What is Probate?

Probate is the legal process for settling a deceased person's estate. It includes validating wills, appointing executors, and distributing assets. Explore our North Dakota-specific templates to simplify your probate needs.

Probate involves managing a deceased person's estate. Our attorney-drafted templates are quick and straightforward.

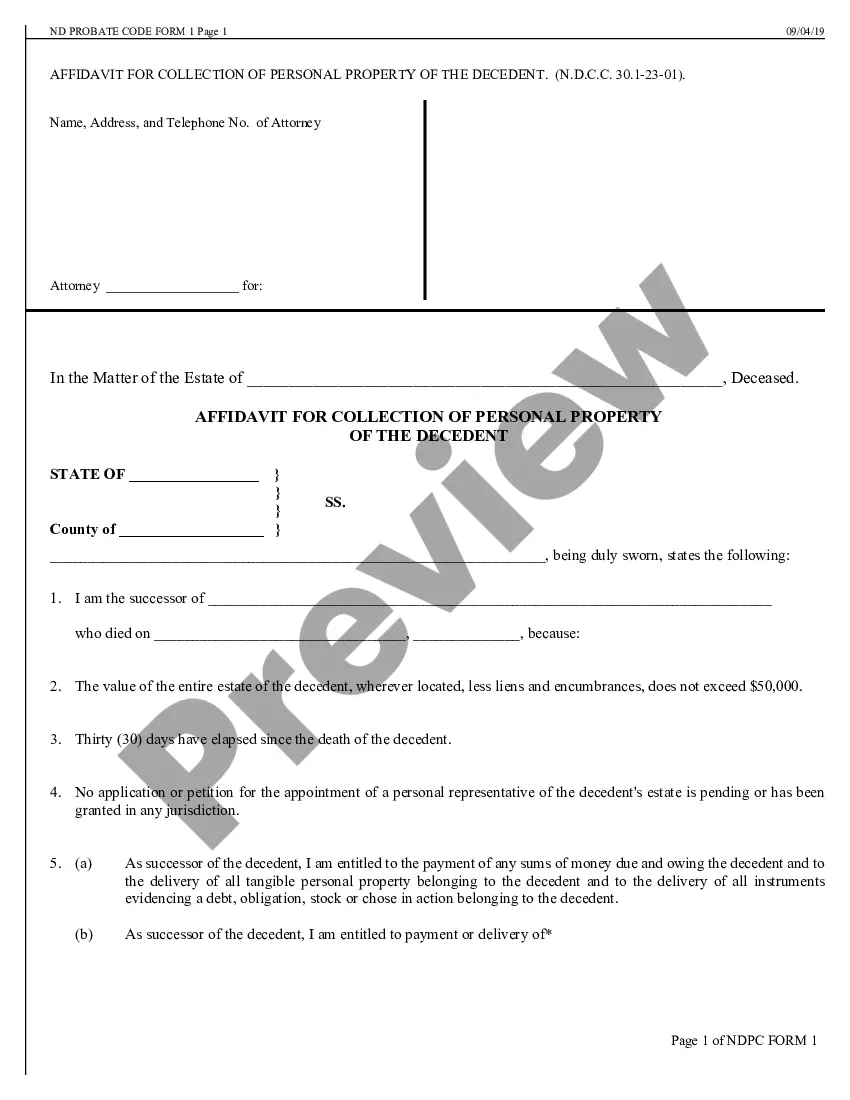

Use this affidavit to claim a deceased person's property without going through probate for estates valued under $100,000.

Manage and distribute small estates without formal court proceedings using this streamlined package.

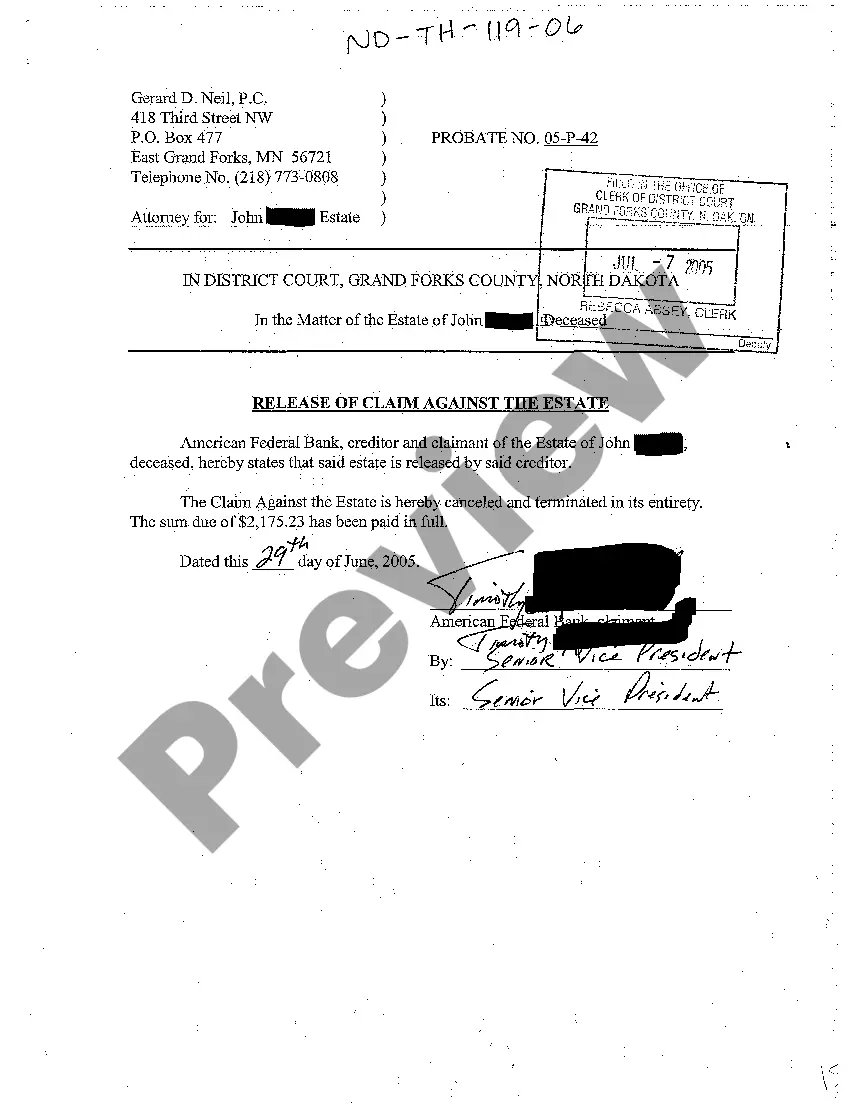

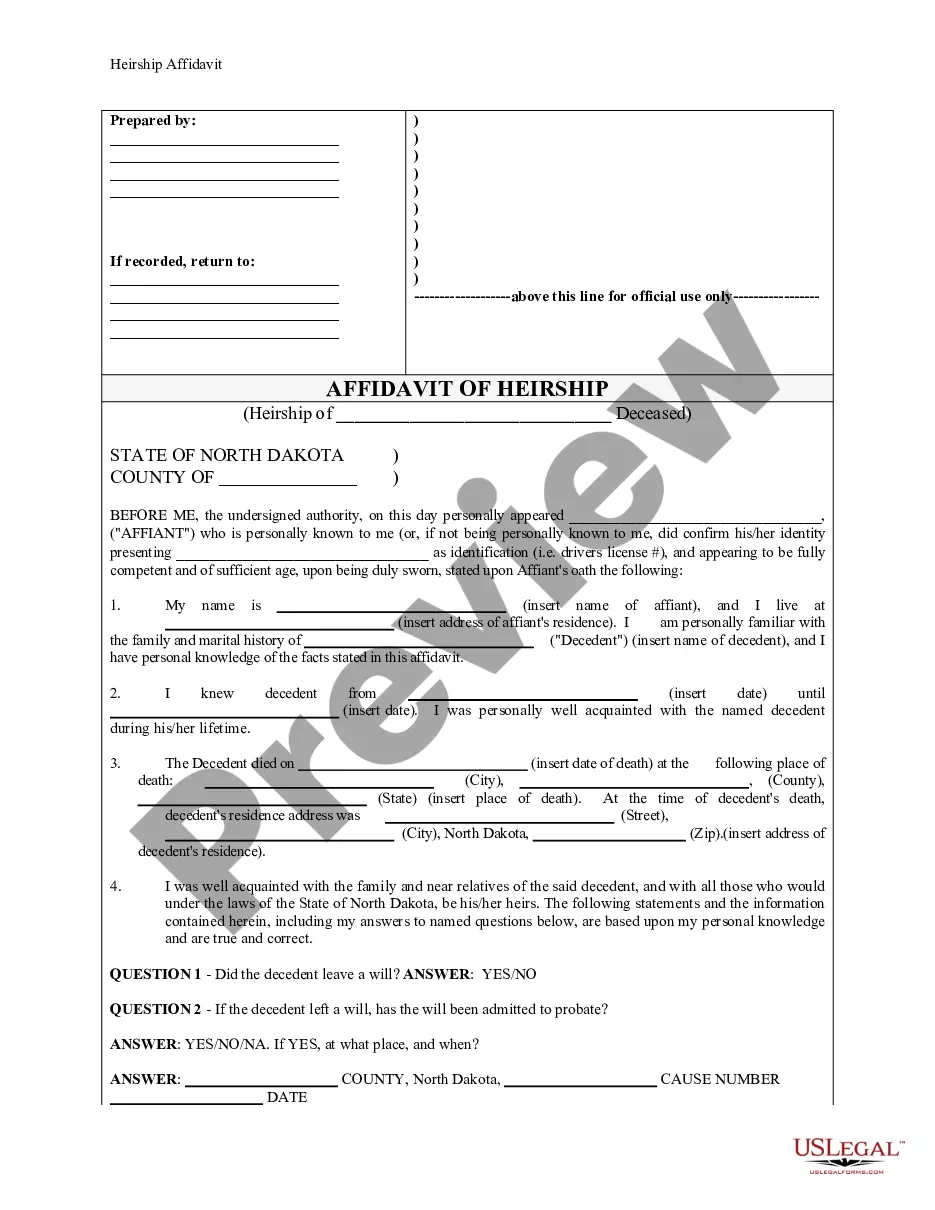

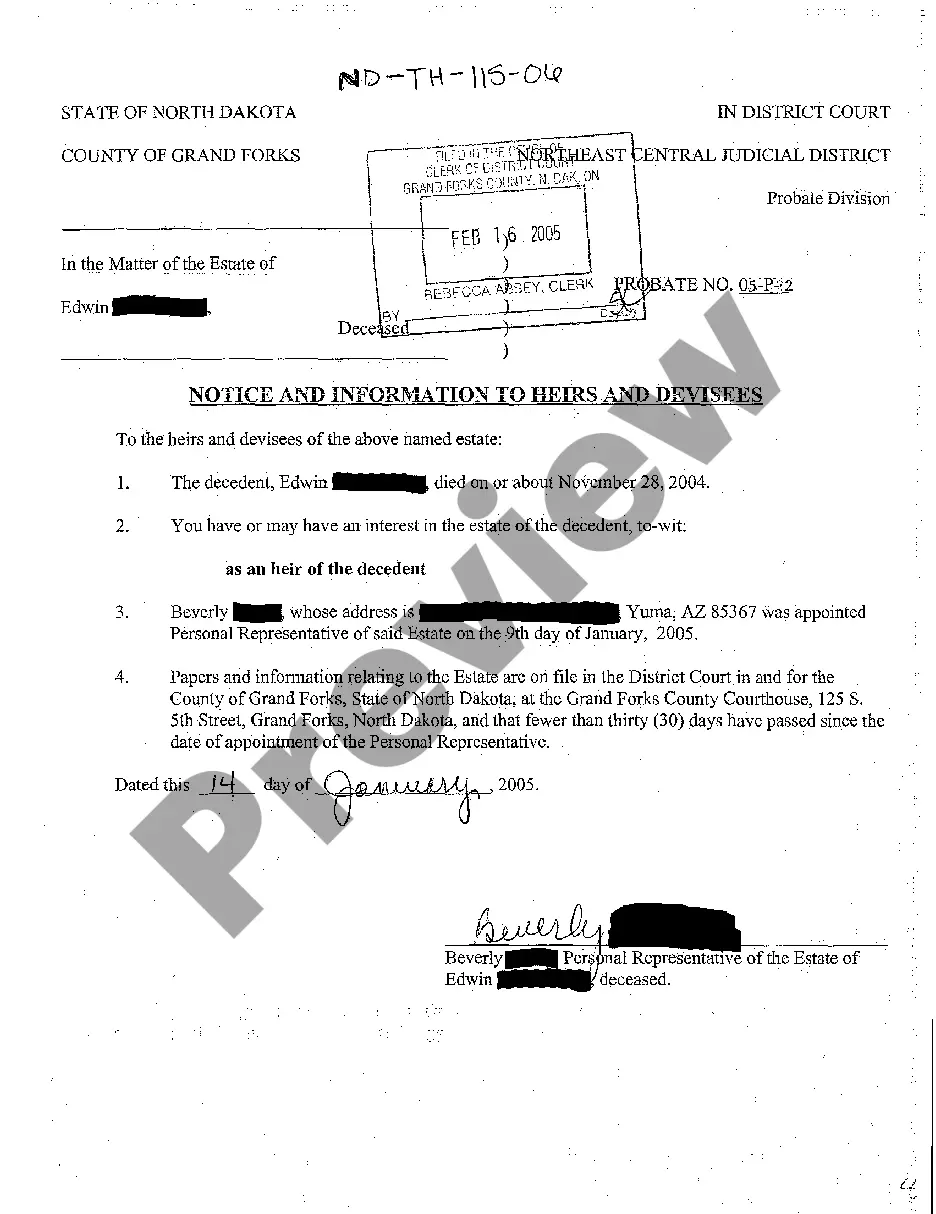

A critical document for establishing the legal heirs of a deceased person, often used in probate situations.

Request a copy of the deceased's will from the executor or person who has it to ensure your inheritance rights.

Notify named beneficiaries about their inclusion in a deceased person's will and provide essential contact information for further details.

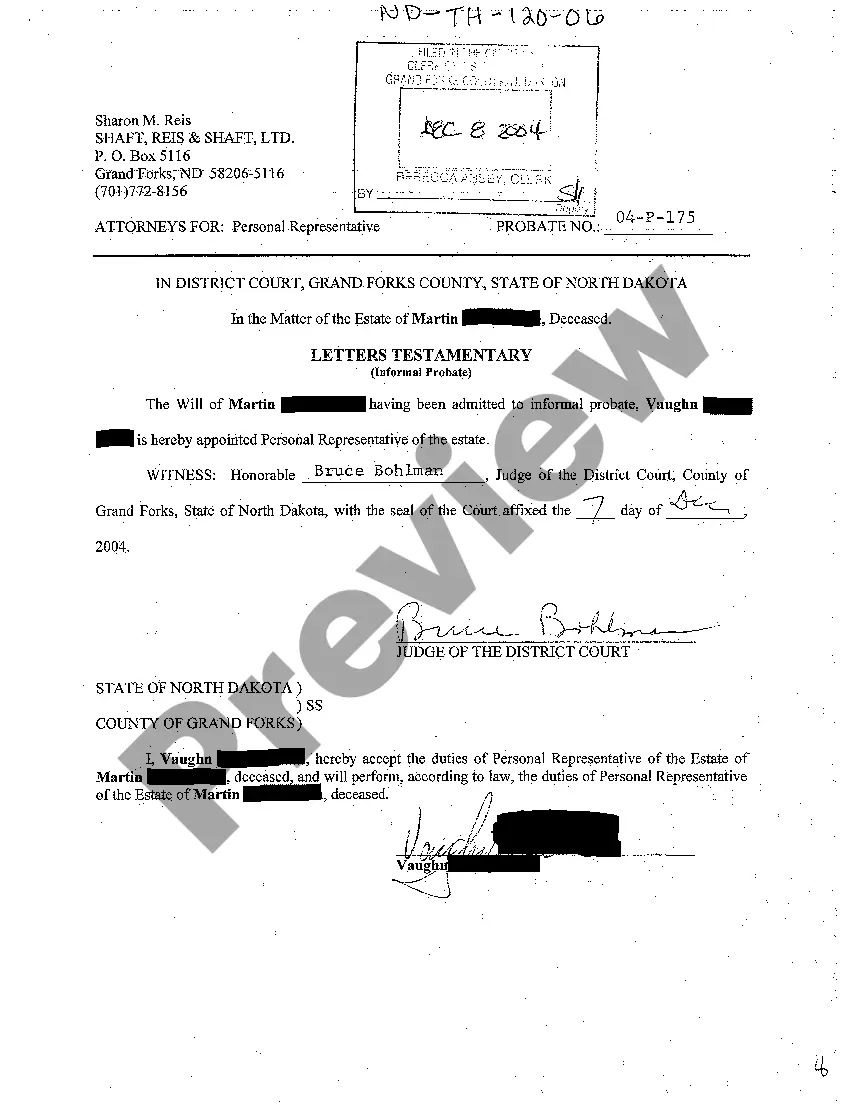

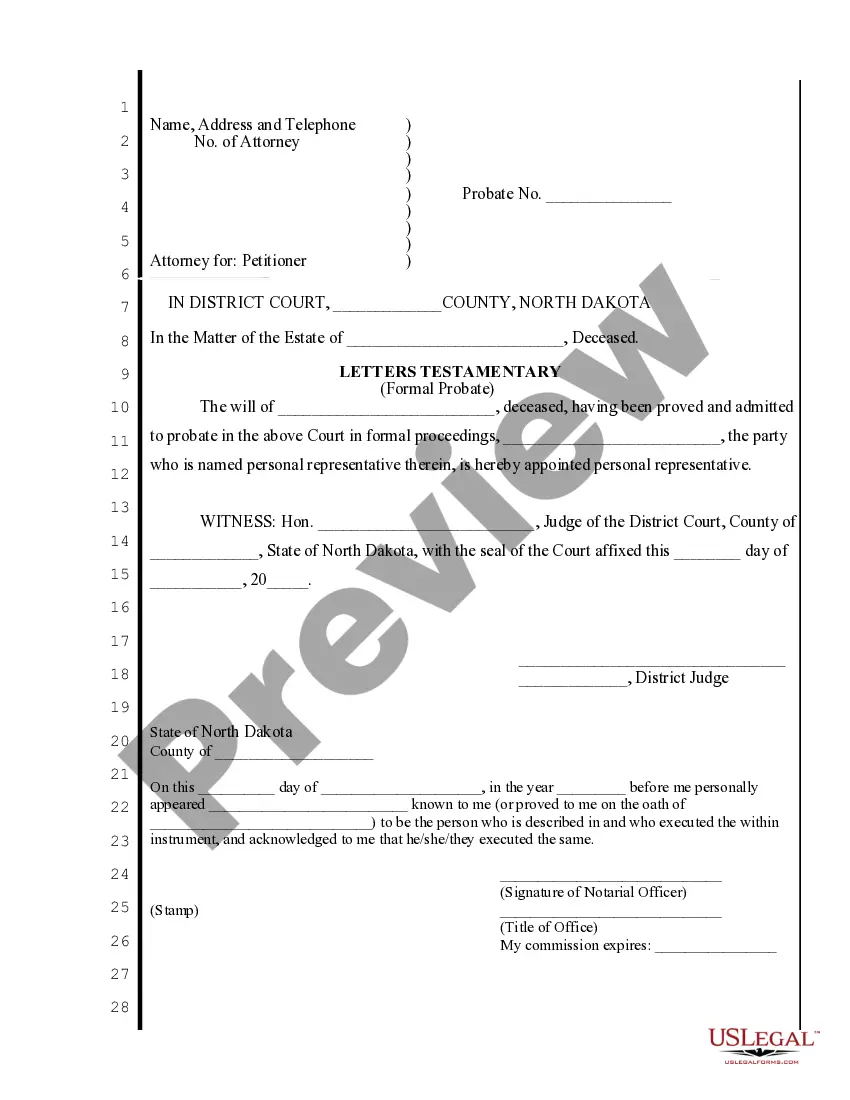

Obtain official recognition as the personal representative of an estate after a will is validated in formal probate proceedings.

Probate is necessary to settle most estates after death.

Wills must go through probate for validation and enforcement.

Intestate estates are managed by court-appointed administrators.

Probate can take several months to complete.

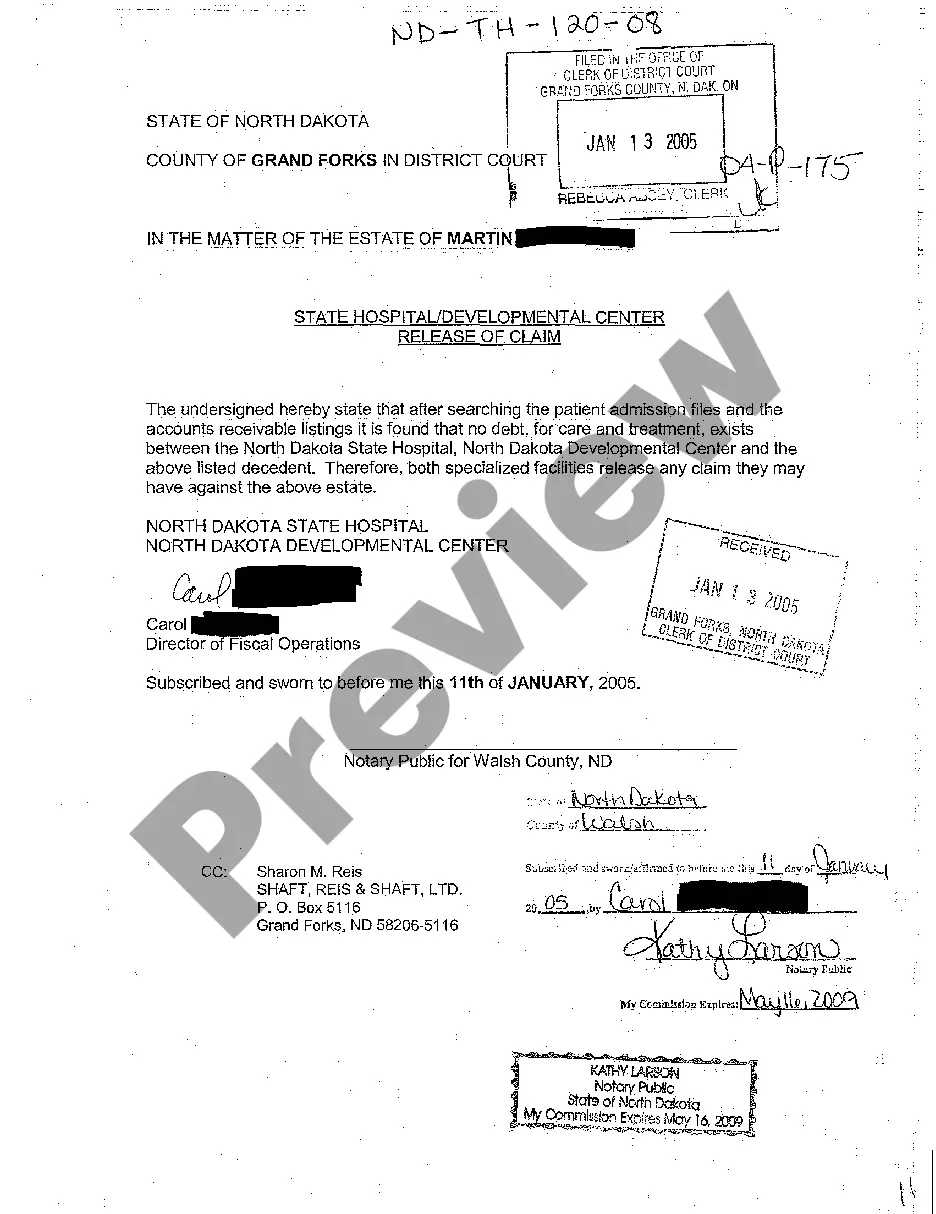

Many documents in North Dakota require notarization or witnesses.

Begin easily with these steps.

A trust can avoid probate and provide additional control over asset distribution.

If you do nothing, your estate may go through probate, potentially leading to delays and costs.

Review your estate plan regularly, especially after major life changes.

Beneficiary designations can override your will, so ensure they align with your overall plan.

Yes, you can appoint separate agents for financial and healthcare decisions.