What is Last Will and Testament?

A Last Will and Testament is a legal document that specifies asset distribution after death. It can also appoint guardians for dependents. Explore state-specific templates for Nebraska.

A Last Will and Testament outlines how your assets are distributed after death. Attorney-drafted templates are quick and easy to complete.

Create a tailored estate plan with everything you need for securing your legacy, all in one convenient package.

Create a legally binding will that details property distribution for a single person with no children.

Make your wishes clear for your estate and loved ones with a legally binding document that addresses your specific needs as a widow or widower.

Create a legal document outlining your wishes for property distribution after death, specifically for divorced individuals with adult children.

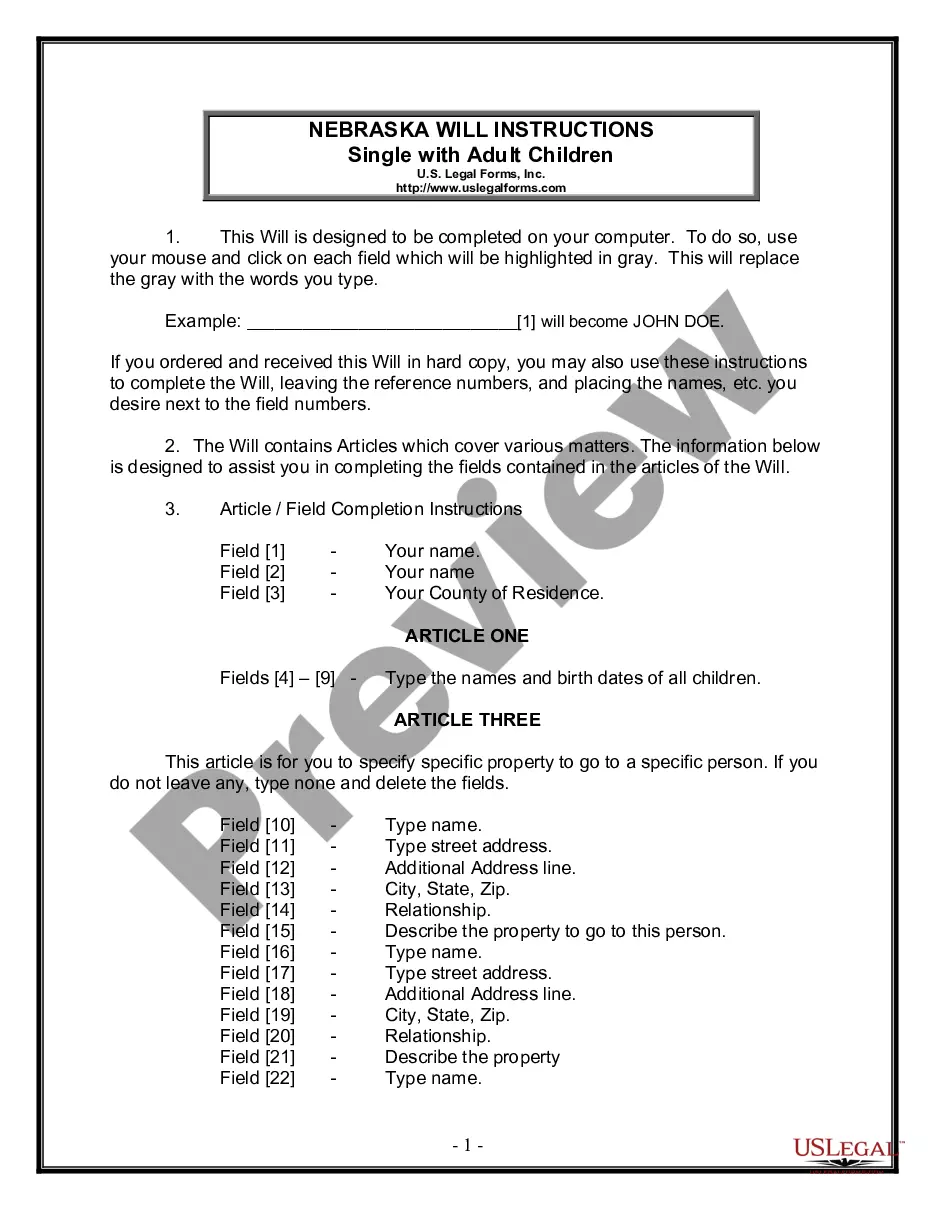

Plan your estate and ensure your adult children inherit as you wish with this essential legal agreement.

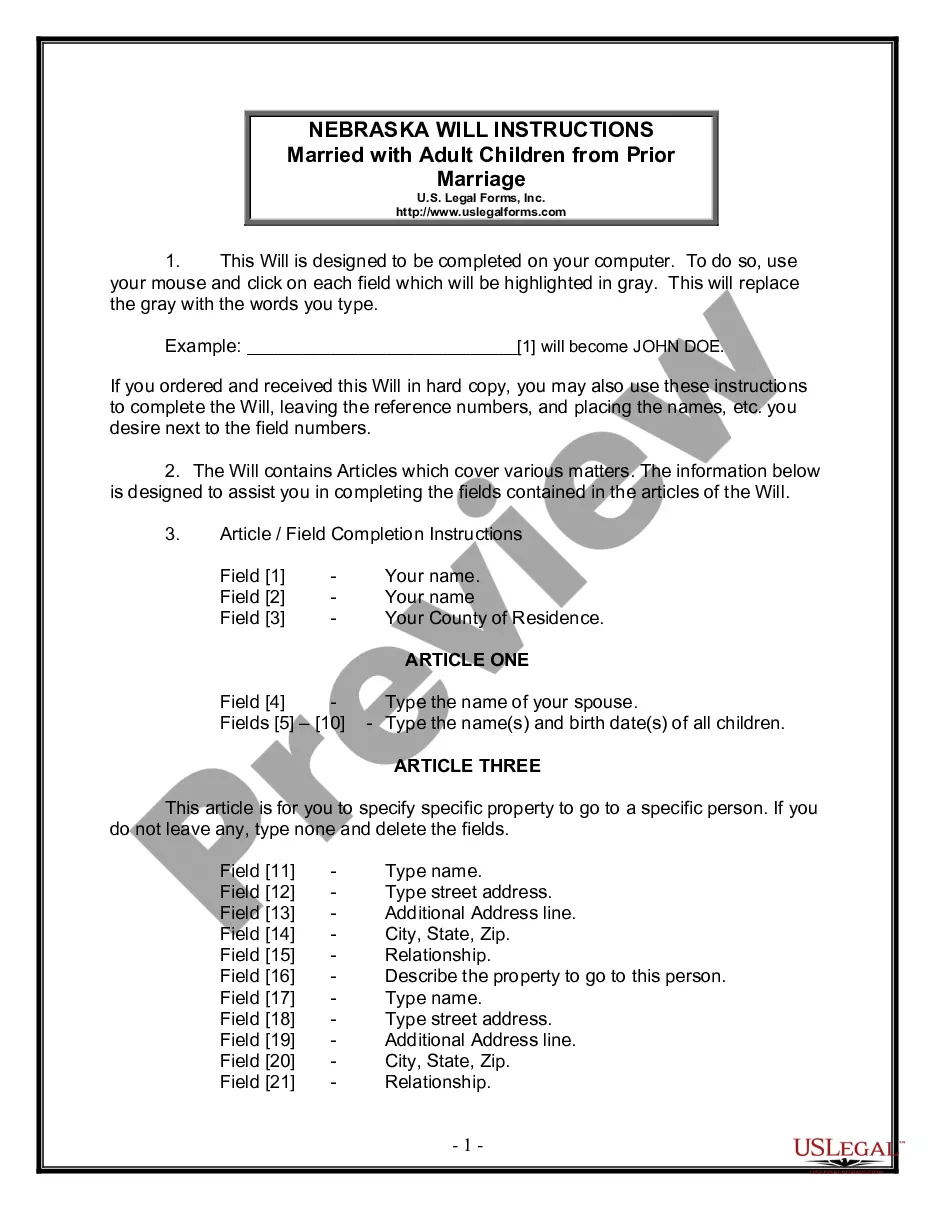

Create a clear plan for distributing your assets, ensuring your wishes are honored after your death, especially with adult children from a prior relationship.

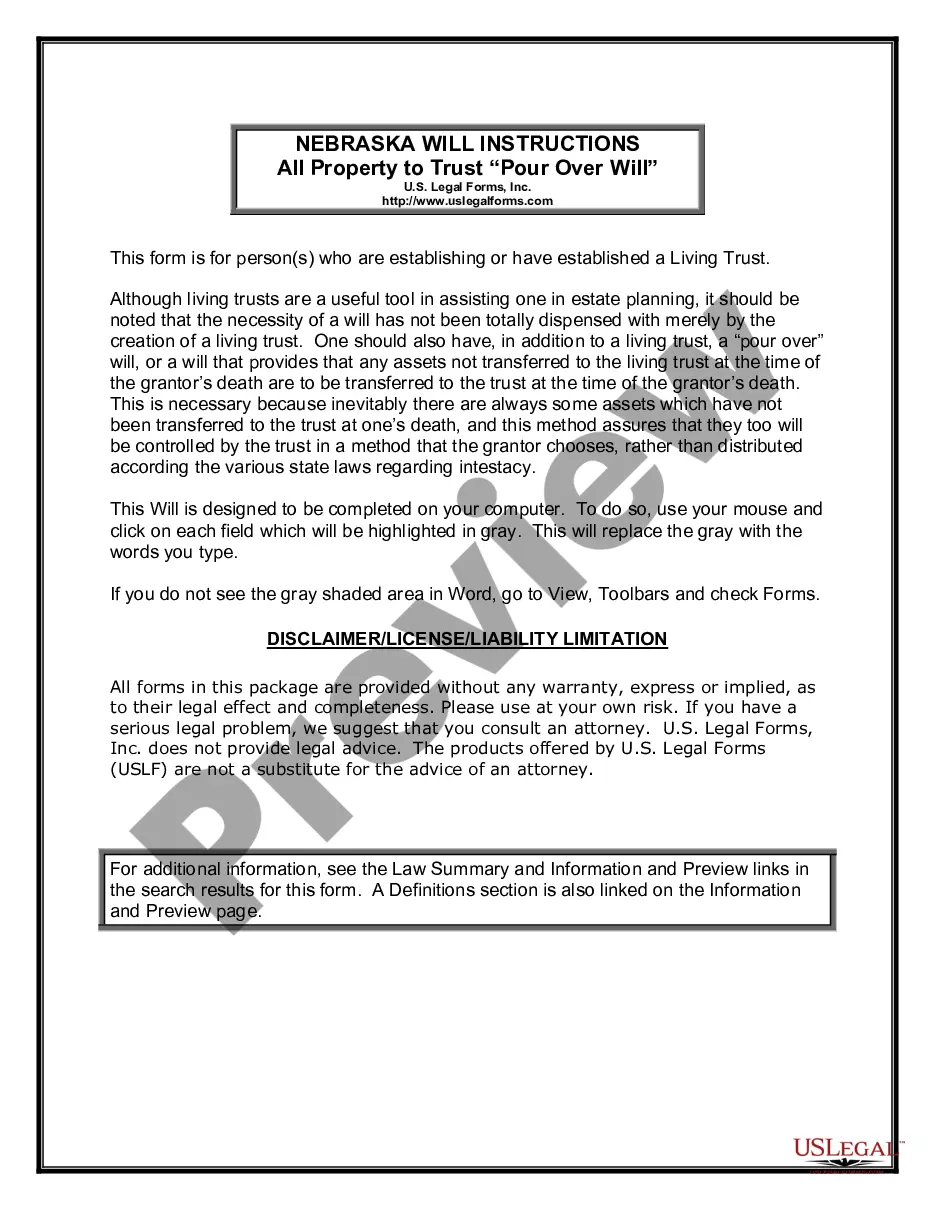

Plan your estate effectively by ensuring all assets are directed to your living trust upon death.

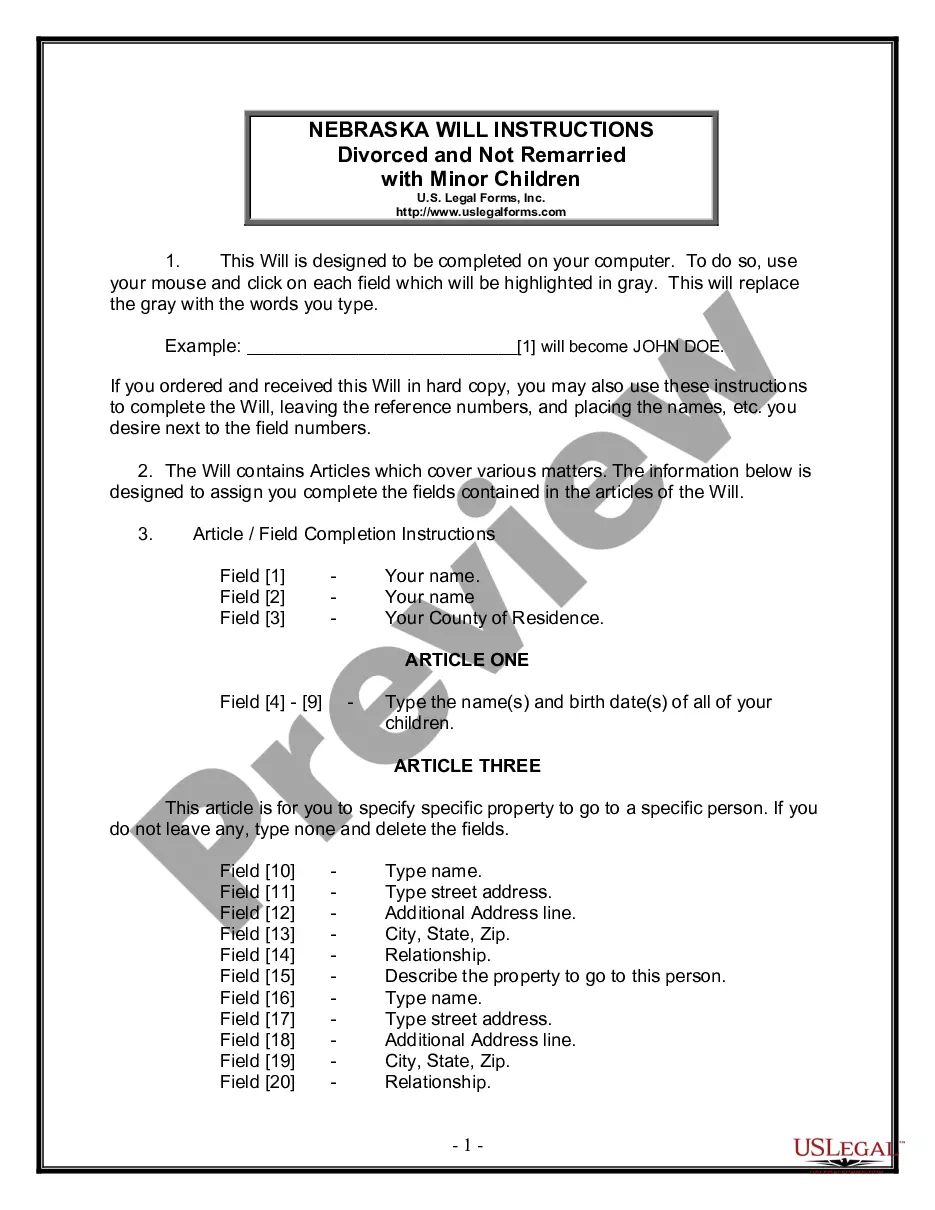

Secure your wishes for your minor children and estate after divorce, ensuring proper guardianship and trustee appointments.

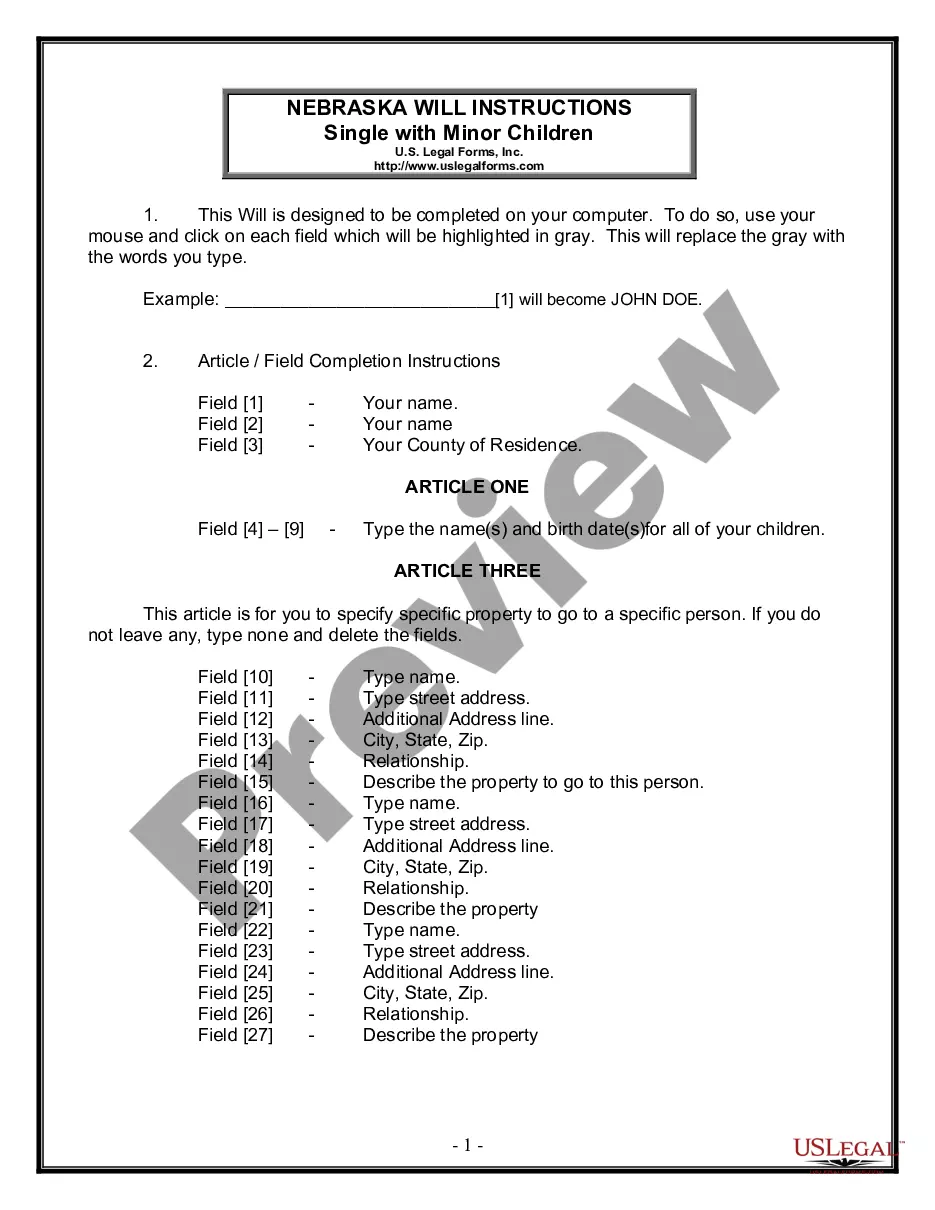

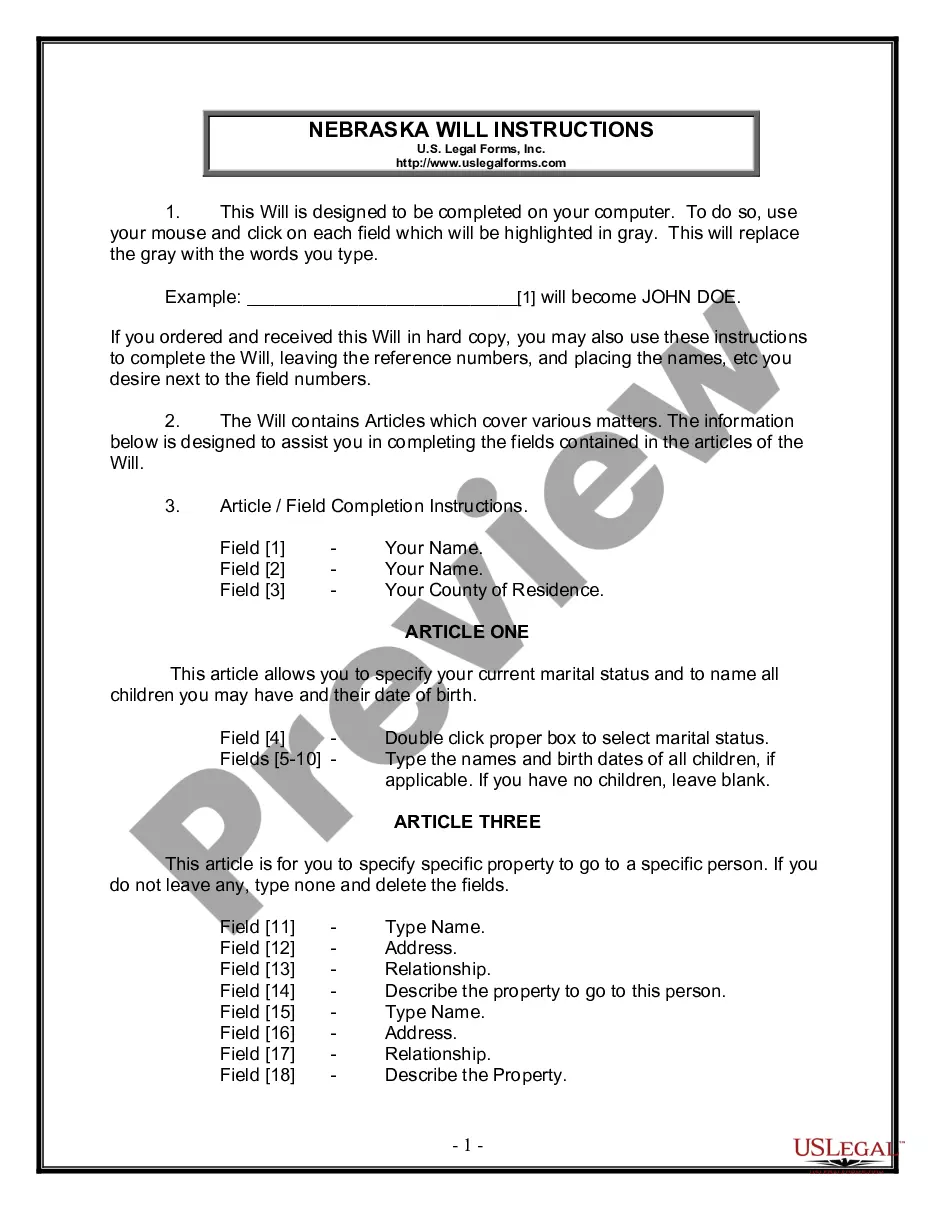

Plan your estate and protect your minor children’s future with a legally binding document that outlines your wishes.

Create a legally valid document to specify the distribution of your assets and appoint guardians for minor children.

A Last Will and Testament takes effect upon death.

Most wills require witnesses to validate them.

Wills can be contested in probate court.

Executors are responsible for distributing assets as per the will.

Beneficiaries are individuals or entities receiving assets.

Wills can be updated or revoked at any time.

Intestacy laws govern assets if no valid will exists.

Begin your estate planning journey with these steps.

Not necessarily. A will can handle asset distribution, while a trust offers additional management benefits.

Without a will, state laws will determine how your assets are distributed, which may not align with your wishes.

Review your will regularly, especially after major life events like marriage, divorce, or the birth of children.

Beneficiary designations on accounts may override will provisions, so it's vital to keep them aligned.

Yes, you can designate different individuals for financial and healthcare decisions in your estate plan.