Az Deed Beneficiary With The Inheritance Payment

Description

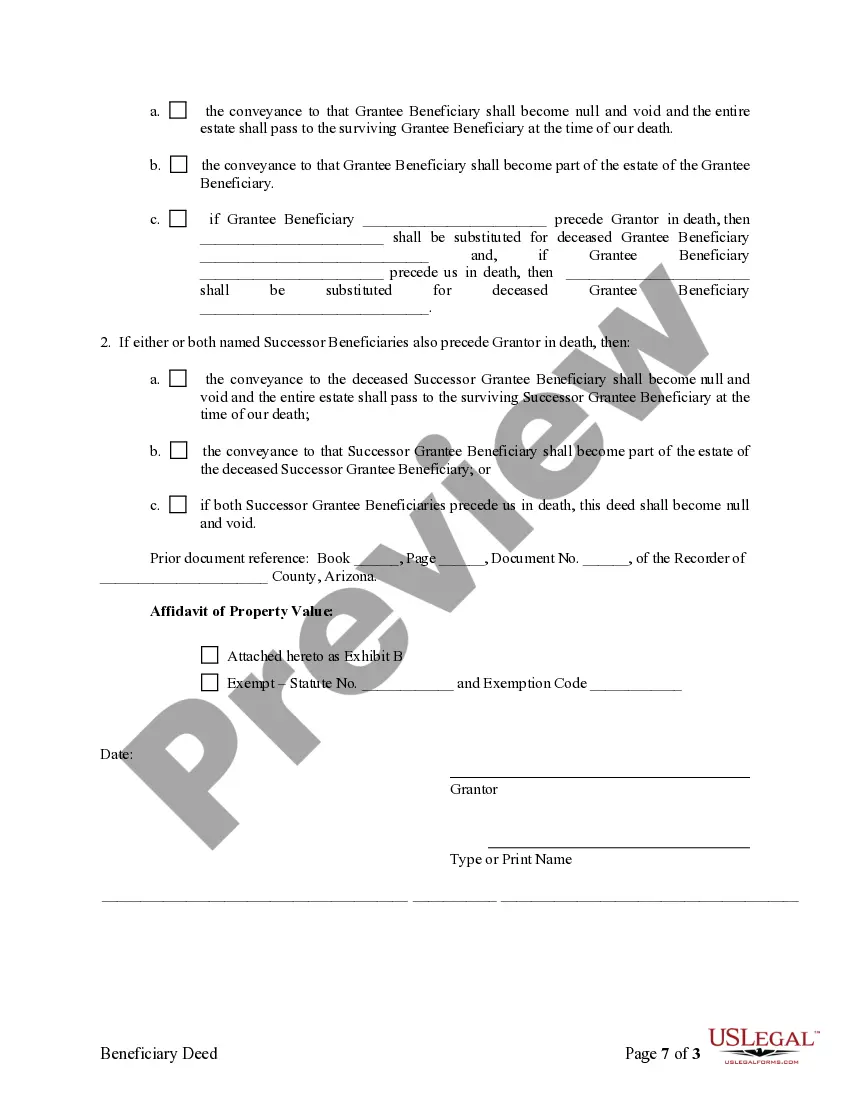

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

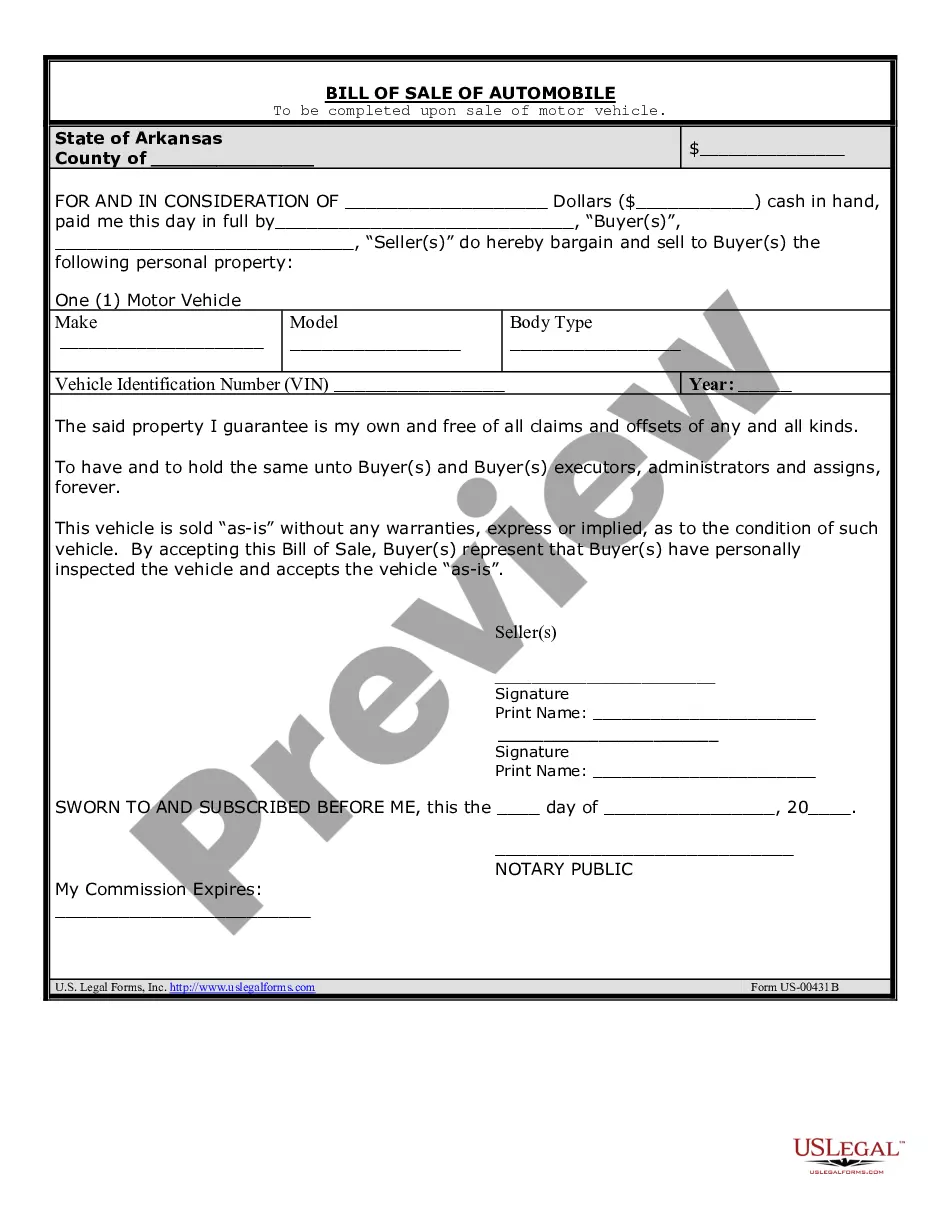

Whether for business purposes or for individual affairs, everyone has to deal with legal situations at some point in their life. Completing legal paperwork needs careful attention, starting with picking the right form template. For example, if you pick a wrong version of the Az Deed Beneficiary With The Inheritance Payment, it will be declined once you send it. It is therefore important to get a trustworthy source of legal files like US Legal Forms.

If you have to get a Az Deed Beneficiary With The Inheritance Payment template, follow these easy steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Check out the form’s information to make sure it matches your case, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong form, get back to the search function to locate the Az Deed Beneficiary With The Inheritance Payment sample you require.

- Download the file if it matches your requirements.

- If you already have a US Legal Forms account, simply click Log in to gain access to previously saved documents in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Select the correct pricing option.

- Finish the account registration form.

- Pick your transaction method: use a credit card or PayPal account.

- Select the file format you want and download the Az Deed Beneficiary With The Inheritance Payment.

- After it is downloaded, you can fill out the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you don’t need to spend time looking for the right sample across the internet. Use the library’s straightforward navigation to find the correct form for any occasion.

Form popularity

FAQ

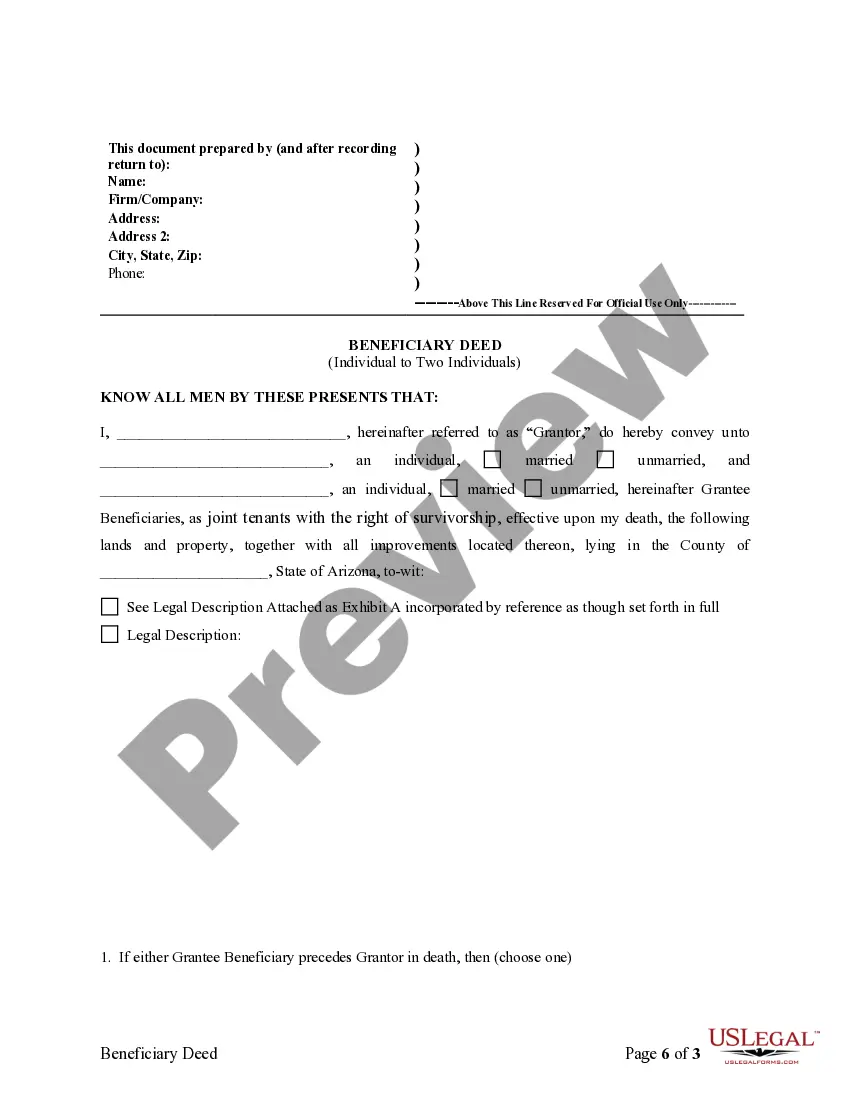

You must sign the deed and get your signature notarized, and then record (file) the deed with the recorder's office before your death. Otherwise, it won't be valid. You can make an Arizona beneficiary deed with WillMaker.

An Arizona Beneficiary Deed is much simpler than creating and administering a trust. In addition, the owner retains complete control over the property with an Arizona Beneficiary Deed. No gift tax liability. Since an Arizona Beneficiary Deed does not transfer property as a ?gift,? it is not subject to gift taxes.

The Arizona Beneficiary Deed Law allows you to avoid the possibly lengthy probate process. It allows you to sign and record a deed, during your lifetime, that transfers real property to one or more people upon your death.

You cannot use your will to revoke or override a beneficiary deed. How ownership is transferred. To get title to the property after your death, the beneficiary must record a certified copy of the death certificate in the recorder's office.