New Jersey Renunciation And Disclaimer of Property from Will by Testate

Description

Definition and meaning

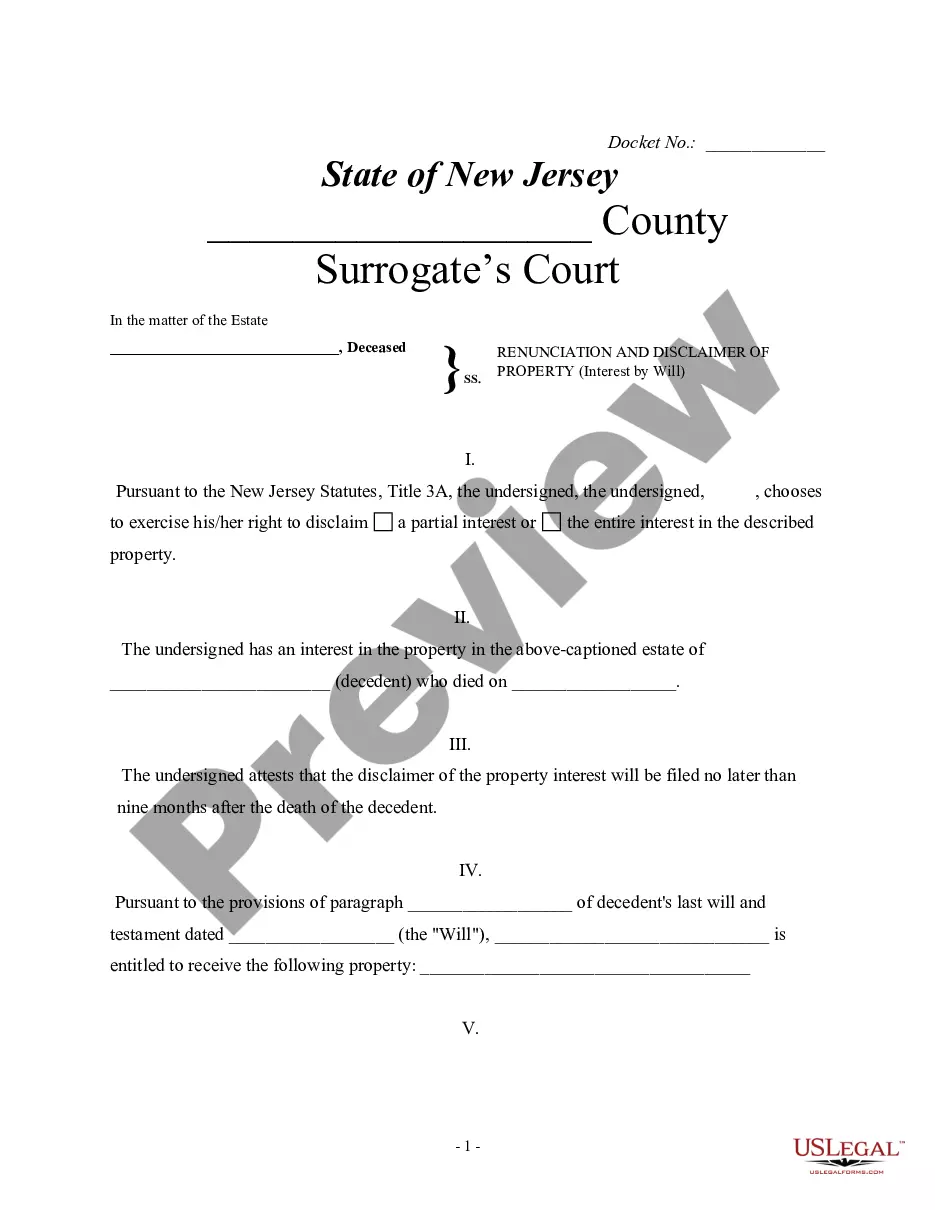

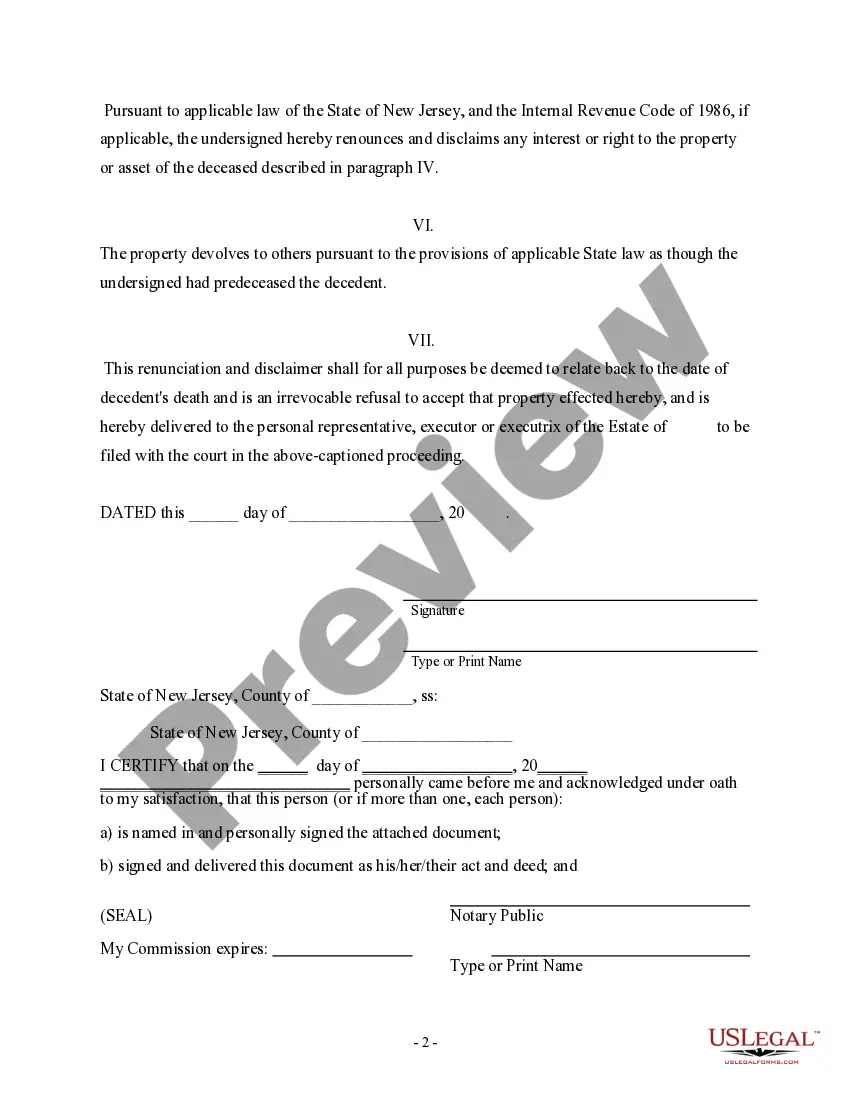

The New Jersey Renunciation and Disclaimer of Property from Will by Testate is a legal document used by an individual to formally refuse any interest in property or assets that they are entitled to inherit under a deceased person's will. This document allows a beneficiary to renounce their rights to the inheritance, ensuring that the property will pass to another designated beneficiary or according to state law, as if the renouncing person had predeceased the decedent.

How to complete a form

Completing the New Jersey Renunciation and Disclaimer of Property form involves several key steps:

- Identify the deceased individual and their date of death.

- Clearly state the interest being renounced, either partially or entirely.

- Ensure the disclaimer is filed within nine months of the decedent’s death.

- Sign the document in front of a notary public.

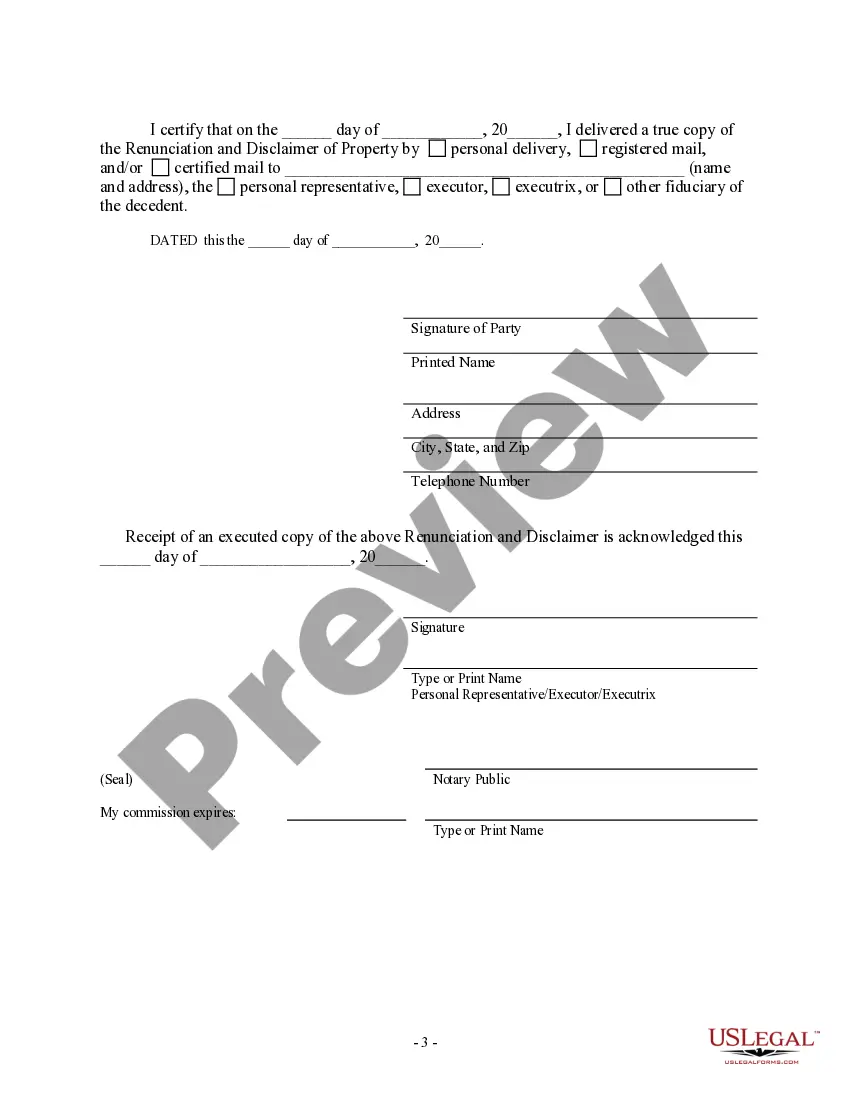

- Deliver a true copy of the executed form to the personal representative or executor of the estate.

Who should use this form

This form is intended for beneficiaries who wish to disclaim their inheritance from an estate in New Jersey. Individuals may choose to use this form for various reasons, such as financial planning, tax implications, or simply because they do not wish to accept the property for personal or familial reasons. It is particularly relevant for those who have been named in a will but prefer that their share passes to others.

Legal use and context

The renunciation and disclaimer of property is governed by New Jersey law, specifically under Title 3A of the New Jersey Statutes. This legal framework outlines the conditions and procedures for disclaiming an interest in a will. It is important for individuals to understand their rights and obligations under the law when completing this form, as failure to comply with legal requirements could invalidate the disclaimer.

State-specific requirements

In New Jersey, there are specific requirements that must be met for a renunciation and disclaimer to be valid:

- The disclaimer must be made within nine months of the decedent's death.

- The document must be signed by the person wishing to disclaim their interest.

- The disclaimer must be notarized and filed with the court overseeing the decedent's estate.

How to fill out New Jersey Renunciation And Disclaimer Of Property From Will By Testate?

US Legal Forms is actually a special platform where you can find any legal or tax template for submitting, such as New Jersey Renunciation And Disclaimer of Property from Will by Testate. If you’re tired of wasting time searching for suitable samples and paying money on record preparation/attorney charges, then US Legal Forms is precisely what you’re seeking.

To experience all of the service’s advantages, you don't have to download any application but simply pick a subscription plan and register your account. If you have one, just log in and find an appropriate sample, download it, and fill it out. Saved documents are stored in the My Forms folder.

If you don't have a subscription but need New Jersey Renunciation And Disclaimer of Property from Will by Testate, check out the recommendations listed below:

- check out the form you’re taking a look at is valid in the state you want it in.

- Preview the example and look at its description.

- Click Buy Now to reach the sign up page.

- Choose a pricing plan and carry on signing up by entering some info.

- Choose a payment method to complete the registration.

- Download the document by selecting the preferred format (.docx or .pdf)

Now, complete the document online or print out it. If you are uncertain concerning your New Jersey Renunciation And Disclaimer of Property from Will by Testate form, contact a lawyer to review it before you decide to send out or file it. Get started hassle-free!

Form popularity

FAQ

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

Danger #1: Only delays probate. Danger #2: Probate when both owners die together. Danger #3: Unintentional disinheriting. Danger #4: Gift taxes. Danger #5: Loss of income tax benefits. Danger #6: Right to sell or encumber. Danger #7: Financial problems.

Disclaim Inheritance, Definition In a nutshell, it means you're refusing any assets that you stand to inherit under the terms of someone's will, a trust or, in the case of a person who dies intestate, the inheritance laws of your state.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.A disclaimer of interest is irrevocable.

It must be in writing. It must be made within 9 months of the date of death of the decedent. The disclaimant cannot receive any benefits from the assets.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

The surviving spouse can serve as the sole trustee, but cannot have any power to direct the beneficial enjoyment of the disclaimed property unless the power is limited by an "ascertainable standard." This is necessary both to qualify the disclaimer and to avoid any taxable general power of appointment.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.