Promissory Note Template Alabama Without Interest

Definition and meaning

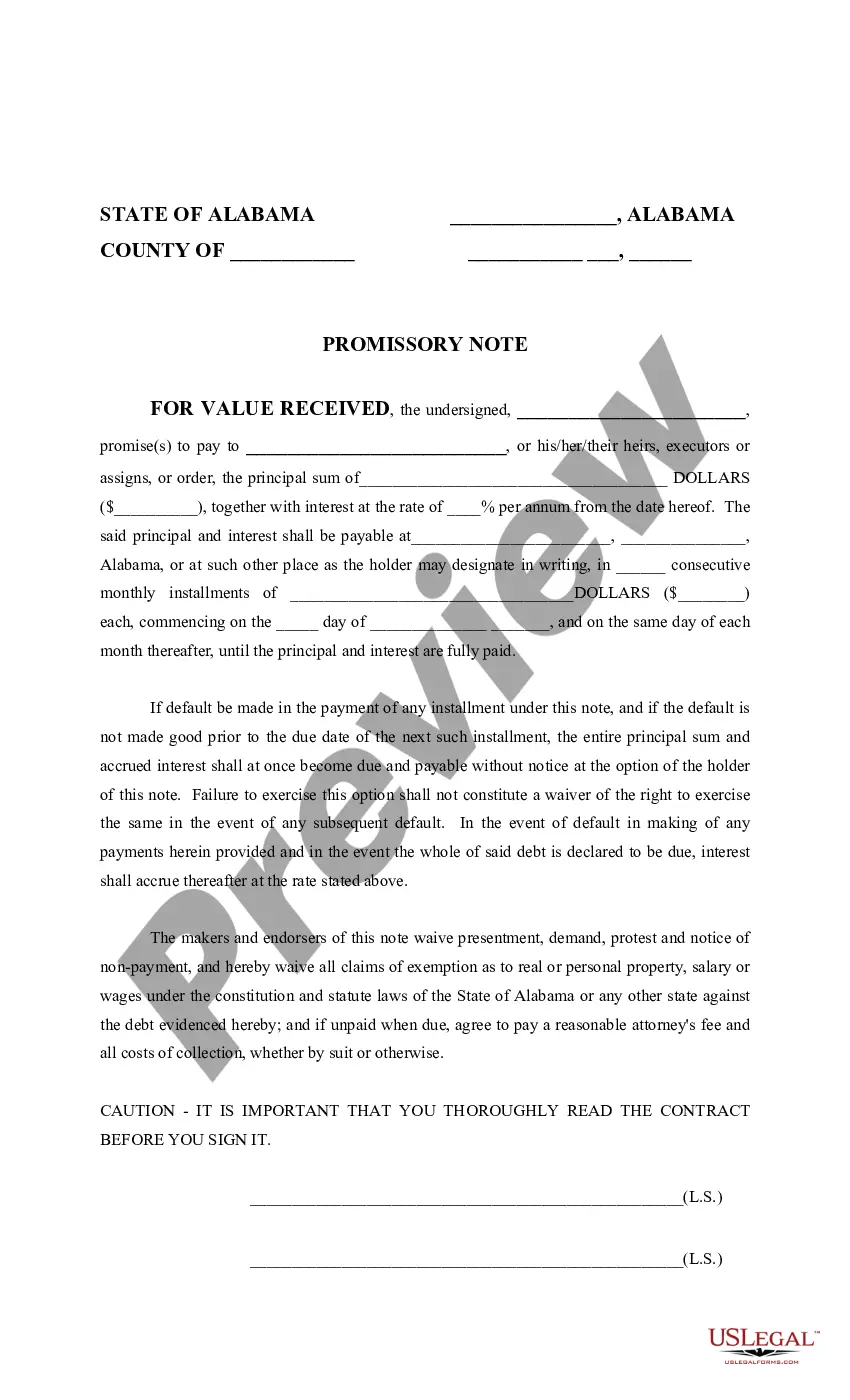

A Promissory Note is a legal document in which one party, known as the maker, promises in writing to pay a specific sum of money to another party, known as the payee, at a predetermined date or on demand. The Promissory Note Template for Alabama without interest formalizes this agreement without attaching any interest obligations, simplifying the repayment process for the borrower.

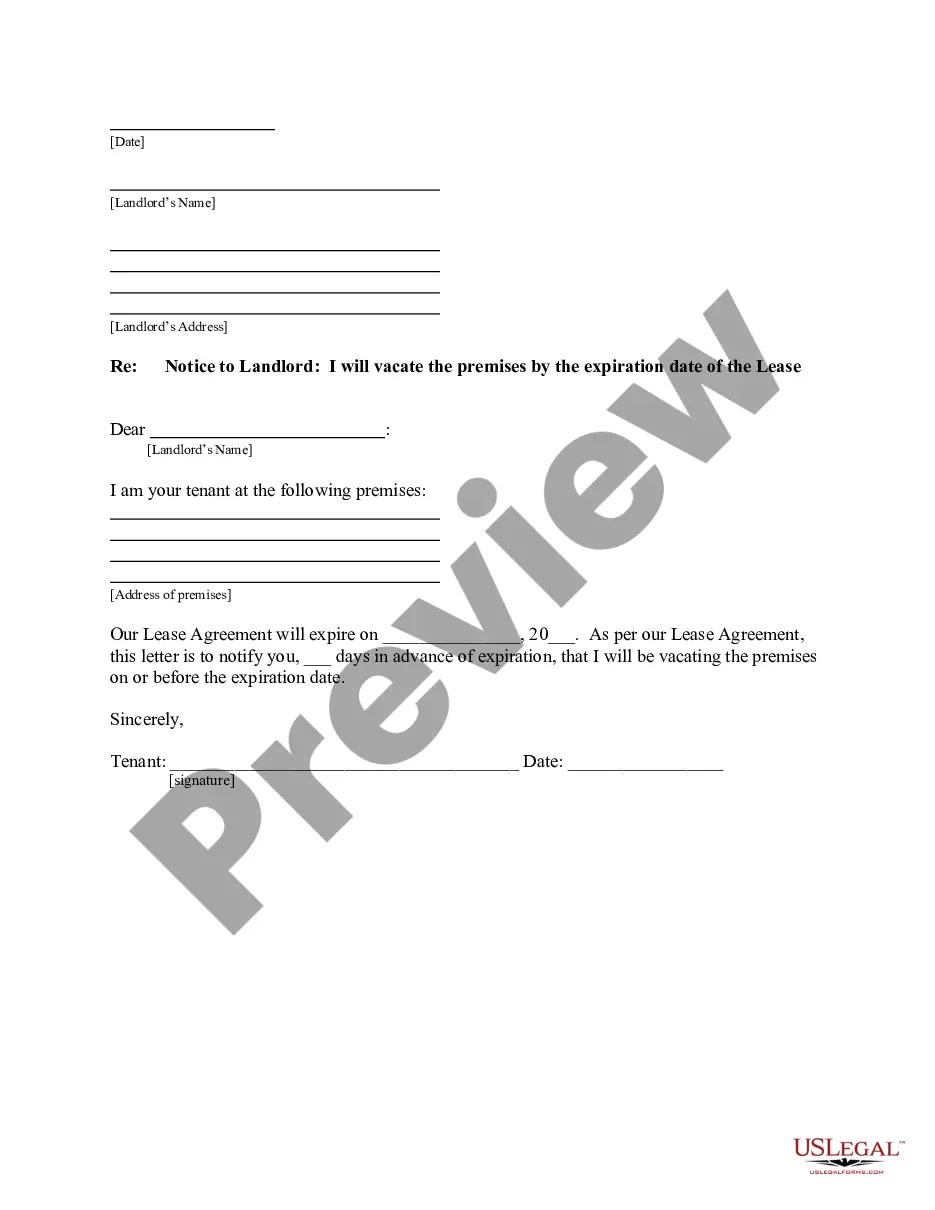

How to complete a form

To properly complete a Promissory Note Template for Alabama without interest, follow these steps:

- Enter your information: Fill in your name and contact details as the maker.

- Identify the payee: Provide the name of the individual or organization receiving the payment.

- Specify the amount: Clearly state the principal sum being borrowed, in both textual and numerical form.

- Set the repayment details: Outline the payment schedule, including the repayment date and any installment amounts.

- Review conditions: Include clauses about default and waivers, ensuring all parties are aware of their rights and responsibilities.

Who should use this form

This form is ideal for individuals or entities in Alabama who need to formalize a loan agreement without interest. Users may include:

- Friends or family lending money without interest.

- Business partners borrowing funds for a project.

- Individuals purchasing a vehicle or property through private financing.

Legal use and context

The Promissory Note Template for Alabama without interest serves as a binding contract, ensuring that both parties have documented their financial agreement. Its significance lies in its ability to legally protect lenders and borrowers, providing avenues for recourse in case of default. The absence of interest rates may simplify the agreement, making it useful in personal loans and informal lending situations.

Key components of the form

Essential elements included in the Promissory Note Template for Alabama without interest are:

- Parties involved: Names and addresses of the maker and payee.

- Loan amount: The principal sum written in both words and numbers.

- Repayment terms: Monthly payment amounts, due dates, and total payment obligations.

- Default provisions: Terms regarding what happens in the event of non-payment.

- Waivers: Statements that waive certain rights to challenge the note.

How to fill out Alabama Promissory Note?

Precisely composed formal documents are one of the crucial assurances for preventing issues and lawsuits, but acquiring them without an attorney's assistance may require time.

Whether you need to swiftly locate a current Promissory Note Template Alabama Without Interest or any other documents for employment, family, or business purposes, US Legal Forms is always available to assist.

The process is even simpler for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen file. Furthermore, you can access the Promissory Note Template Alabama Without Interest at any time later, as all documents ever acquired on the platform are accessible within the My documents tab of your profile. Save time and money on preparing official papers. Experience US Legal Forms today!

- Ensure that the document is appropriate for your situation and location by reviewing the description and preview.

- Look for another sample (if necessary) using the Search bar located in the page header.

- Click Buy Now when you identify the relevant template.

- Select the pricing option, Log In to your account, or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Promissory Note Template Alabama Without Interest.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

If you decide to give the loan without charging any interest, be prepared to justify it to the IRS, because it literally is a gift in the IRS's eyes. The IRS can "impute" interest on your loan, whether you actually charged any interest or not, and require you to report that imputed interest as income.