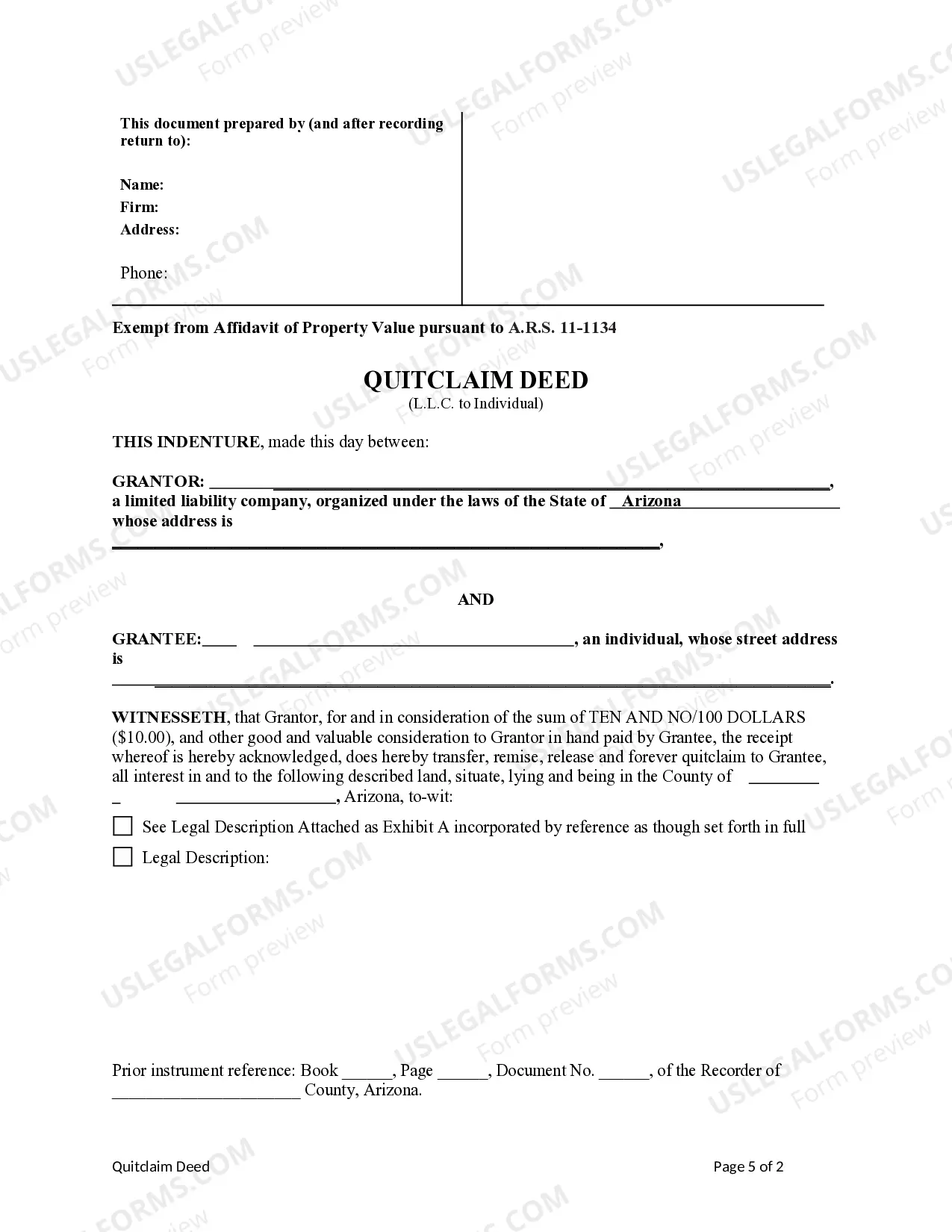

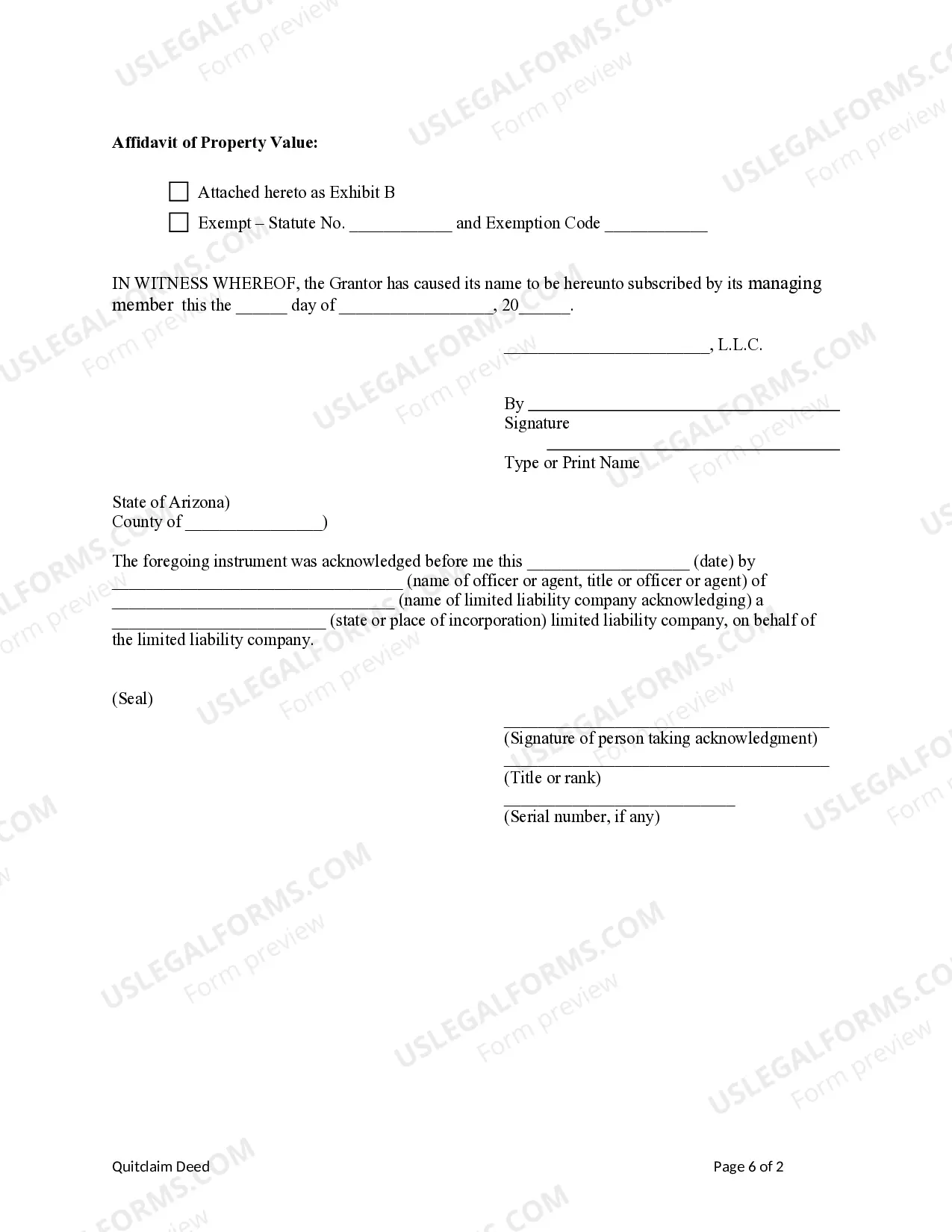

Limited Liability Company With Example

Description

How to fill out Arizona Quitclaim Deed From A Limited Liability Company To An Individual?

- If you're a returning user, log in to your account to access your forms directly. Ensure that your subscription is current; renew if necessary.

- For first-time users, begin by previewing the document. Assess the description to confirm it fits your local jurisdiction for forming an LLC.

- Should you find the document unsuitable, utilize the Search feature to locate the correct form that fits your requirements.

- Once the appropriate document is identified, proceed by clicking the Buy Now button. You’ll need to select a subscription that suits your needs and create an account.

- Complete your purchase by entering payment details via credit card or PayPal. This step grants you access to all documents in the library.

- Finally, download the form and save it on your device. You can also revisit your downloaded forms anytime under the My Forms section of your profile.

By leveraging US Legal Forms, you can enjoy the benefits of a comprehensive form collection that greatly exceeds that of competitors. With over 85,000 easily fillable and editable legal forms, this platform equips users with the necessary tools for precise and legally compliant documents.

In conclusion, starting your journey with your LLC has never been easier with US Legal Forms. Take the first step towards successful business formation today by exploring their extensive library of forms!

Form popularity

FAQ

Yes, you can file your LLC by yourself, which is often referred to as DIY filing. However, it’s important to ensure that you complete all necessary forms accurately and comply with your state's regulations. An error in your paperwork can delay the process or lead to complications. If you want guidance through the process, platforms like US Legal Forms can simplify filing your limited liability company with example, allowing you to focus on your business.

To write a limited liability company, you need to follow specific steps. First, choose a unique name that includes 'Limited Liability Company' or abbreviations like 'LLC'. Second, file the Articles of Organization with your state's Secretary of State. Lastly, create an operating agreement to outline the management structure. This process provides clarity and ensures compliance, making the limited liability company with example effective for asset protection.

To write an LLC example, begin with the name that reflects your business's identity. Include the type of business activities it will engage in. An example could be, 'Flowers & Gifts LLC is a limited liability company focused on providing floral arrangements and gift services.' This composition highlights both the business function and its legal designation, making it clear and informative.

An LLC is properly written by using the designation 'Limited Liability Company' or its abbreviation 'LLC' after the company name. For example, if your business is called 'Tech Innovations,' you should refer to it as 'Tech Innovations LLC.' This designation helps clarify the legal structure and protects you from personal liability. Consistency in using the LLC designation is key for formal documents and business communications.

To write an LLC example, start by providing the name of the limited liability company, followed by the purpose of the business. For instance, you can write: 'XYZ LLC is a limited liability company formed to provide consulting services.' This clearly illustrates what an LLC might look like in practice. Remember to include important elements like the registered address and management structure.

Amazon is not an LLC; it's structured as a corporation. This corporation structure affords it specific benefits in terms of shareholder engagement and tax obligations, distinguishing it from a limited liability company with example. Companies may choose between these structures based on their growth strategies and operational goals.

Amazon operates as a corporation, specifically as Amazon, Inc. rather than a limited liability company. This corporate structure allows for scalability and attracts investment while providing the necessary legal protections. It's essential to recognize how different structures can influence a business's operations and growth potential.

Apple Inc. is a corporation and not an LLC. The 'Inc.' designation signifies that it is a corporation, which provides a different set of legal protections and operational methodologies compared to a limited liability company with example. This choice reflects strategic decisions regarding growth and shareholder value.

Google is not a limited liability company; it is a corporation. However, many subsidiaries under the Alphabet umbrella may operate as LLCs. Understanding this distinction is crucial for those exploring business structures, as it impacts liability and taxation.

A limited company refers to a business structure that protects its owners from personal liability, such as a limited liability company with example. For instance, 'Dairy Queen' operates as a limited company in some regions, safeguarding individual assets from business debts. This structure typically appeals to those looking for security while running their businesses.