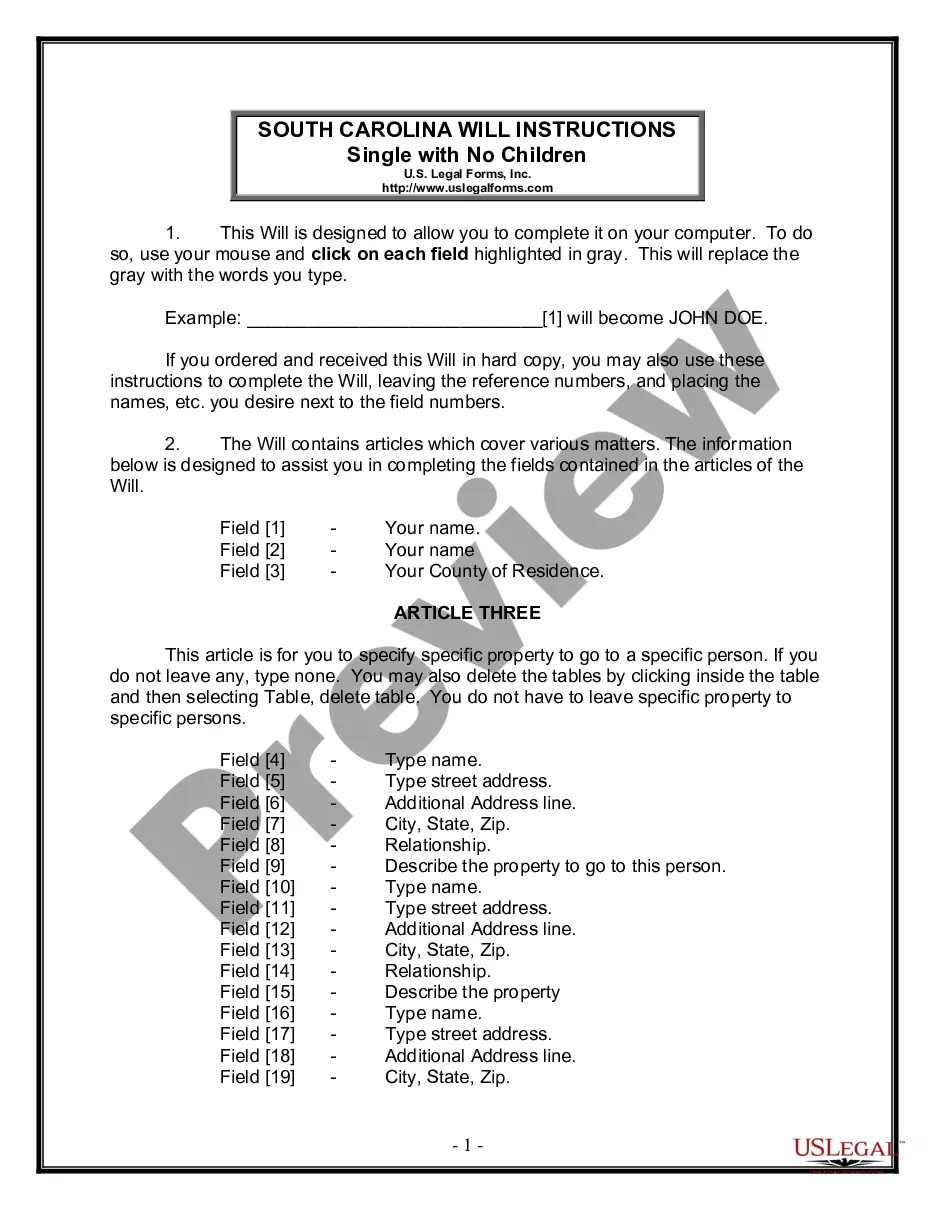

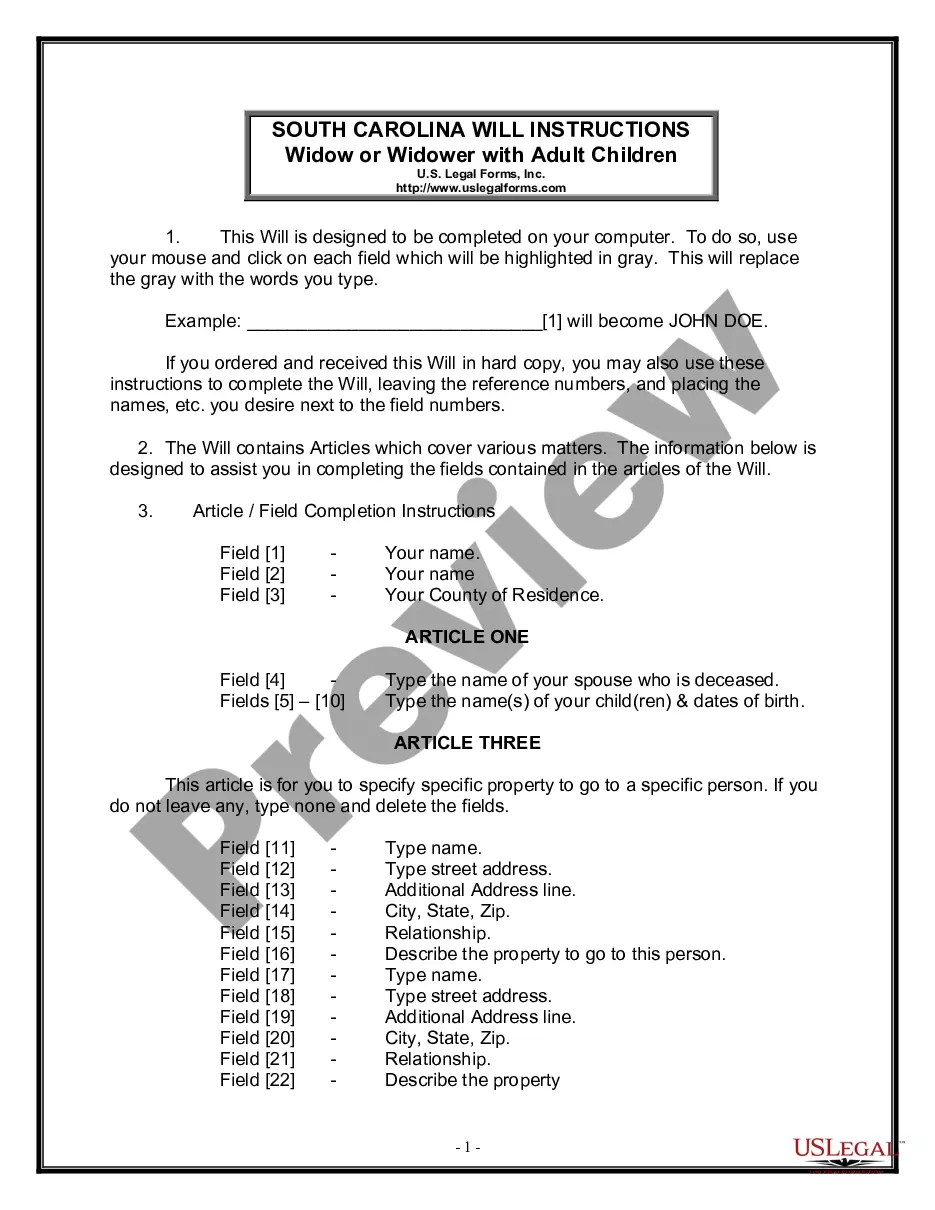

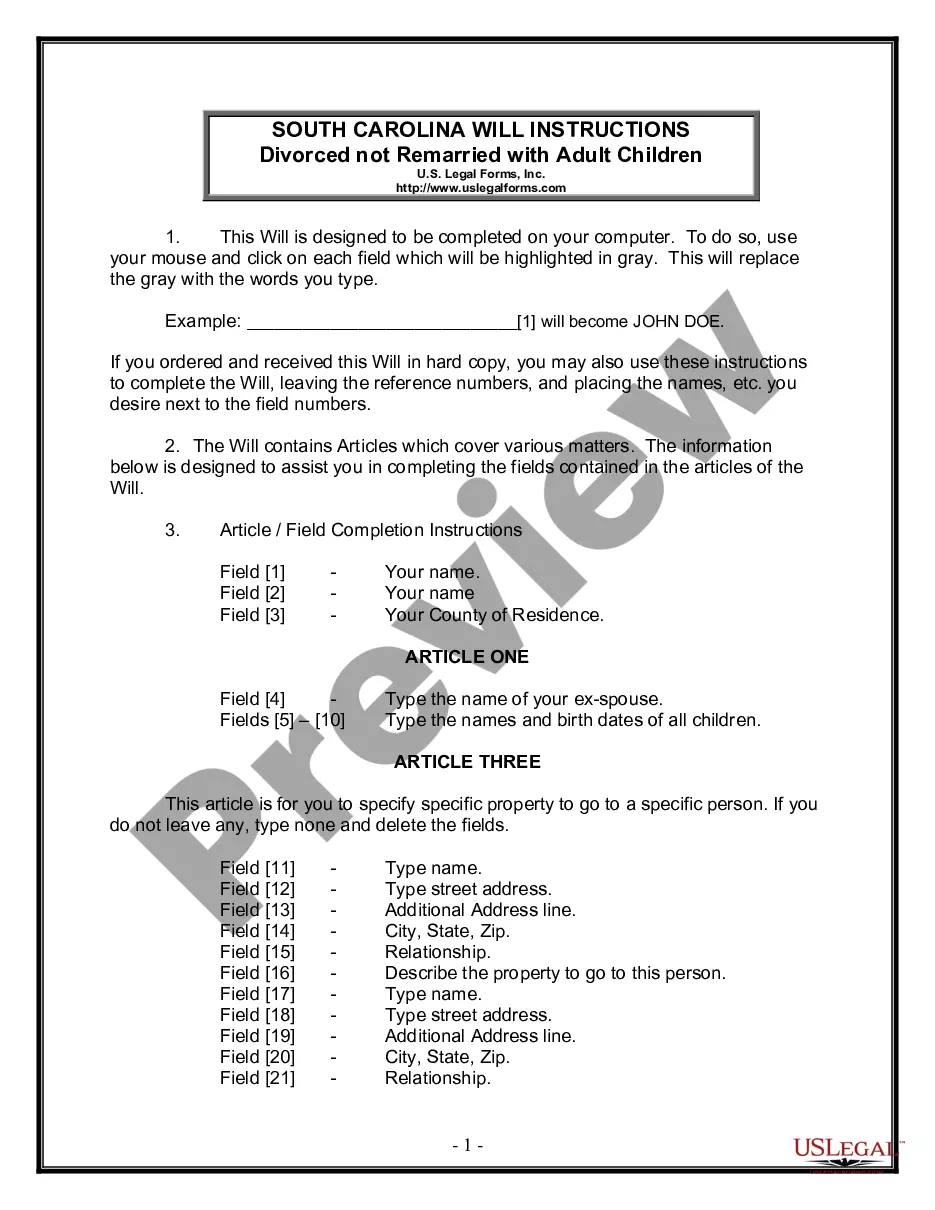

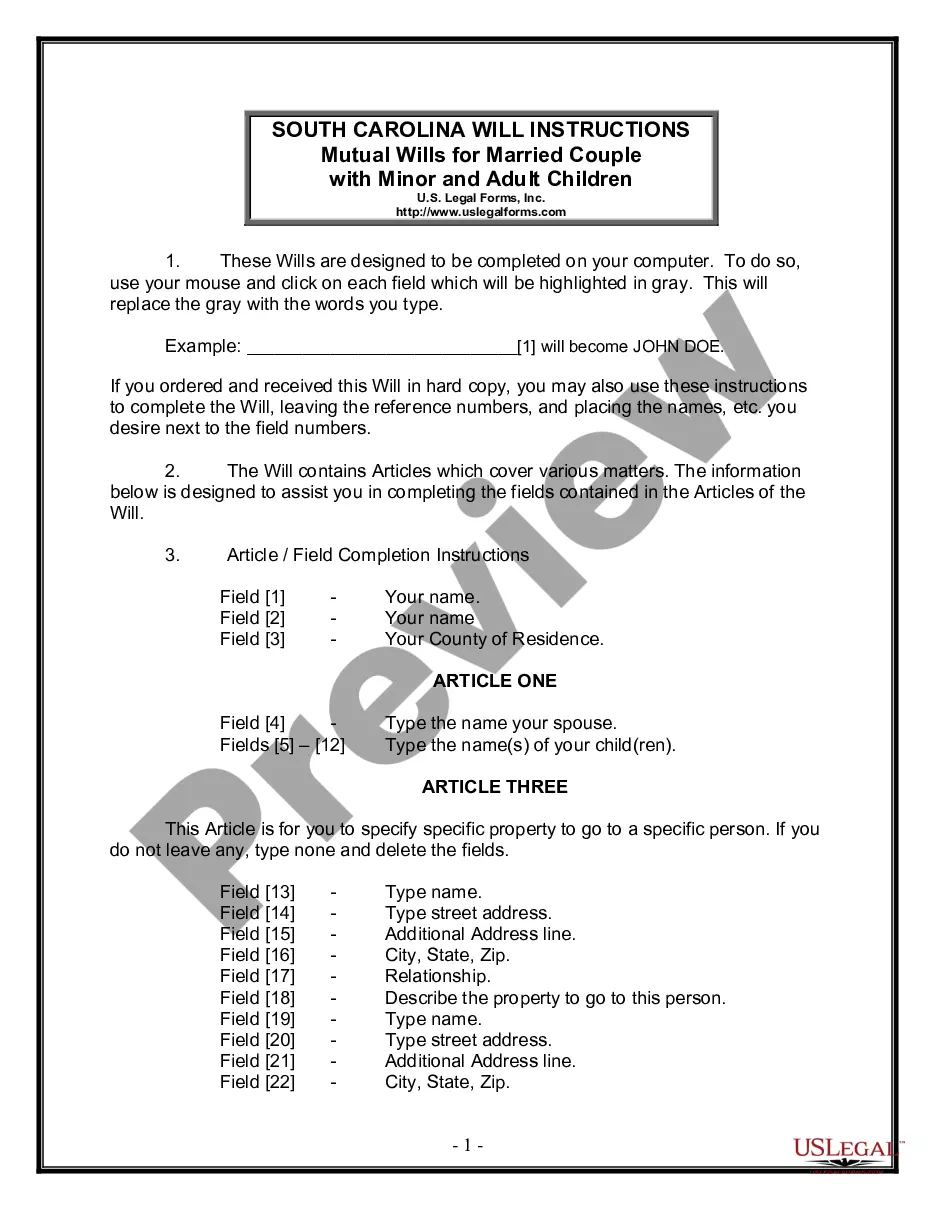

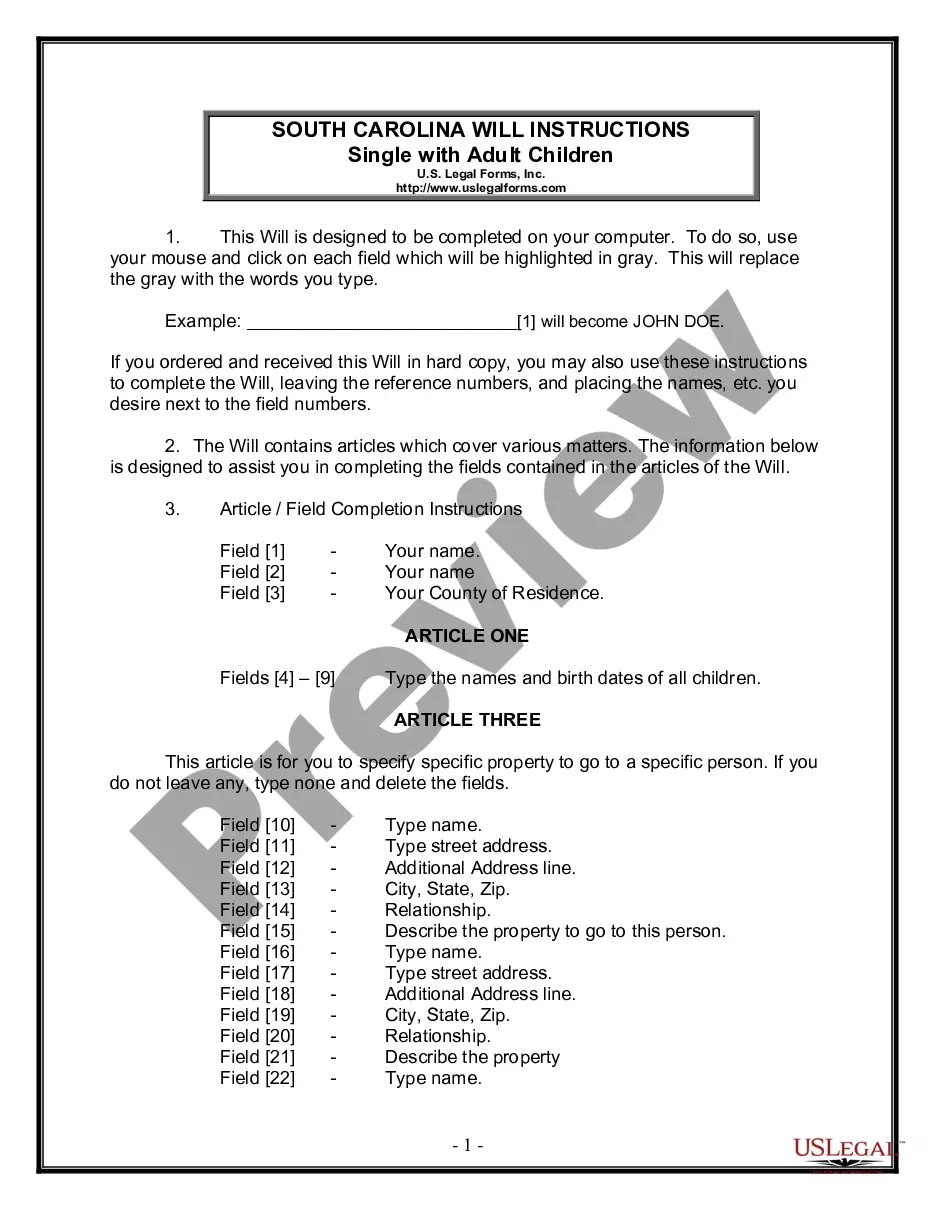

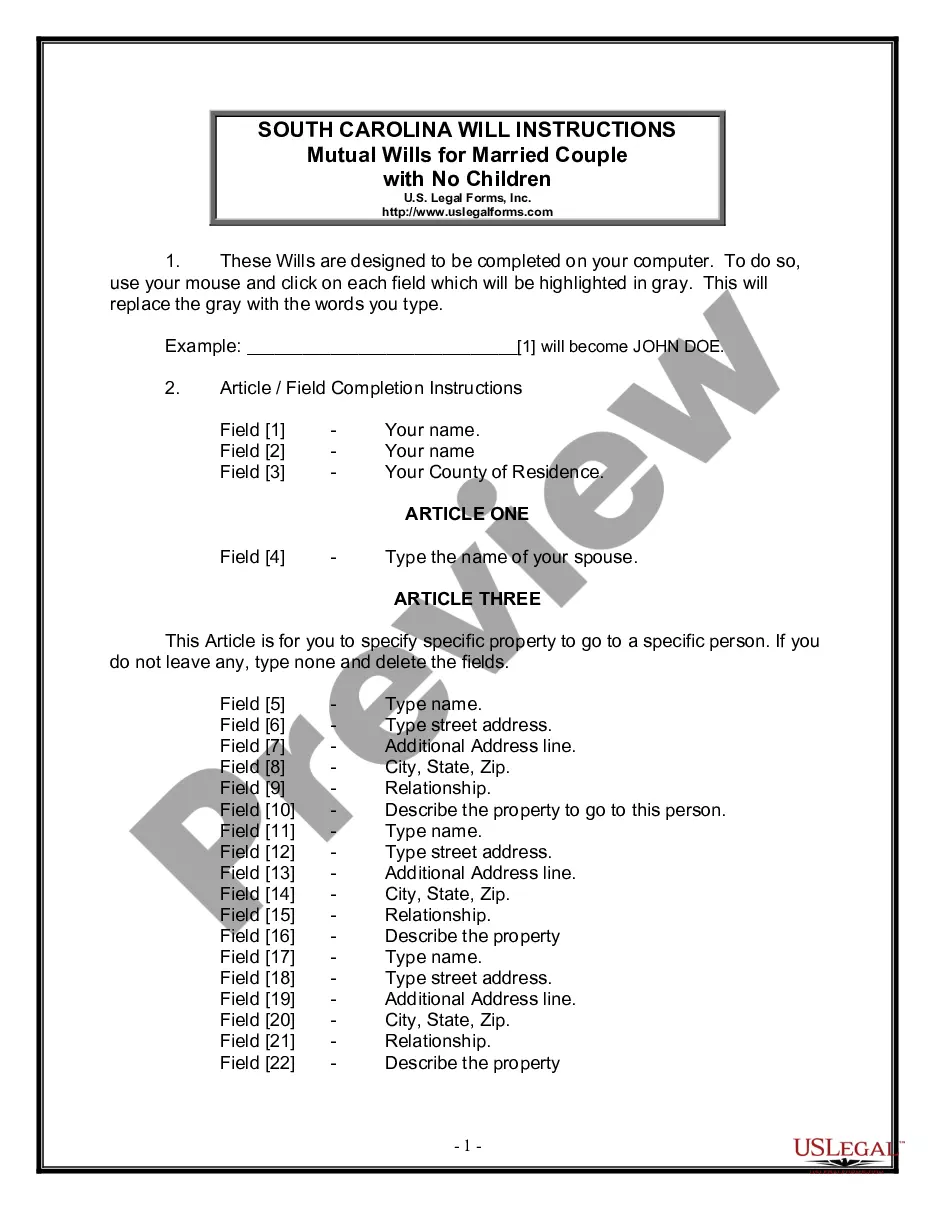

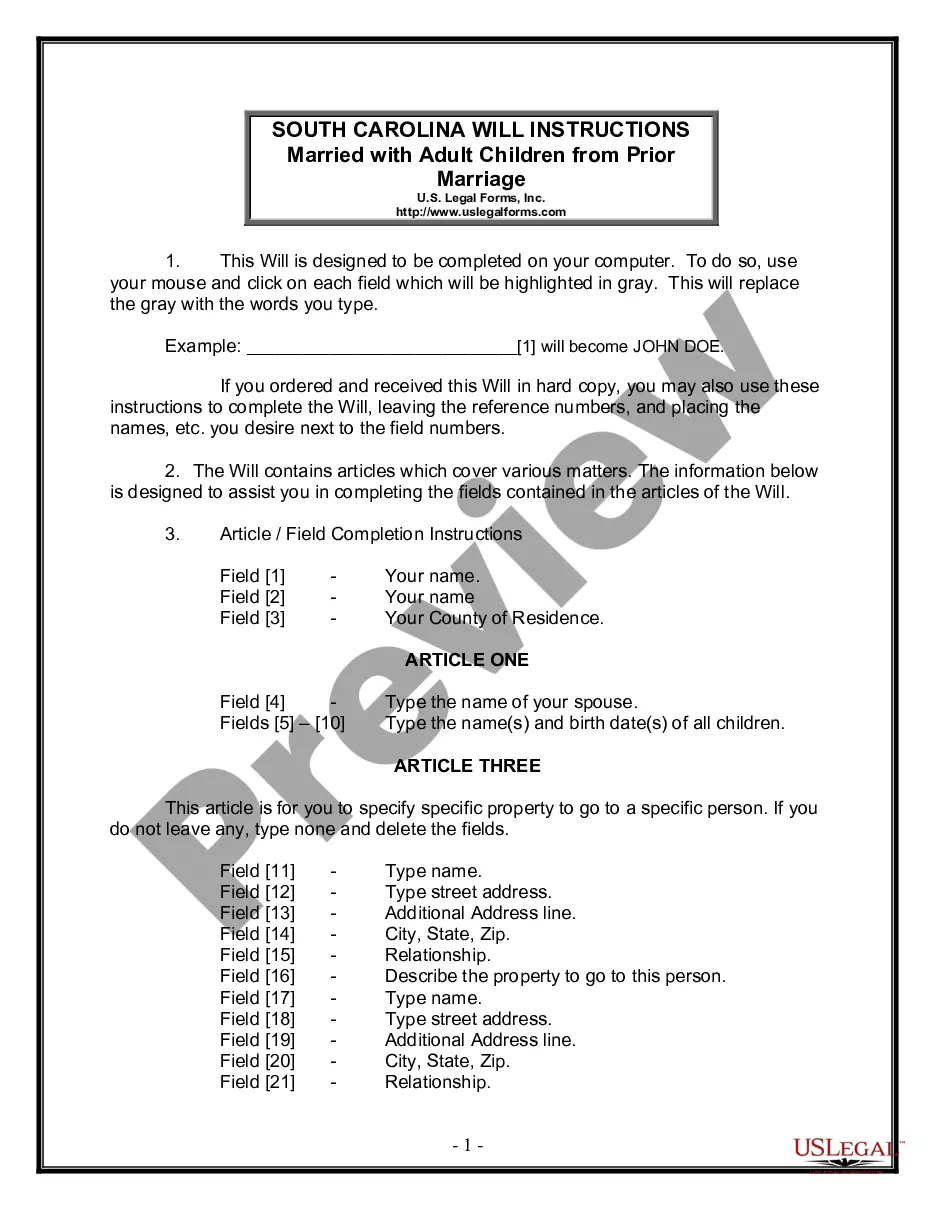

What is Last Will and Testament?

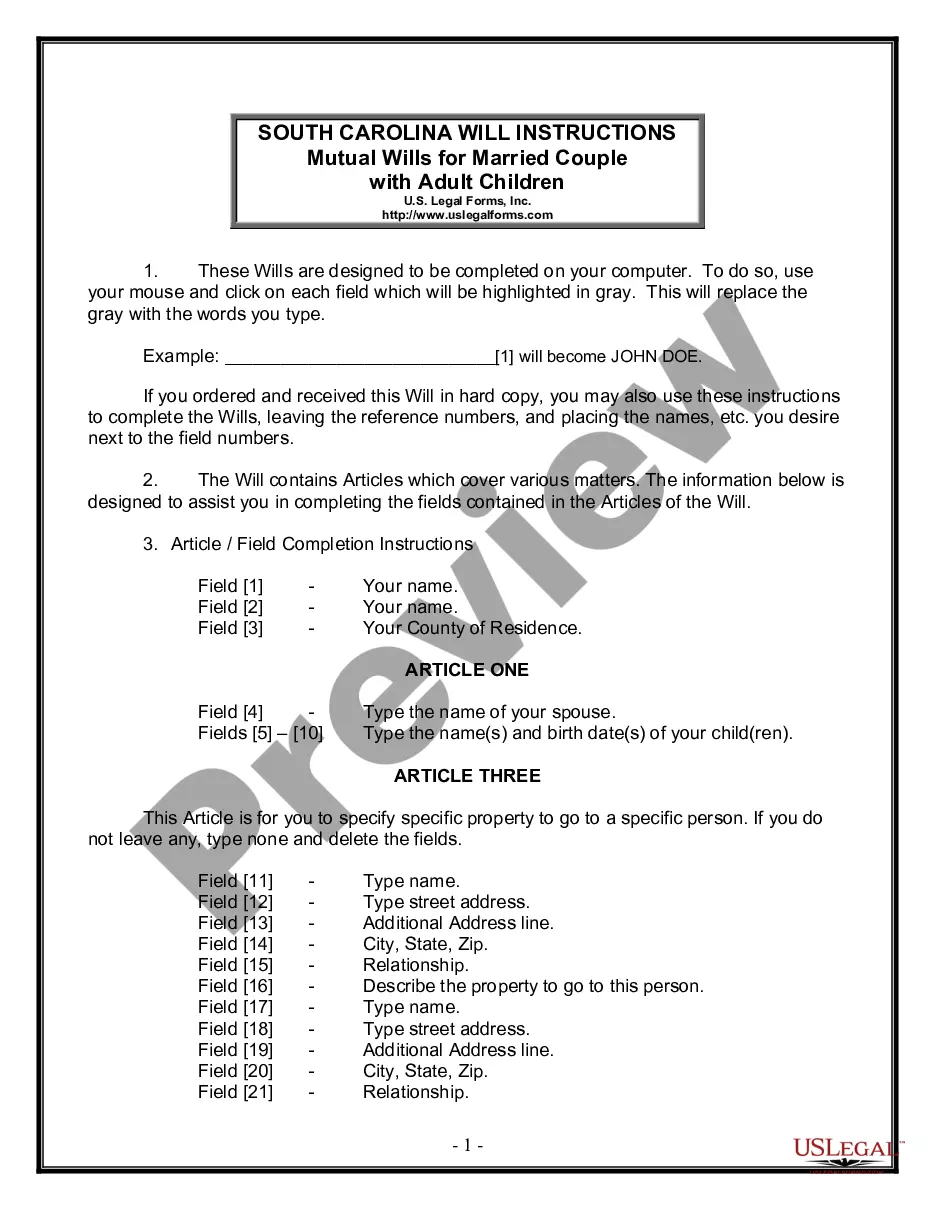

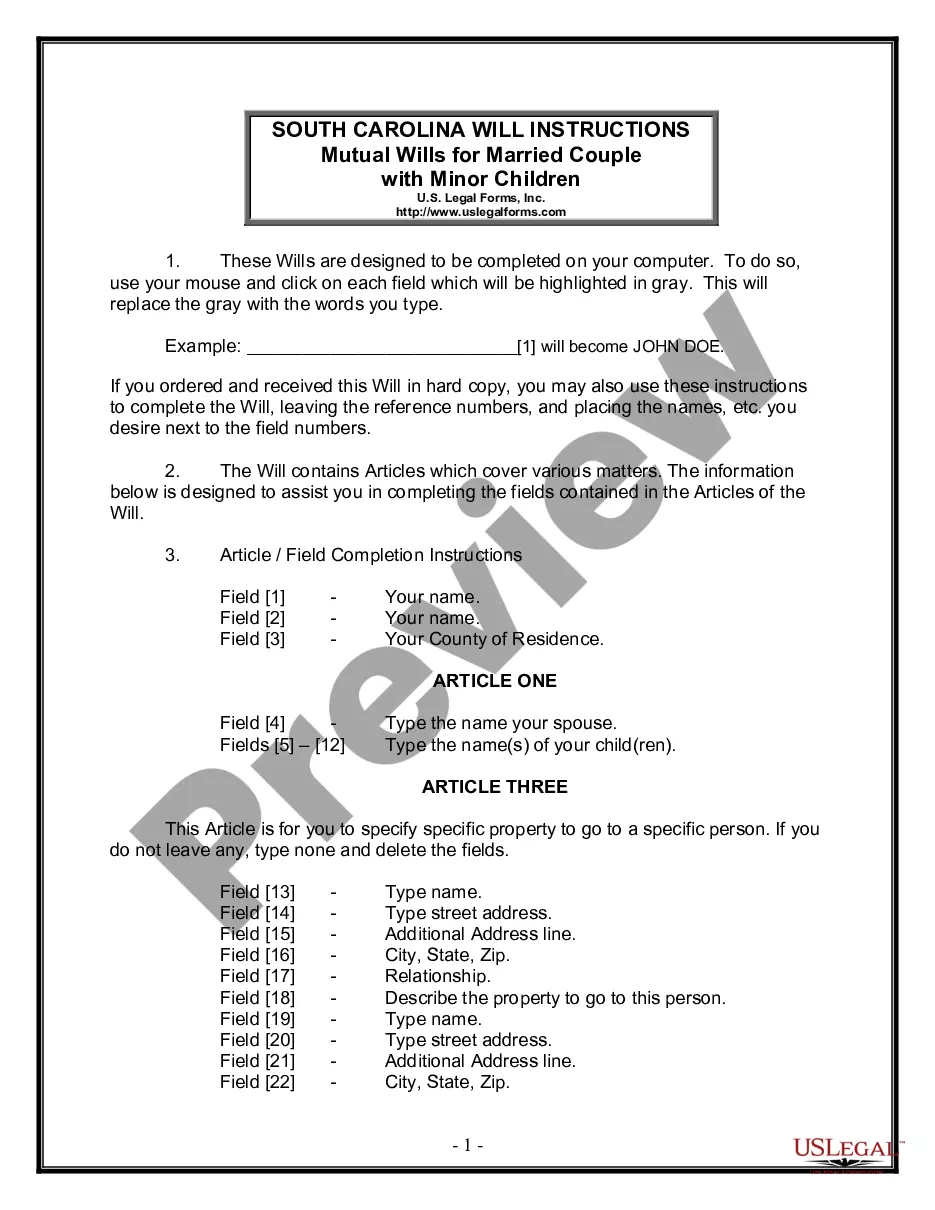

A Last Will and Testament is a legal document that specifies how your assets should be managed and distributed upon your passing. It is essential for ensuring your wishes are honored. Explore state-specific templates to get started.