What is Last Will and Testament?

A Last Will and Testament is a legal document that specifies how your assets will be distributed after your death. It can also designate guardians for minors. Explore state-specific templates to meet your needs.

A Last Will and Testament outlines your wishes for after you pass. Attorney-drafted templates are quick and easy to complete.

Prepare for the future with essential legal forms for your estate planning needs, all conveniently included in one package.

Create a legally binding will that clearly outlines how your estate should be distributed after your death, ensuring your wishes are honored.

Create a legally binding will to specify how your estate will be distributed after your death, ensuring your wishes are honored.

Create a comprehensive estate plan that clearly outlines distribution of your assets to your adult children after divorce.

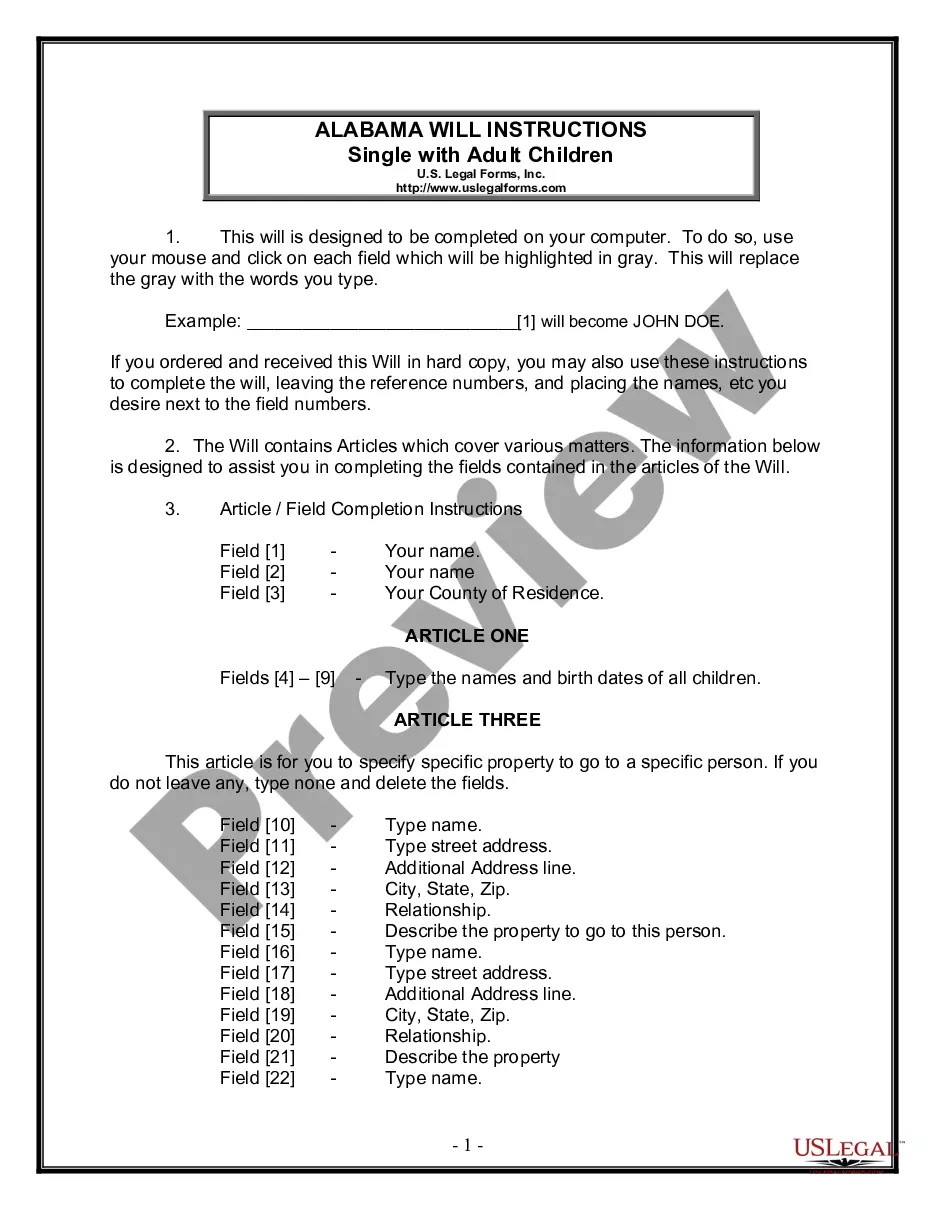

Create a legally binding document to dictate asset distribution after your passing, particularly important for singles with adult children.

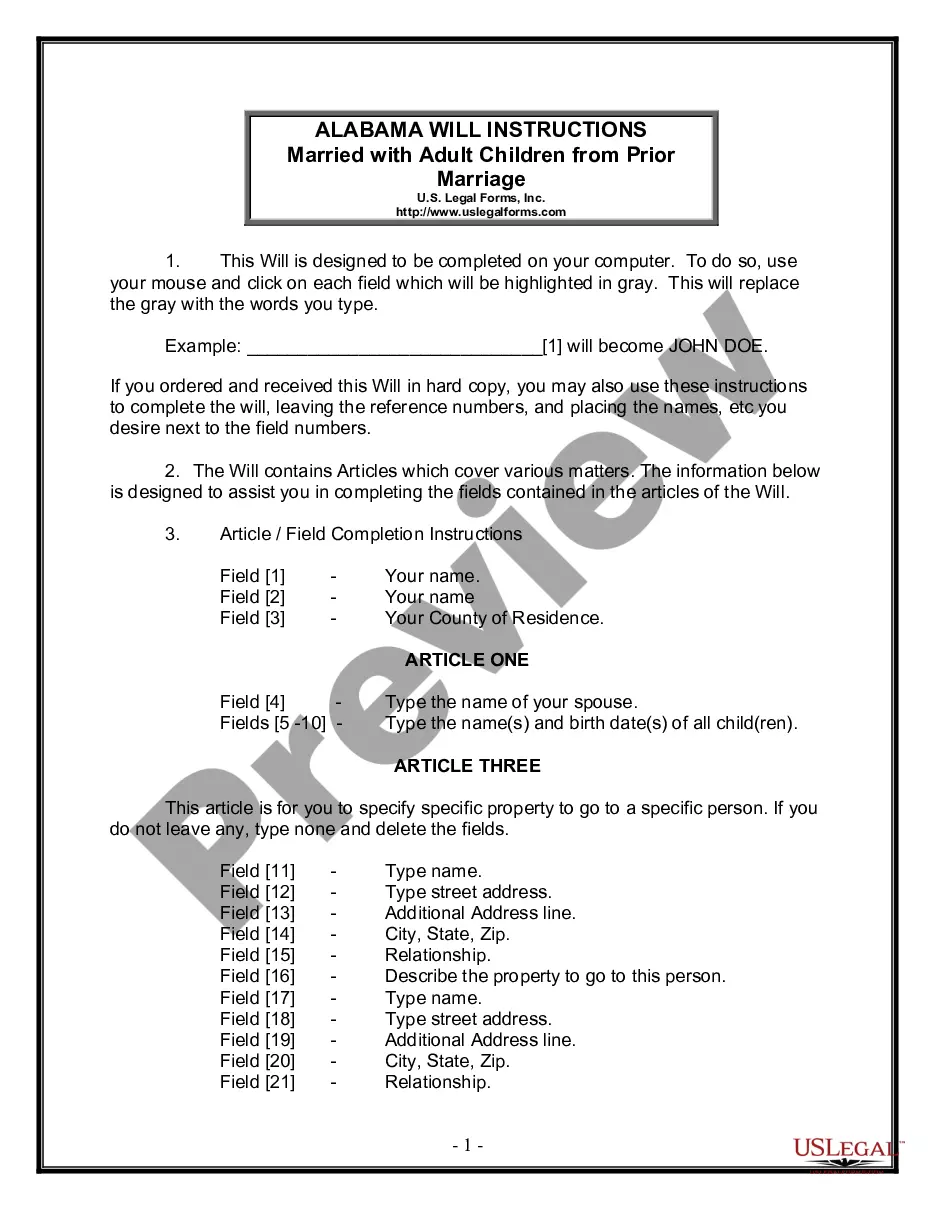

Plan your estate and determine how to distribute your assets to your spouse and children from a previous marriage after your passing.

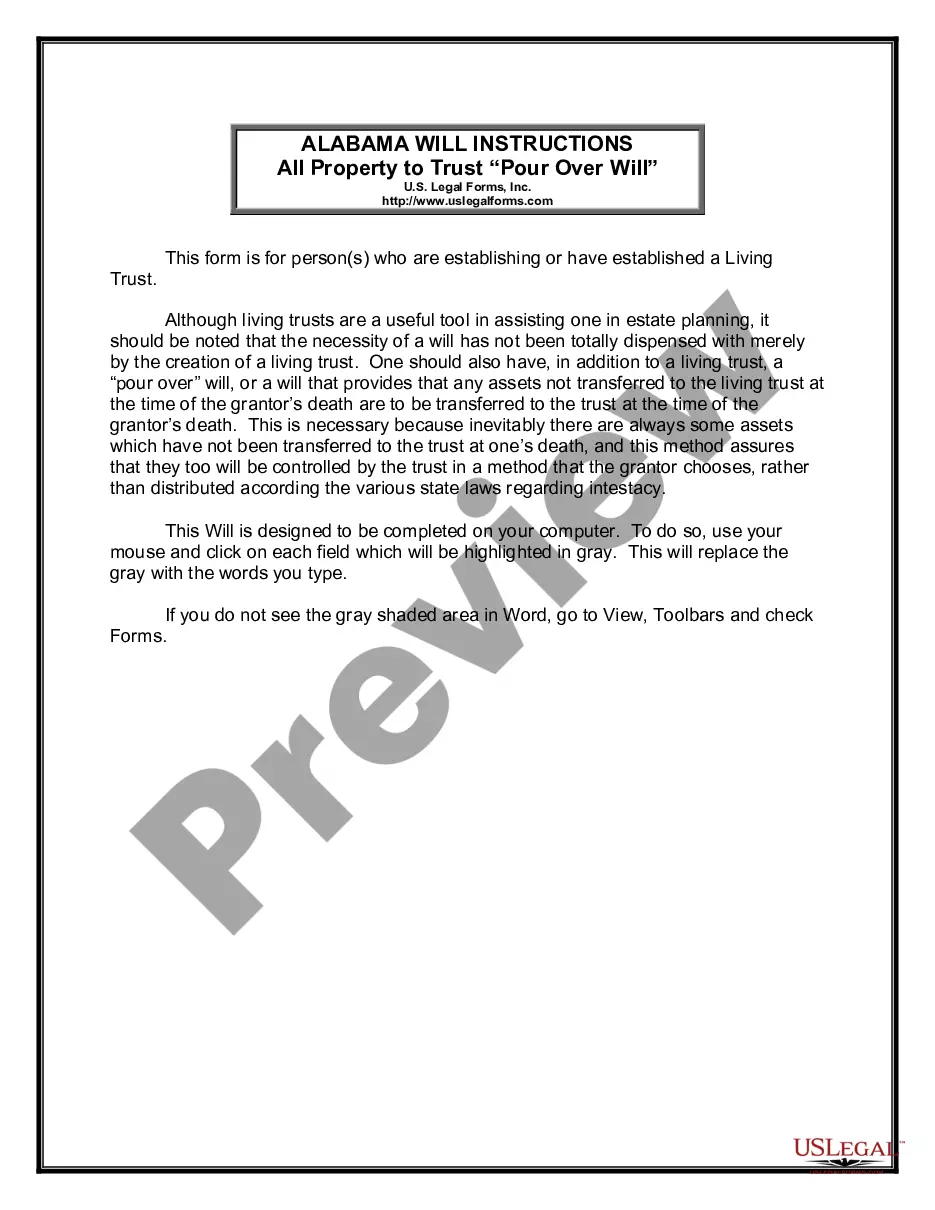

Ideal for individuals with a living trust, this will ensures any remaining assets are transferred to that trust upon death.

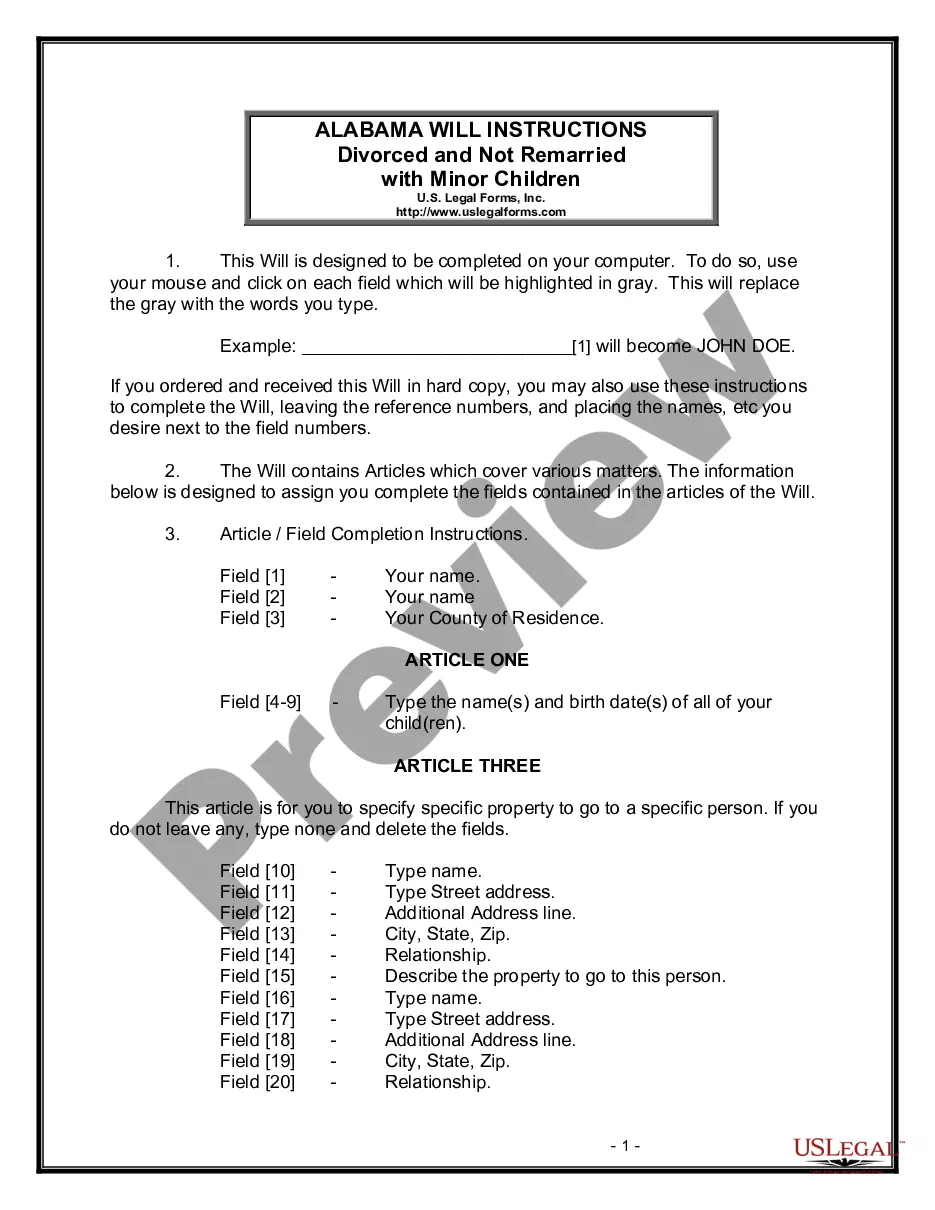

Create a legally binding will tailored for a divorced parent with minor children, specifying guardians, property distribution, and trust management.

Create a comprehensive plan for your estate and guardianship when you're a single parent with minor children.

Create a detailed plan for distributing your assets after death, ensuring your wishes are honored.

A Last Will and Testament is essential for clear asset distribution.

Witnesses are often required to validate the will.

Wills can be updated or revoked at any time during your life.

Beneficiaries do not need to be present during the will's creation.

Wills can include specific funeral and burial instructions.

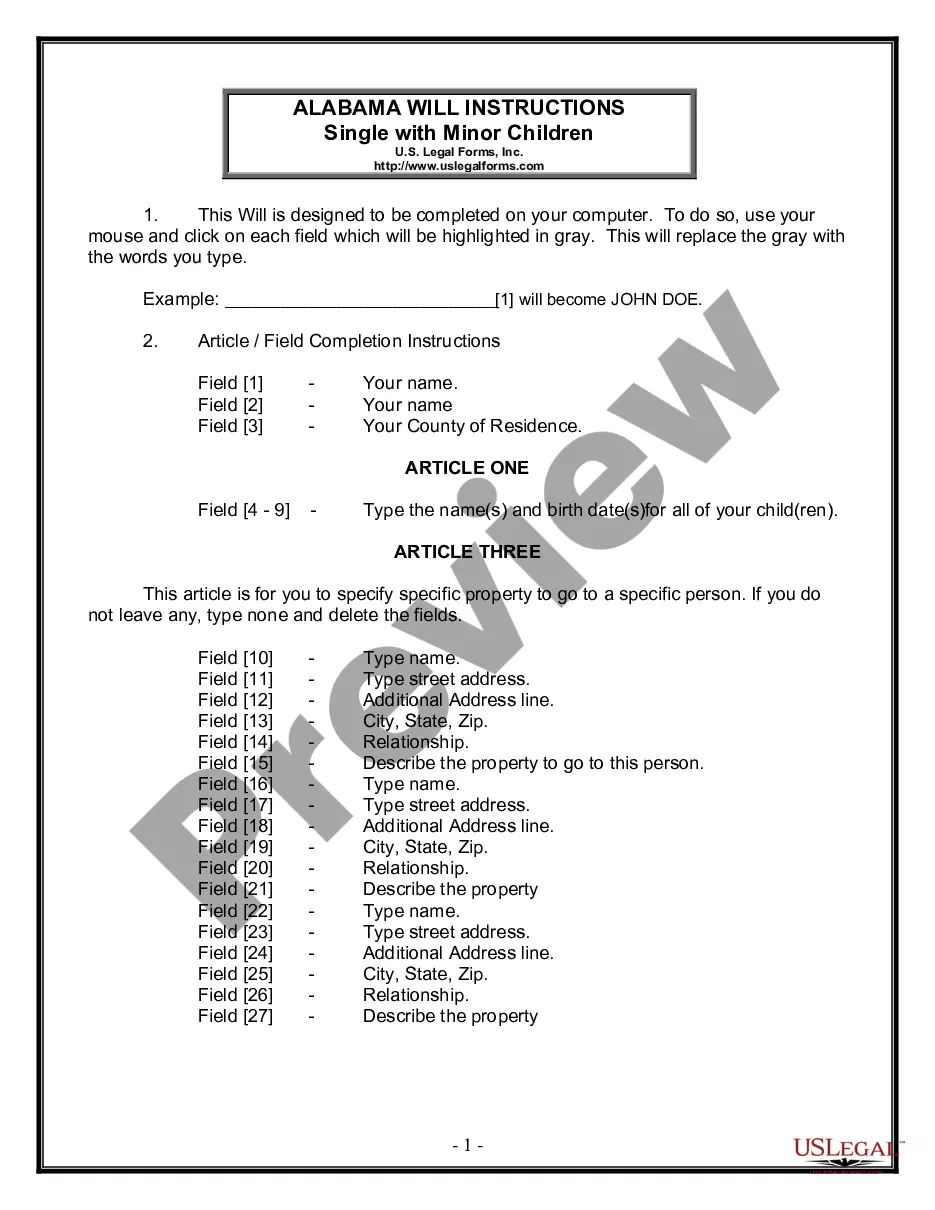

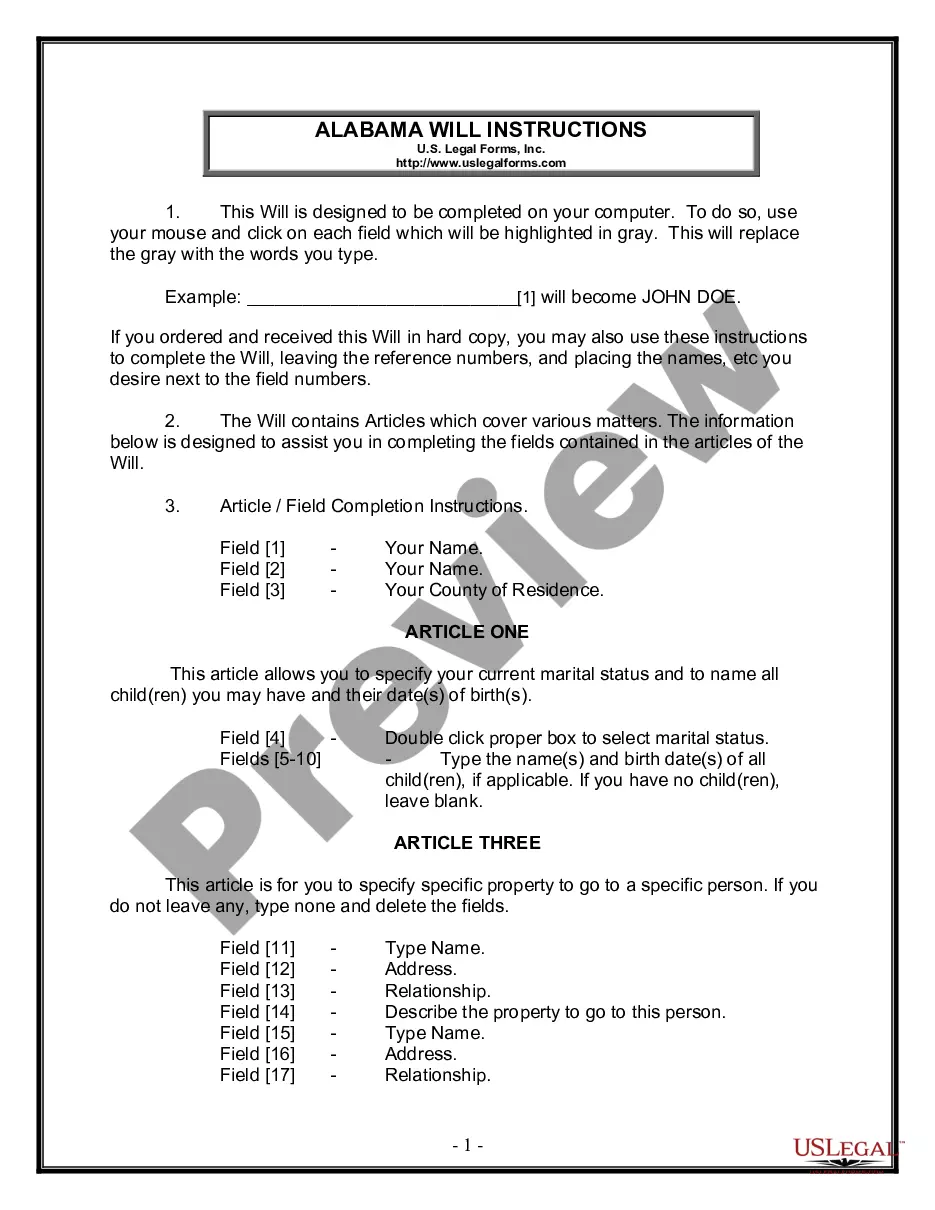

Begin quickly with these straightforward steps.

Not necessarily, but a trust can offer additional benefits like avoiding probate.

Intestate laws will determine how your assets are distributed, which may not align with your wishes.

Review your will every few years or after major life changes, such as marriage or divorce.

Beneficiary designations on accounts typically override will instructions, so keep them updated.

Yes, you can designate separate individuals for financial and healthcare decisions in your planning.