What is Probate?

Probate is the legal process of administering a deceased person's estate. It includes validating the will, settling debts, and distributing assets to beneficiaries. Explore state-specific templates for your needs.

Probate involves managing a deceased person's estate. Attorney-drafted templates make the process fast and easy to complete.

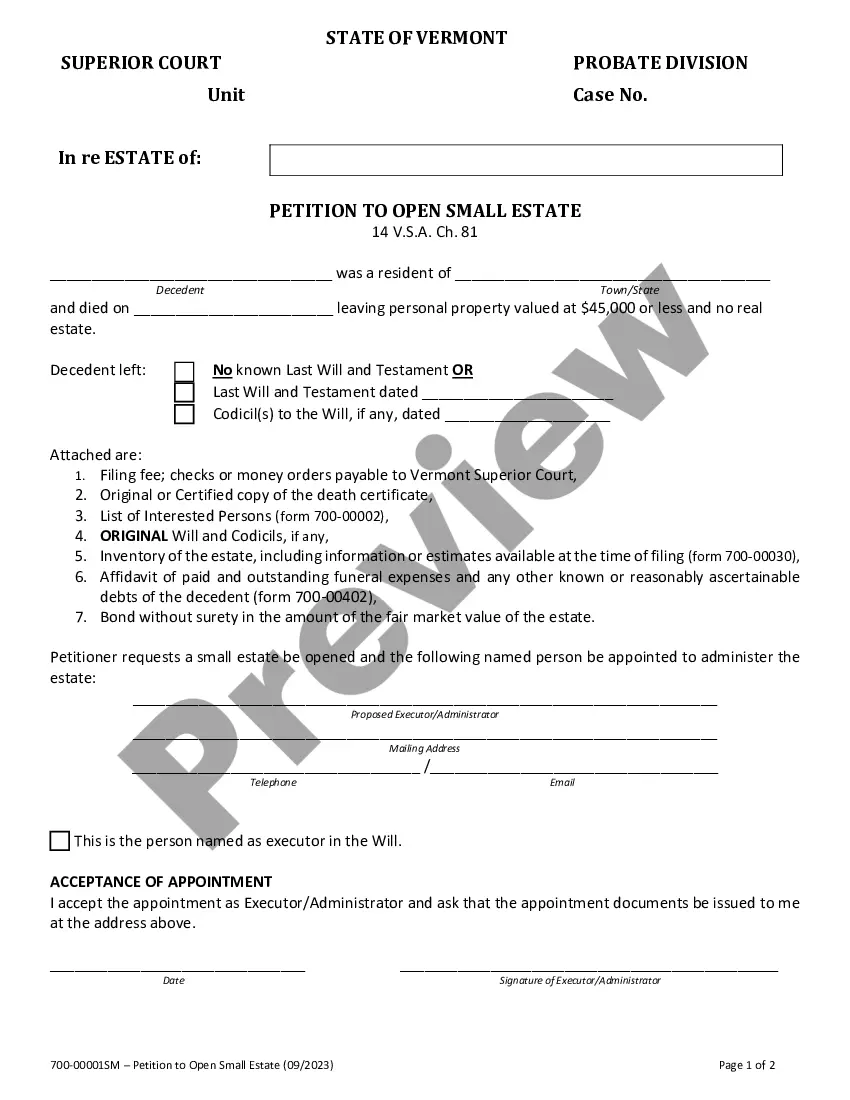

Open a small estate for personal property valued under $45,000 with streamlined court approval.

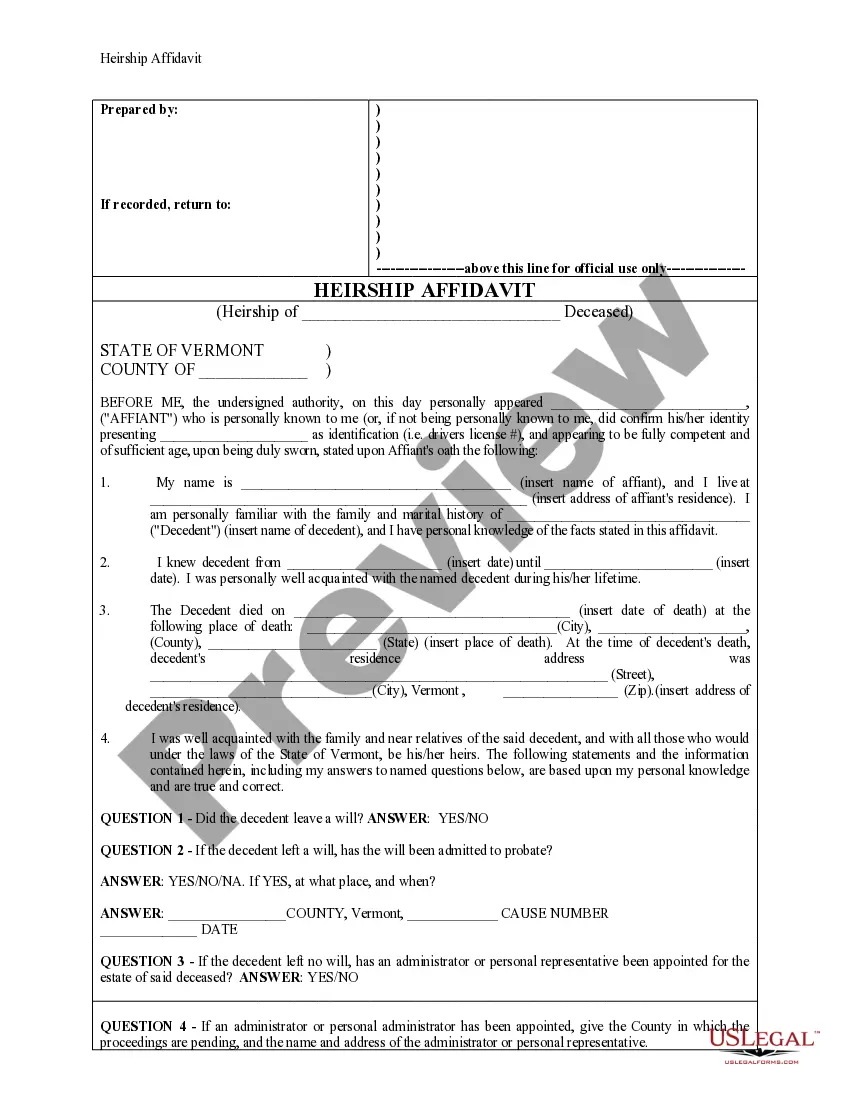

Establishes heirs for a deceased person, clarifying family relationships and estate matters.

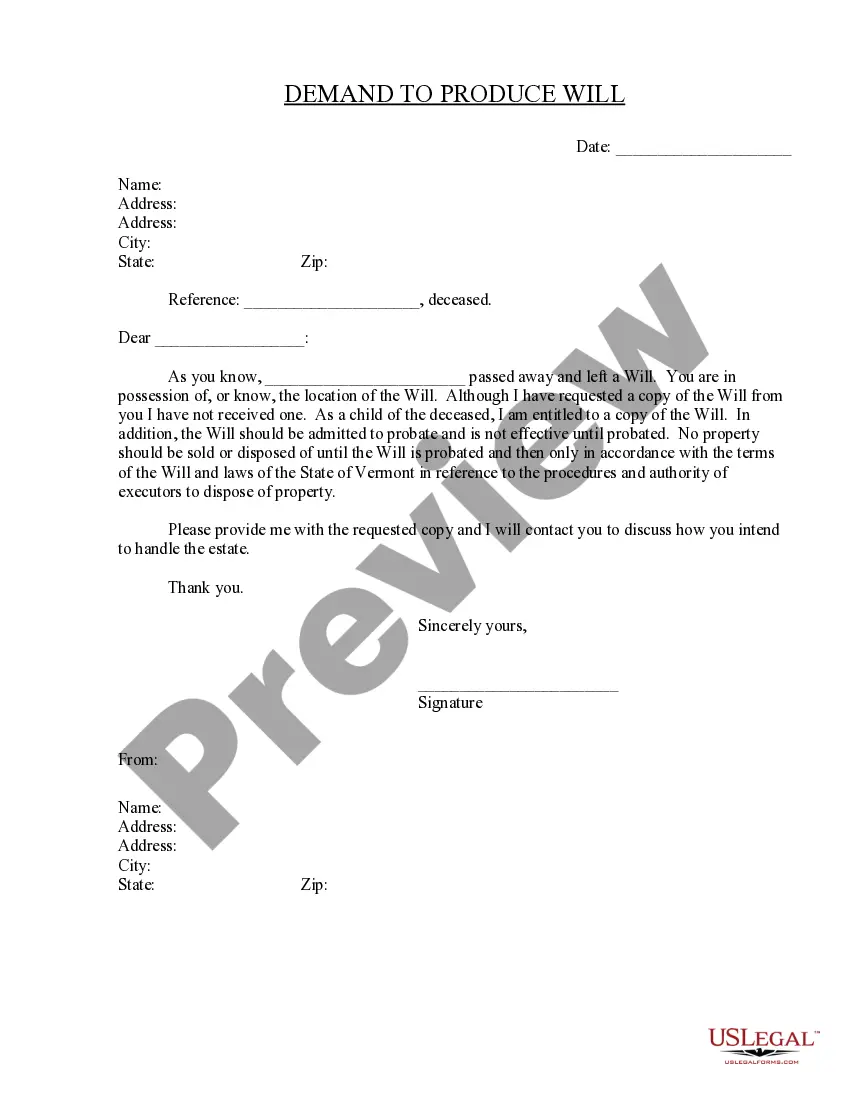

Request a copy of the deceased's Will to ensure the estate is handled according to their wishes.

Securely document your receipt and storage of firearms after a court order, ensuring compliance with state laws.

Obtain a divorce or civil union dissolution in Vermont without being a resident, if specific criteria are met.

Secure a court order to confirm your gender reassignment and update your birth certificate.

Determine fines and surcharges for specific offenses with this organized schedule, simplifying legal financial obligations.

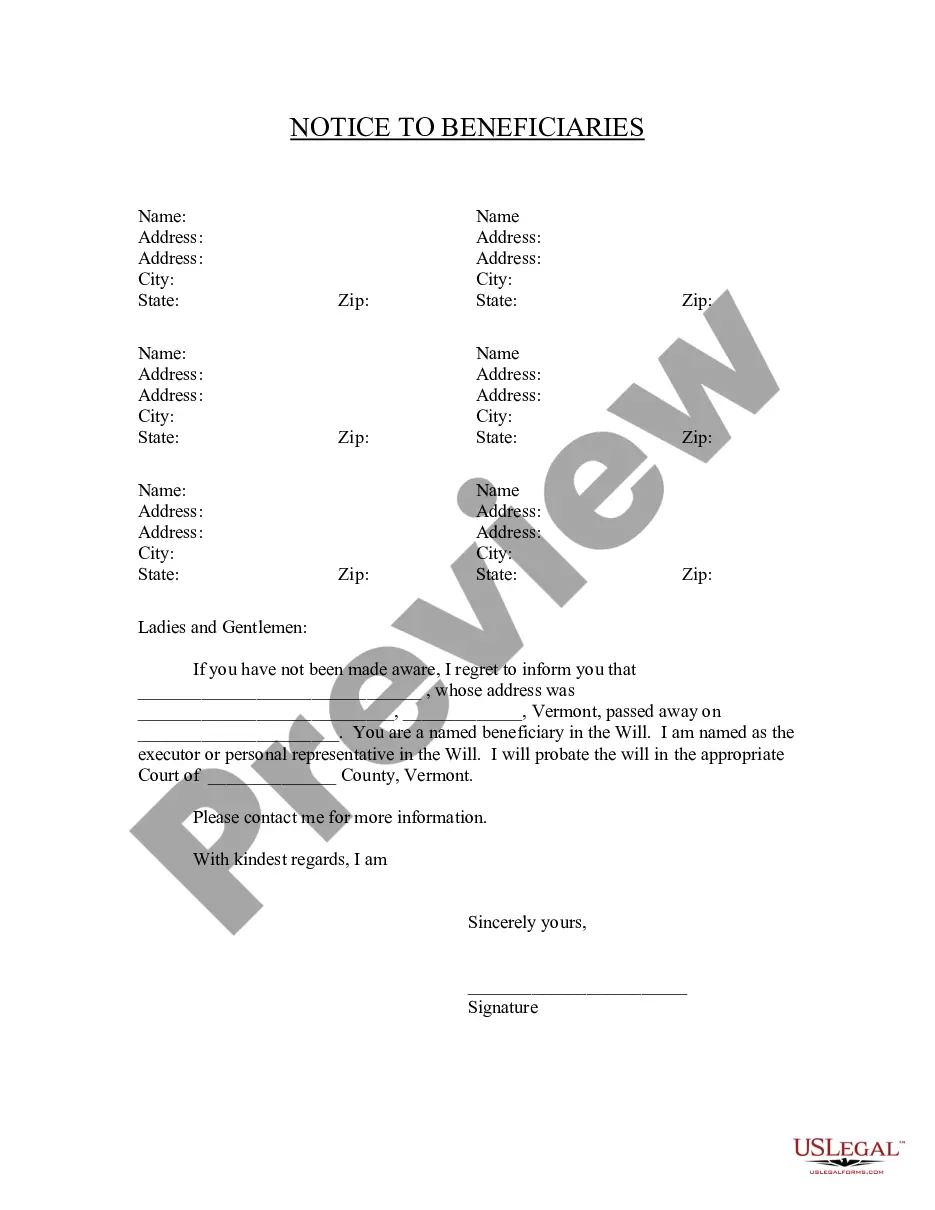

Notify beneficiaries of their status in a will, essential for ensuring they receive their inheritance.

Indicate whether to pursue or withdraw a complaint related to abuse, neglect, or exploitation after a denied request for emergency relief.

Navigate the complexities of CHINS cases with expert guidance on court processes and legal representation.

Probate is necessary for settling a deceased person's estate.

Not all assets require probate, especially those with designated beneficiaries.

The process can take several months to complete.

Wills must be filed with the probate court to be valid.

Creditors may claim against the estate during probate.

Probate laws can vary significantly by state.

Beneficiaries should be informed of their rights during the process.

Begin quickly with these simple steps.

A trust is not necessary if a will sufficiently meets your needs for asset distribution.

If you do nothing, your estate may go through probate under state laws without your wishes considered.

It's wise to update your estate plan after major life events, such as marriage or the birth of a child.

Beneficiary designations typically override wills, so they should align with your overall estate plan.

Yes, you can designate separate agents for financial and health care decisions in your estate plan.