Lien Holder Agreement Form

Description

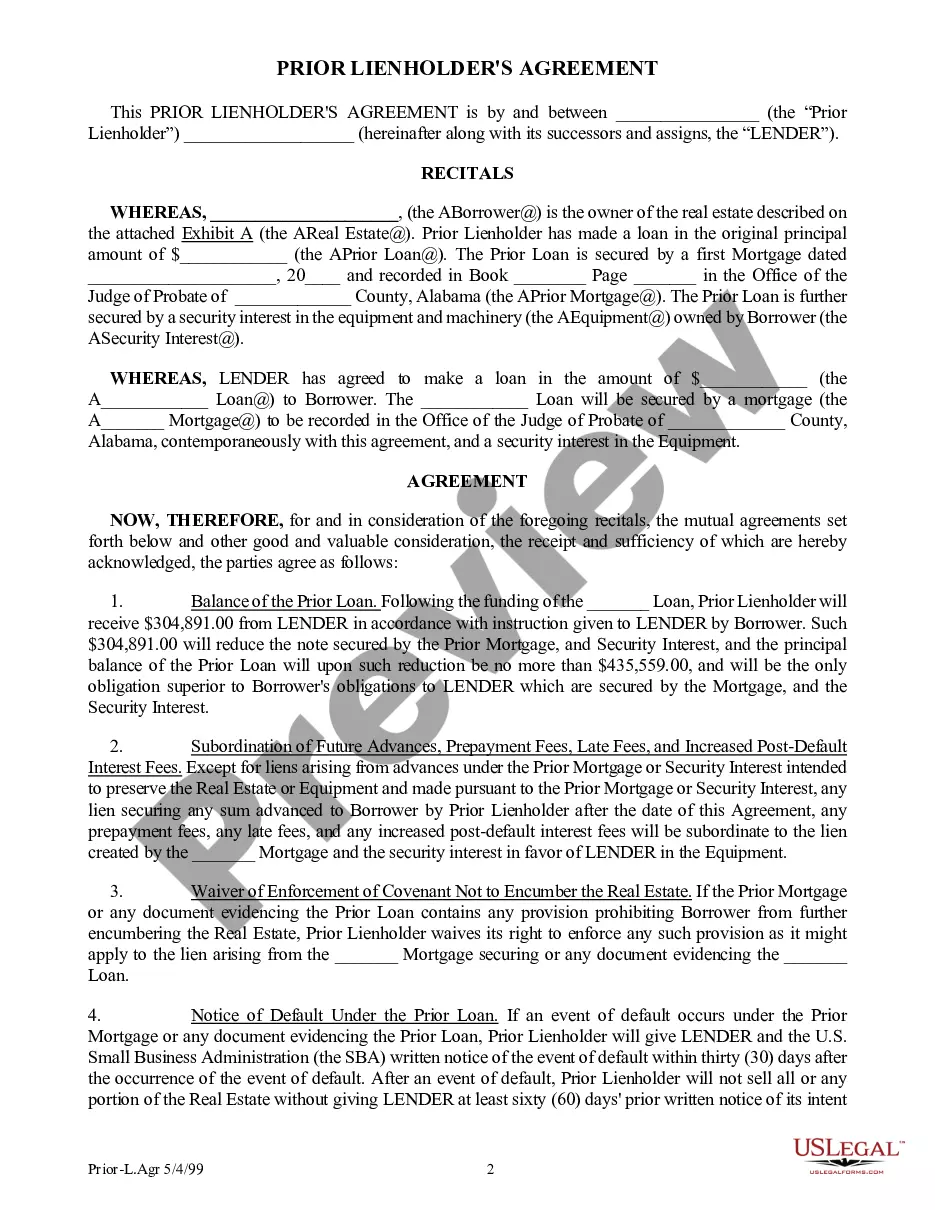

How to fill out Alabama Prior Lienholder's Agreement And Subordination?

There’s no further justification to squander time searching for legal documents to satisfy your local state stipulations. US Legal Forms has consolidated all of them in one location and enhanced their accessibility.

Our platform offers over 85k templates for any business and personal legal circumstances organized by state and area of usage. All forms are accurately drafted and verified for authenticity, so you can trust in receiving a current Lien Holder Agreement Form.

If you are acquainted with our service and already possess an account, ensure your subscription is active before acquiring any templates. Log In to your account, select the document, and click Download. You can also revisit all obtained paperwork as needed by accessing the My documents tab within your profile.

Print your form to fill it out manually or upload the sample if you prefer to utilize an online editor. Preparing official documents under federal and state laws is quick and simple with our library. Experience US Legal Forms today to maintain your documentation in order!

- If you’ve never utilized our service before, the procedure will require a few additional steps to finalize.

- Here’s how new users can find the Lien Holder Agreement Form in our collection.

- Examine the page content closely to ensure it contains the sample you need.

- To do so, employ the form description and preview options if available.

- Make use of the Search bar above to identify another template if the current one doesn’t meet your needs.

- Click Buy Now adjacent to the template name once you locate the suitable one.

- Select the most appropriate pricing plan and either create an account or Log In.

- Process payment for your subscription using a credit card or via PayPal to proceed.

- Select the file format for your Lien Holder Agreement Form and download it to your device.

Form popularity

FAQ

New Jersey lien holders must visit a motor vehicle agency to complete this transaction; out-of-state lien holders may submit through the mail. In both cases, the new title will be mailed to the lien holder.

Tampa, Florida 33619-0917Submit paper title or a completed HSMV 82101 if unable to locate paper title.Your customer should sign a completed form HSMV 82139 Notice of Lien.Submit the completed form HSMV 82139 and a check (see fees) to the Tax Collector's office. The lien will be added to show you as lienholder.

Talk to your state's DMV about the procedure for filing a mechanic's lien. Most times, you will fill out an "Entry of Lien" form and file documents showing that you are owed money and are legally entitled to file the lien.

The lien agreement form is a security measure taken by the creditor by which an asset owned by the debtor cannot be sold before the creditor is repaid in full.

Add or Remove a Lien on a Vehicle To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.