What is Last Will and Testament?

A Last Will and Testament details how a person's assets should be distributed after their death. It is typically used to ensure one's wishes are honored. Explore templates specific to your state.

Last Will and Testament documents help individuals outline their wishes after death. Attorney-drafted templates are quick and easy to complete.

Create legally binding wills for spouses with adult children to ensure property is distributed according to their wishes.

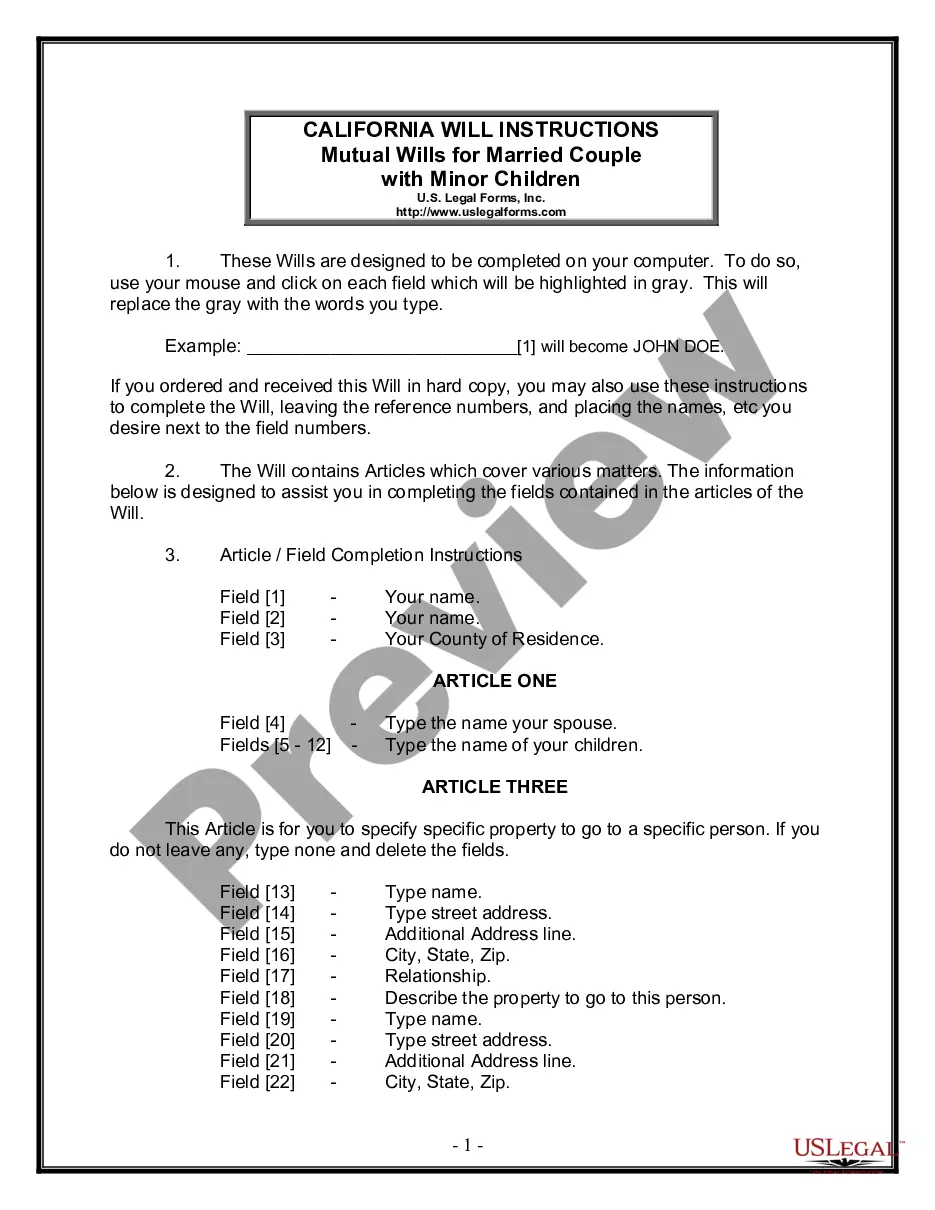

Ensure your estate is managed according to your wishes with mutual wills tailored for parents of minor children.

Prepare for the future with all necessary estate planning forms in one convenient package.

Create a clear plan for your assets after your passing, ensuring they go to designated individuals.

Secure your wishes for property distribution and guardianship after your passing, ensuring clarity for your loved ones.

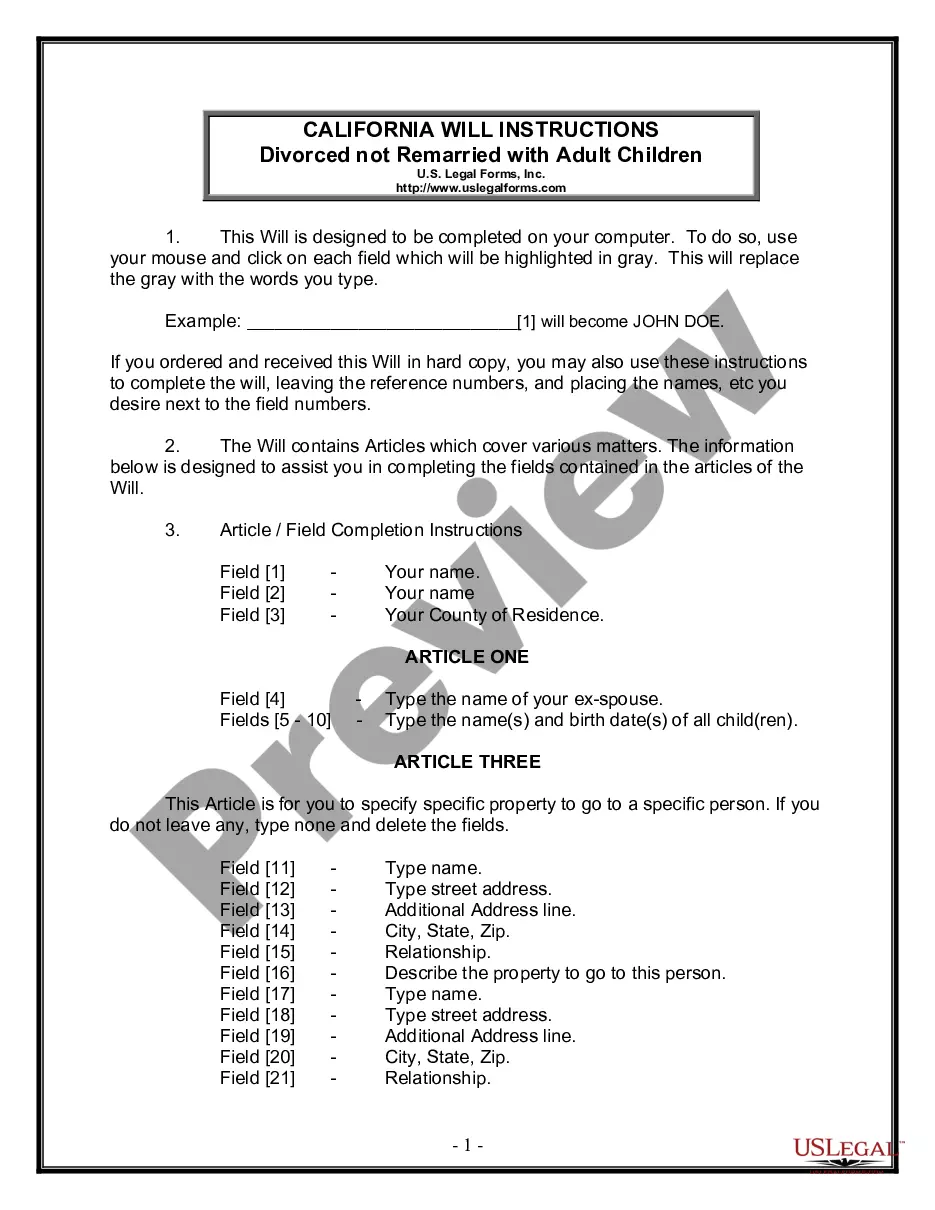

Ensure your estate is distributed according to your wishes after divorce with this straightforward will designed for individuals with adult children.

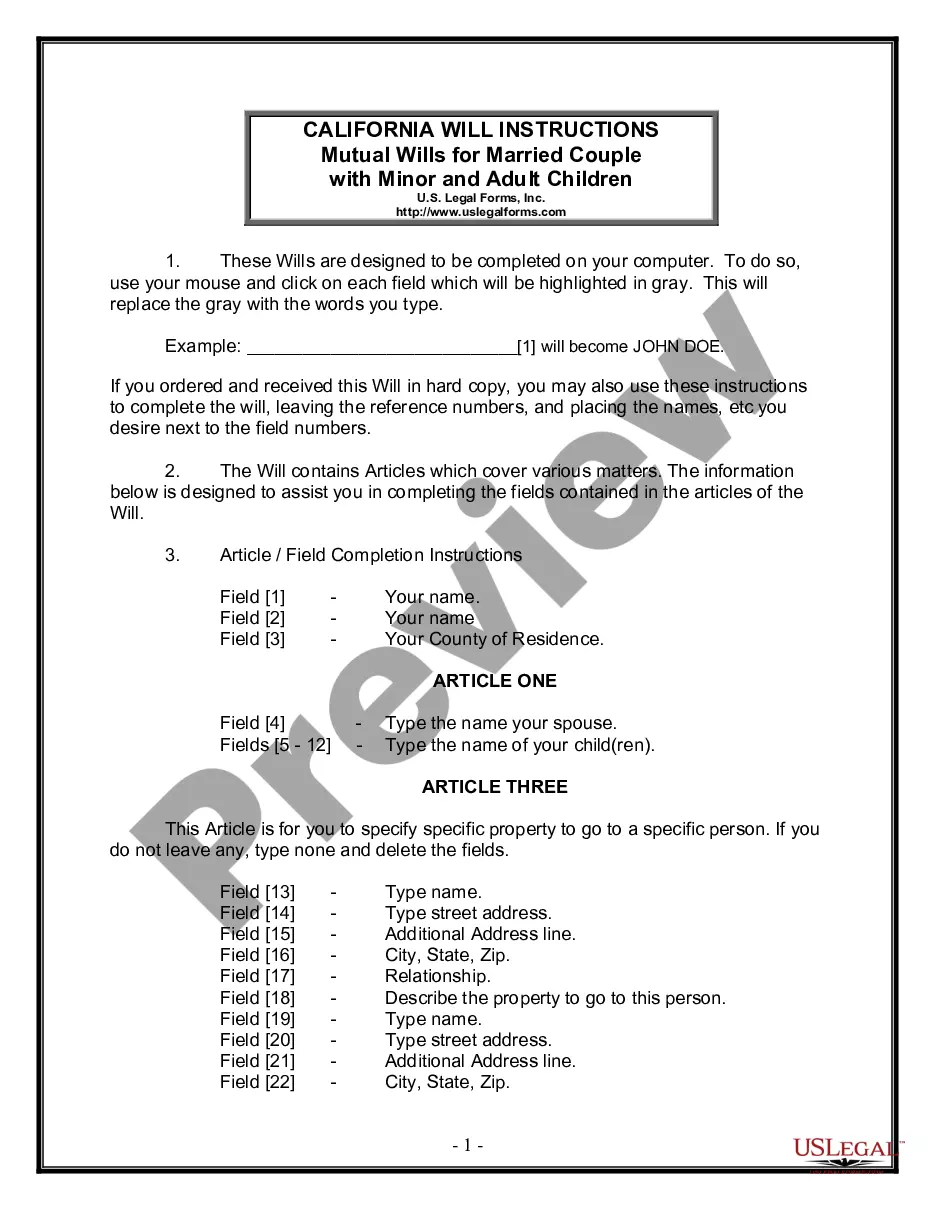

Create legally binding mutual wills for a married couple with children, ensuring asset distribution aligns with family intentions and protecting minors.

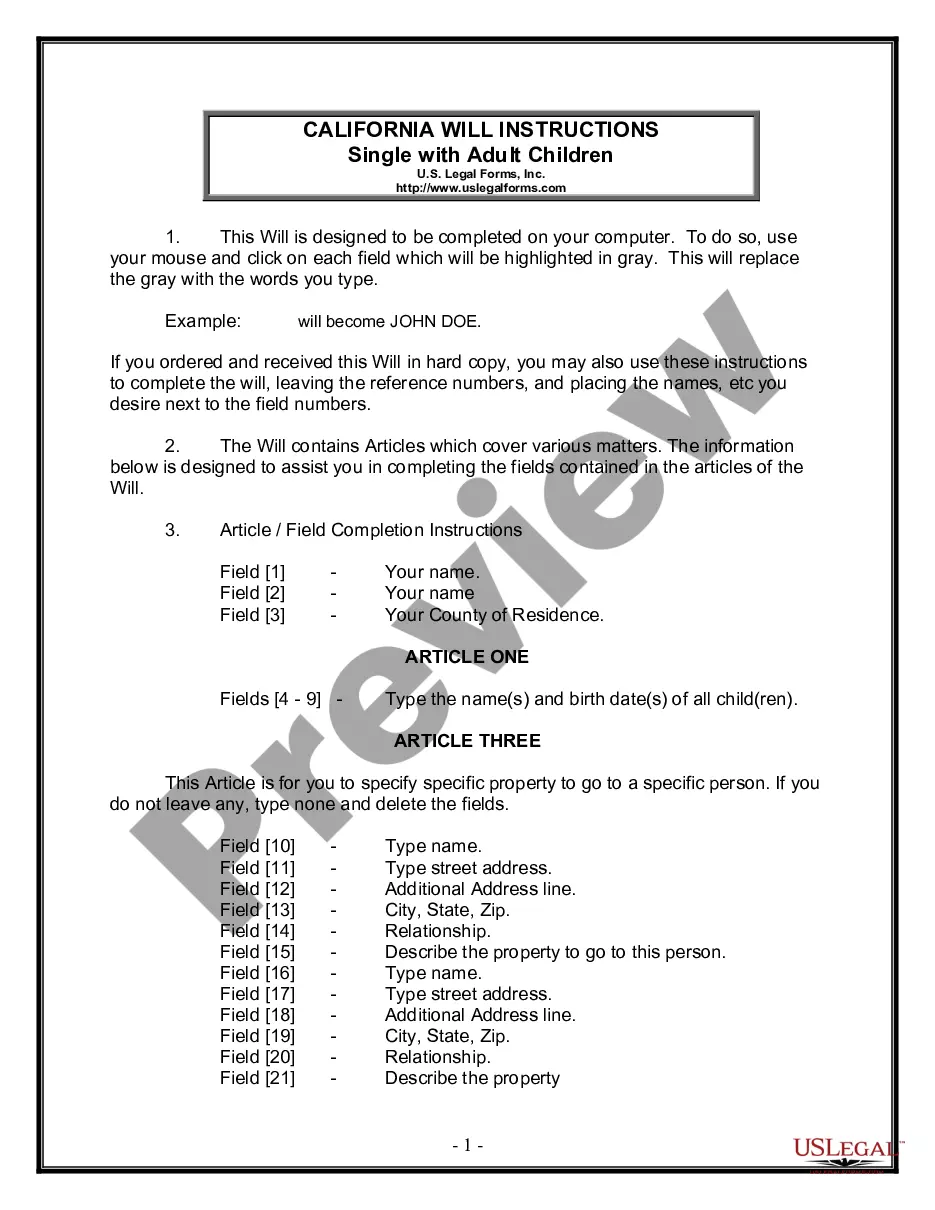

Ensure your wishes are honored after your passing by detailing asset distribution and appointing an executor.

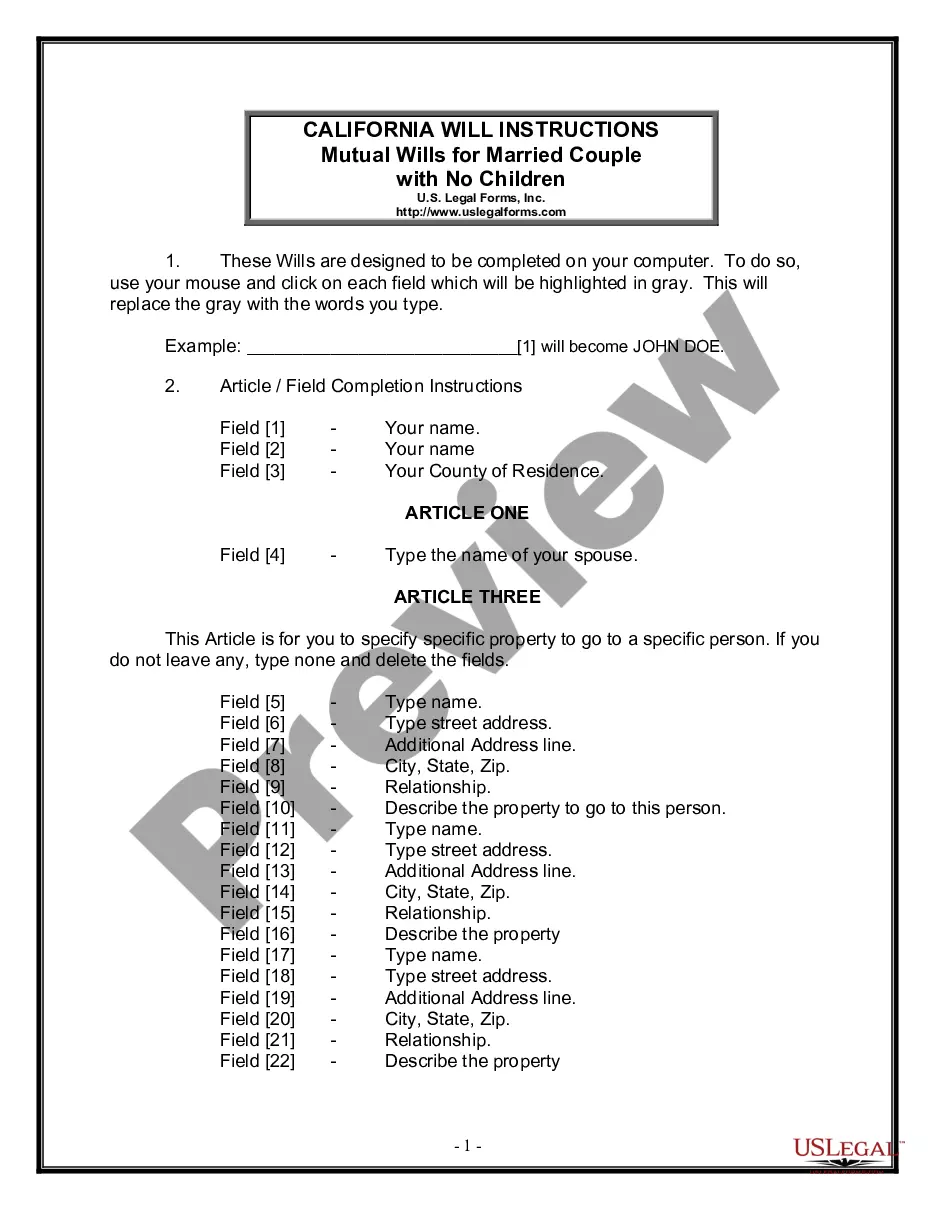

Create legally binding wills for married couples without children, ensuring clear distribution of assets and designating a personal representative.

Prepare a comprehensive estate plan to specify how your assets will be distributed, especially when remarriage and blended families are involved.

A last will takes effect after death.

Beneficiaries are individuals or entities receiving assets.

Witnesses may be needed to validate a will.

Wills can be amended or revoked by the testator.

Intestacy laws apply if there is no valid will.

Specific assets can be bequeathed to chosen individuals.

Personal representatives handle the will's execution.

Begin your process with these simple steps.

A trust can manage assets during life and after, while a will only addresses post-death asset distribution.

If there is no will, state laws will determine asset distribution, which may not reflect your wishes.

It’s wise to review your will every few years or after significant life changes.

Beneficiary designations on accounts may override instructions in your will.

Yes, you can designate separate individuals for financial and healthcare decisions.