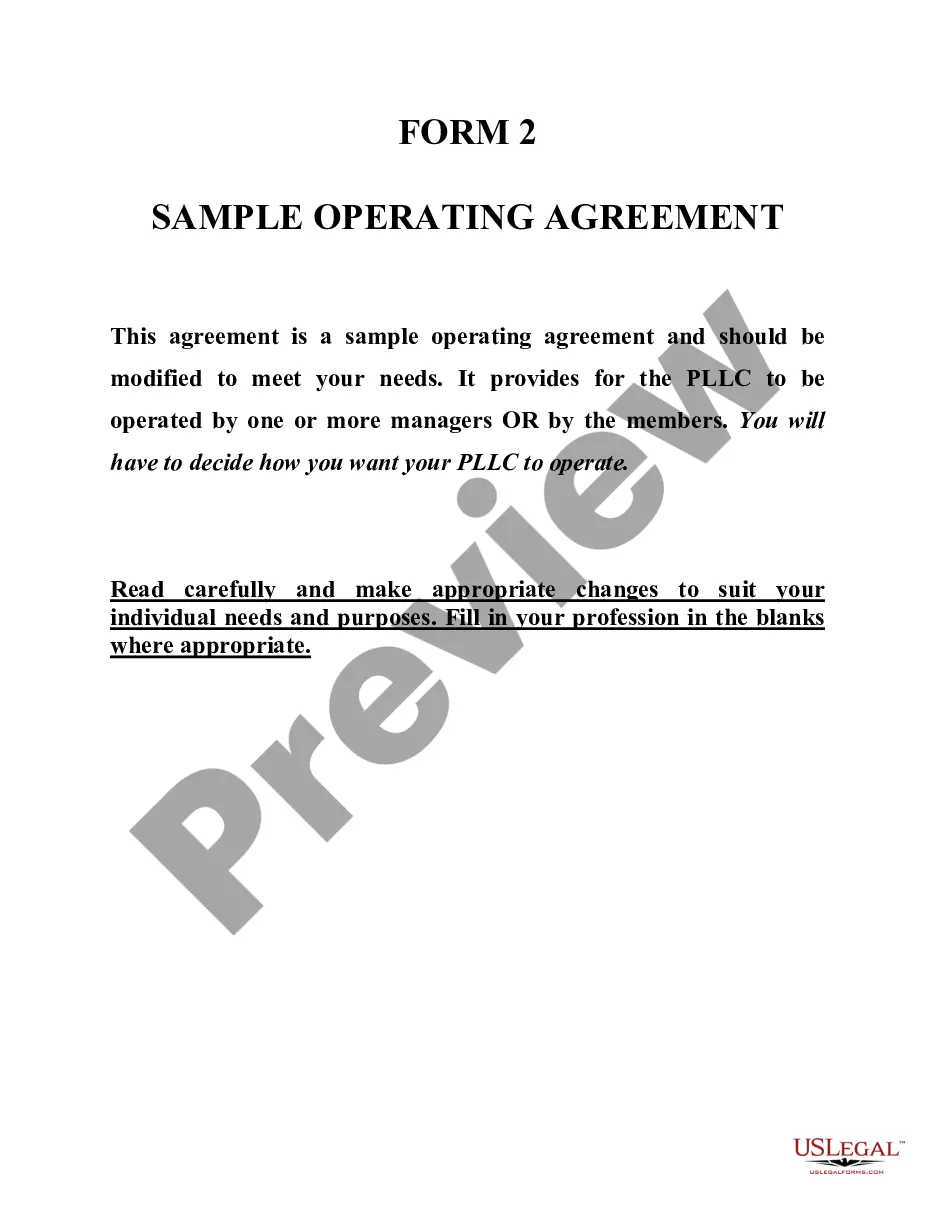

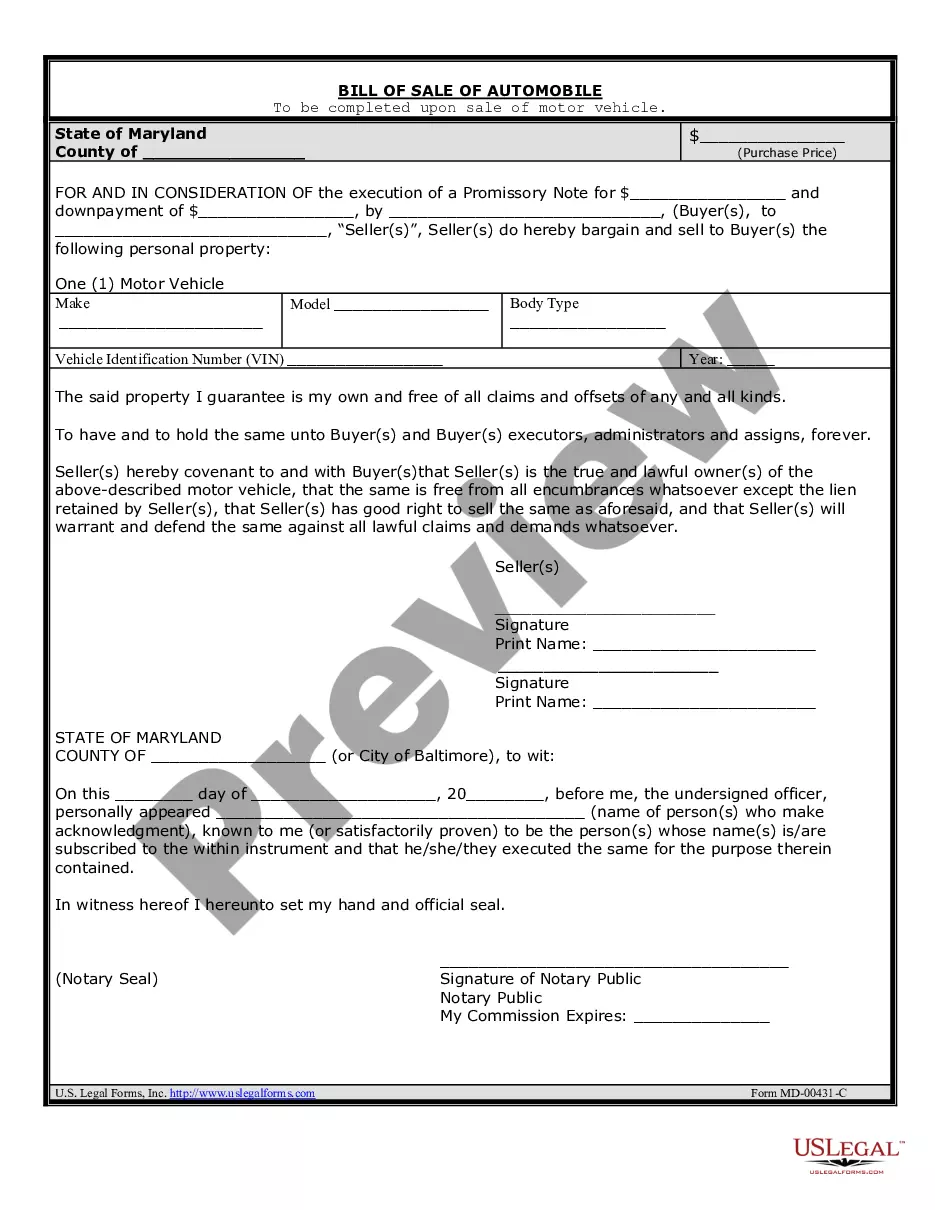

Help save effort and time trying to find the papers you will need, and utilize US Legal Forms’ advanced search and Preview tool to find Child Support Modification Arizona Withholding Limits and download it. In case you have a subscription, log in to the US Legal Forms profile, search for the form, and download it. Take a look at My Forms tab to find out the papers you previously saved as well as to deal with your folders as you see fit.

Should it be your first time with US Legal Forms, create a free account and have unrestricted usage of all benefits of the platform. Listed below are the steps for taking after getting the form you want:

- Validate it is the proper form by previewing it and reading its description.

- Be sure that the sample is accepted in your state or county.

- Choose Buy Now once you are ready.

- Choose a monthly subscription plan.

- Pick the formatting you want, and Download, complete, eSign, print and send out your papers.

Benefit from the US Legal Forms online library, supported with 25 years of expertise and trustworthiness. Change your day-to-day papers managing in to a easy and easy-to-use process right now.

Form popularity

FAQ

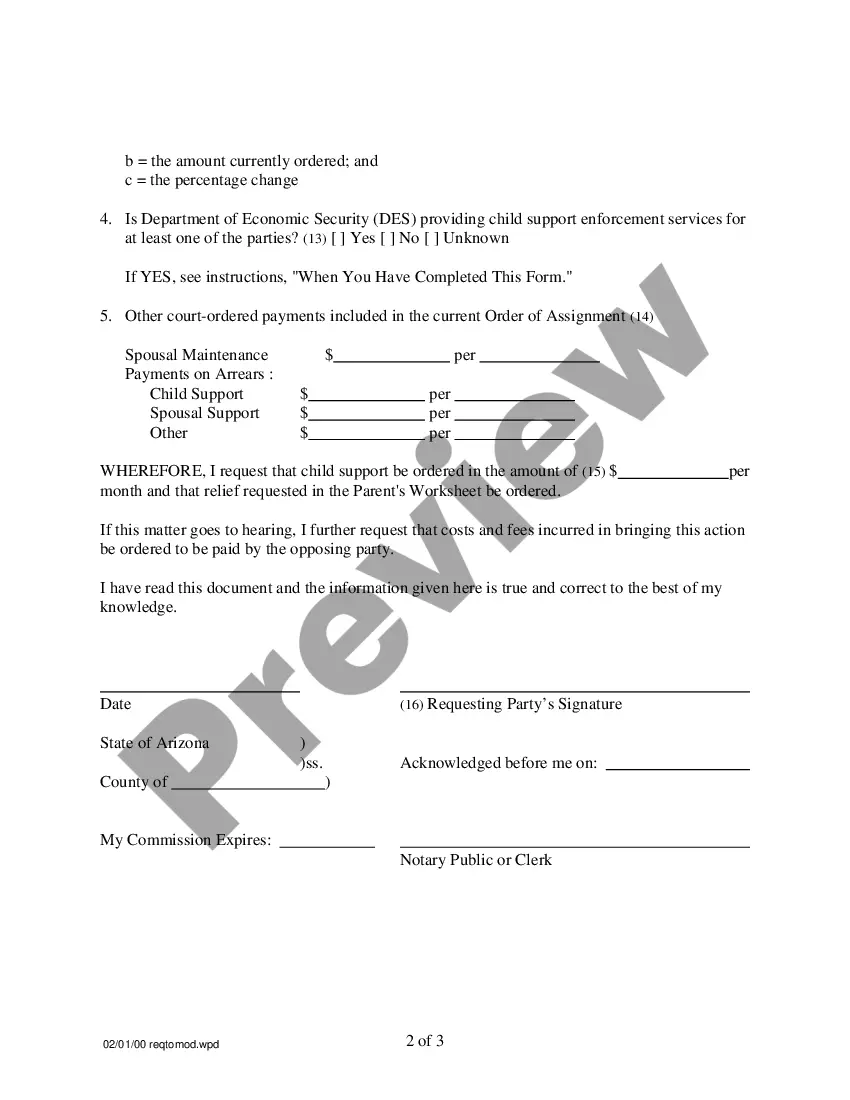

Child support must be withheld, up to 50% of the employee's disposable earnings, before deductions for other withholding orders are taken.

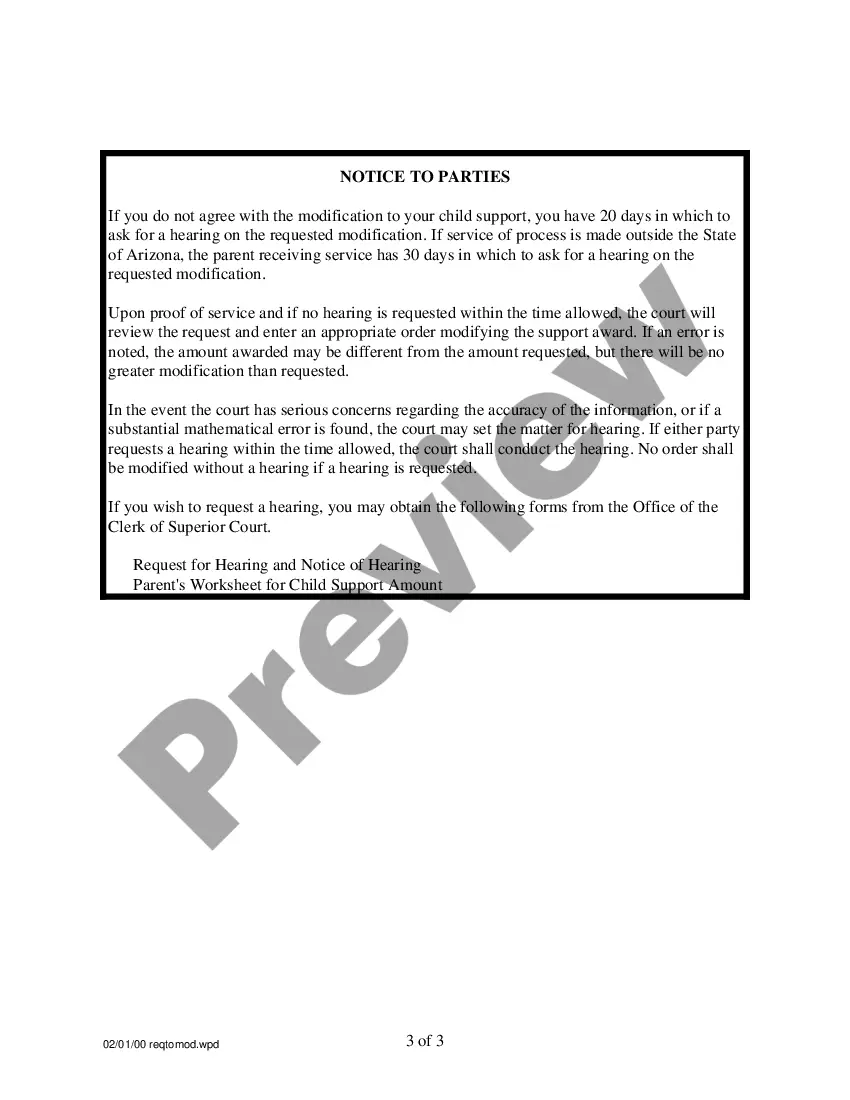

Three Years: A child support modification can be requested once every three years regardless of the above circumstances. If you have your child support agreement put into place less than three years ago then you are going to need to qualify for a modification along one of the paths listed above.

How long does the modification process take? DCSS should complete the review and modification within six (6) months, however, this may vary ing to the court schedule.

The withholding limits set by the federal CCPA are: 50 percent - Supports a second family with no arrearage or less than 12 weeks in arrears. 55 percent - Supports a second family and more than 12 weeks in arrears. 60 percent - Single with no arrearage or less than 12 weeks in arrears.

Is there a limit to the amount of money that can be taken from my paycheck for child support? 50 percent of disposable income if an obligated parent has a second family. 60 percent if there is no second family.