199 Superior Client For Windows

Description

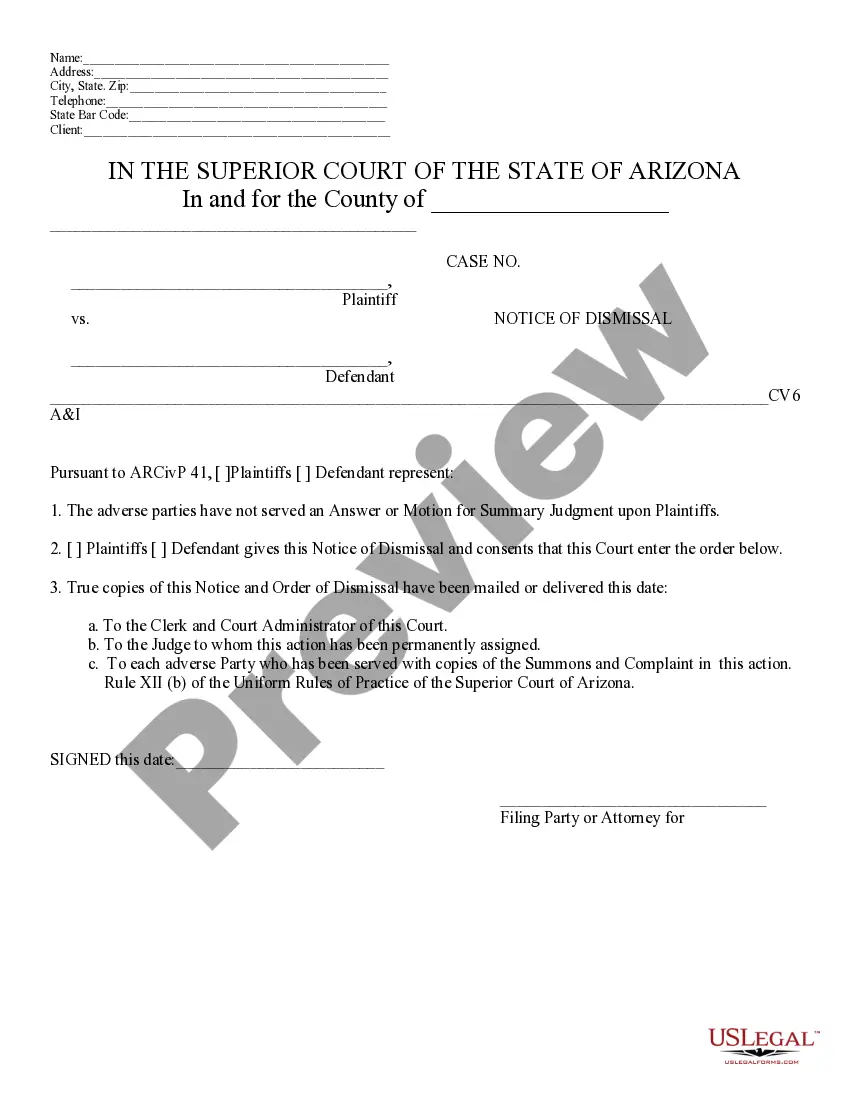

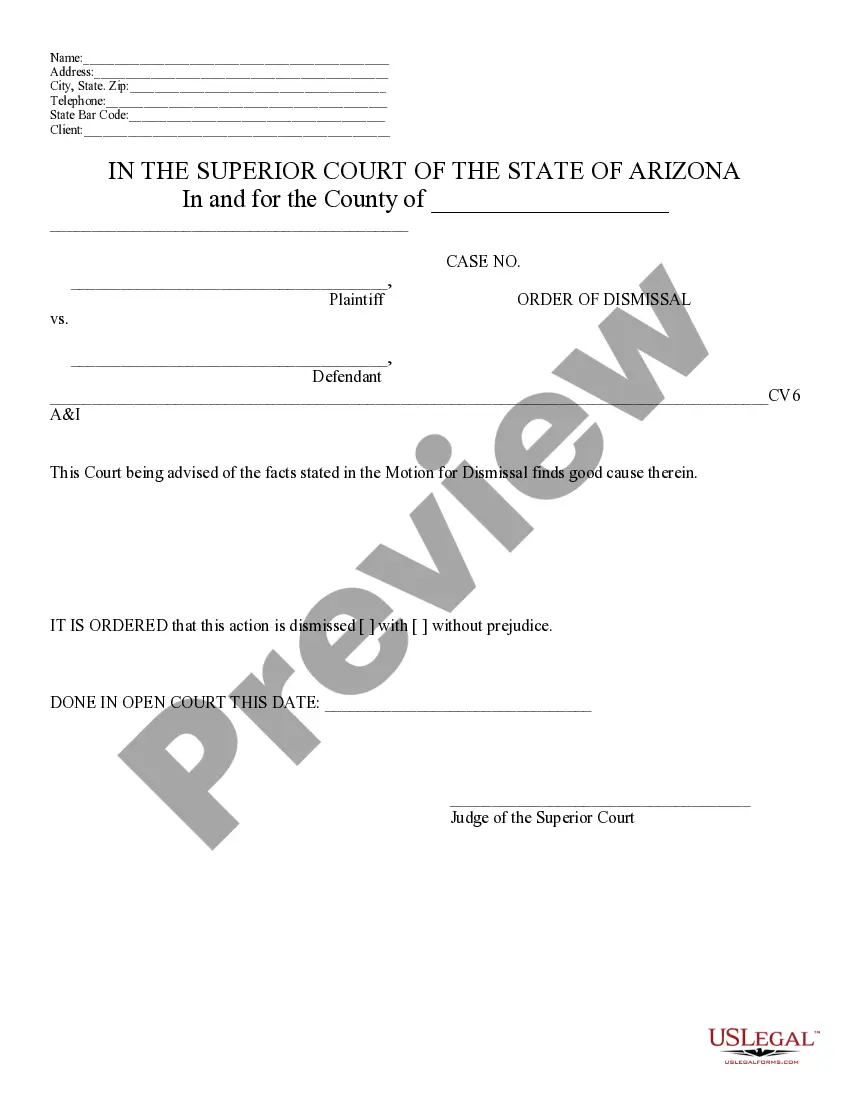

How to fill out Arizona Motion For Dismissal?

Whether for business purposes or for personal matters, everyone has to deal with legal situations sooner or later in their life. Filling out legal papers needs careful attention, beginning from selecting the proper form template. For example, when you choose a wrong version of a 199 Superior Client For Windows, it will be declined once you send it. It is therefore important to have a trustworthy source of legal documents like US Legal Forms.

If you have to obtain a 199 Superior Client For Windows template, stick to these easy steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Look through the form’s information to make sure it suits your situation, state, and region.

- Click on the form’s preview to see it.

- If it is the wrong document, return to the search function to locate the 199 Superior Client For Windows sample you need.

- Get the file if it meets your requirements.

- If you have a US Legal Forms account, just click Log in to access previously saved files in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the account registration form.

- Pick your transaction method: use a credit card or PayPal account.

- Choose the file format you want and download the 199 Superior Client For Windows.

- When it is downloaded, you are able to fill out the form by using editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you do not need to spend time looking for the appropriate template across the web. Make use of the library’s simple navigation to get the right form for any situation.

Form popularity

FAQ

Form 199 or Form 109 with Balance Due: Franchise Tax Board. P.O. Box 942857. Sacramento, CA 94257-0701.

Penalties. Failure to File a Timely Return ? An organization that fails to file the return on or before the original due date, or extended due date, is assessed a penalty of $5 for each month, or part of the month, the return is late.

How to File CA Form 199 Electronically Add Organization Details. Search for your EIN, and our system will import your organization's details from the IRS. ... Choose Tax Year and Form. Tax 990 supports current and previous tax years' filing. ... Provide Required Information. ... Review Your Form Summary. ... Transmit it to the FTB.

Most tax-exempt organizations are required to file Form 199 or FTB 199N. Some types of organizations do not have a filing requirement. Form 199 is used by the following organizations: Organizations granted tax-exempt status by the FTB.

Exempt organizations and non-profits FormWithout paymentWith payment199Franchise Tax Board PO Box 942857 Sacramento CA 94257-0500Franchise Tax Board PO Box 942857 Sacramento CA 94257-0501 24-May-2023