Sample Letter for Instructions to Execute Complaint to Probate Will

Understanding this form

The Sample Letter for Instructions to Execute Complaint to Probate Will is a template letter designed to guide individuals through the process of requesting the execution of a complaint for probate. This formal letter serves as a vital communication tool in estate management, ensuring that the necessary instructions are conveyed clearly to the relevant parties. Unlike other forms related to wills, this letter specifically focuses on initiating the probate process after a loved one has passed away.

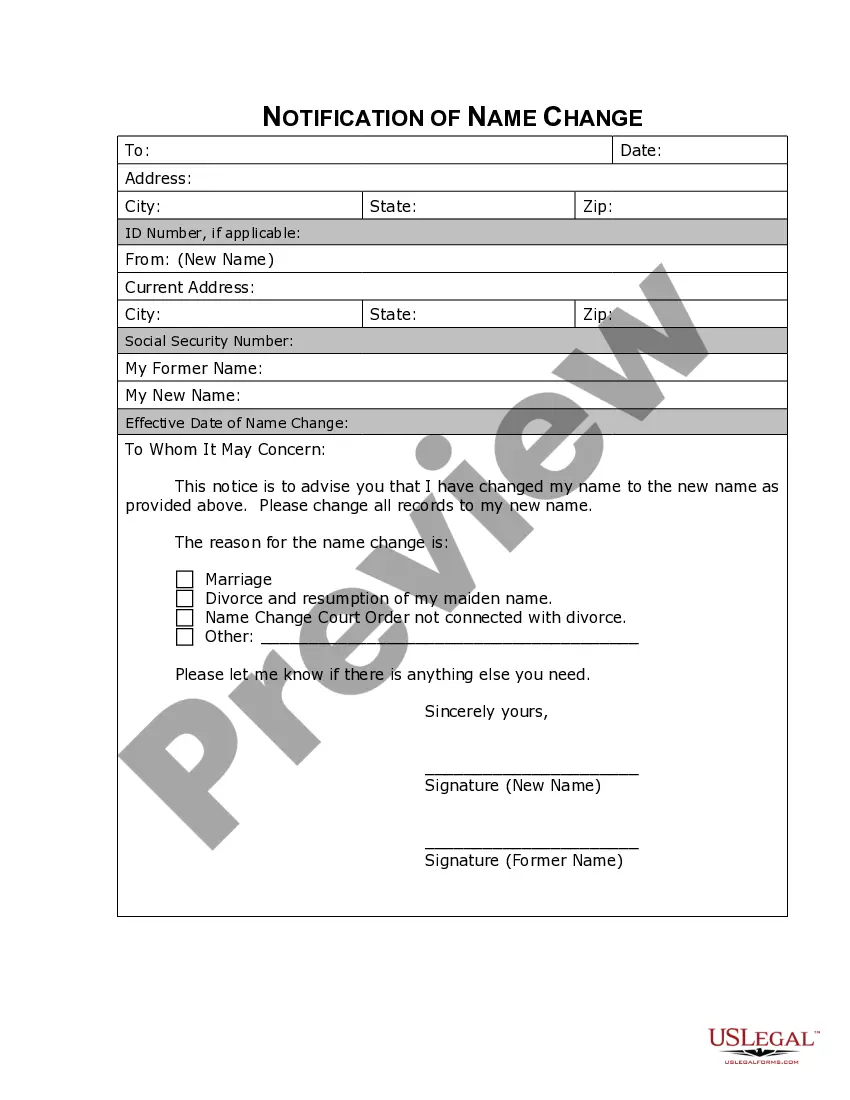

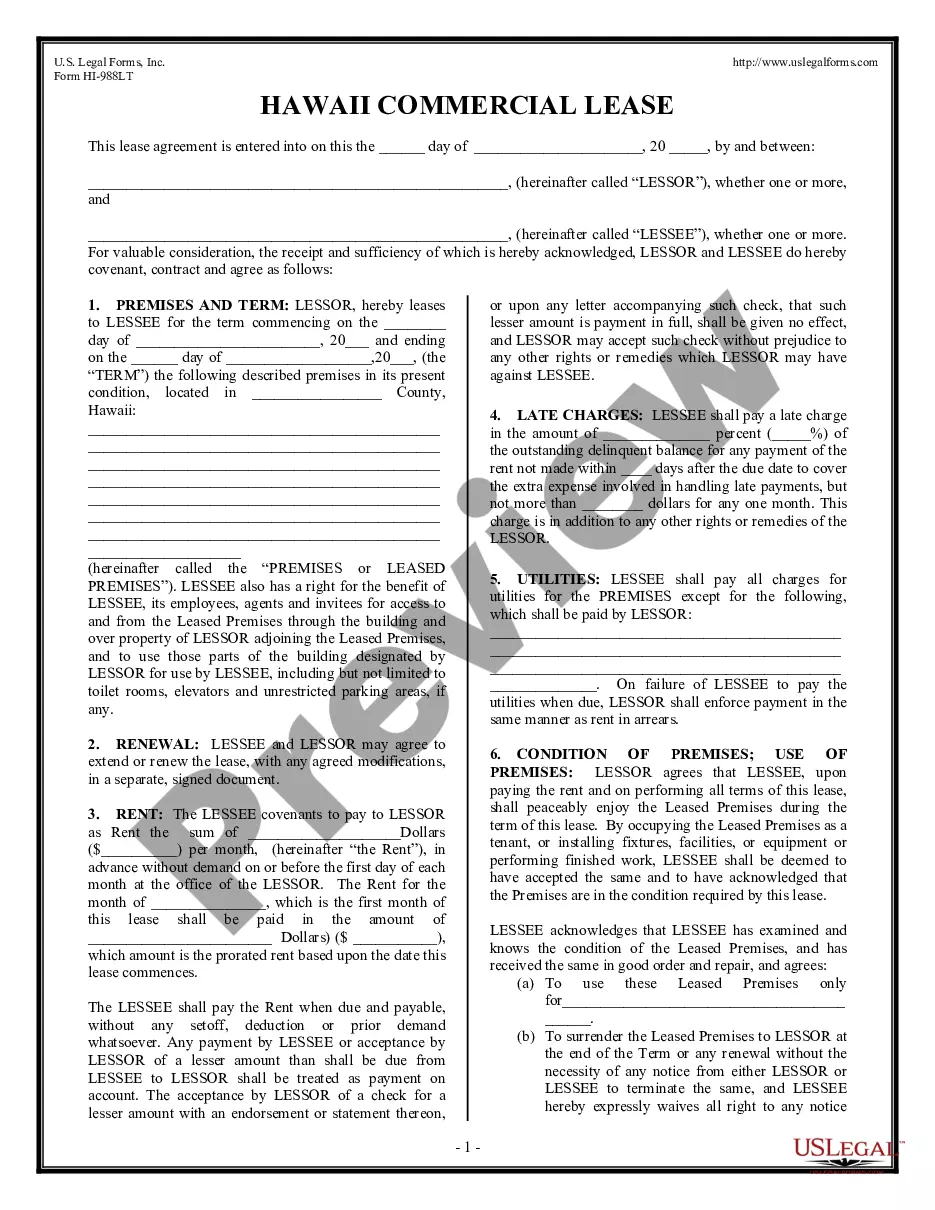

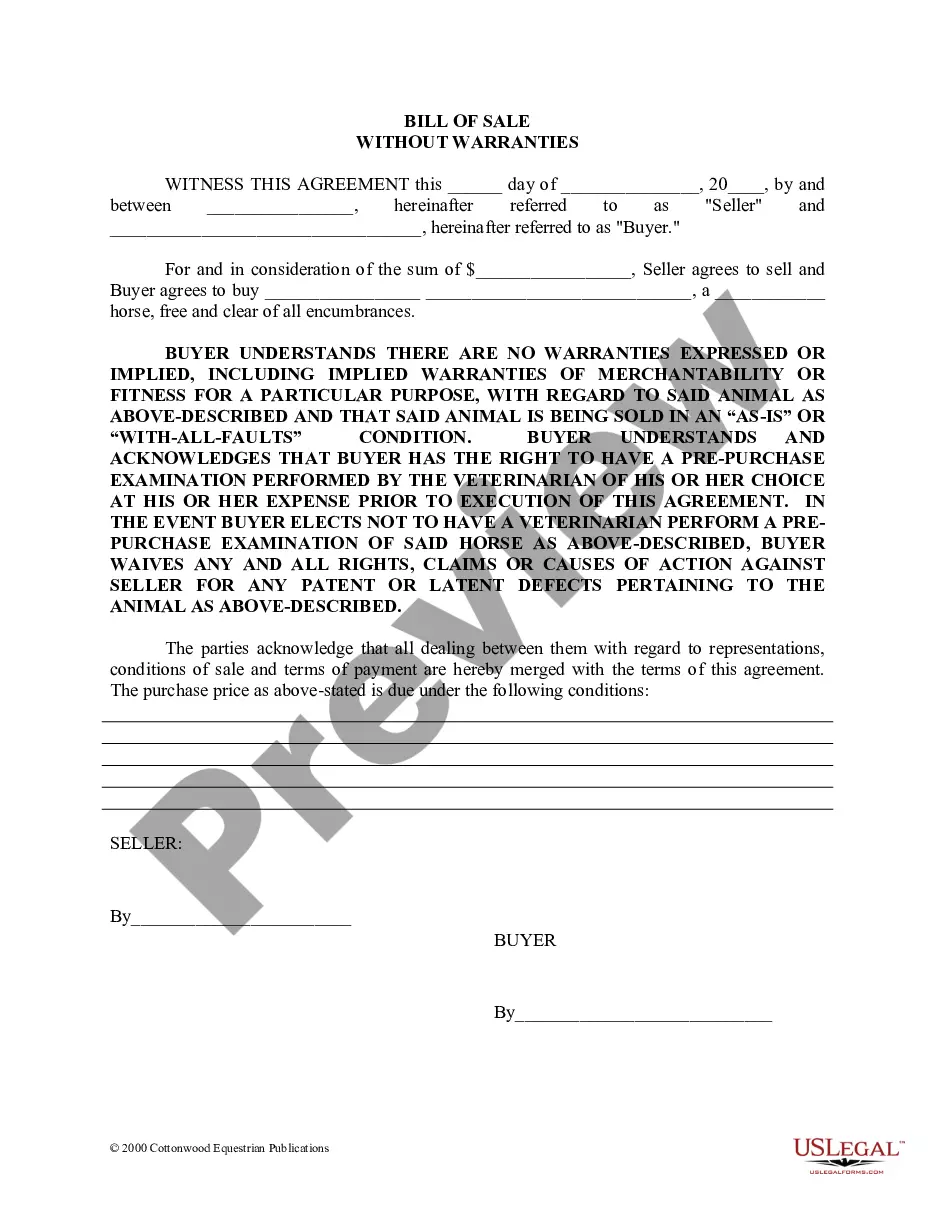

Key components of this form

- Date: Indicates when the letter is sent.

- Recipient's name and address: Details the intended recipient of the letter.

- Subject line: Clearly states the matter regarding the estate of the deceased.

- Body of the letter: Provides specific instructions or inquiries related to the probate process.

- Closing: Includes a polite sign-off and space for the sender's name.

When to use this document

This form should be used when you need to formally communicate with an attorney, executor, or court regarding the initiation of a probate complaint. It is especially useful in situations where clarity is required concerning the instructions for handling an estate after the death of an individual. Use this form to ensure that all parties are informed of the necessary steps to take in the probate process.

Who this form is for

- Executors or personal representatives of an estate.

- Beneficiaries of a will seeking clarity on the probate process.

- Family members involved in managing a deceased estate.

- Attorneys representing clients in probate matters.

Instructions for completing this form

- Enter the date at the top of the letter.

- Fill in the recipient's name and address accurately.

- Clearly state the subject line regarding the estate of the deceased.

- In the body of the letter, specify any instructions or requests.

- Sign off with your name after a courteous closing.

Notarization requirements for this form

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Mistakes to watch out for

- Not including the correct recipient's address.

- Failing to specify the subject clearly.

- Leaving out important details in the body of the letter.

- Not signing the letter before sending.

Advantages of online completion

- Convenient access to a professionally drafted template.

- Easy customization to fit specific circumstances.

- 24/7 availability to download and fill out as needed.

- Reduces errors and omissions compared to writing from scratch.

Form popularity

FAQ

How much money can you have in the bank before probate? The probate threshold will depend on the bank or financial service. Generally, probate will be needed if the size of the estate is more than £5000.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

You can step down as executor before formal court appointment without giving a reason. In most states, all you need to complete is a Renunciation of Executor form, which is a legal document that states the person named in the will as executor will not act as executor for the estate.

Procedure to get a Will executed The execution of a Will is to be done by the executor appointed for the purpose by the testator. It is nothing but the distribution of property of the deceased according his/her intent as worded in the Will. In order to start his duties as an executor of a Will, a probate is necessary.

You can fill in the probate application form 'PA1P' yourself, or call the probate and inheritance tax helpline to get help filling in the form.

File the petition to probate. Obtain the grant of probate. Have the last will and testament authenticated by the probate court. Post a probate bond. Record inventory and appraise the assets. Notify the creditors and pay any debt and taxes owed. Conduct a probate sale. Distribute and close the remaining estate.

While an executor is obligated to notify beneficiaries and then move things along at a reasonable pace, he or she isn't required to distribute inheritances at the time of notification. In fact, beneficiaries might not receive anything until several months after they've been notified of their place in the will.

Register the death. Find out if there's a will. Apply for a grant of probate and sort inheritance tax. Complete a probate application form. Complete an inheritance tax form. Send your application form. Tell all organisations and close accounts. Pay off any debts.

Do you need a solicitor Many executors and administrators act without a solicitor. However, if the estate is complicated, it is best to get legal advice. You should always get legal advice if, for example: the terms of a will are not clear.