Az Occupancy Withholding

Description

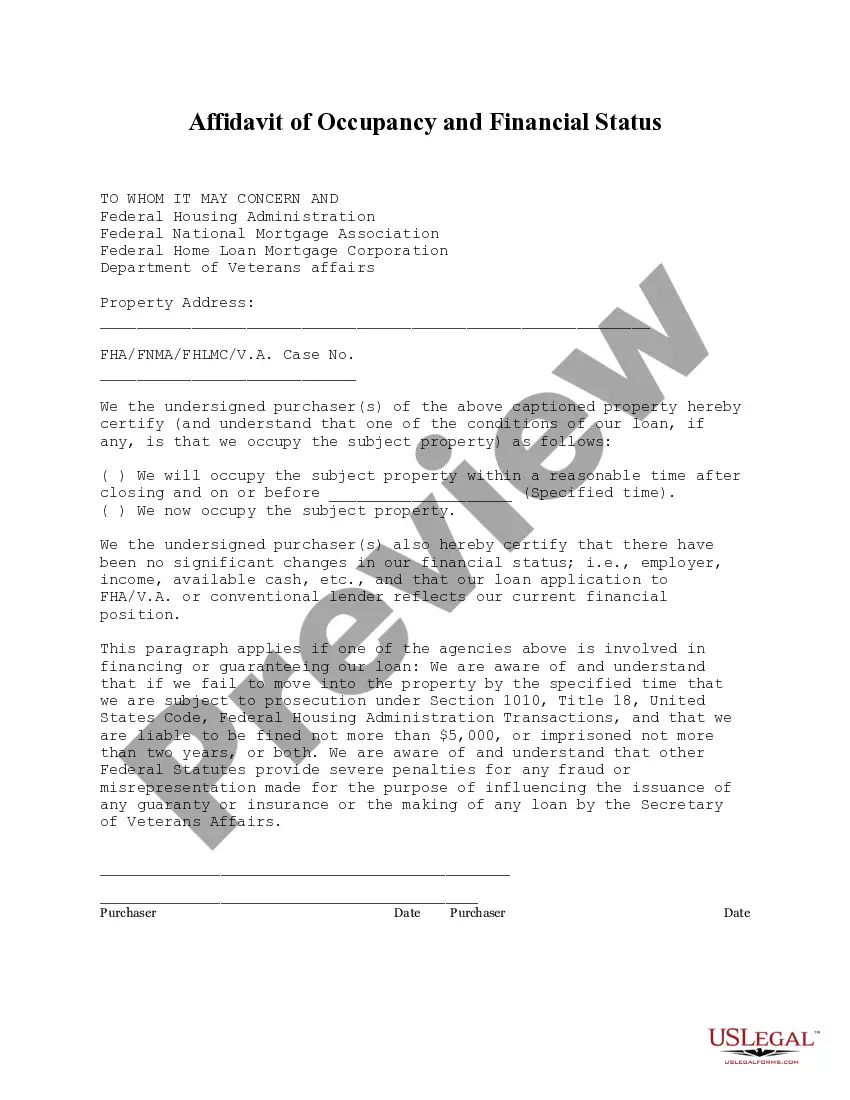

How to fill out Arizona Affidavit Of Occupancy And Financial Status?

It’s widely known that you cannot transform into a legal expert in a day, nor can you learn to swiftly create Az Occupancy Withholding without possessing a unique set of competencies.

Assembling legal paperwork is a lengthy endeavor that necessitates specific education and abilities. So why not entrust the development of the Az Occupancy Withholding to the experts.

With US Legal Forms, one of the most extensive legal template collections, you can discover everything from court documents to templates for internal business communication. We understand how vital compliance and adherence to federal and state regulations are.

You can regain access to your documents from the My documents tab at any time. If you’re an existing client, you can simply Log In, and locate and download the template from the same tab.

Regardless of the reason for your forms—whether financial and legal, or personal—our platform has you covered. Try US Legal Forms now!

- Discover the document you require using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if Az Occupancy Withholding is what you're looking for.

- Initiate your search again if you need a different document.

- Create a free account and choose a subscription plan to acquire the template.

- Select Buy now. Once the payment is processed, you can obtain the Az Occupancy Withholding, complete it, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

To change the amount of Arizona income tax withheld, an employee must complete Arizona Form A-4 and submit to his or her employer to choose a different withholding percentage option. Employees may request to have an additional amount withheld by their employer.

If you have an Arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should promptly file a new Form A-4 and choose a withholding percentage that applies to you.

The new default Arizona withholding rate is 2.0%.

The transient lodging tax rate is 5.0% of the total amount charged for occupancy of space including the use of furnishings. This tax is assessed above and beyond the 2.0% transaction privilege tax. See the Hotel/Motel Tax Brochure and the Arizona Tax Matrix for Hotel/Motel Lodging Industry [PDF] for more information.

Yes, the employer should then select 2.0% as the default rate. This means by March 2023 the paychecks would have the default rate chosen for them.