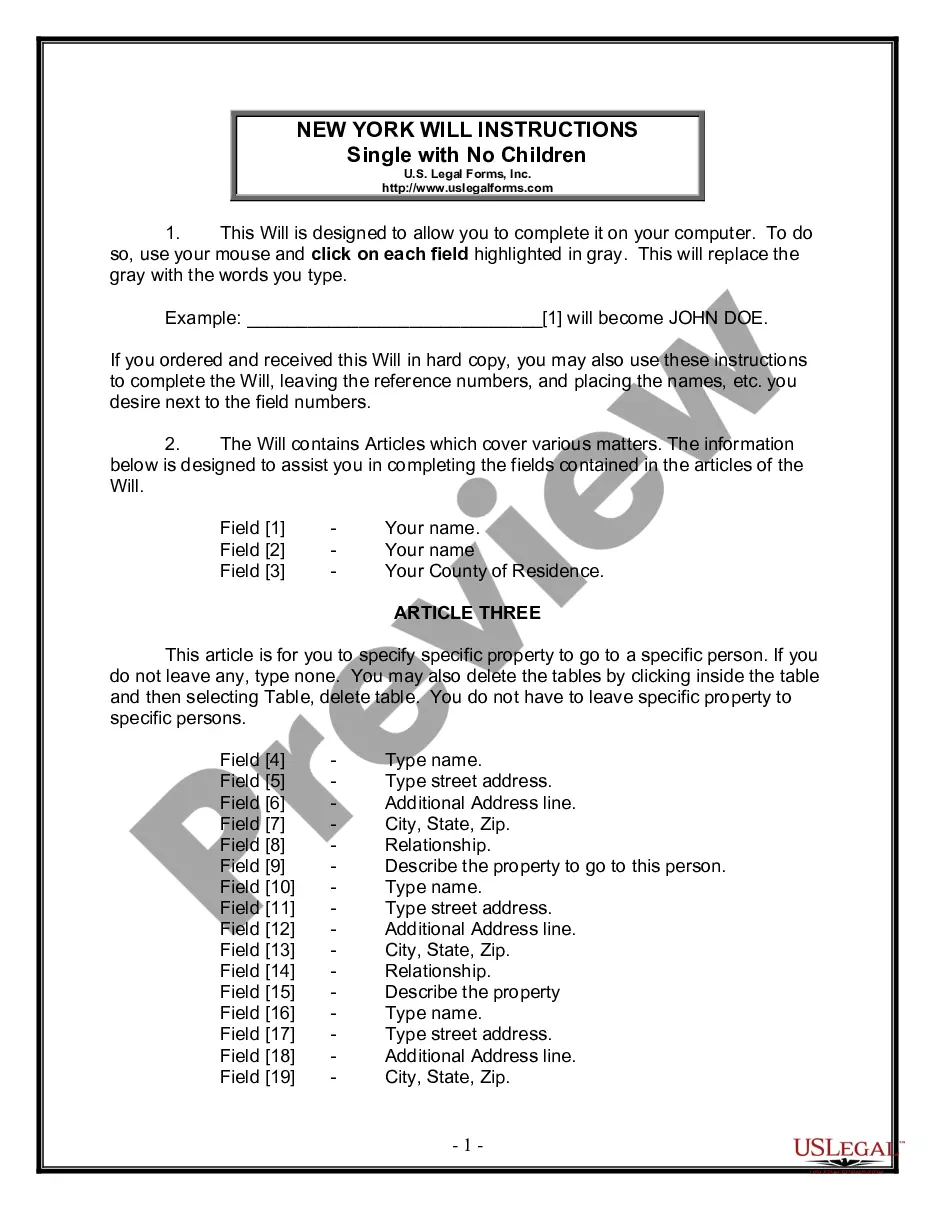

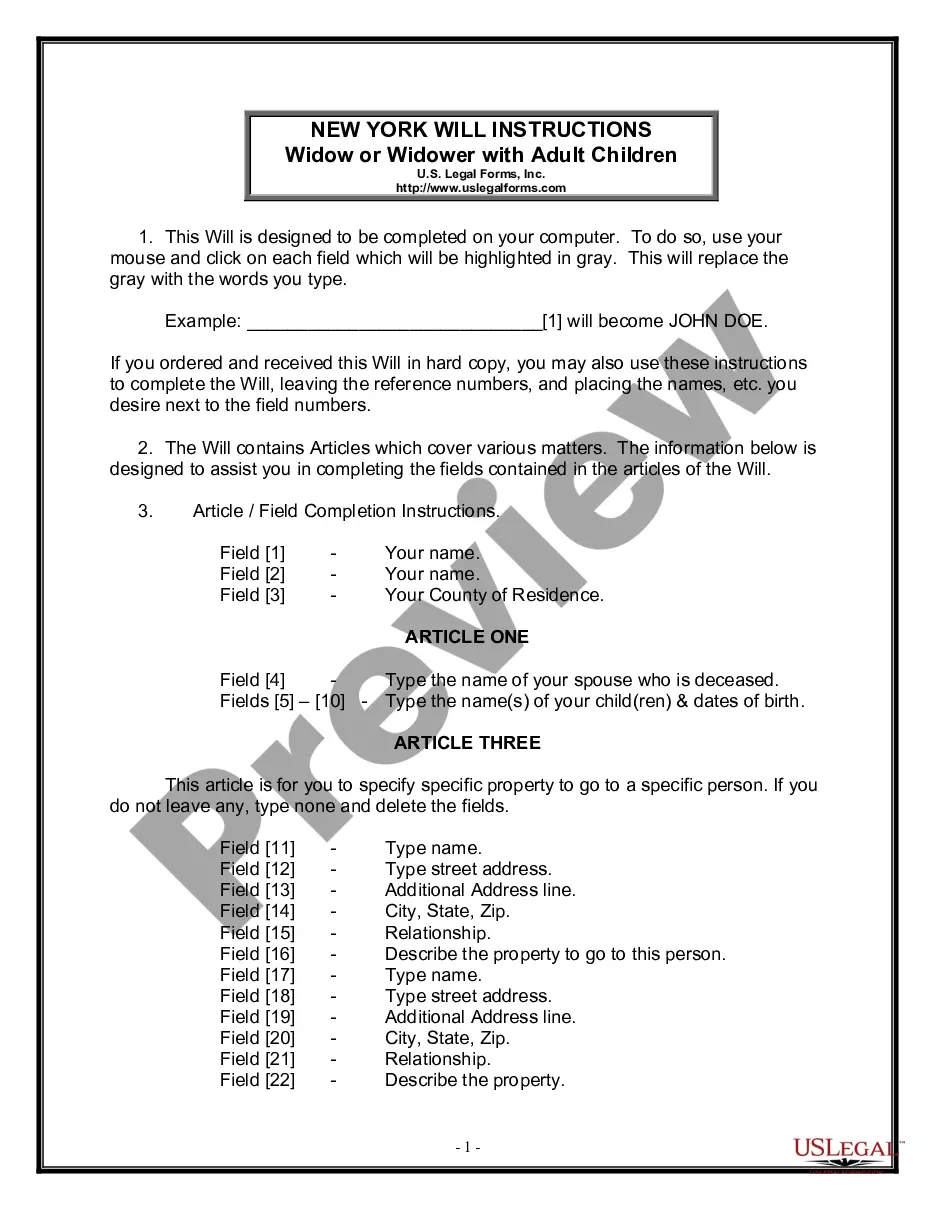

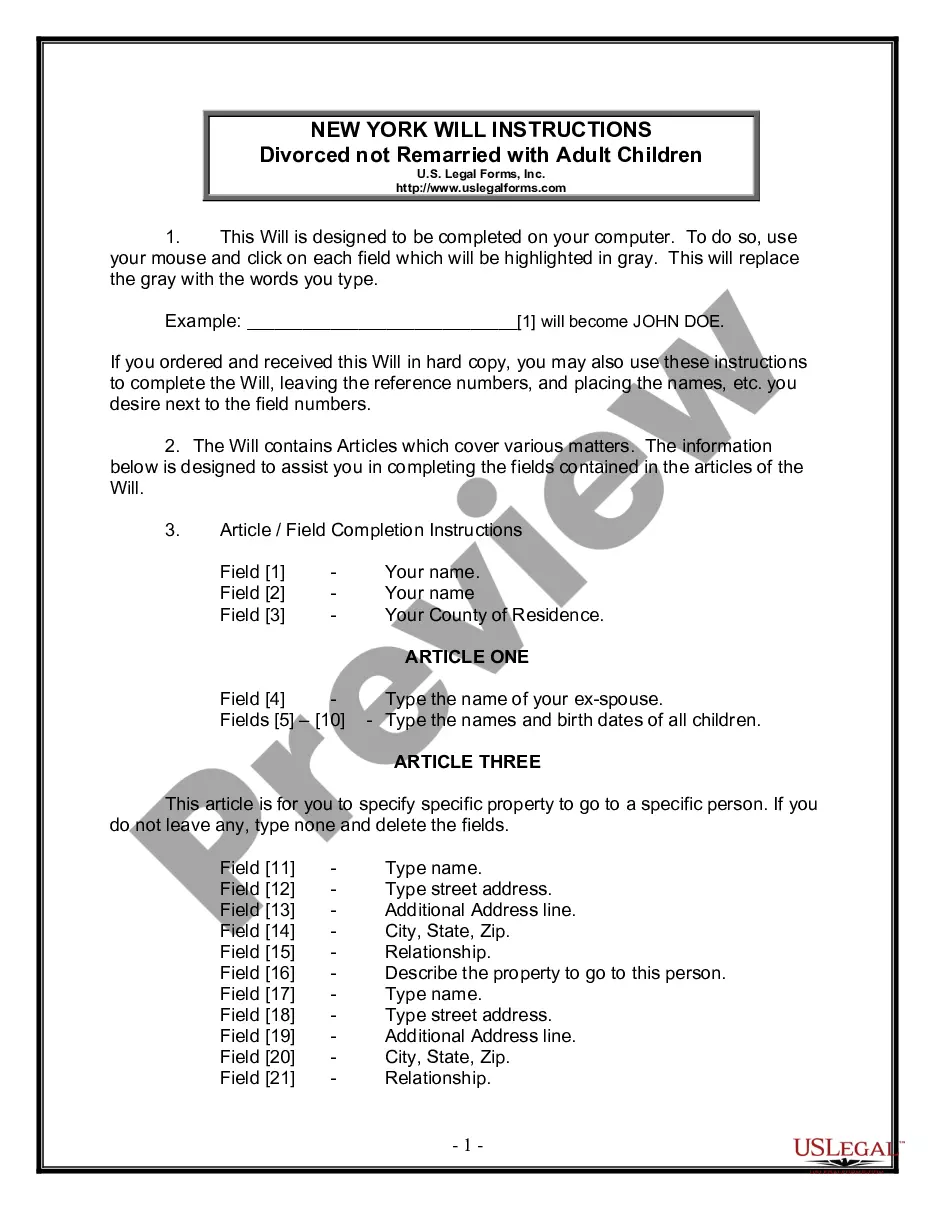

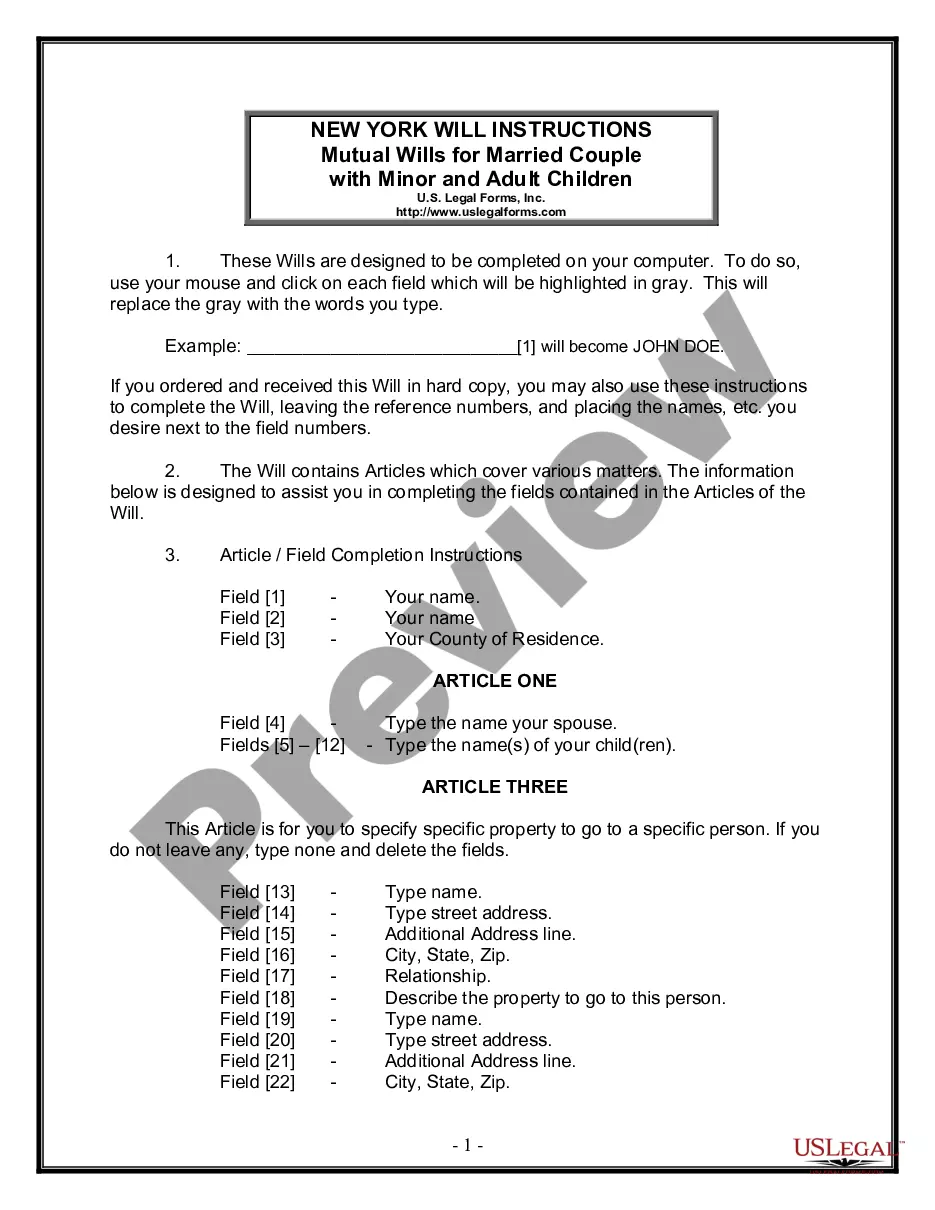

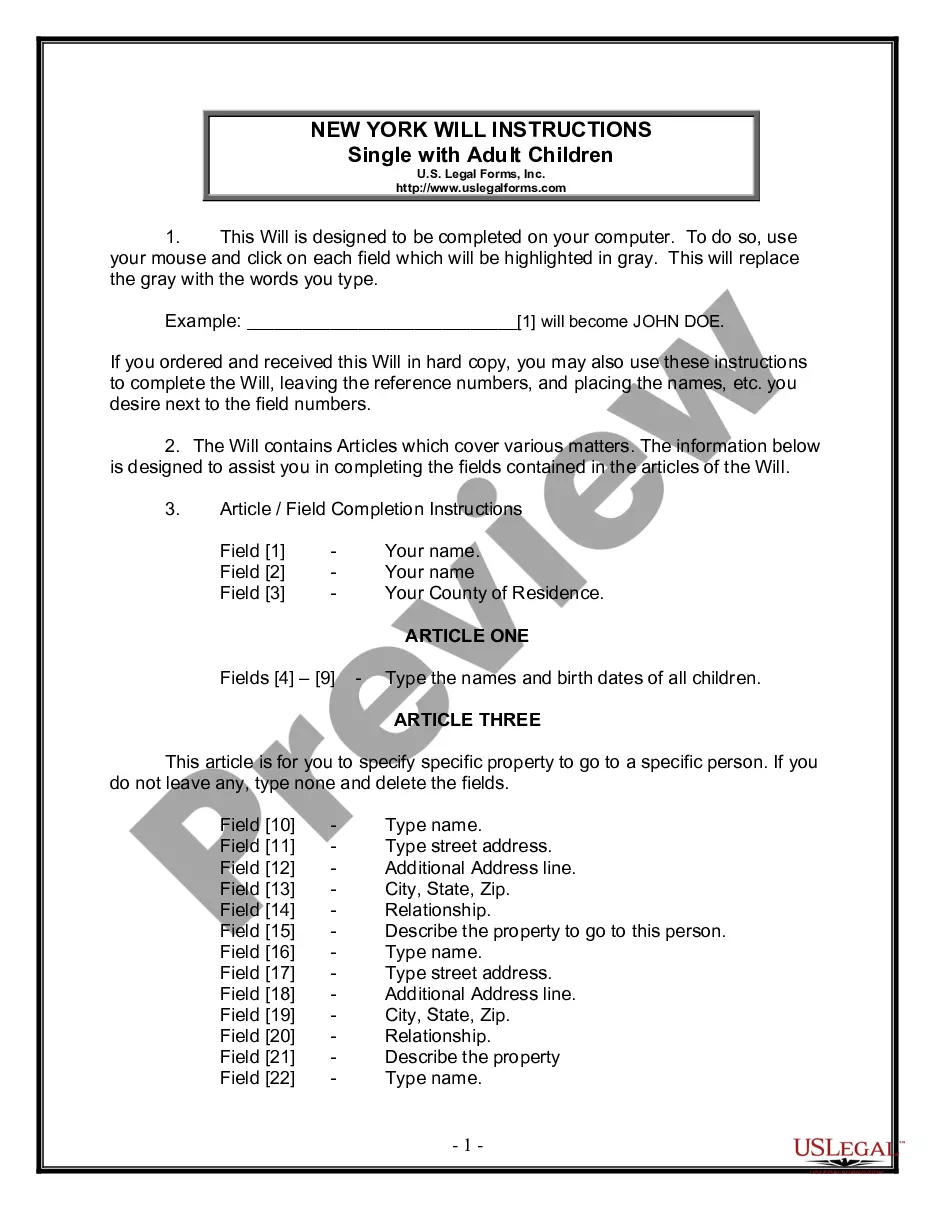

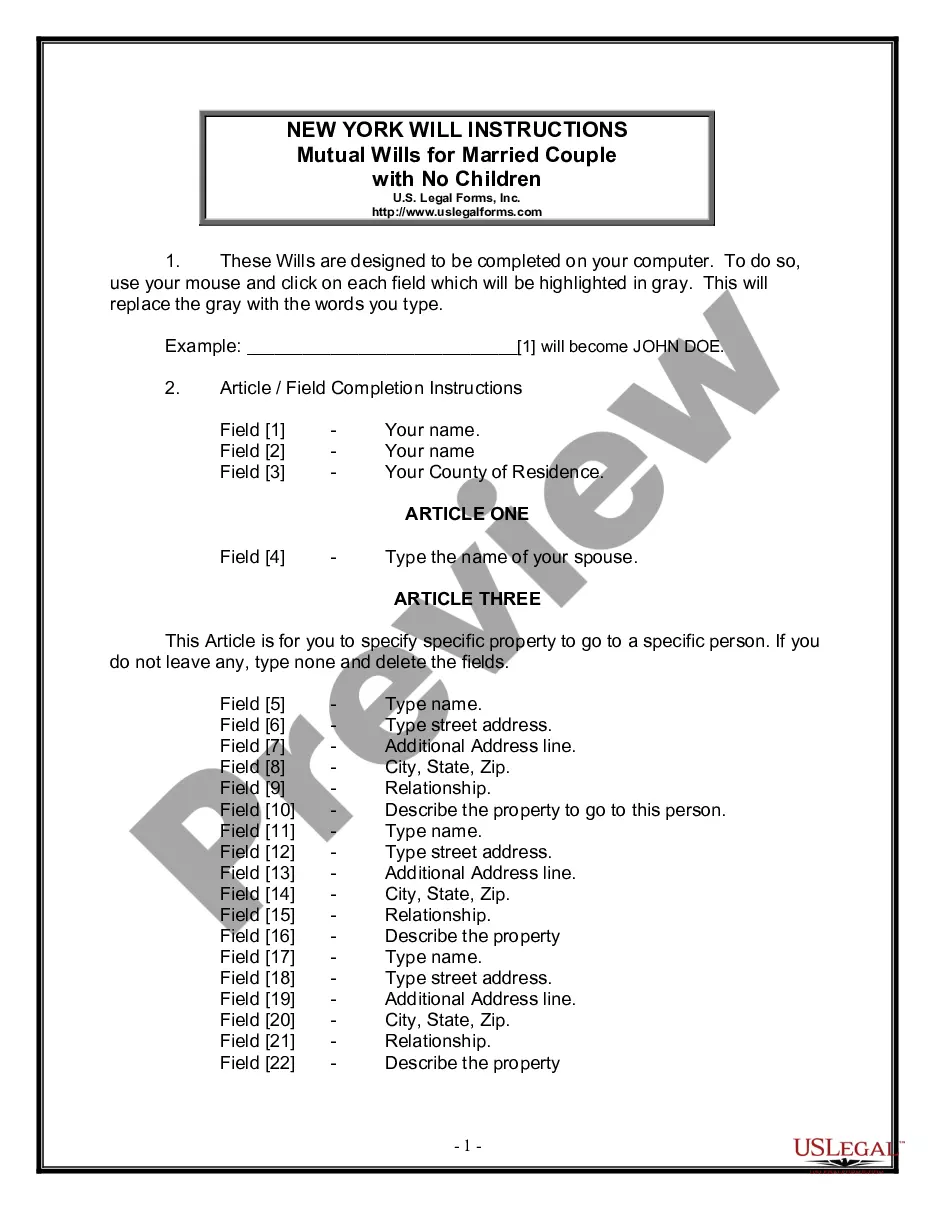

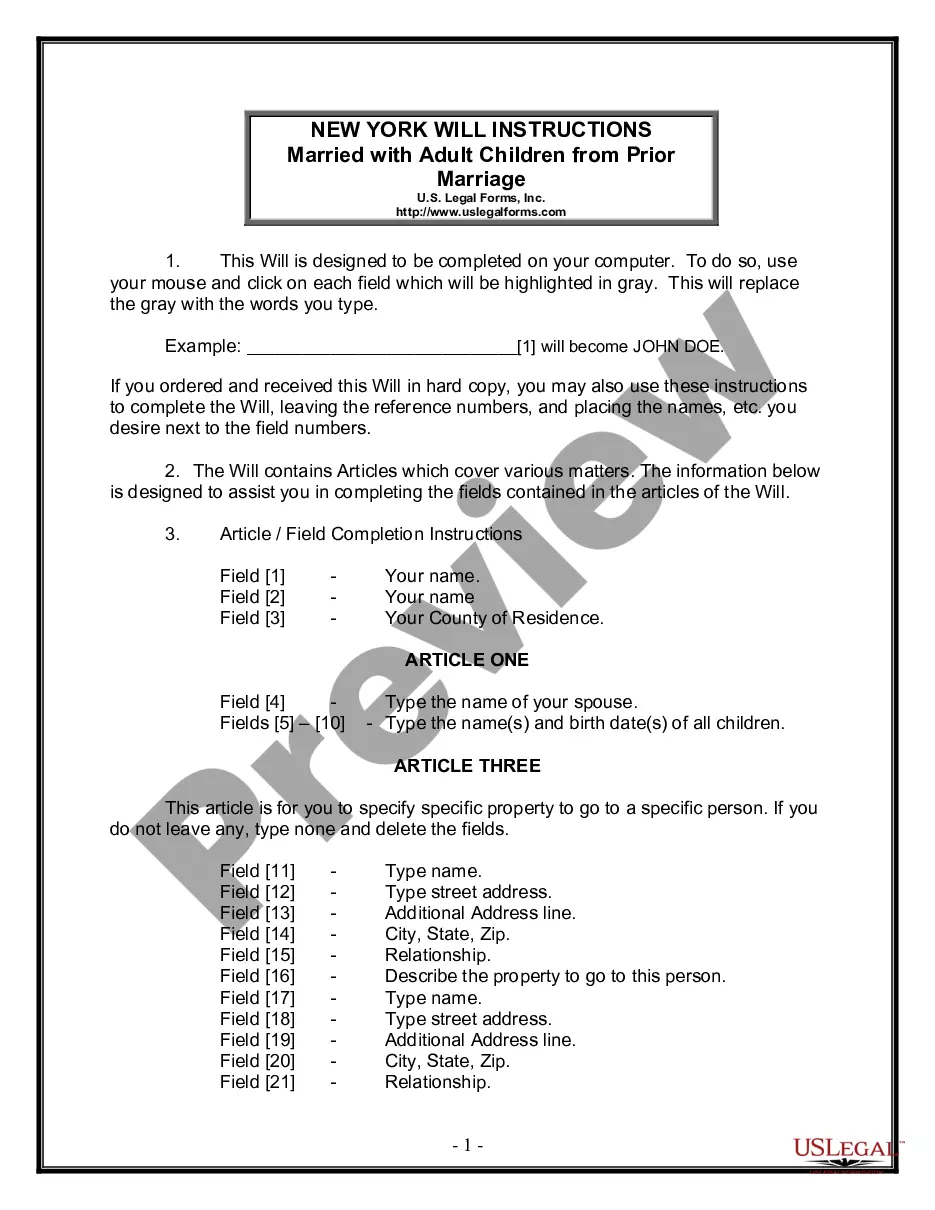

What is Last Will and Testament?

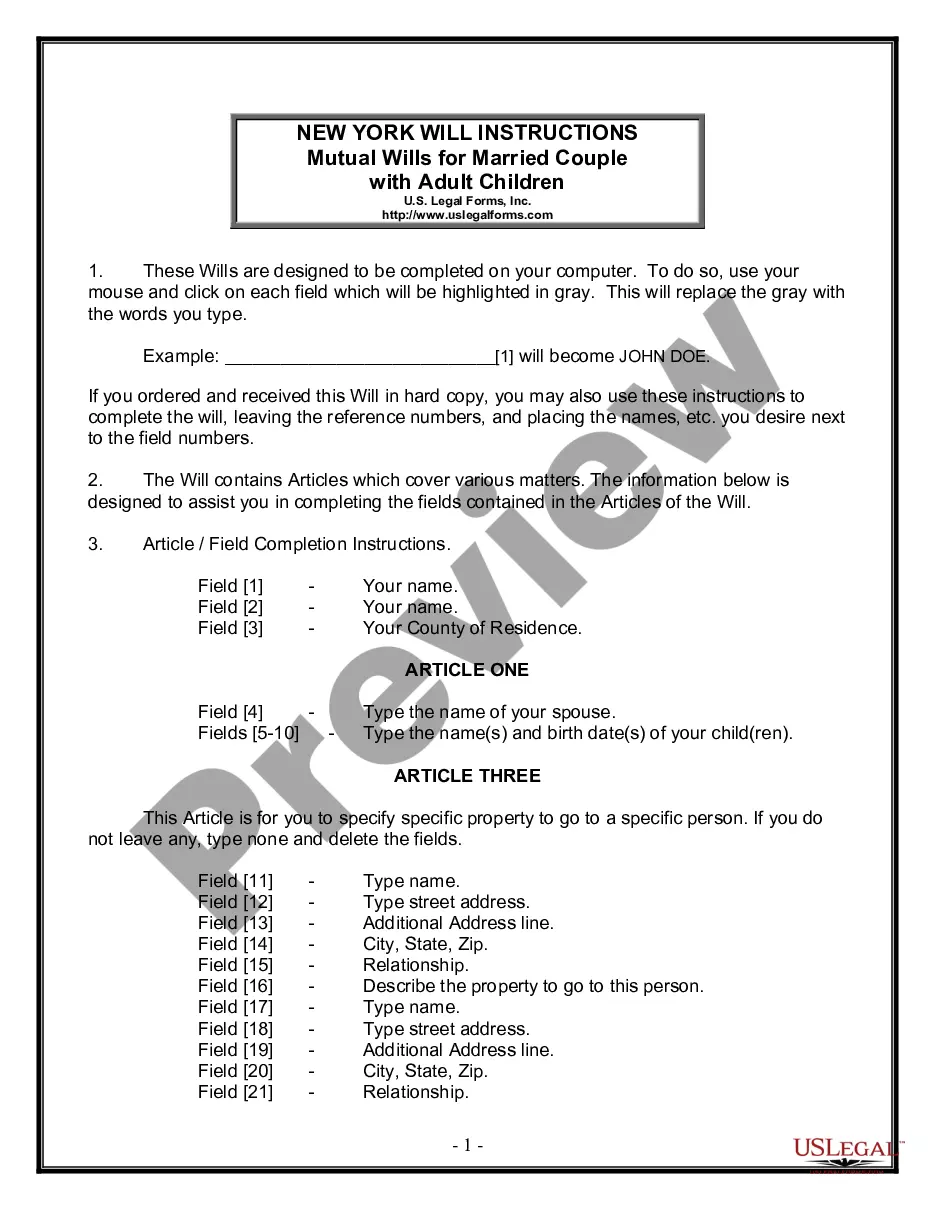

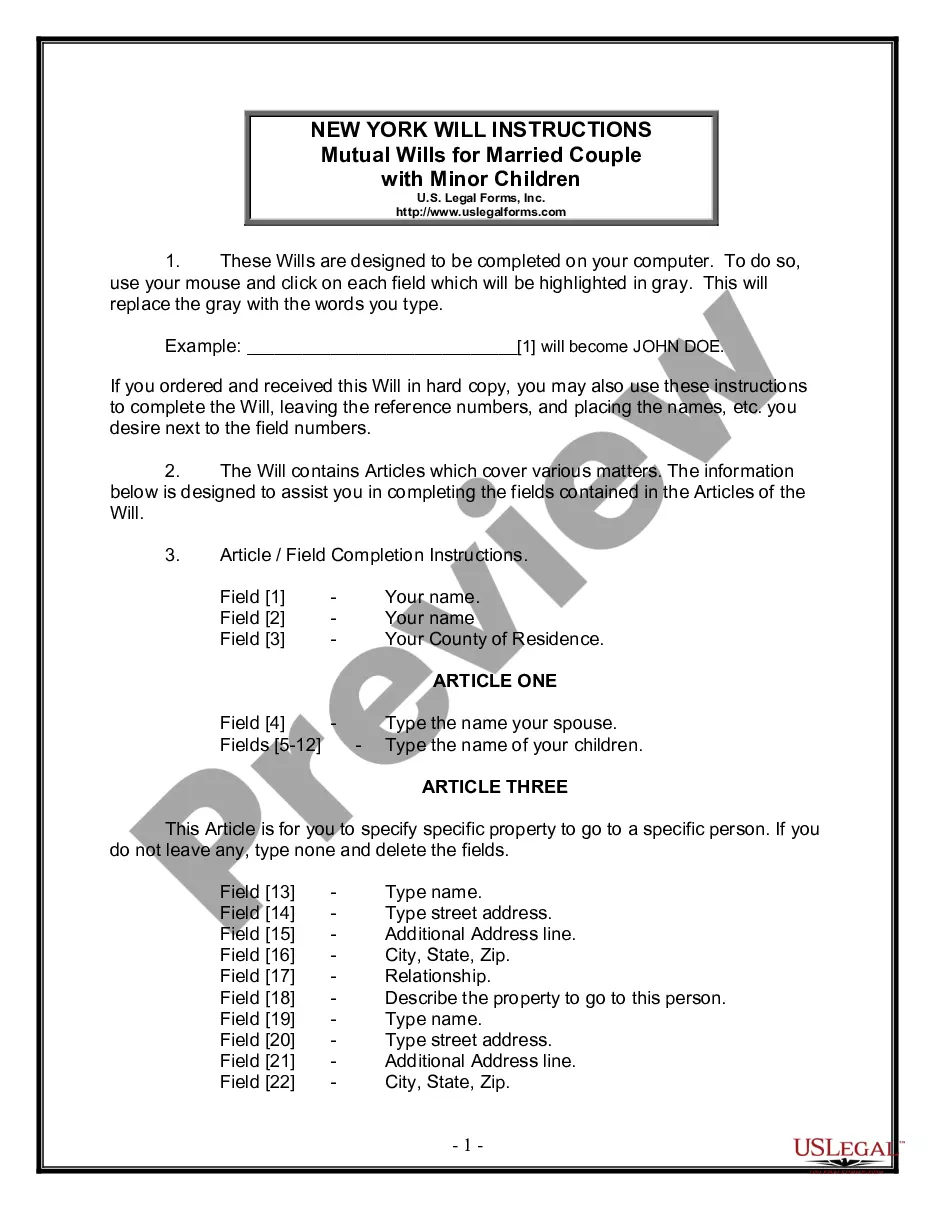

A Last Will and Testament is a legal document that specifies how your assets will be distributed after your death. It is used to express your final wishes and appoint guardians for minor children. Explore state-specific templates for your needs.