What is Last Will and Testament?

A Last Will and Testament is a legal document that details how your assets will be distributed after your death. It is used to ensure your wishes are honored. Explore state-specific templates for your needs.

In Missouri, a Last Will and Testament outlines your wishes for asset distribution. Attorney-drafted templates are quick and easy to complete.

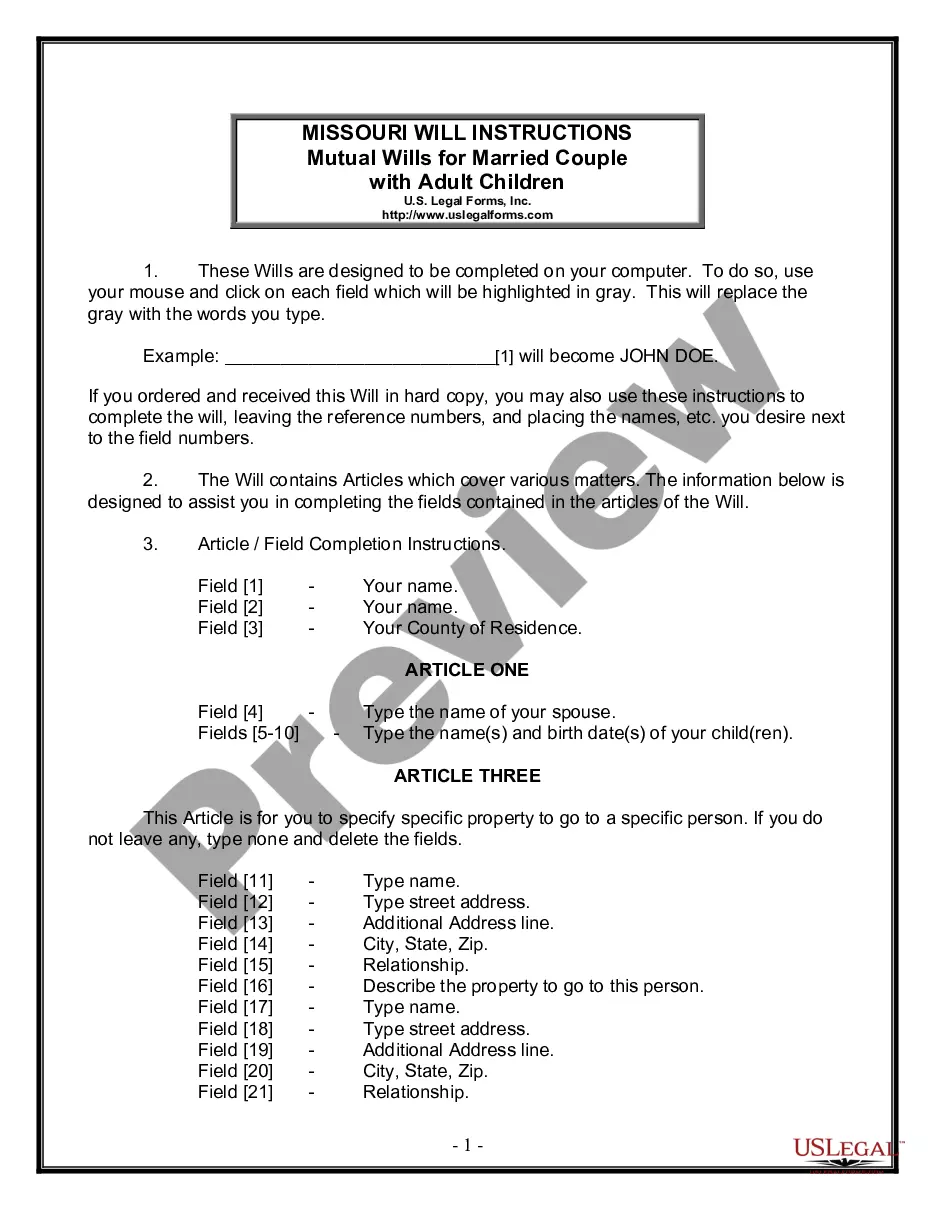

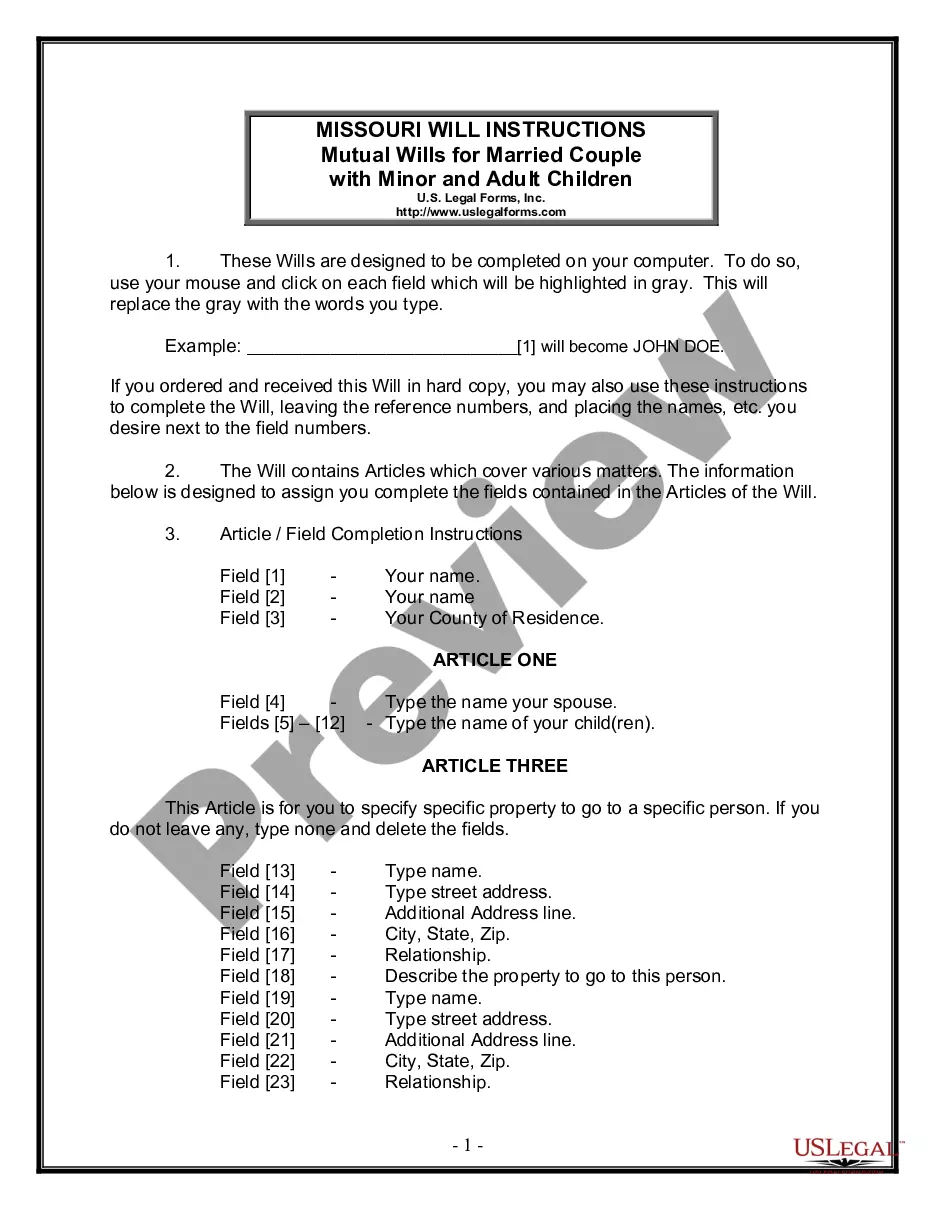

Create legally binding mutual wills for married couples with adult children, ensuring your estate is distributed according to your wishes.

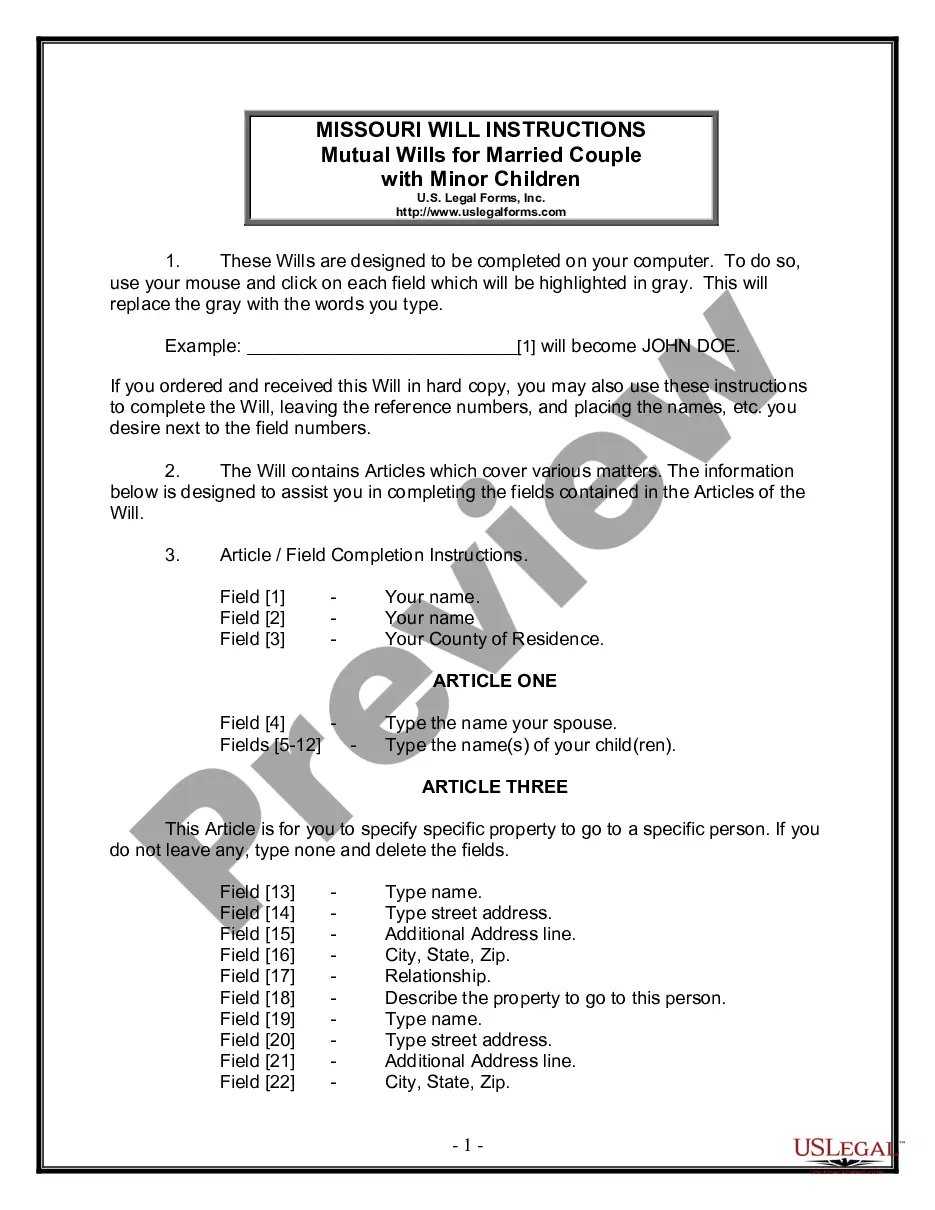

Protect your family's future with tailored wills that address your marriage and minor children's needs.

Prepare essential legal documents to safeguard your estate and ensure your wishes are honored, all in one convenient package.

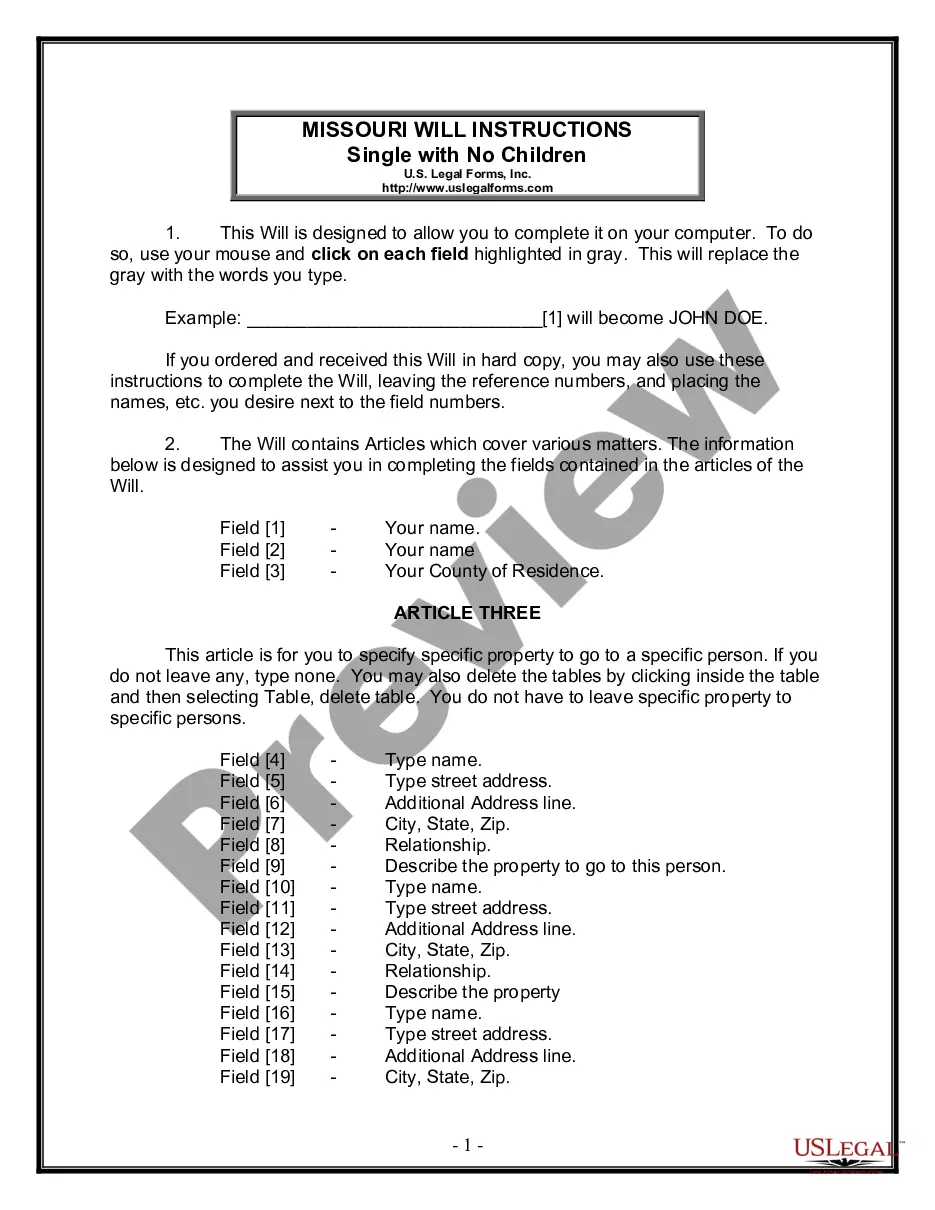

Ensure your final wishes are honored without children or a spouse. This essential document clearly outlines how your assets should be distributed.

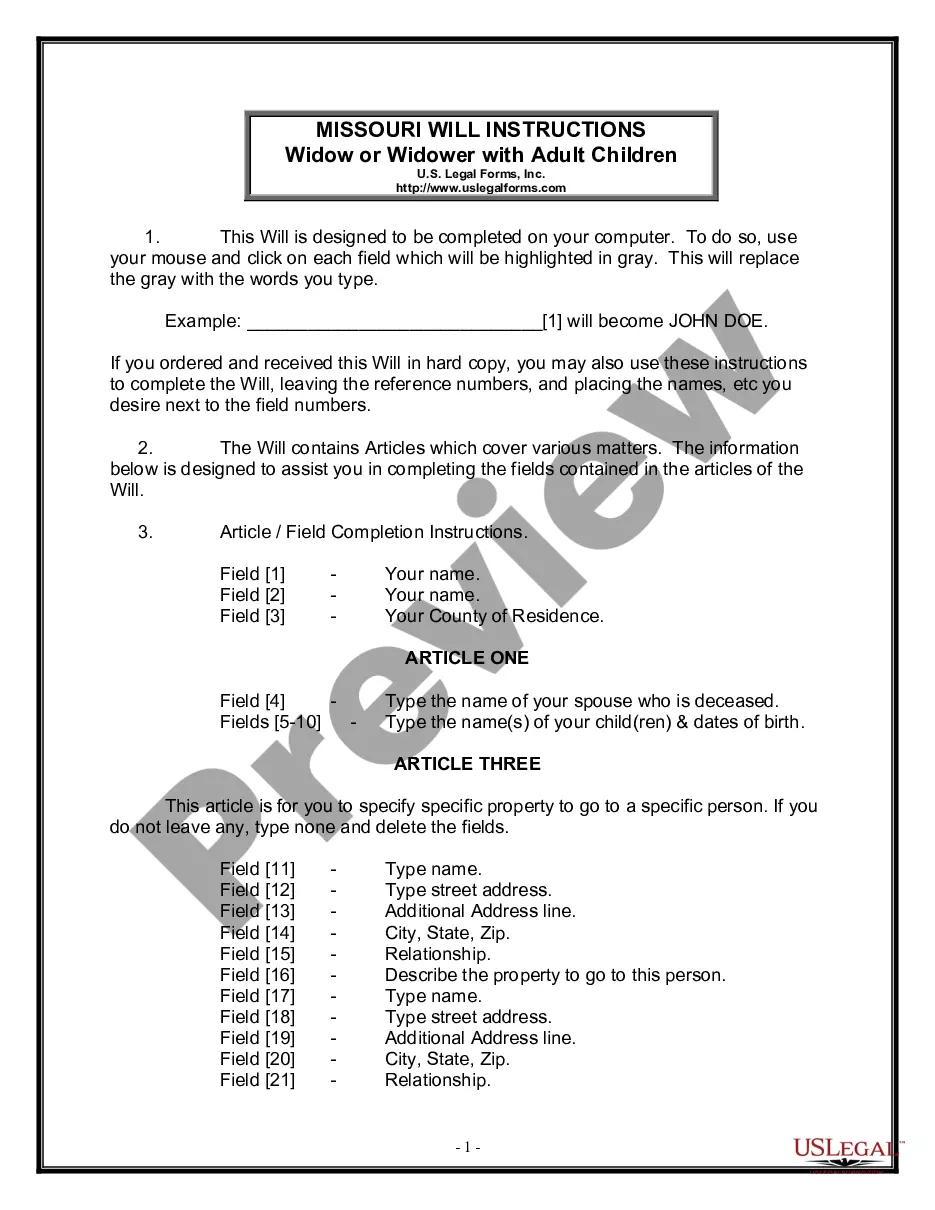

Planning your estate is crucial for ensuring your wishes are honored. This document helps widows or widowers with adult children allocate assets effectively.

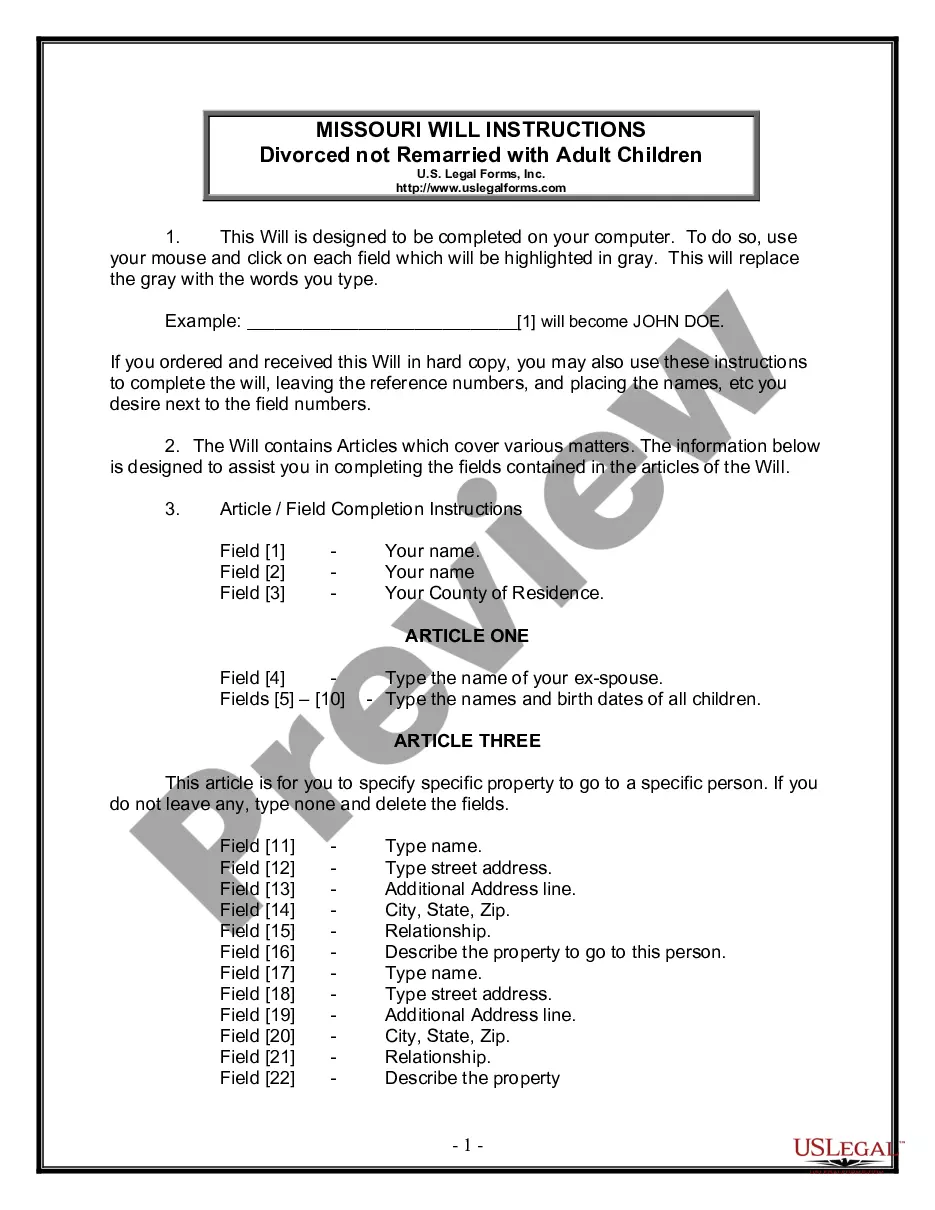

Create a comprehensive will that designates your adult children as beneficiaries and outlines your estate management preferences after divorce.

Ensure proper estate planning with customized wills for couples, addressing both minor and adult children.

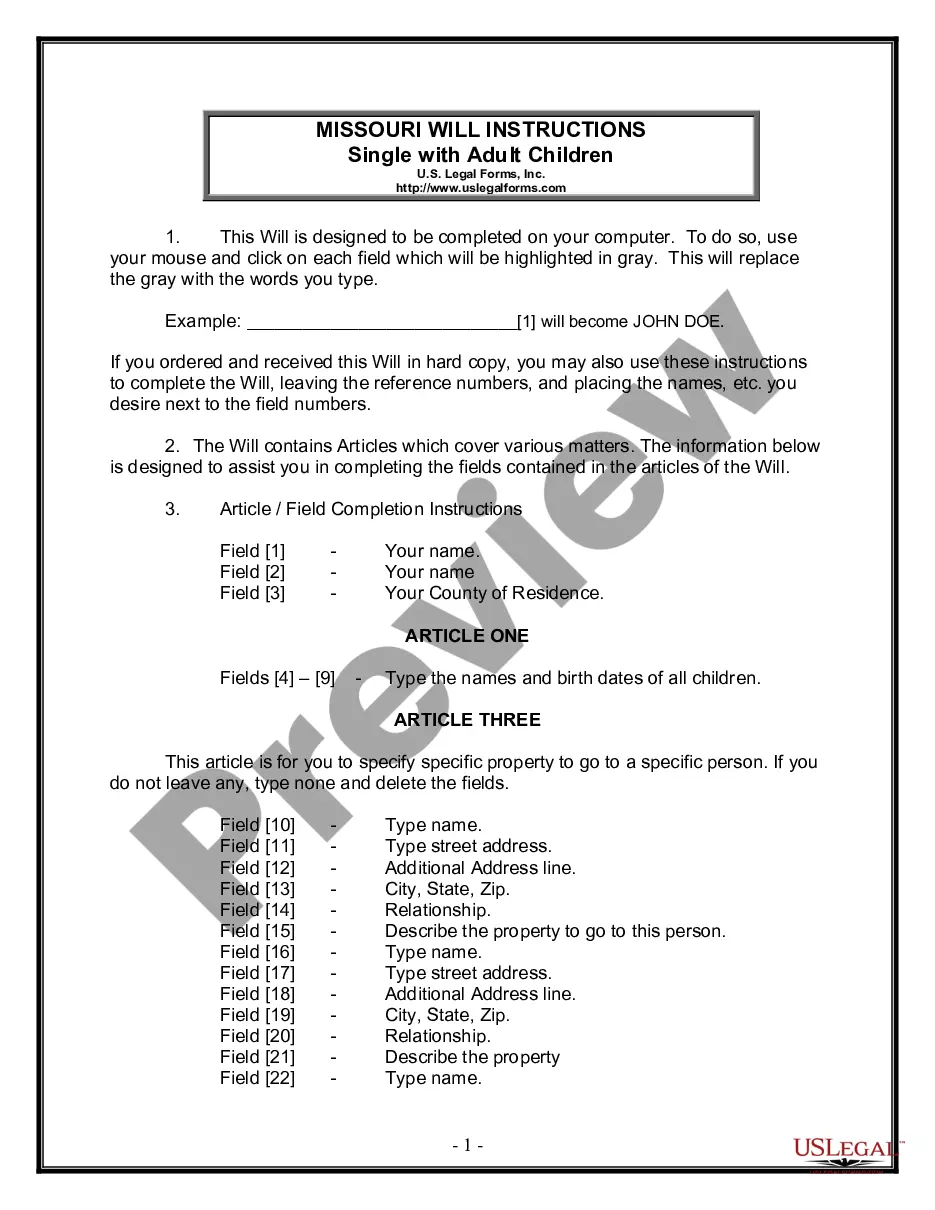

Ensure your wishes are honored after your passing with a legal document tailored for single parents with adult children.

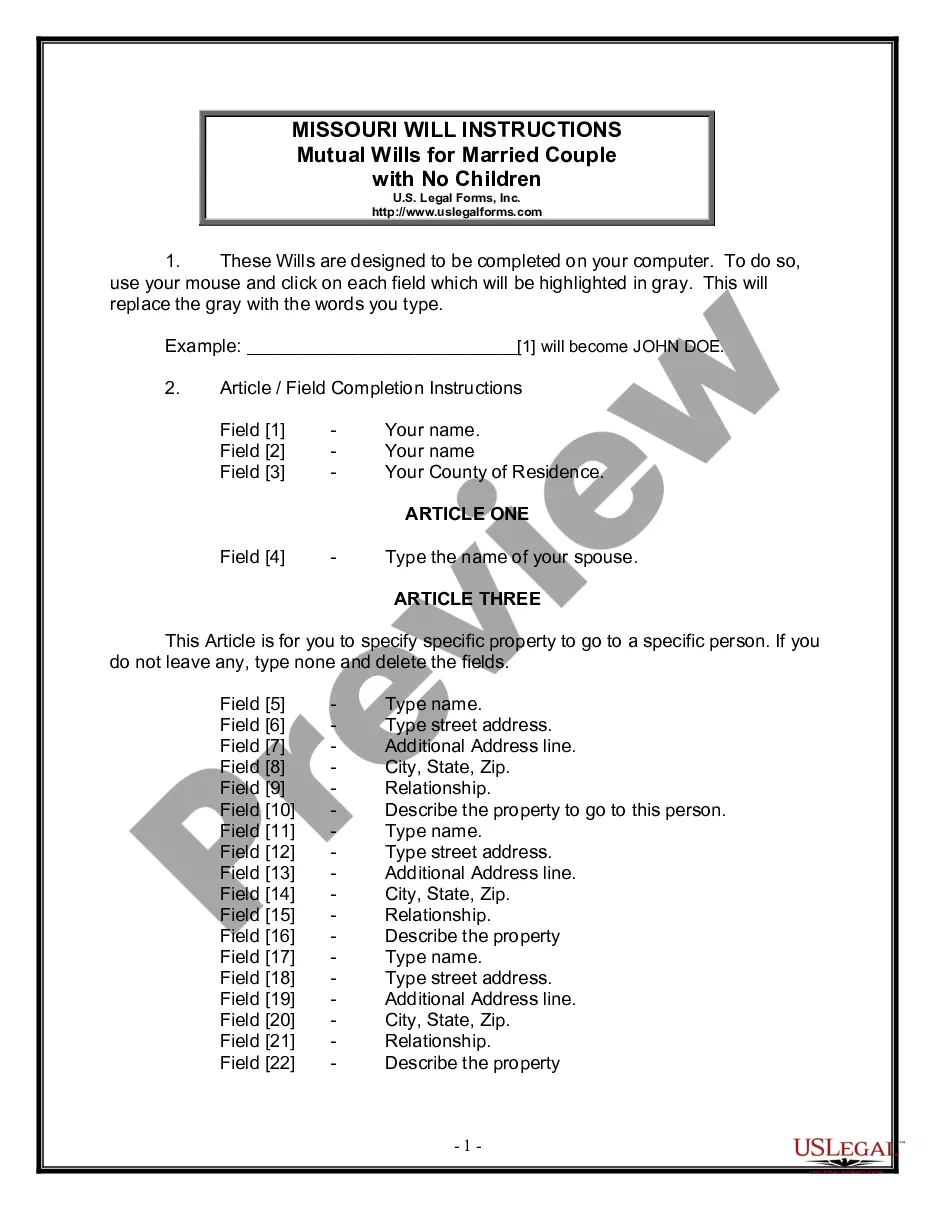

Plan your estate with mutual wills that ensure your spouse is cared for after your passing, perfect for couples without children.

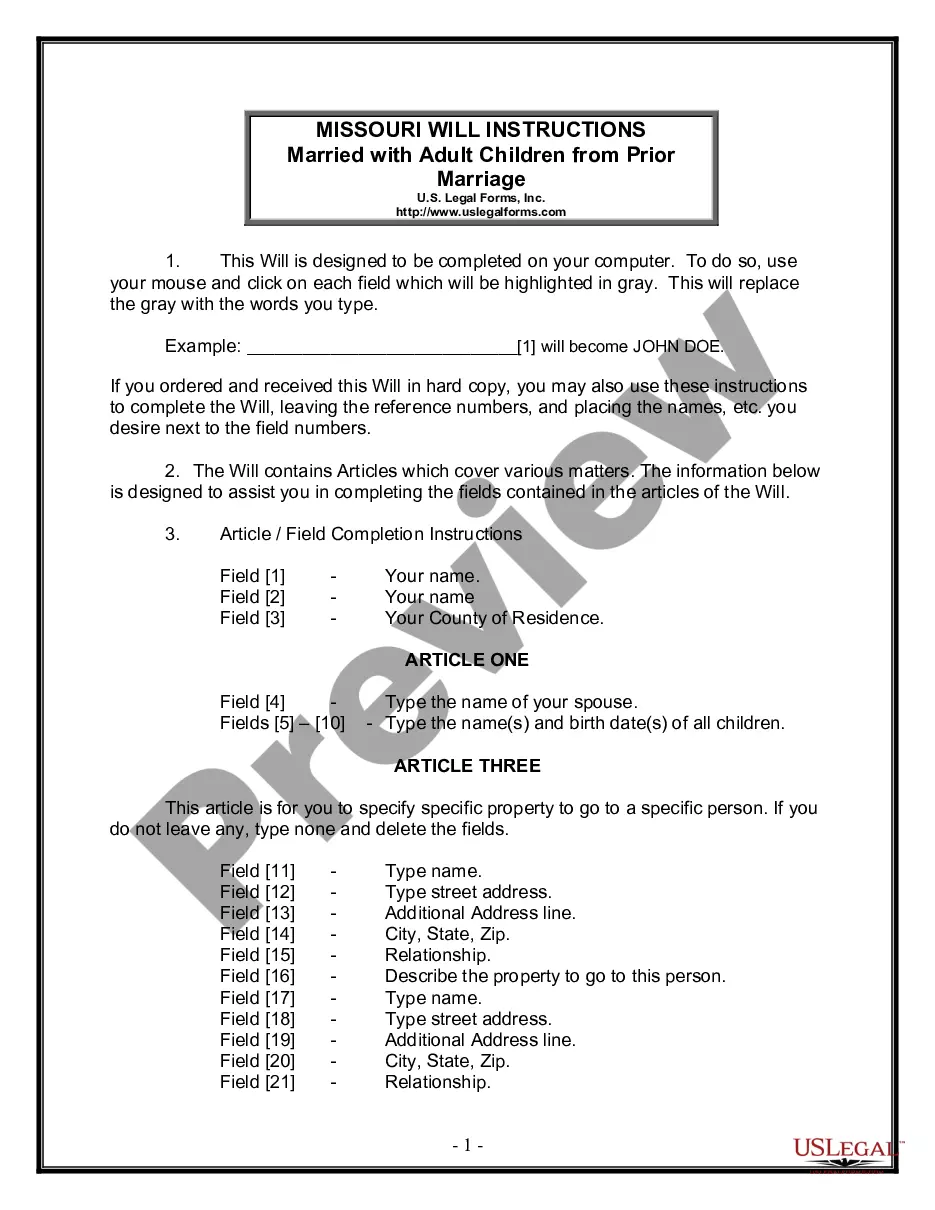

Plan your estate effectively with a document tailored for married individuals with adult children from previous relationships.

A Last Will and Testament is essential for asset distribution.

Beneficiaries can be anyone you choose.

Wills can name guardians for minor children.

Many wills need to be signed in front of witnesses.

Holographic wills may not need witnesses in some states.

Updating your will after major life events is wise.

A will does not avoid probate; it directs it.

Begin quickly with these simple steps.

Not necessarily; a will can serve many purposes, but trusts offer additional benefits.

If you do not have a will, state laws will determine how your assets are distributed.

Review your will every few years or after significant life changes.

Beneficiary designations can override your will, so ensure they align with your wishes.

Yes, you can appoint different individuals for financial and healthcare decisions.