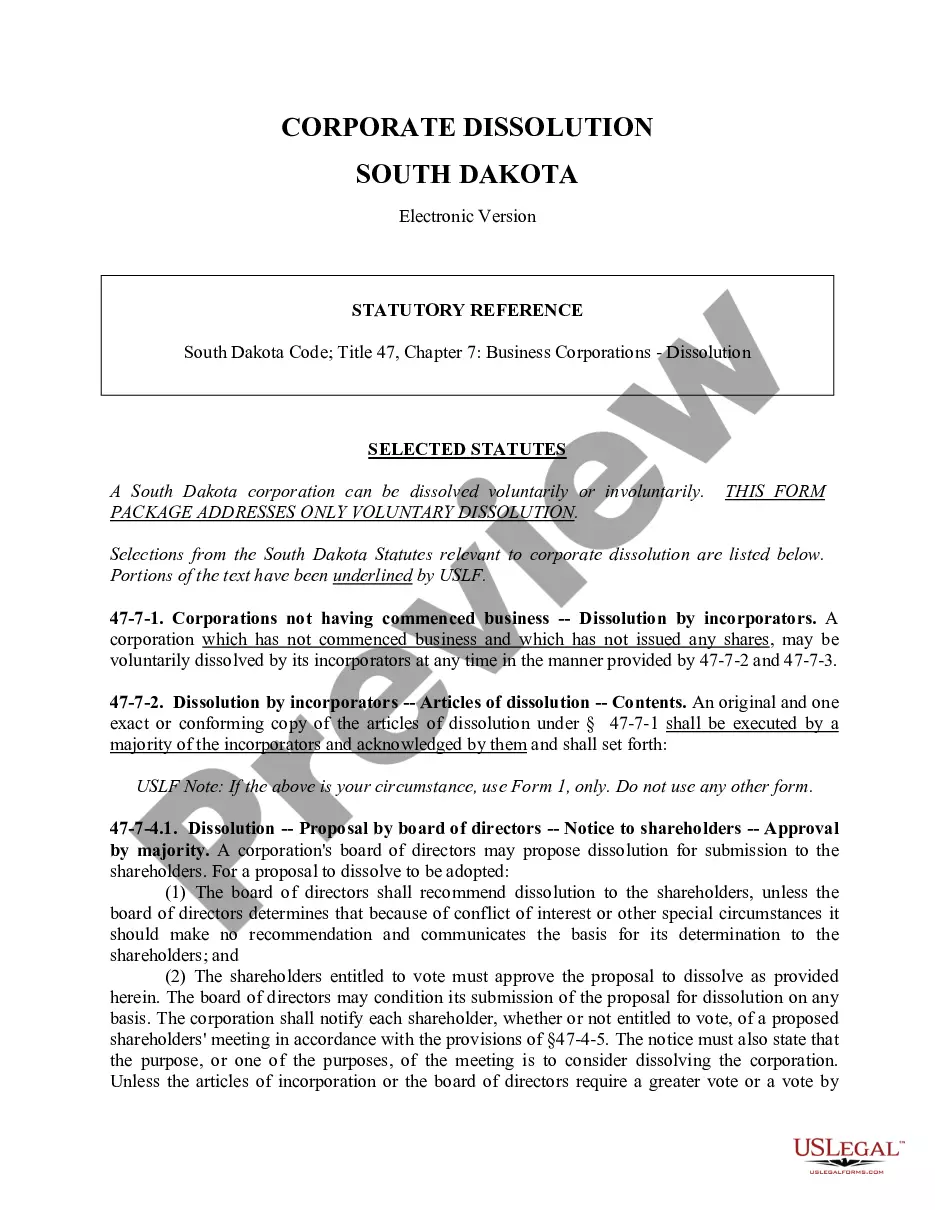

Alabama Resale Certificate Example

Description

How to fill out Alabama Sale Of A Business Package?

Legal administration can be daunting, even for the most proficient professionals.

When you are looking for an Alabama Resale Certificate Sample and lack the time to dedicate to finding the correct and current edition, the tasks can be taxing.

Access a repository of articles, tutorials, manuals, and resources related to your situation and needs.

Conserve time and effort searching for the documents you require, and utilize US Legal Forms’ sophisticated search and Review feature to find your Alabama Resale Certificate Sample and acquire it.

Leverage the US Legal Forms online library, supported by 25 years of expertise and reliability. Improve your everyday document management into a seamless and user-friendly experience today.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents section to review the documents you have previously saved and to organize your folders as you wish.

- If this is your first encounter with US Legal Forms, create a free account and gain unlimited access to all the advantages of the library.

- Here are the steps to follow after downloading the form you require.

- Ensure it is the correct form by previewing it and reviewing its details.

- Confirm that the sample is approved in your state or county.

- Click Buy Now when you are prepared.

- Choose a subscription plan.

- Select the format you want, then Download, complete, sign, print, and send your document.

- Access state- or county-specific legal and organizational documents.

- US Legal Forms meets all your requirements, ranging from personal to business forms, all in one location.

- Utilize advanced tools to fill out and handle your Alabama Resale Certificate Sample.

Form popularity

FAQ

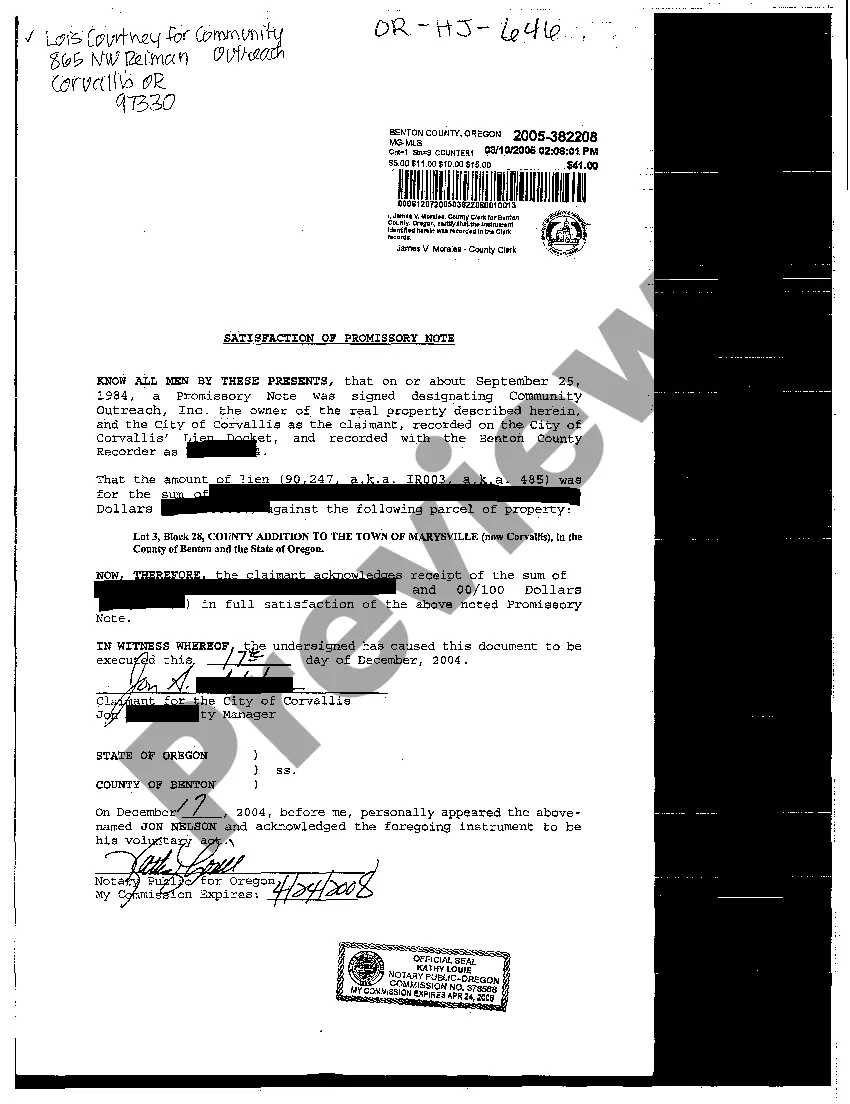

FastFilings can quickly help you obtain your Alabama resale certificate?i.e., seller's permit?using our simplified process. Complete our secure online application form. Upload any required documentation. Submit your payment information. We review your application for accuracy and submit it electronically to the state.

You must complete the appropriate application found on the website at .revenue.alabama.gov. The applicable form will be ST: EX-A1 (For Wholesalers, Manufacturers, and Other Product Based Exemptions) or ST: EX-A1-SE (For Statutorily Exempt Entities).

Alabama Visit My Alabama Taxes. Click ?Verify a Resale Certificate? Choose whether to enter your customer's Federal Employee ID Number (FEIN), Individual Tax ID Number (ITIN), or Social Security Number (SSN) and enter it. Enter the customer's Exempt Sales Account Number.

Accept Out-of-state Resale Certificate? Alabama requires you to register for a sales tax permit in order to purchase items in-state tax free for resale unless you are a dropshipper. If you are dropshipping, Alabama will accept your home-state exemption certificate.

To get a resale certificate in Alabama, you may complete the Alabama Application for Certificate of Exemption (Form ST-EX-A1).