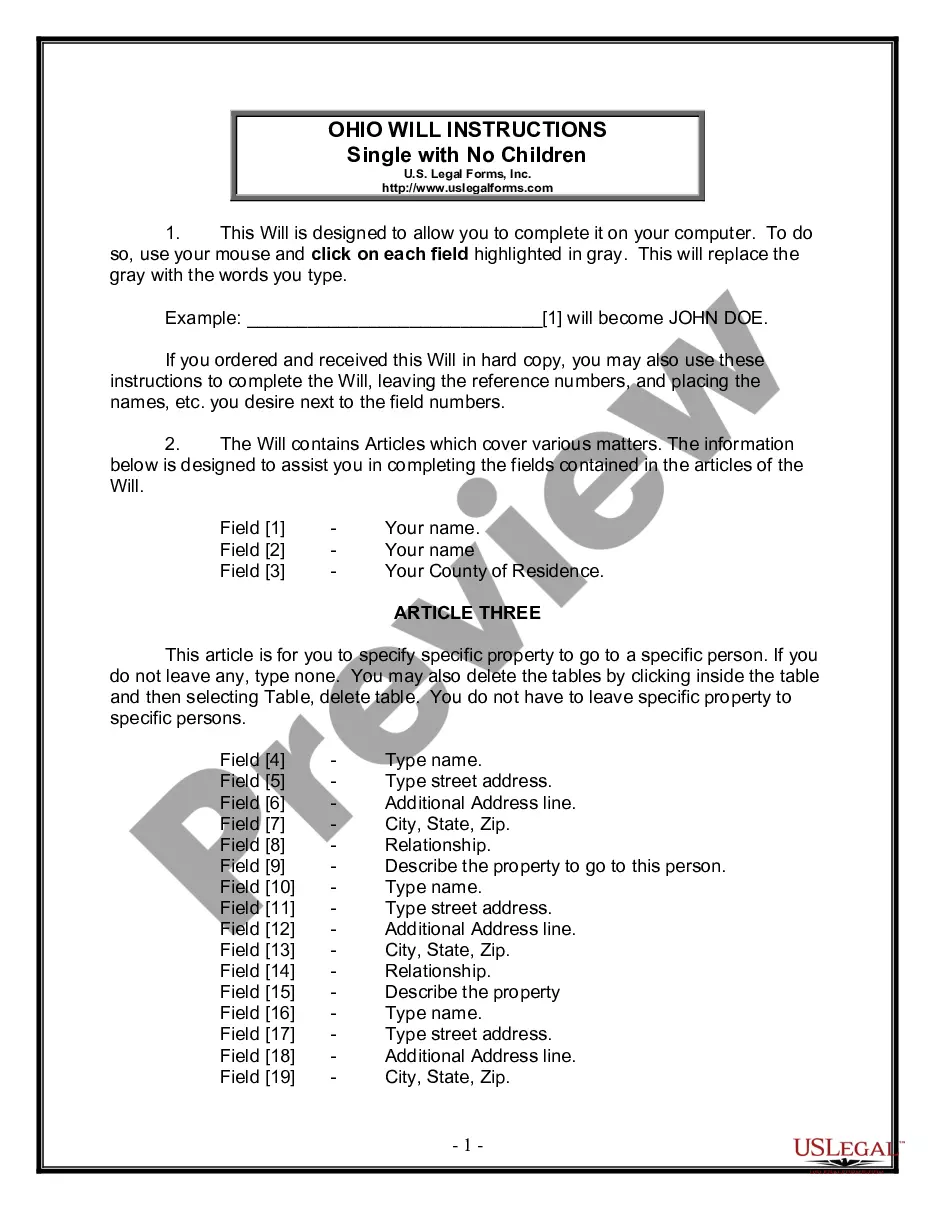

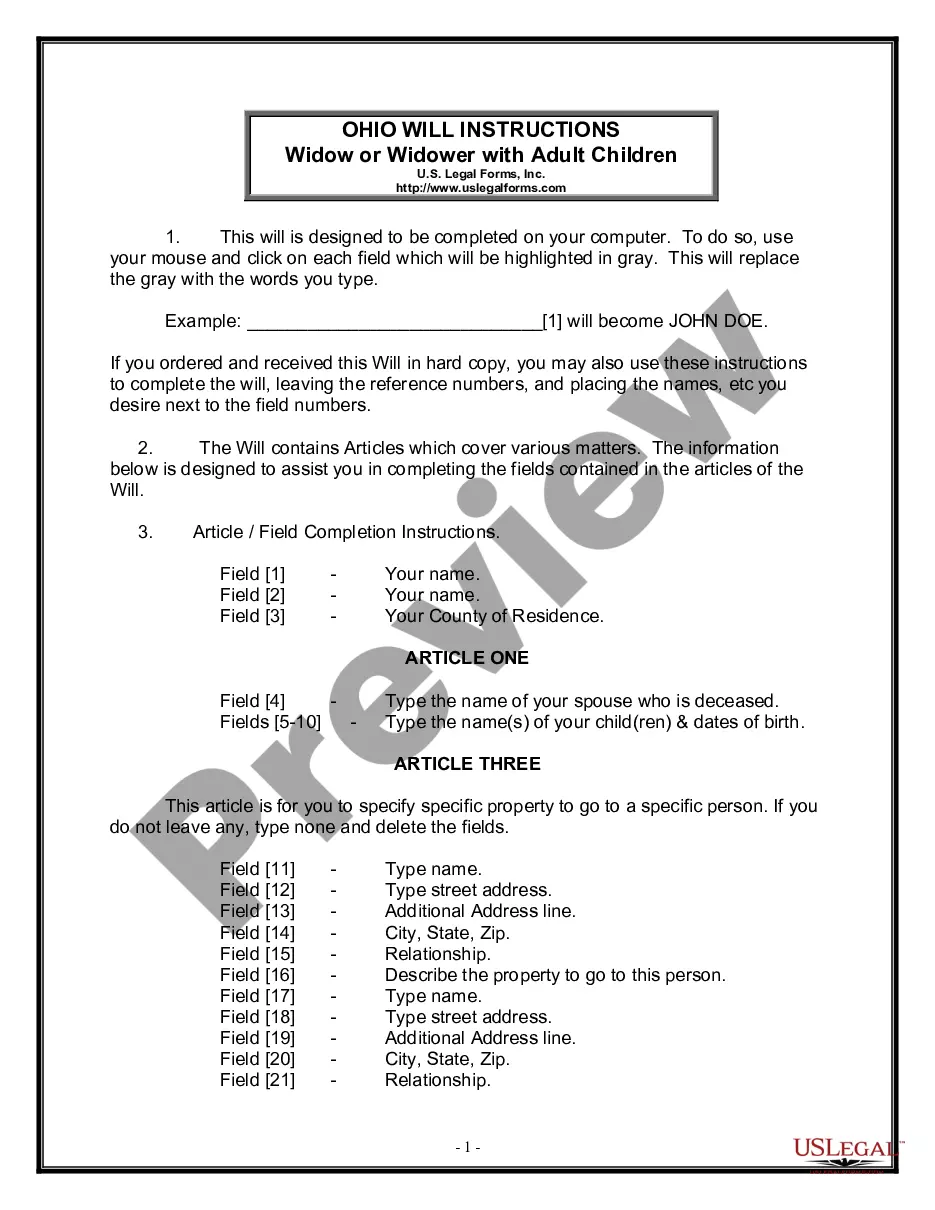

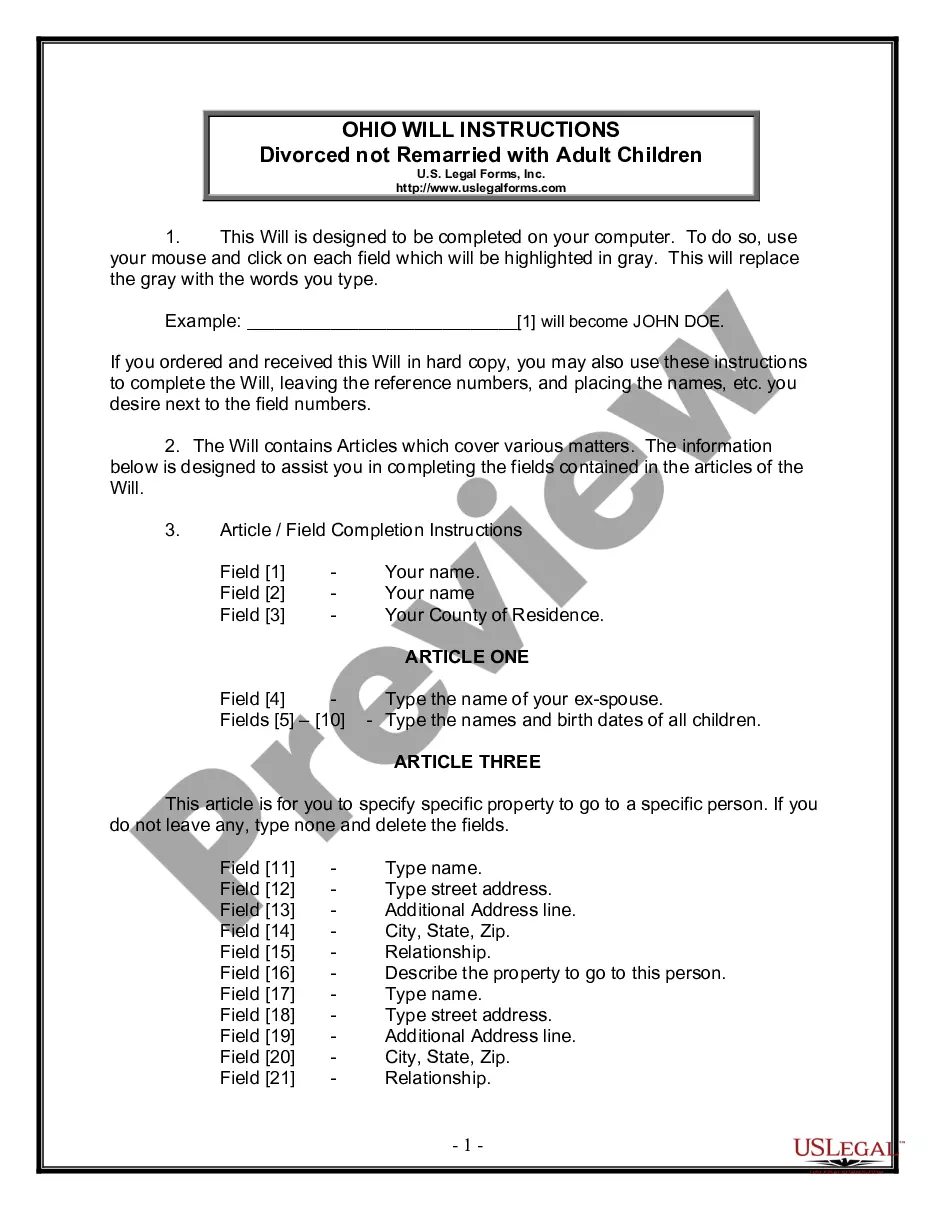

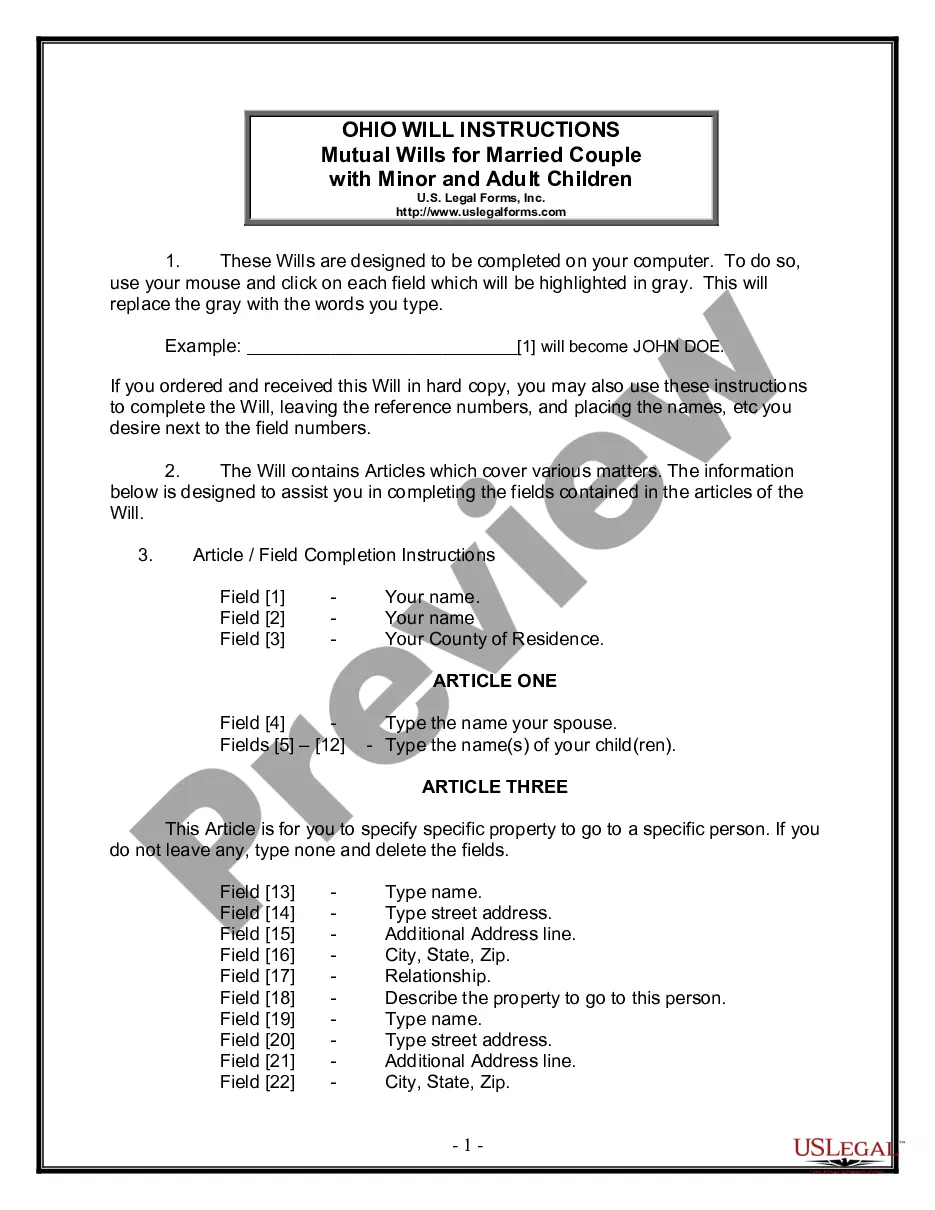

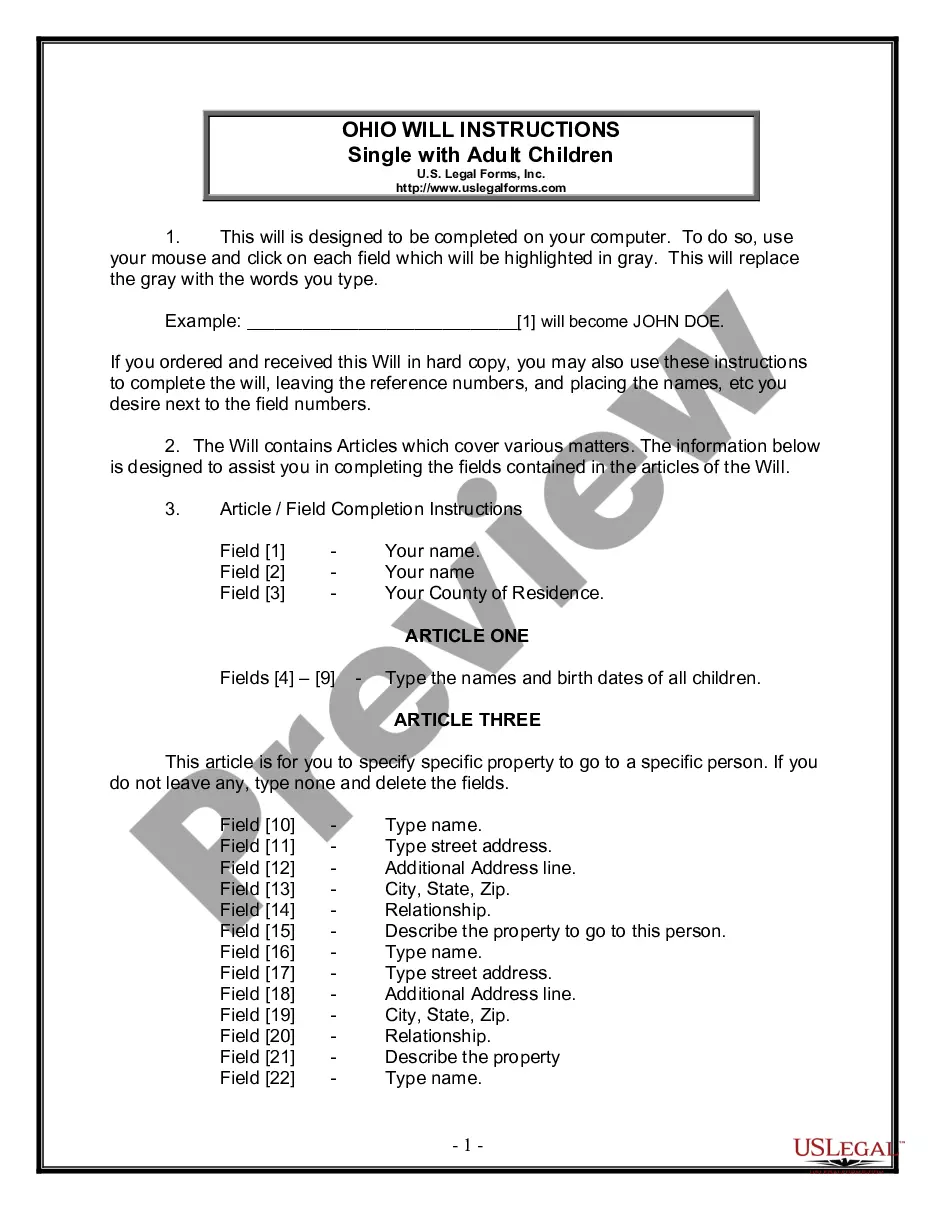

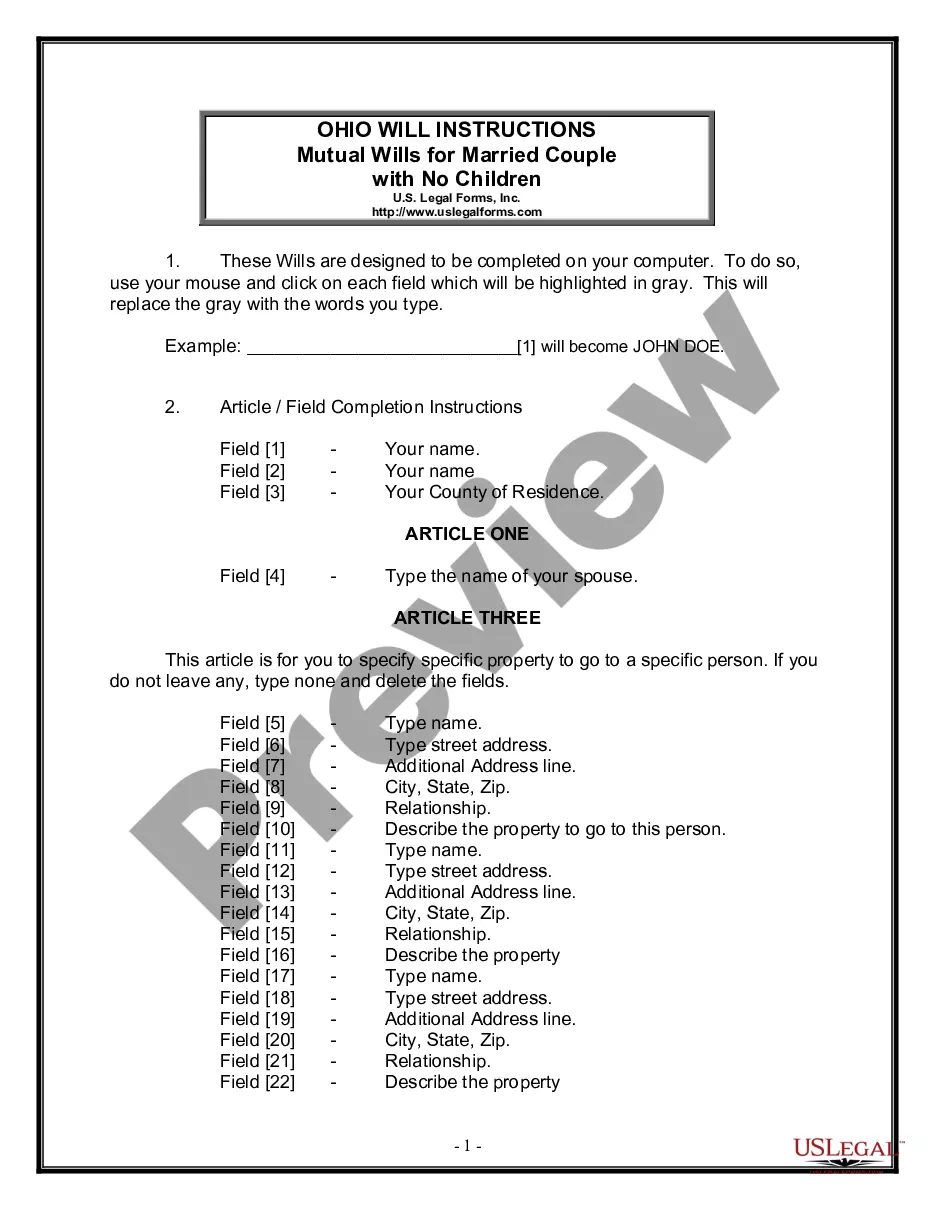

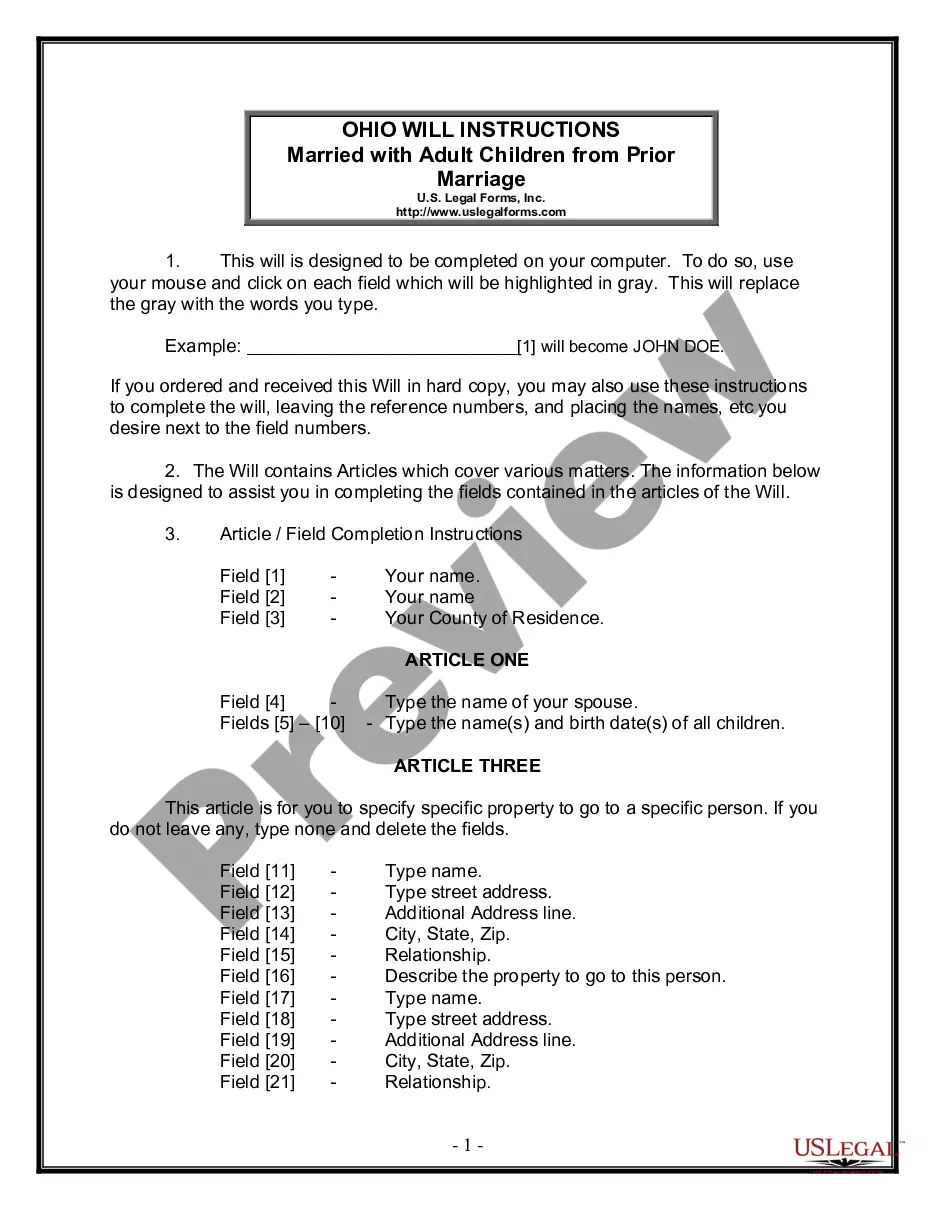

What is Last Will and Testament?

A Last Will and Testament is a legal document that specifies how a person's assets will be distributed upon their death. It is commonly used to ensure that your wishes are honored. Explore state-specific templates for your needs.