What is Last Will and Testament?

A Last Will and Testament specifies how your assets will be distributed after death. These documents are essential for ensuring your wishes are honored. Choose from our state-specific templates for guidance.

Last Will and Testament documents help individuals outline their wishes after death. Our attorney-drafted templates are quick and easy to complete.

Prepare for the future with essential legal forms that safeguard your health, finances, and affairs in one convenient package.

Create a legally binding document to outline how your assets will be distributed after your death, specifically for those without children.

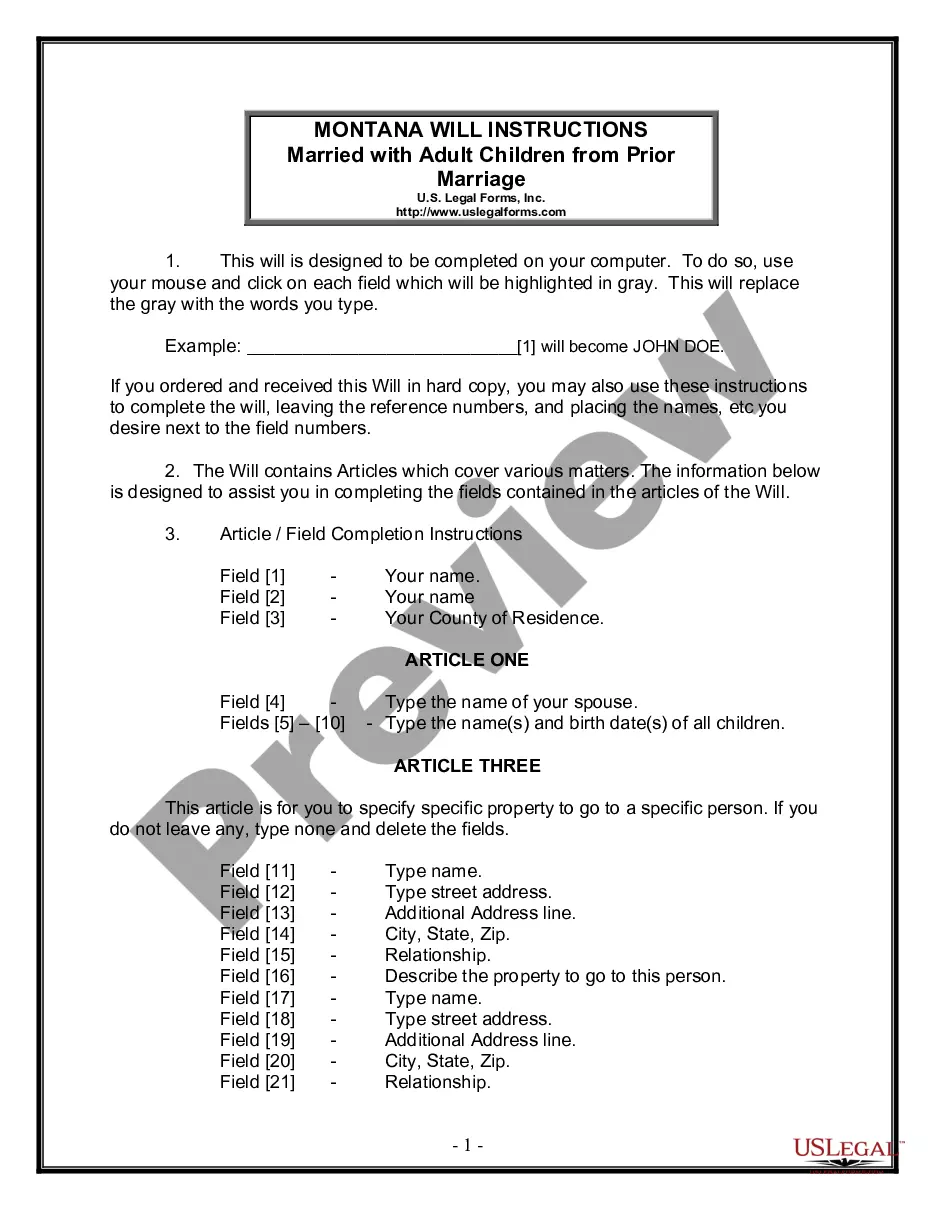

Create a legally binding document to outline your wishes regarding property distribution, especially important for widows or widowers with adult children.

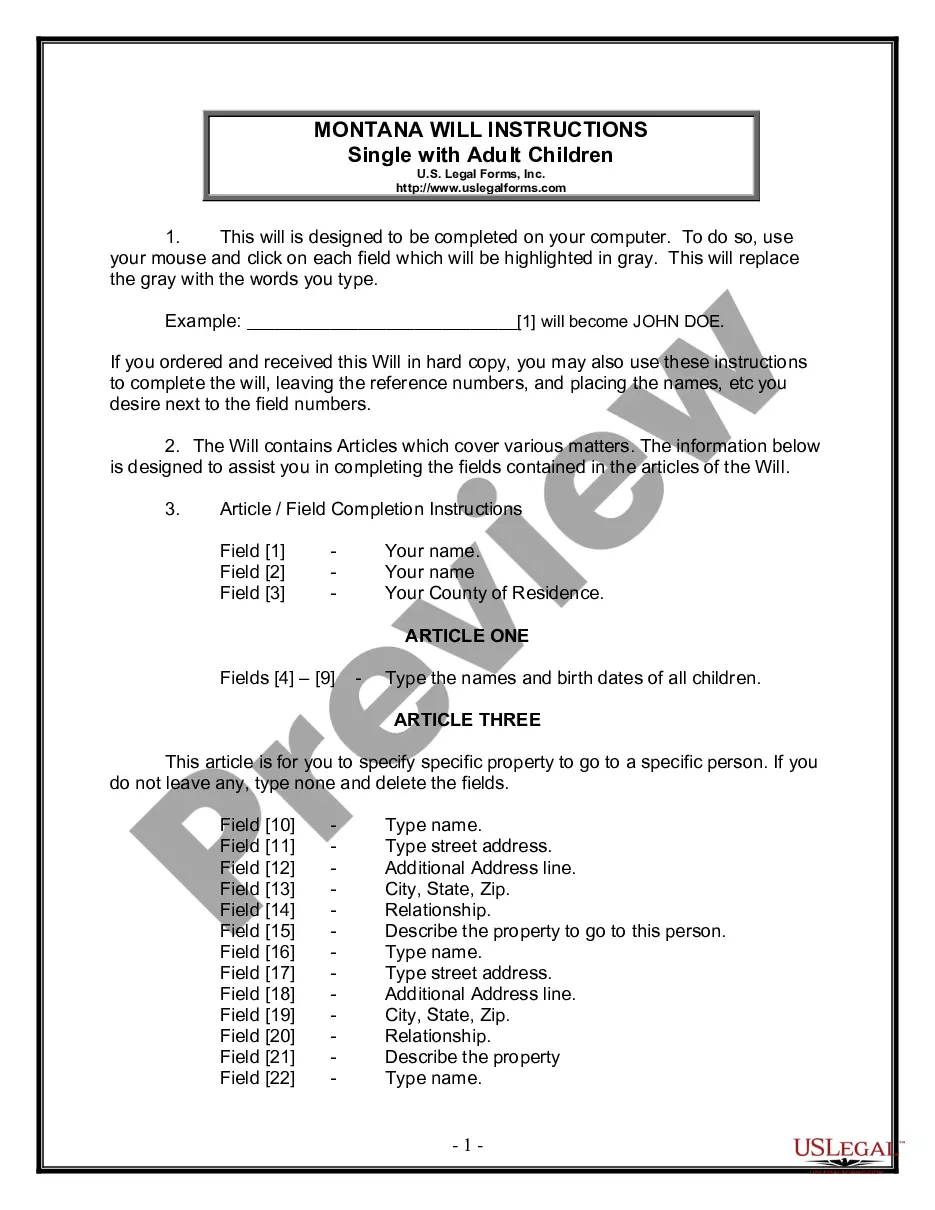

Craft a legally binding document to specify asset distribution after your death, designed specifically for those with adult children and no remarriages.

Ensure your wishes are honored after passing with a document tailored for single parents with adult children.

Design a comprehensive estate plan that outlines how your assets will be distributed to your spouse and adult children from a previous marriage.

Use this comprehensive document to ensure all your assets go to your living trust, providing clarity and control over your estate distribution.

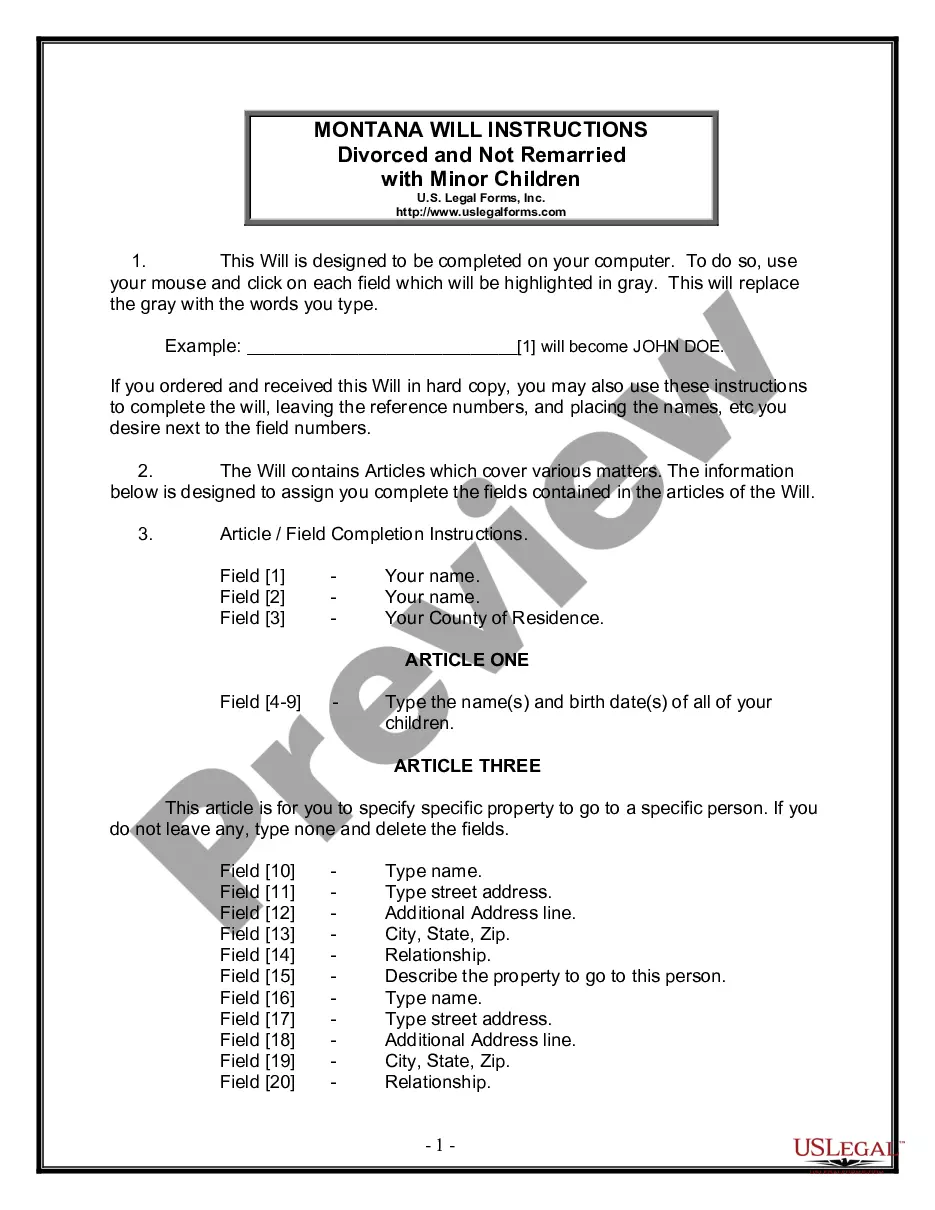

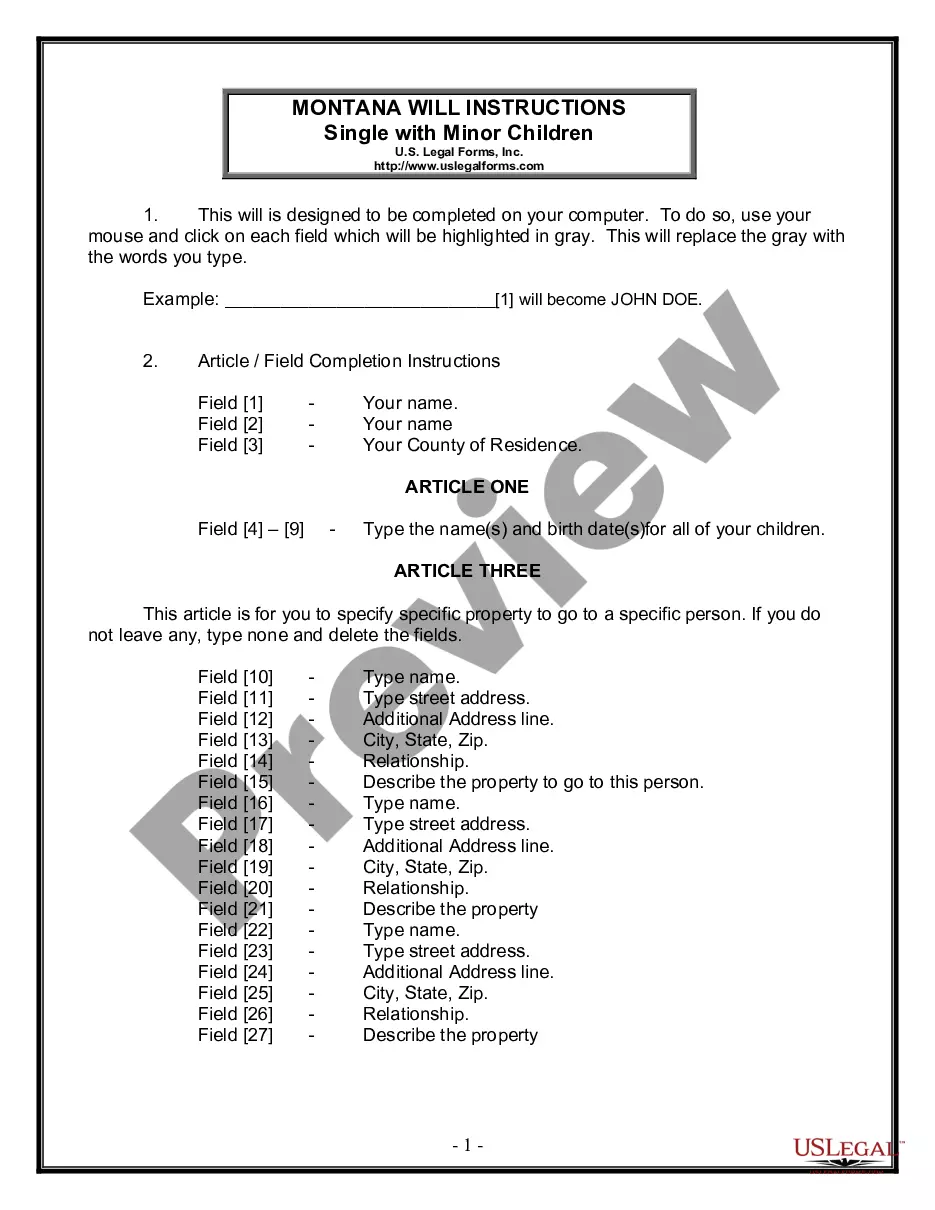

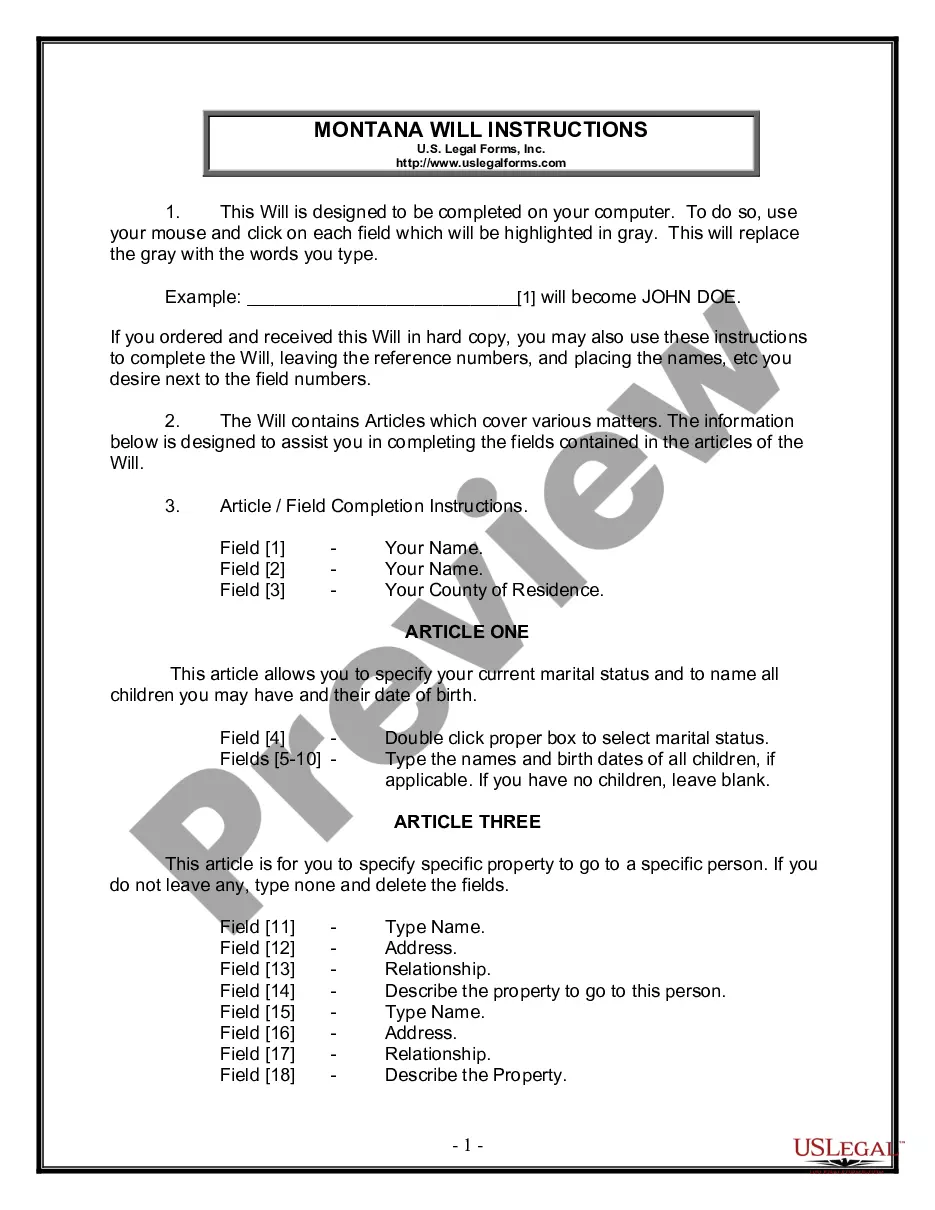

Create a legally binding document for managing your estate and protecting your minor children after divorce.

Plan for the future with a comprehensive document that ensures your minor children are cared for and your assets are distributed as you wish.

Create a personalized will to specify how your assets will be distributed and who will manage your estate after your death.

A Last Will and Testament is crucial for asset distribution.

It can appoint guardians for minors and manage final wishes.

Witnesses are typically required for validity.

An executor is named to carry out the will's instructions.

Wills can be contested in probate court.

It’s wise to review and update your will regularly.

Different types of wills serve unique purposes.

Follow these simple steps to create your will efficiently.

A trust can provide additional control over asset distribution, but a will is essential.

Without a will, state laws dictate asset distribution, which may not reflect your wishes.

Review your will every few years or after major life changes.

Beneficiary designations generally override will instructions for specific assets.

Yes, you can appoint separate individuals for financial and health matters.