Promissory Note Template Alabama With Amortization Schedule

Definition and meaning

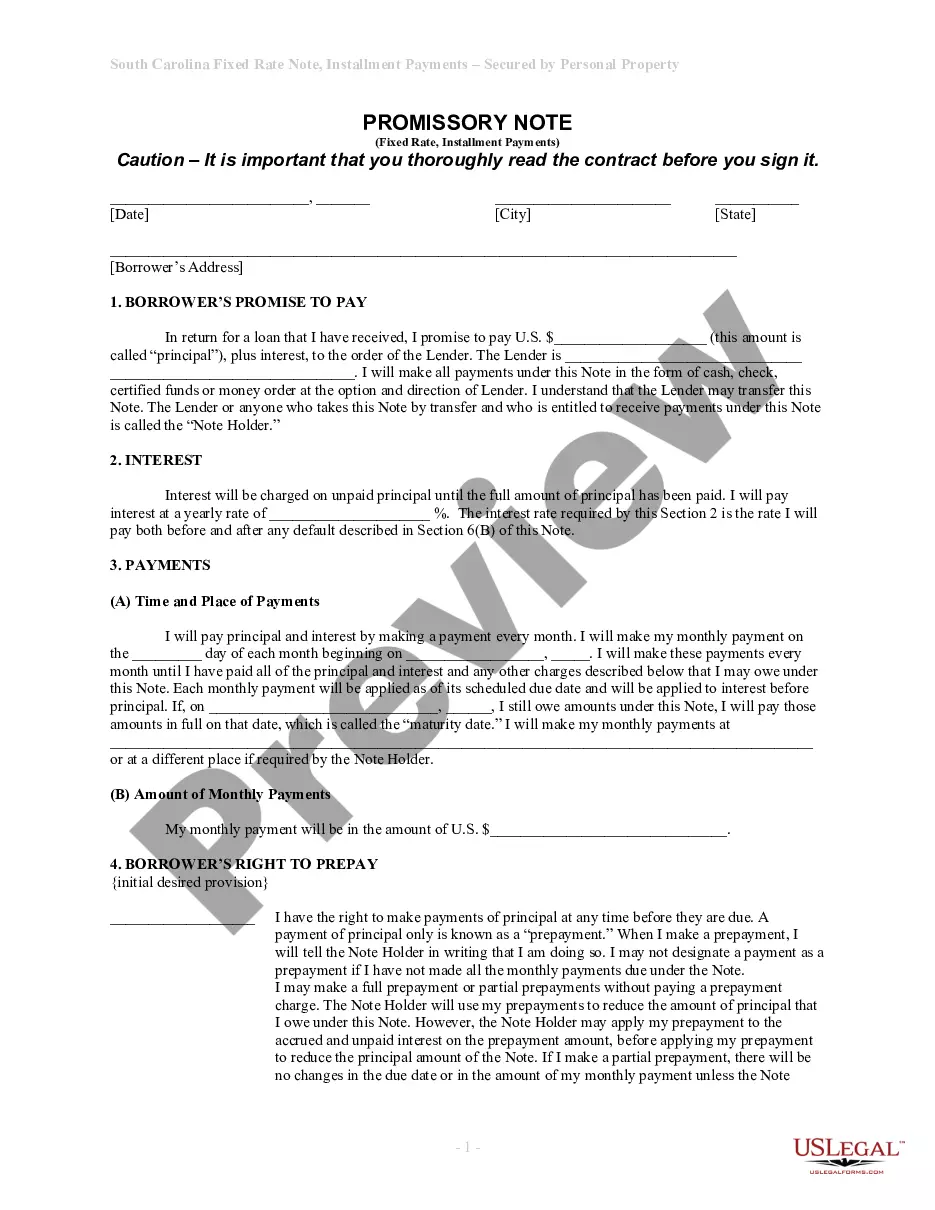

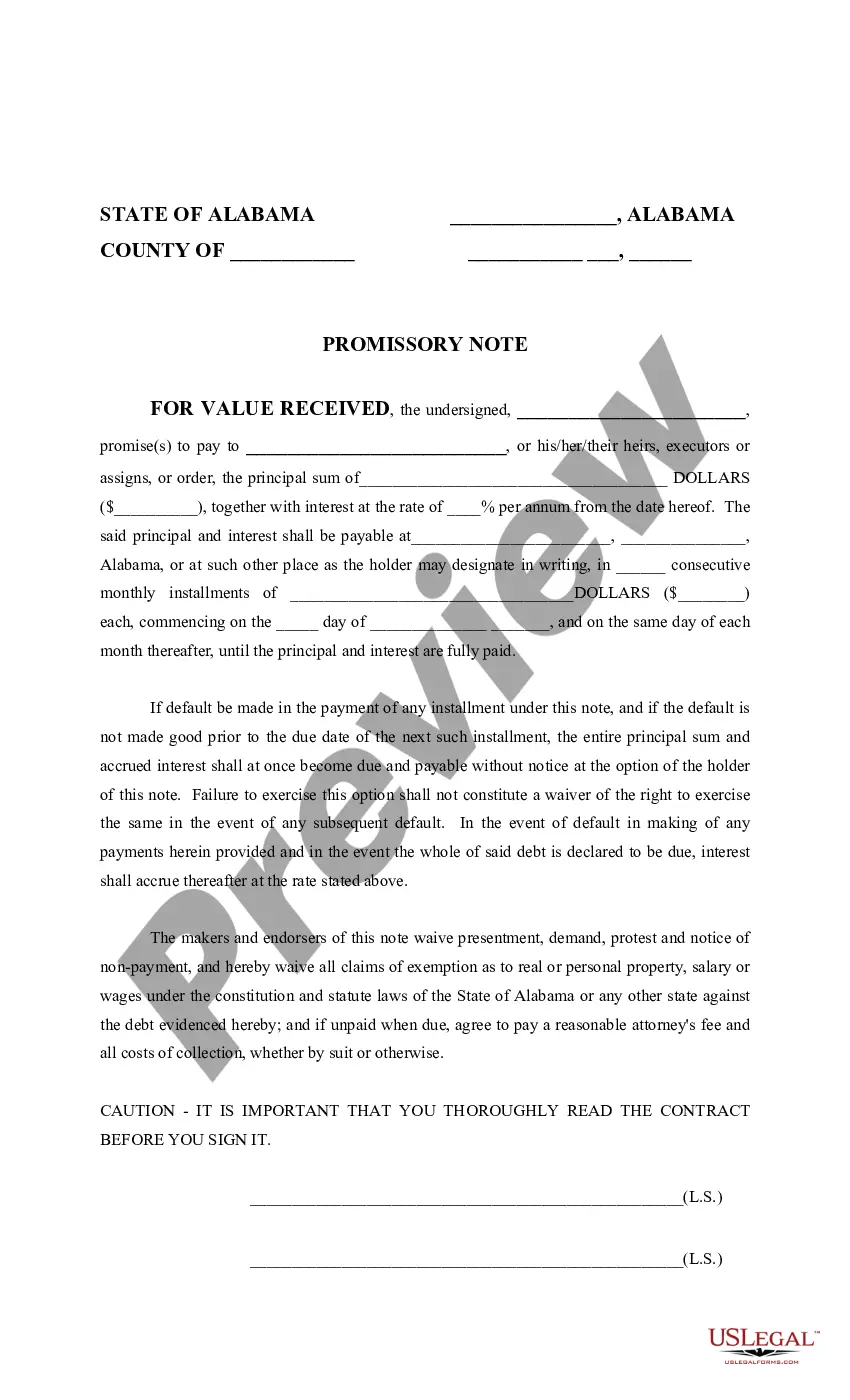

A promissory note is a legal document that contains a written promise from one party (the borrower) to pay a specific sum of money to another party (the lender) at a determined future date. The Alabama promissory note template with amortization schedule is specifically designed for borrowers and lenders in Alabama, incorporating provisions that adhere to state laws. The amortization schedule outlines the payment plan over the life of the loan, detailing how each payment is divided between principal repayment and interest expenses.

Key components of the form

The Alabama promissory note template with amortization schedule includes several essential components:

- Parties: Full legal names, addresses, and contact details of both borrower and lender.

- Loan Details: The principal amount borrowed, the interest rate, and the repayment terms, distinguishing between monthly or other periodic payments.

- Amortization Schedule: A detailed schedule breaking down each payment into principal and interest components.

- Maturity Date: When the loan must be fully paid.

- Collateral: Information about secured assets, if applicable.

- Default Terms: Terms outlining penalties for late or missed payments.

- Governing Law: Indicates that the note is subject to Alabama law.

How to complete a form

Filling out a promissory note template involves several steps:

- Identify the Parties: Enter the full legal names and addresses of both the borrower and lender.

- Specify Loan Details: Fill in the principal amount, interest rate, and the total payment amount.

- Establish Payment Schedule: State the repayment frequency and include the amortization schedule.

- Outline Terms: Include any collateral, default terms, and maturity date provisions.

- Sign the Document: Both parties must sign and date the document, and consider having it notarized for added legal weight.

Benefits of using this form online

Using an Alabama promissory note template with amortization schedule online offers numerous advantages:

- Convenience: Available anytime and from any location, making it easy to complete the document.

- Time-Saving: Ready-to-use templates streamline the preparation process, allowing users to focus on key details.

- Lawyer-Approved: Many templates are drafted or reviewed by licensed attorneys, ensuring compliance with Alabama laws.

- Customization: Users can tailor details specific to their agreement's terms and conditions.

Common mistakes to avoid when using this form

When completing a promissory note, be cautious of the following pitfalls:

- Incomplete Information: Ensure all fields, including borrower and lender details, are fully completed.

- Incorrect Terms: Double-check the interest rate and payment amounts for accuracy.

- Forgetting Signatures: Both parties must sign the document for it to be enforceable.

- Neglecting Notarization: Consider notarizing the document, especially for larger amounts, to add legal validity.

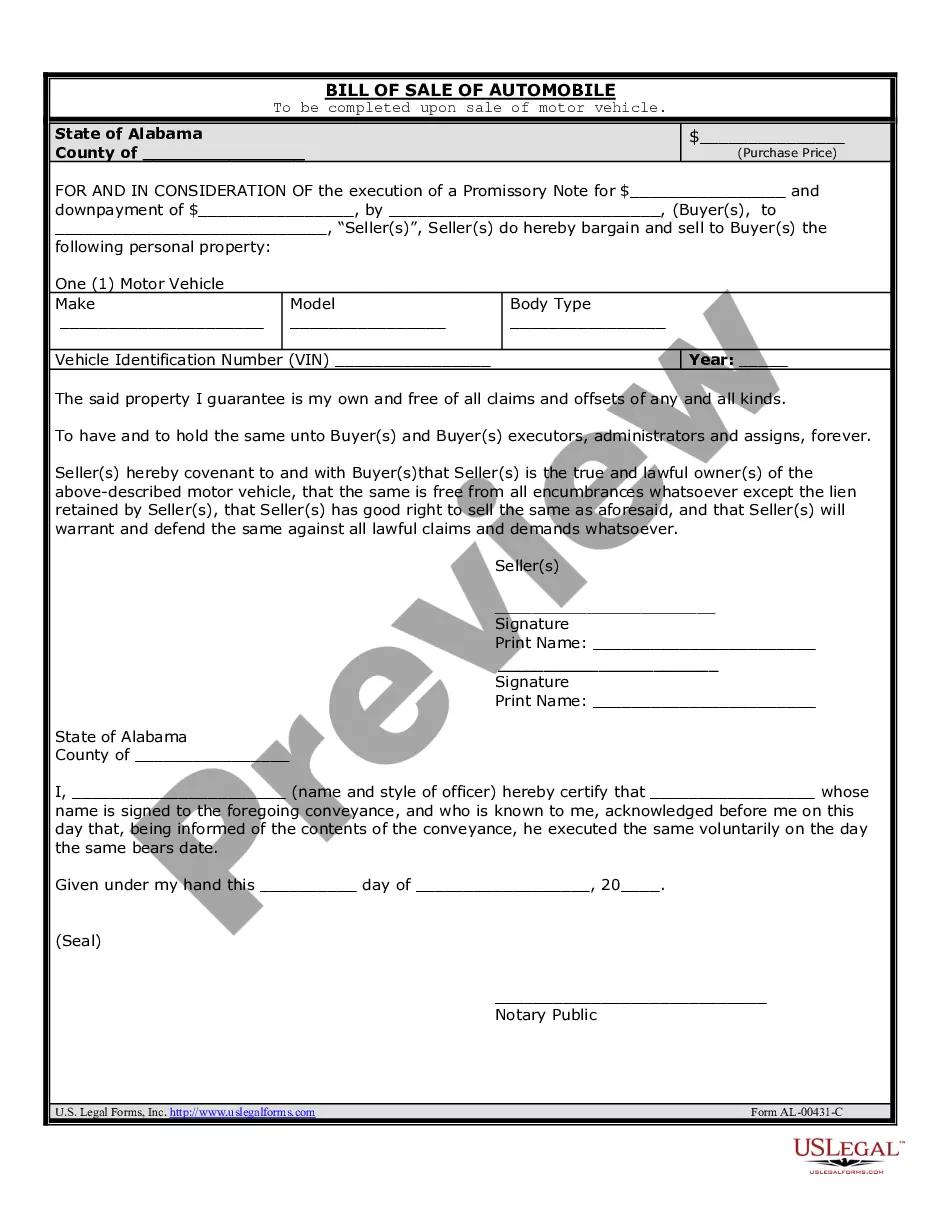

What documents you may need alongside this one

Depending on the terms of the loan, additional documents may be required to support the promissory note:

- Identification: Government-issued IDs from both parties to verify identities.

- Proof of Income: Recent pay stubs or tax returns to demonstrate the borrower's ability to repay the loan.

- Collateral Documentation: Documentation detailing any assets used as collateral for the loan.

- Previous Agreements: Review any existing agreements that may influence the new loan terms.

How to fill out Alabama Promissory Note?

Individuals often link legal documentation with something complex that only an expert can handle.

In some respects, this is accurate, as creating a Promissory Note Template Alabama With Amortization Schedule necessitates considerable knowledge of subject matters, including state and local laws.

Nevertheless, with the US Legal Forms, everything has become more user-friendly: ready-to-use legal templates for any life and business scenario tailored to state laws are gathered in a single online repository and are now accessible to everyone.

Print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once obtained, they are saved in your profile. You can access them whenever necessary via the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Sign up today!

- US Legal Forms provides over 85k current documents organized by state and area of application, so searching for a Promissory Note Template Alabama With Amortization Schedule or any other specific template only requires minutes.

- Previously registered users with an active membership need to Log In to their account and click Download to retrieve the form.

- New users to the service will first need to sign up for an account and subscribe before they can download any documents.

- Here is the step-by-step guide on how to acquire the Promissory Note Template Alabama With Amortization Schedule.

- Examine the page content thoroughly to ensure it meets your requirements.

- Review the form description or confirm it through the Preview option.

- Locate another sample using the Search field above if the previous one does not fit your needs.

- Click Buy Now when you find the appropriate Promissory Note Template Alabama With Amortization Schedule.

- Select a subscription plan that aligns with your needs and budget.

- Create an account or Log In to continue to the payment page.

- Complete the payment for your subscription using PayPal or your credit card.

- Choose the format for your file and click Download.

Form popularity

FAQ

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

If our payments are monthly, then we divide our annual interest rate by 12. The P stands for the fixed monthly payment amount that we will have to pay. To find the total amount that we end up paying, we multiply this fixed monthly amount by the total number of payments.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.