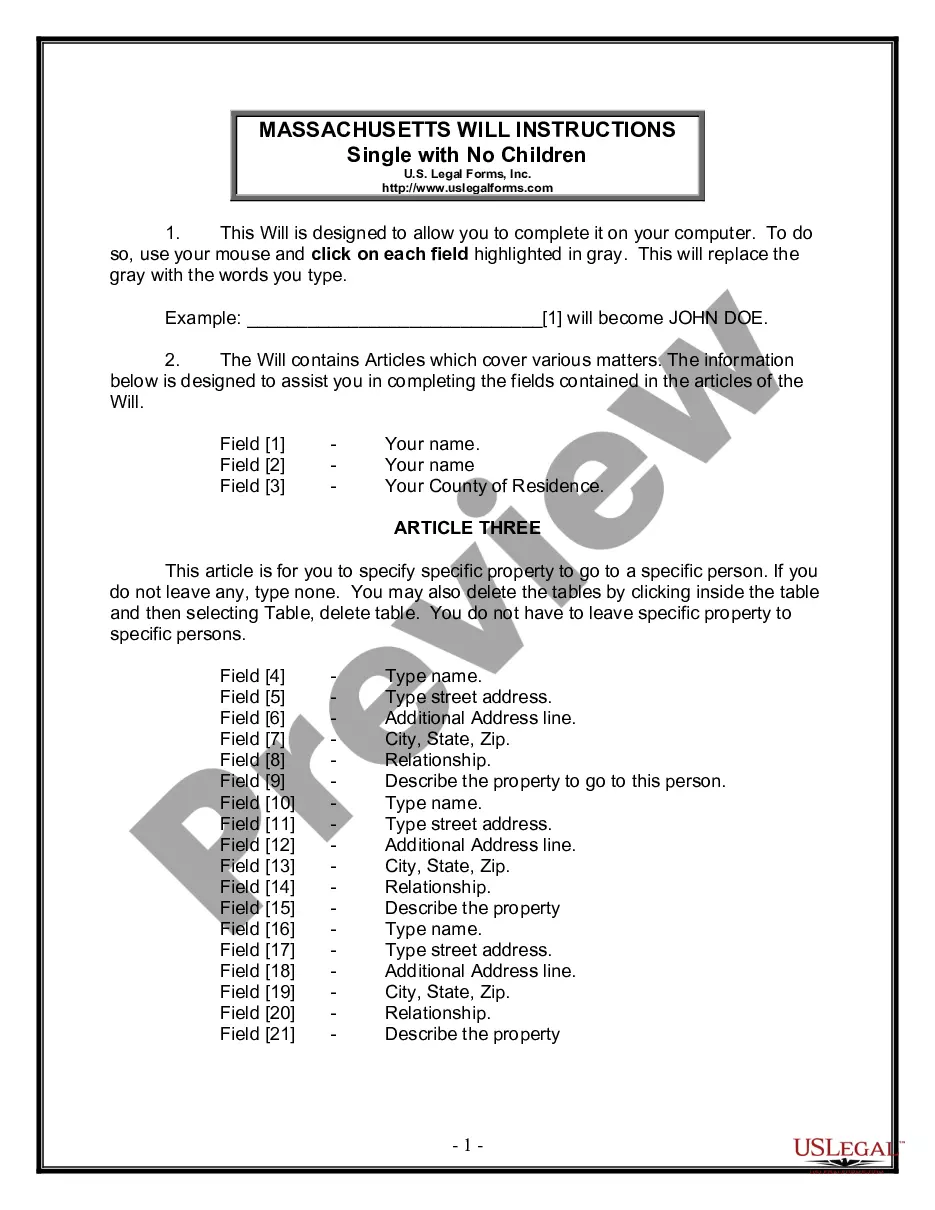

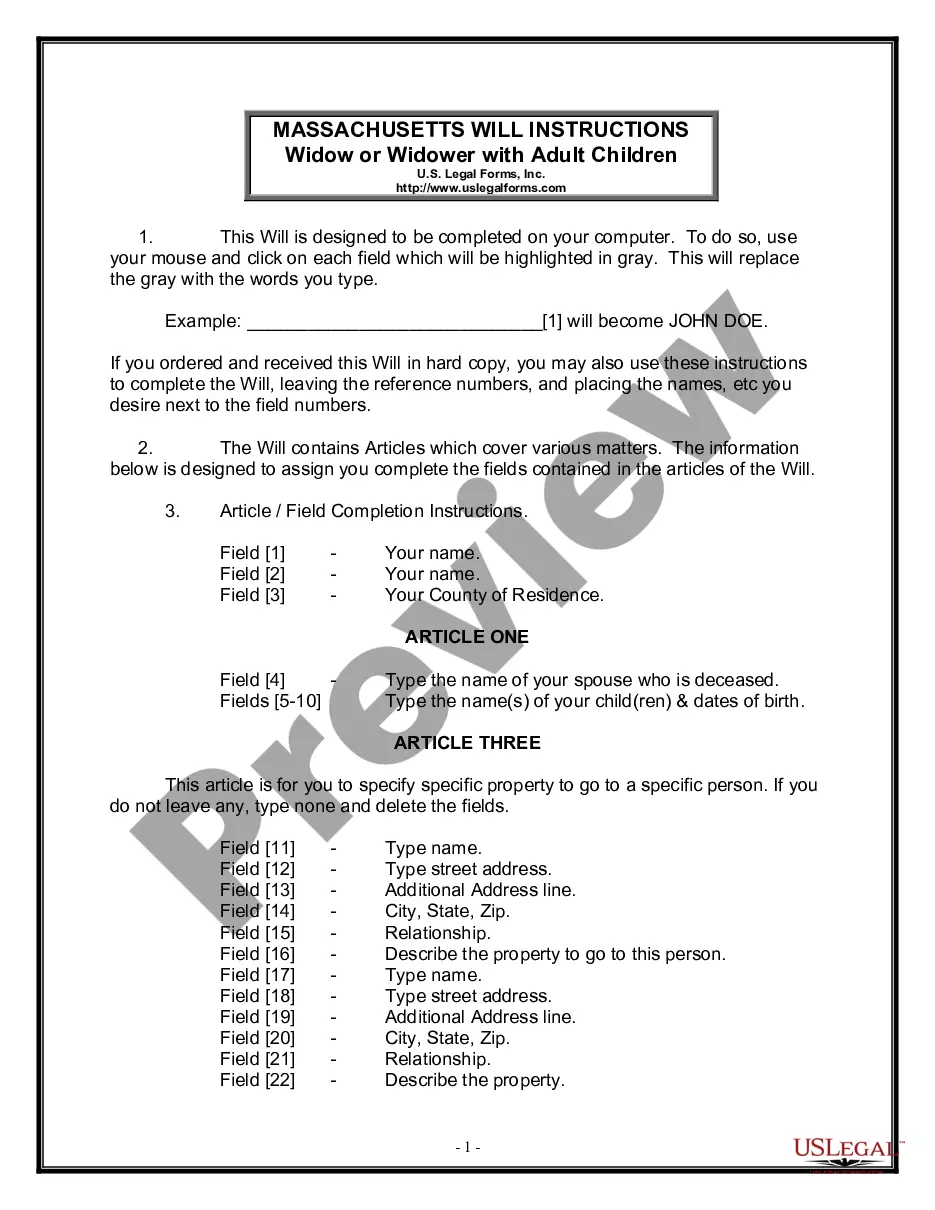

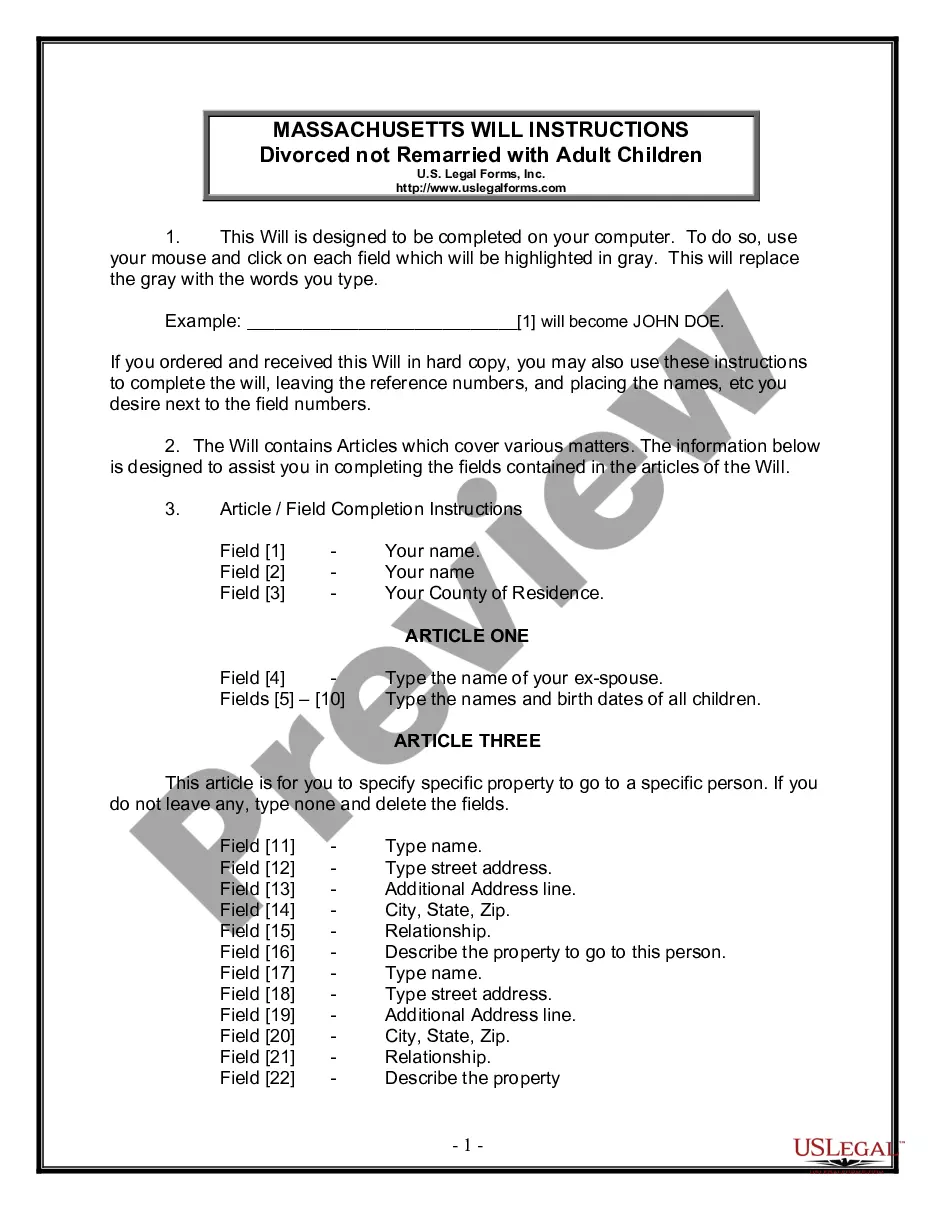

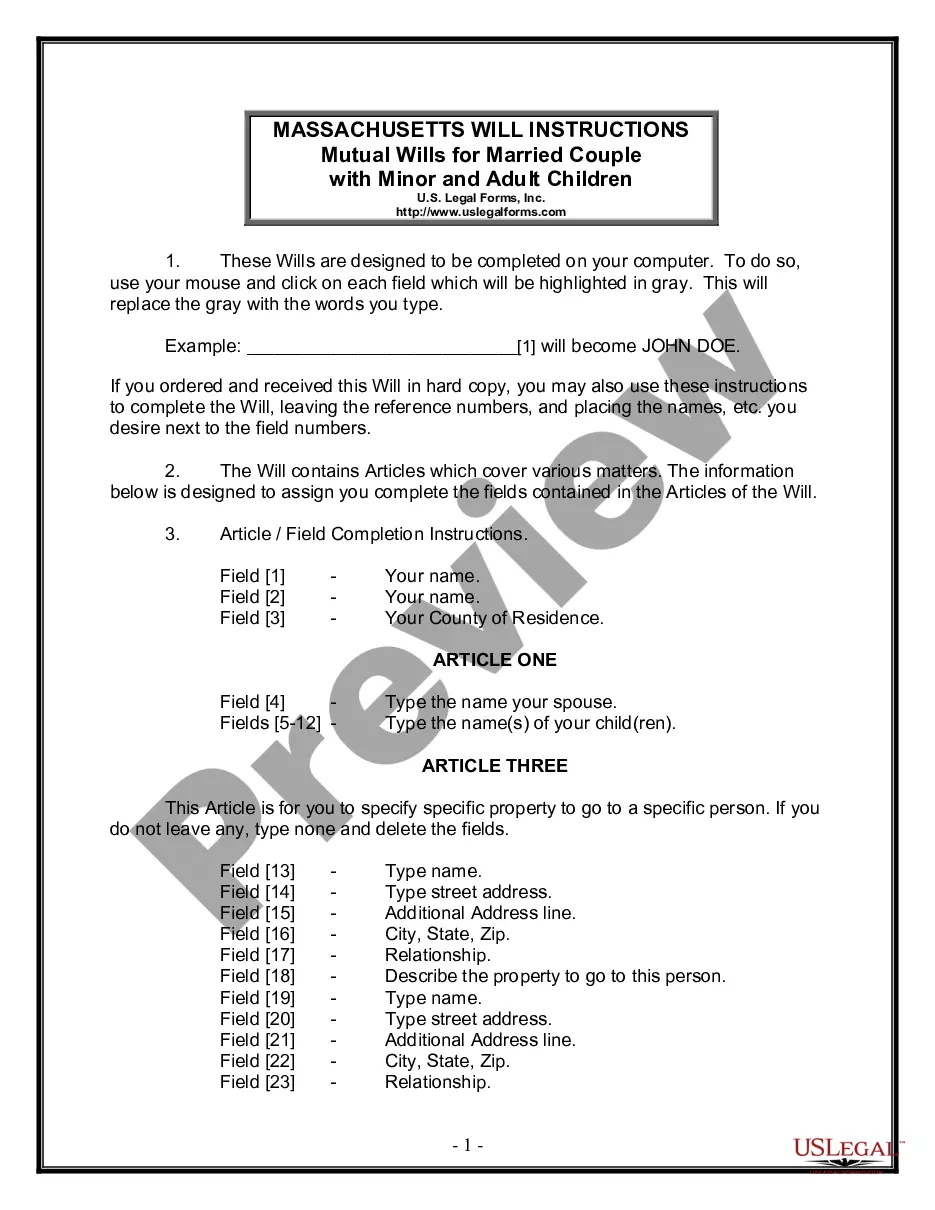

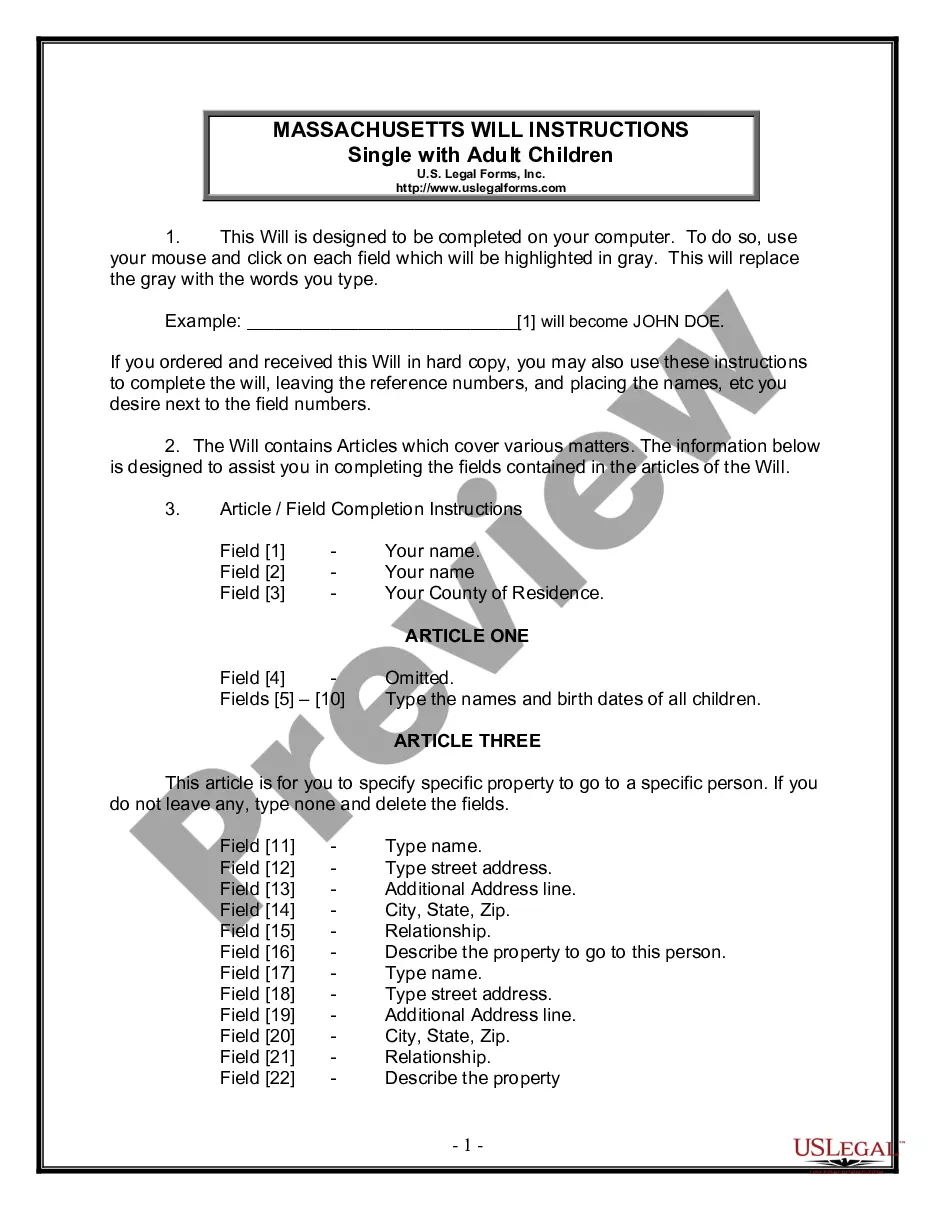

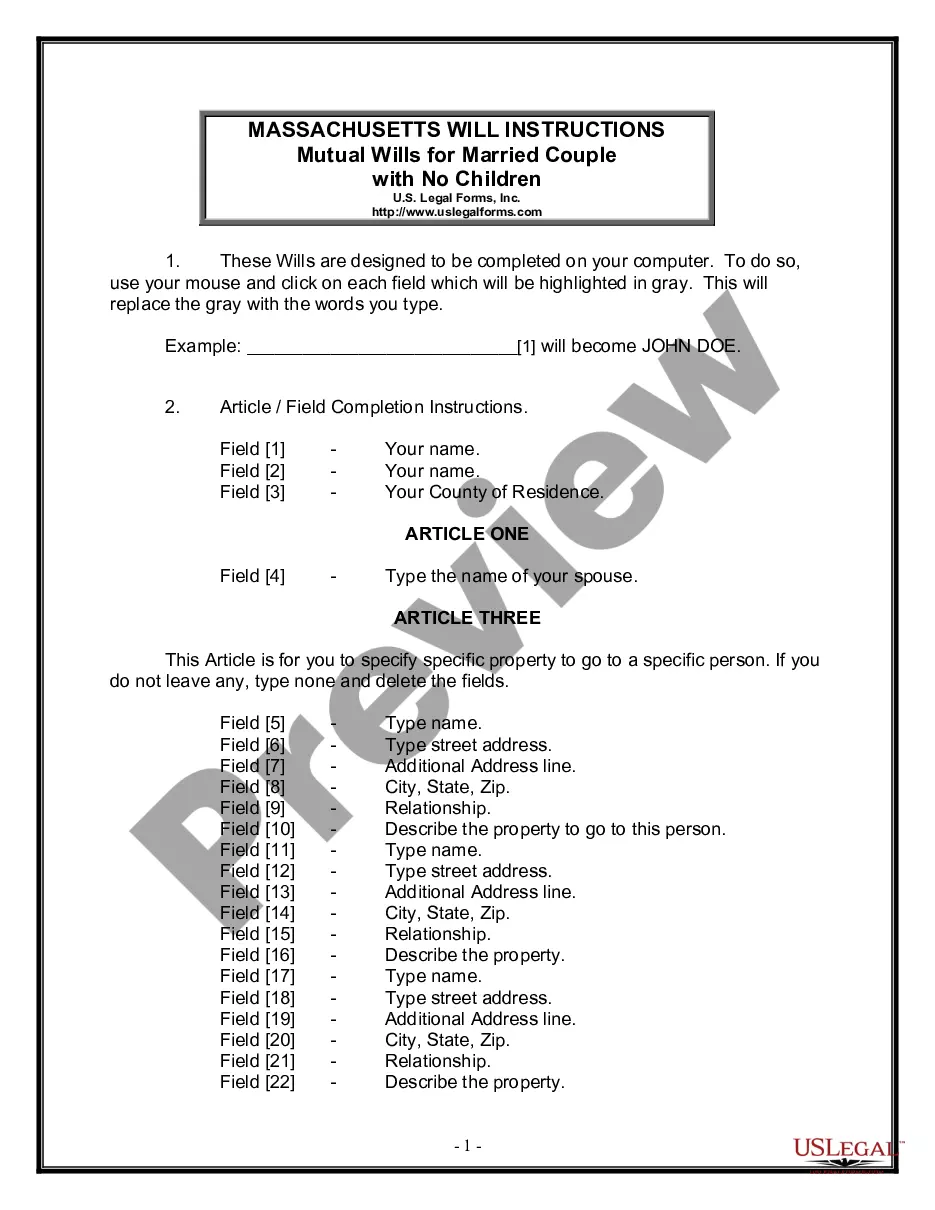

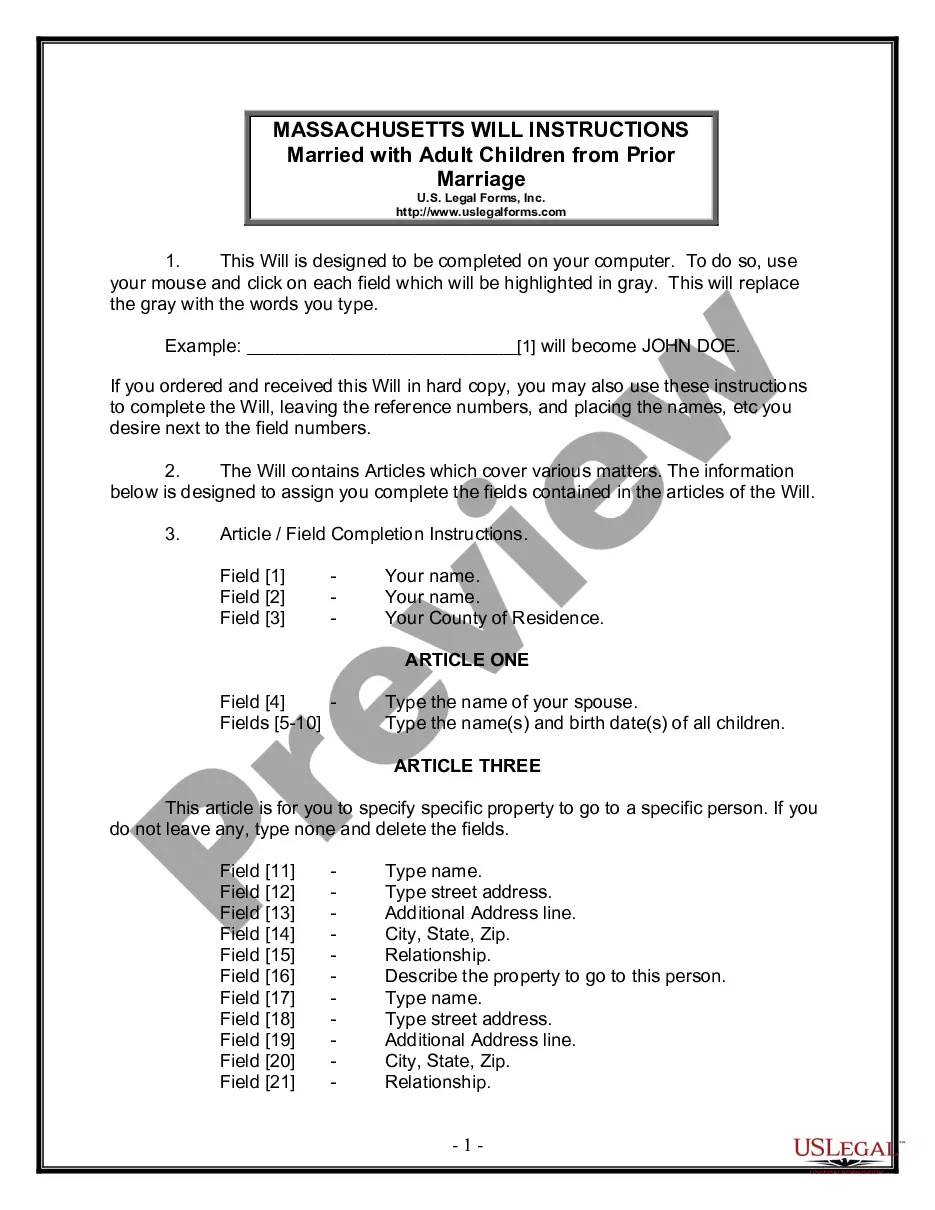

What is Last Will and Testament?

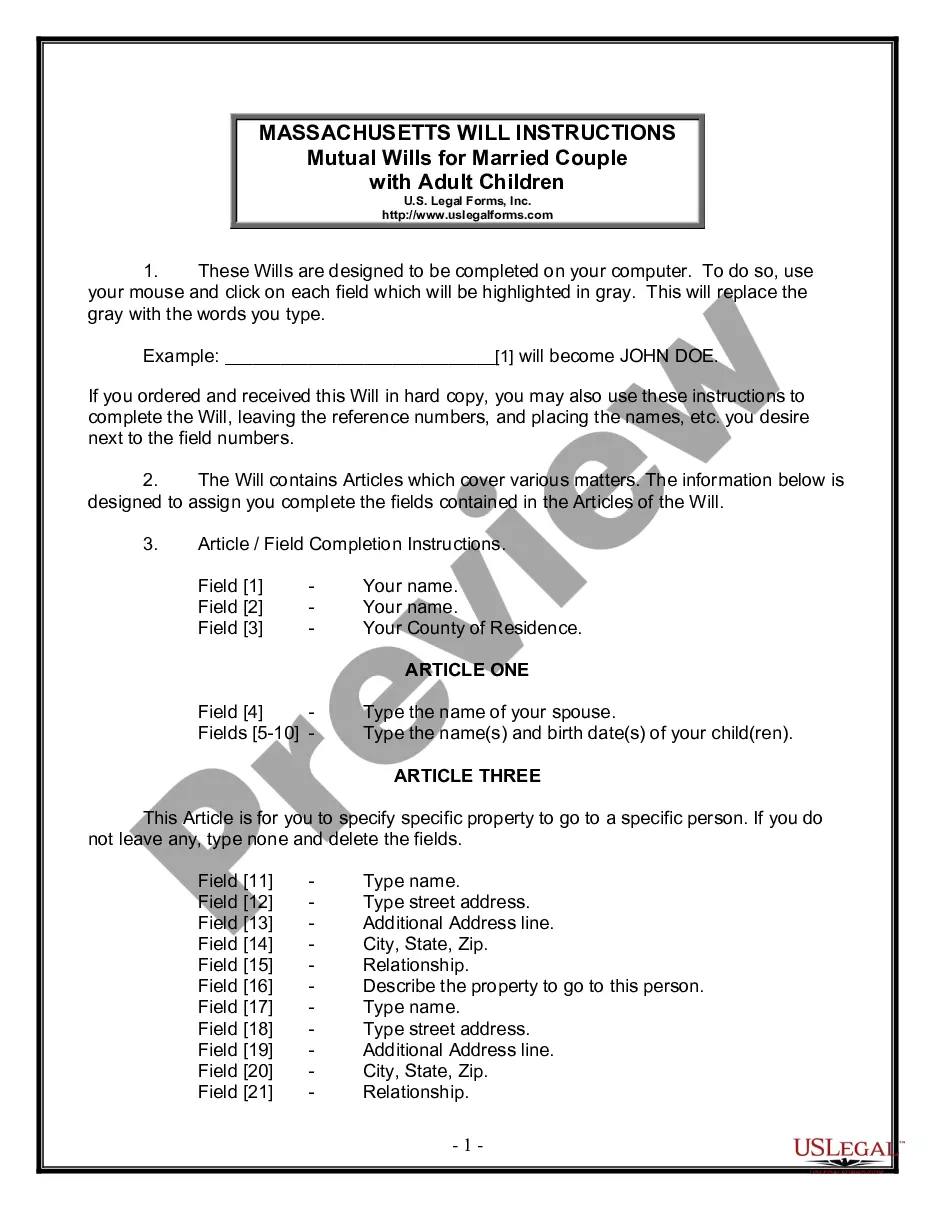

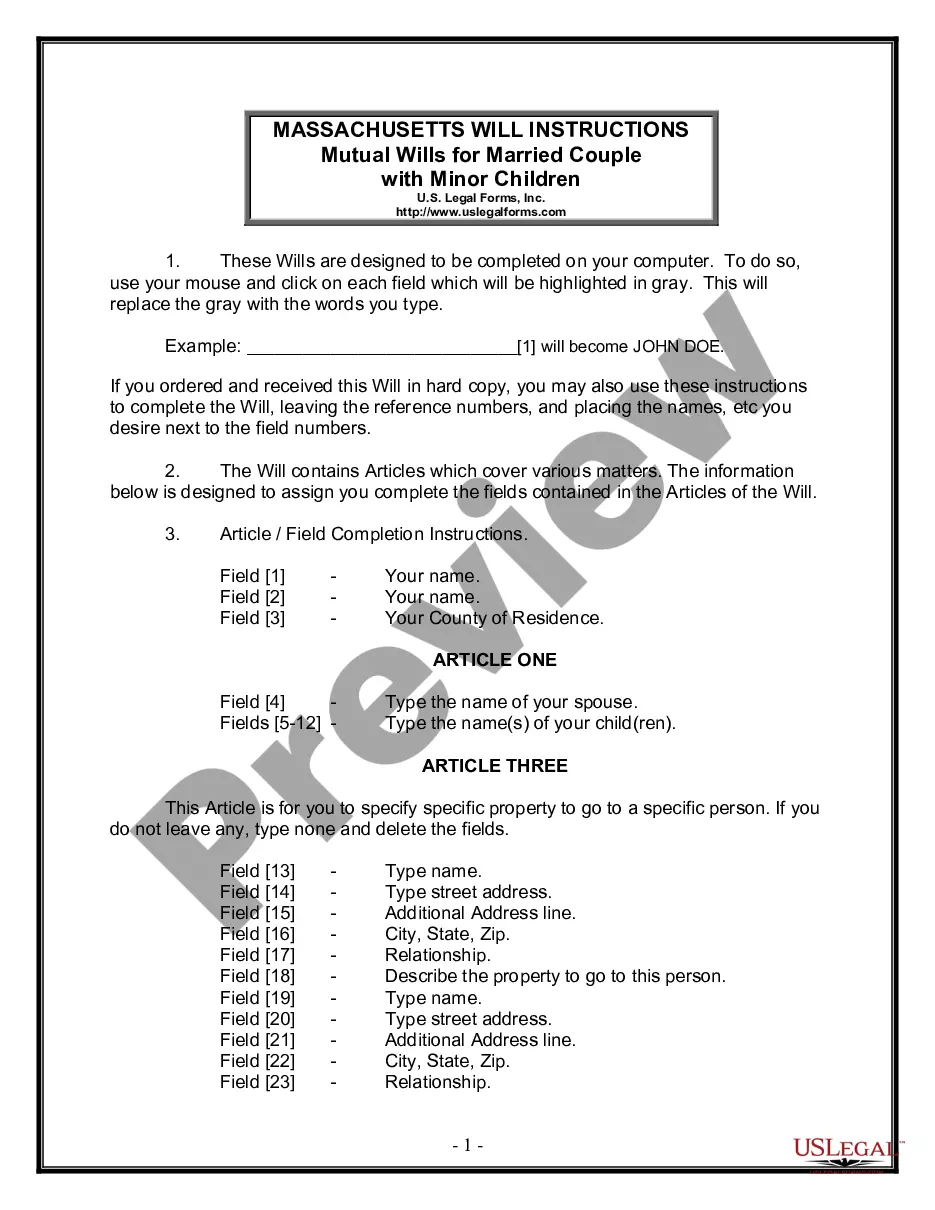

A Last Will and Testament is a legal document that specifies how your assets will be distributed after your death. It is commonly used to ensure your wishes are honored. Explore state-specific templates to find the right fit for your needs.