Llc Limited Liability With Us

Description

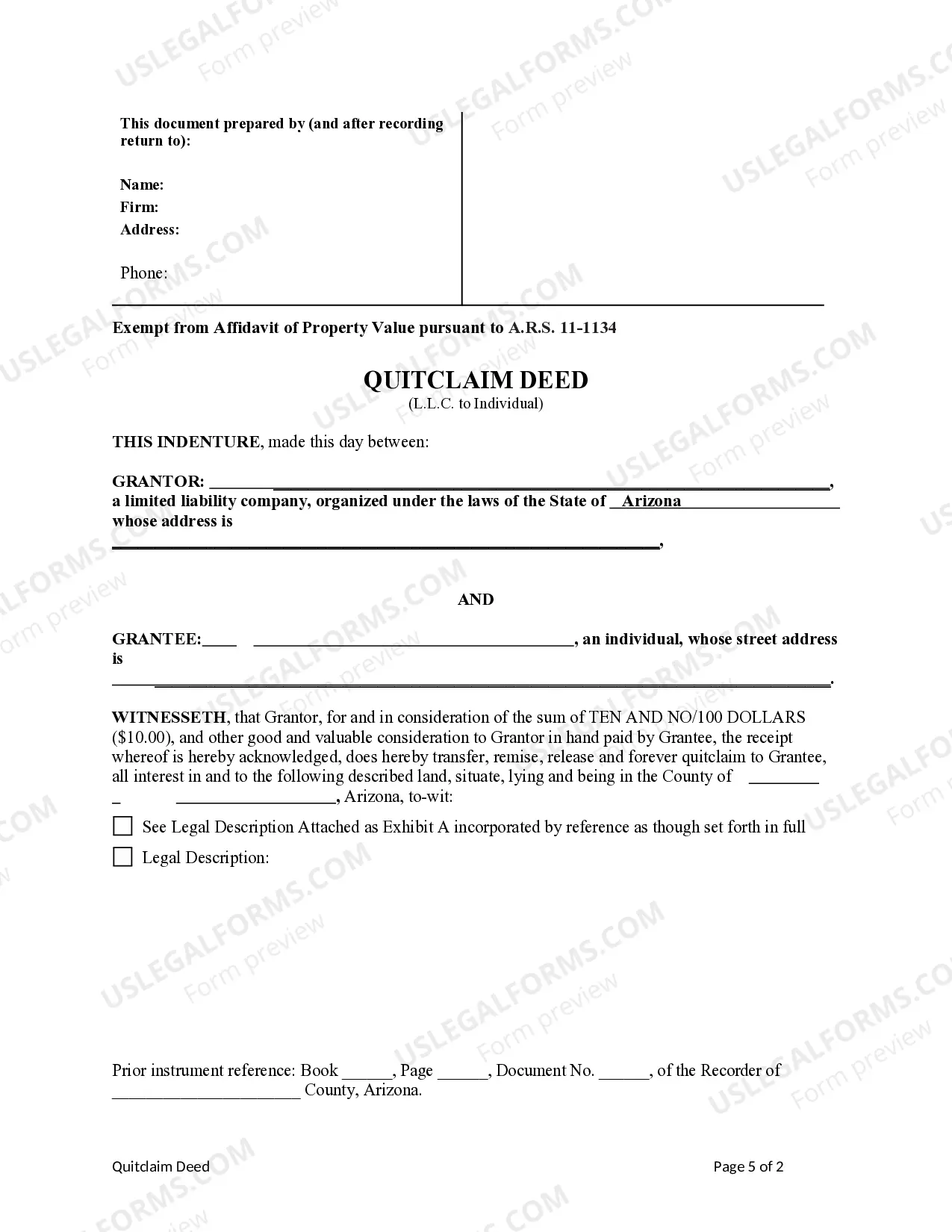

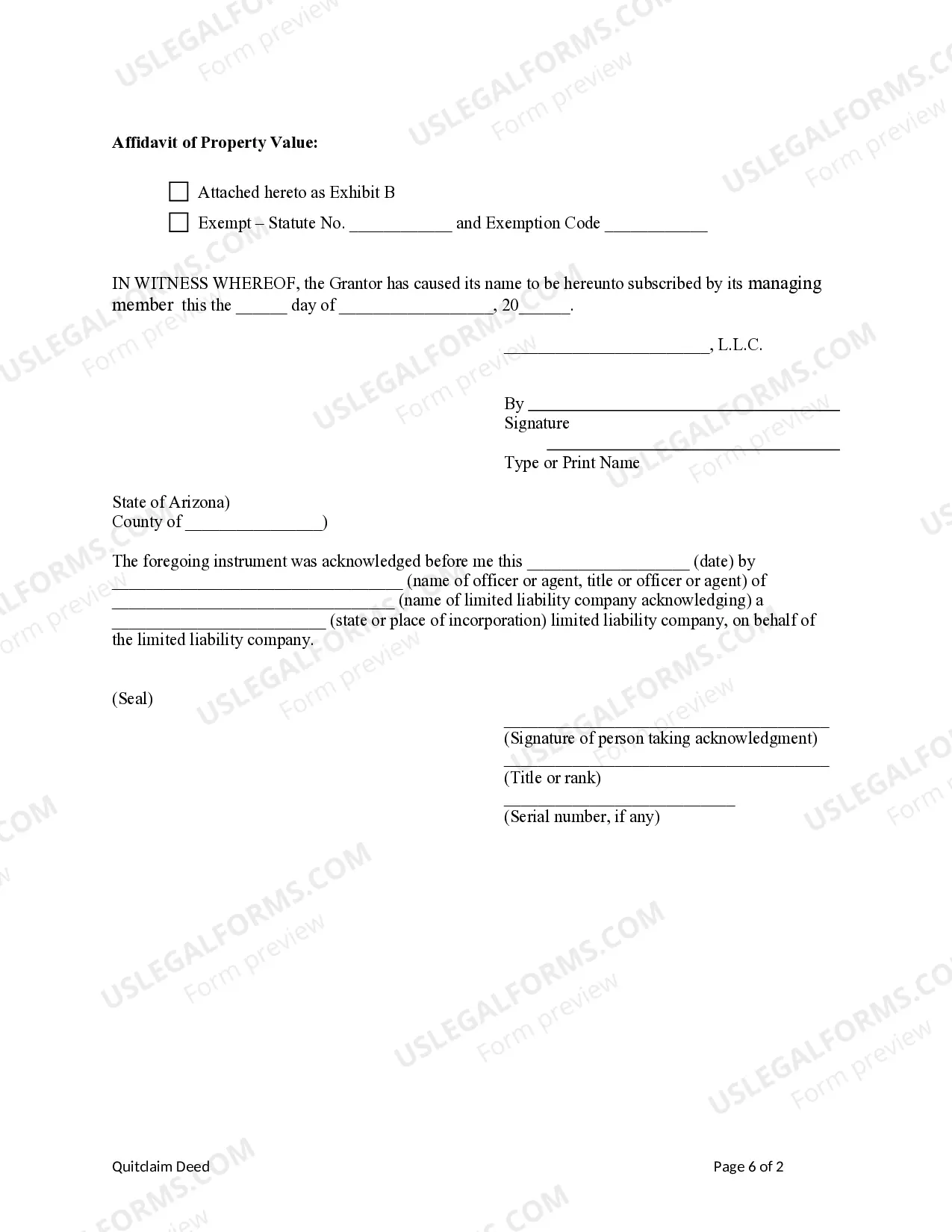

How to fill out Arizona Quitclaim Deed From A Limited Liability Company To An Individual?

- If you are a returning user, simply log in to your account and download your required form. Ensure that your subscription is active; if not, renew as needed.

- For first-time users, start by browsing our form library. Check the Preview mode and form descriptions to find a suitable document that meets your local jurisdiction's requirements.

- If necessary, utilize the Search tab to find additional templates that meet your specific needs.

- Once you've identified the correct form, click on the Buy Now button and select your preferred subscription plan. Remember to create an account to access our full library.

- Proceed to make your purchase using your credit card or PayPal account.

- After completing the transaction, download your chosen form and save it on your device for easy access. You can also find it later in the My Forms section of your profile.

US Legal Forms offers a robust collection of over 85,000 customizable legal documents, ensuring you have more options than with competing services. Our platform not only allows you to create necessary legal forms quickly but also provides access to premium experts for guidance on form completion.

Empower your business journey today by utilizing US Legal Forms to establish your LLC limited liability with us!

Form popularity

FAQ

Legally, an LLC is considered a separate entity and is often viewed as a 'person' within the context of business law. This means it can enter contracts, sue, and be sued. When you choose to create your LLC limited liability with us, you can take advantage of this separate legal status, allowing for greater business credibility while protecting your personal assets.

Certain individuals, such as those who are minors or certain felons, cannot be members of an LLC. Additionally, some states have specific regulations regarding who can own an LLC based on residency or other factors. It's valuable to consult with us while considering forming your LLC limited liability with us, as we can help clarify these restrictions to ensure compliance.

While an LLC offers many advantages, there are some disadvantages to consider. One limitation is that LLCs can incur self-employment taxes, which might be higher than corporate taxes. Additionally, certain states impose additional fees or regulations on LLCs. If you're interested in forming your LLC limited liability with us, we can help you weigh these factors effectively.

A US Person for tax purposes typically includes US citizens, residents, and businesses located in the United States. This classification affects how income, gains, and distributions are taxed. If you're forming an LLC limited liability with us, it's essential to understand these definitions to ensure compliance with tax obligations and make informed decisions.

An LLC limited liability company combines the benefits of a corporation and a partnership. In this structure, the owners, also known as members, enjoy limited liability protection, which means their personal assets are usually safe from business debts. When you form an LLC limited liability with us, you gain the protection of your personal assets while maintaining the flexibility of a partnership.

Yes, a non-citizen can be a member of an LLC. This means that individuals without US citizenship can still enjoy the benefits of forming a limited liability company. If you're considering creating an LLC limited liability with us, rest assured that we can guide you through the process, ensuring that you understand all the legal implications involved.

When you file taxes for your LLC limited liability with us, it primarily depends on the tax classification of your business. If your LLC is a single-member entity, you typically report your business income on your personal tax return using Schedule C. However, if your LLC has multiple members, it generally files a partnership tax return, and each member reports their share of income separately on their personal returns. Understanding these details can ensure you maximize your tax benefits while minimizing compliance issues.

Yes, an LLC can be considered a US person for tax purposes, provided it meets certain criteria established by the IRS. This classification means that the LLC can file tax returns and comply with tax regulations just like an individual. This advantageous status can simplify tax obligations and enhance compliance for business operations. Embracing Llc limited liability with us can further streamline this entire process.

An example of a limited liability company is a small family-owned business, like a bakery, operated by a few family members. This structure allows the owners to limit their personal liability while enjoying the flexibility of a partnership. By forming an LLC, the bakery can protect personal assets from business debts. This is a prime example of how Llc limited liability with us works in practice.

A single member LLC should complete a W9 form by entering the LLC's name and the owner's name, indicating that it's a single-member entity. In the tax classification section, select 'Limited Liability Company' and provide the classification code, typically 'Disregarded Entity' for tax purposes. This helps ensure proper tax reporting. UsLegalForms can offer templates and guidance to help ensure accurate completion.