What is Probate?

Probate is the legal process of settling an estate after someone passes away. It involves validating wills and distributing assets. Explore our state-specific templates for your needs.

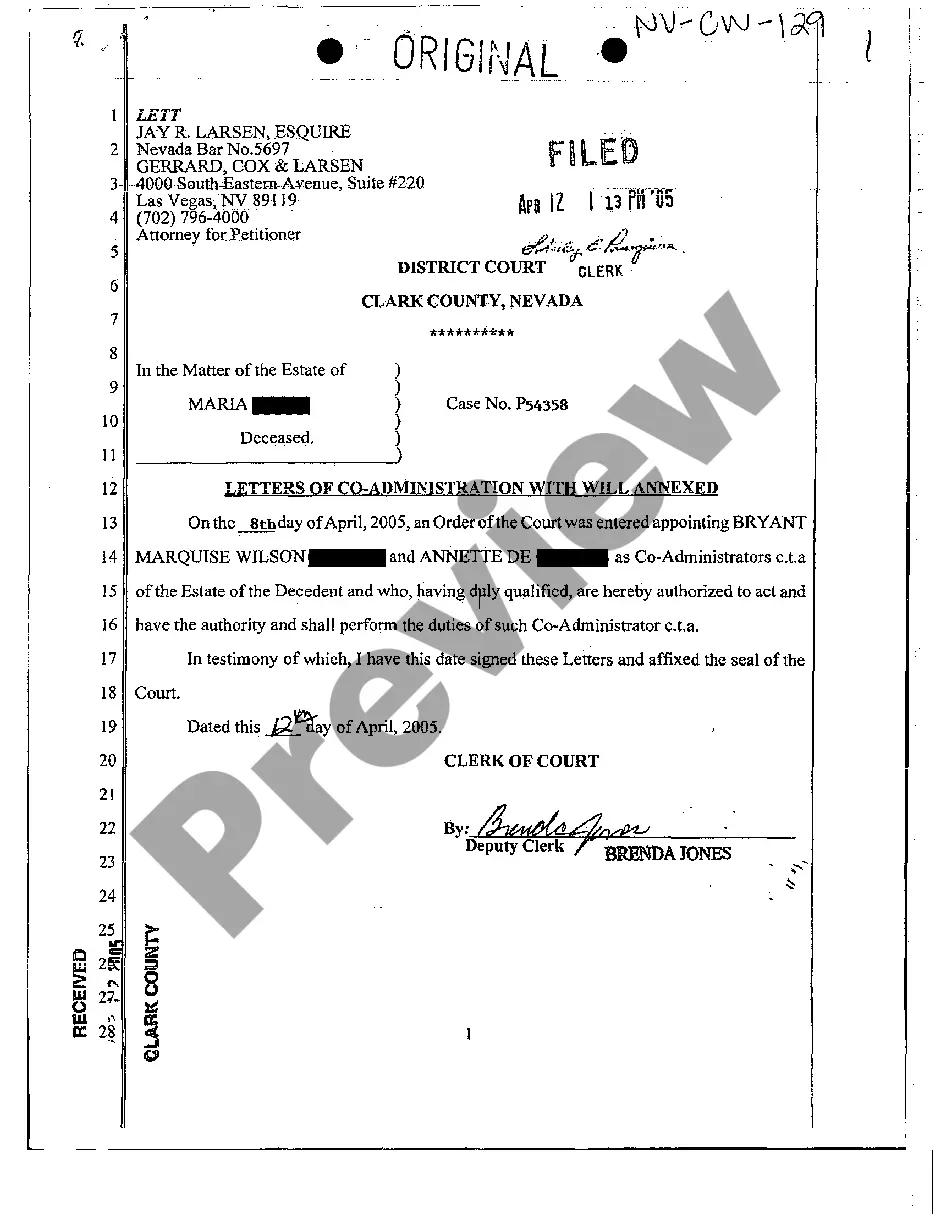

Probate involves managing a deceased person's estate. Our attorney-drafted templates are quick and easy to use.

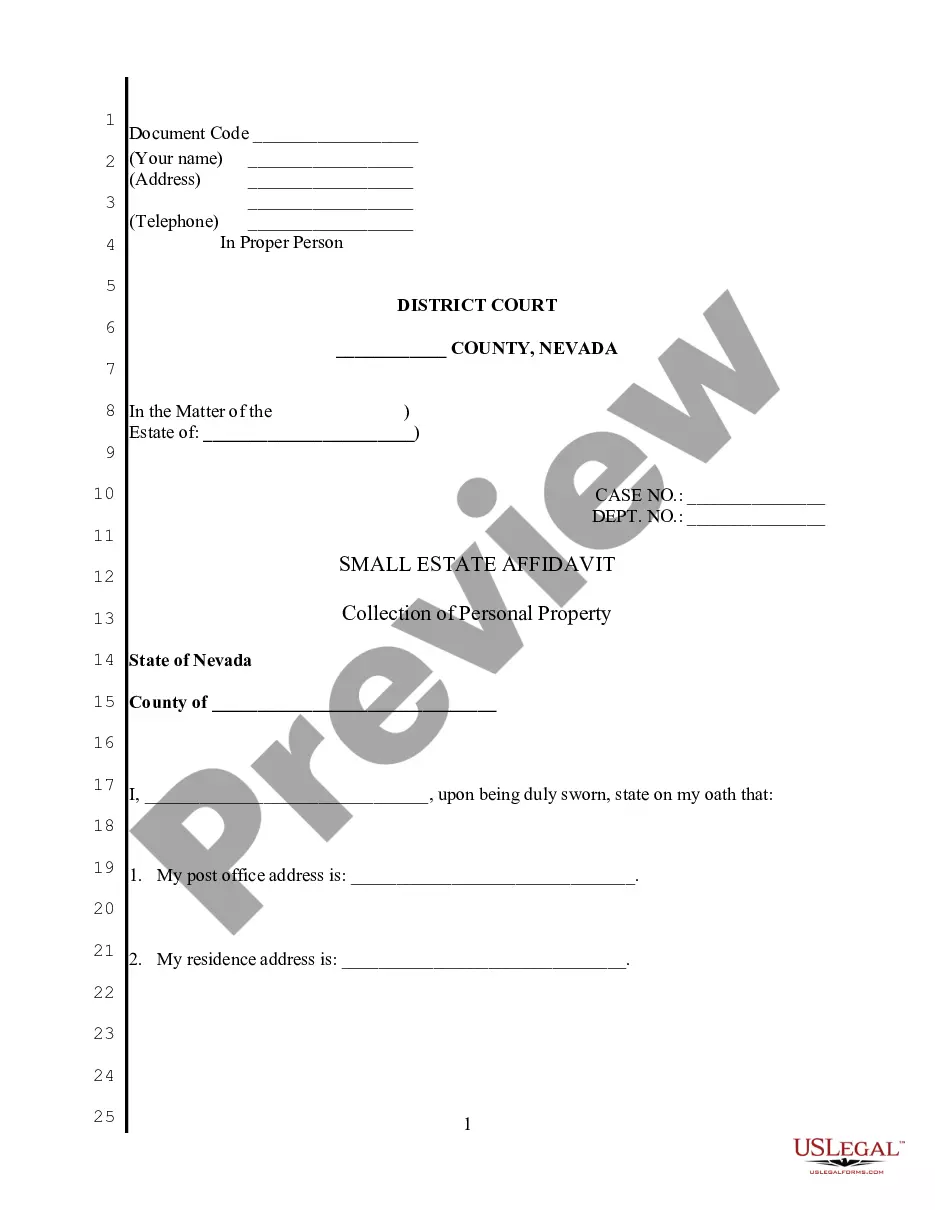

Use this affidavit to streamline the collection of personal property from a deceased person's estate without complicated probate processes.

Use this package for simplified estate administration for estates valued up to $300,000, streamlining the legal process for quick resolutions.

Ideal for settling small estates valued under $100,000, this package simplifies the probate process for users.

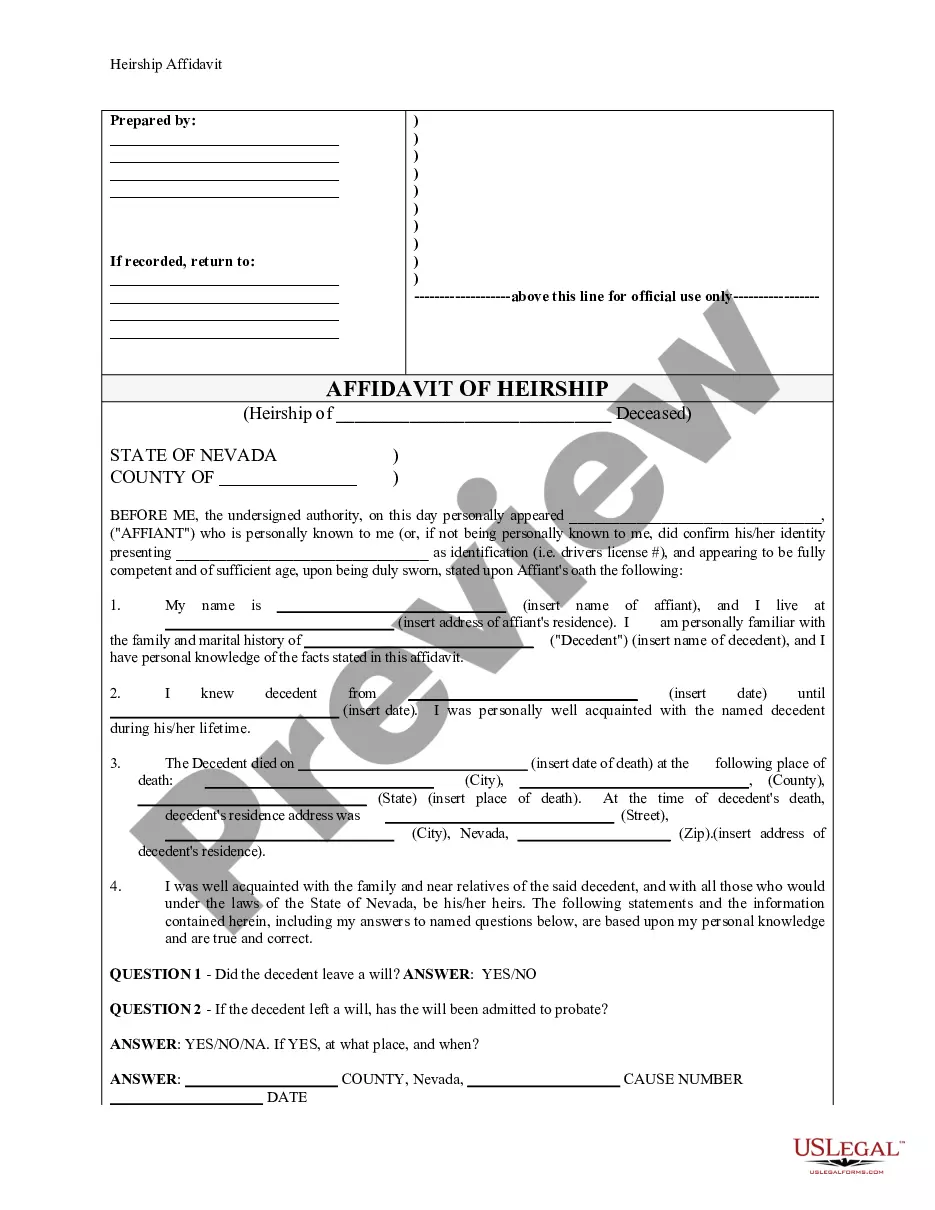

Clarifies the heirs of a deceased person, helping to establish rightful ownership of their estate.

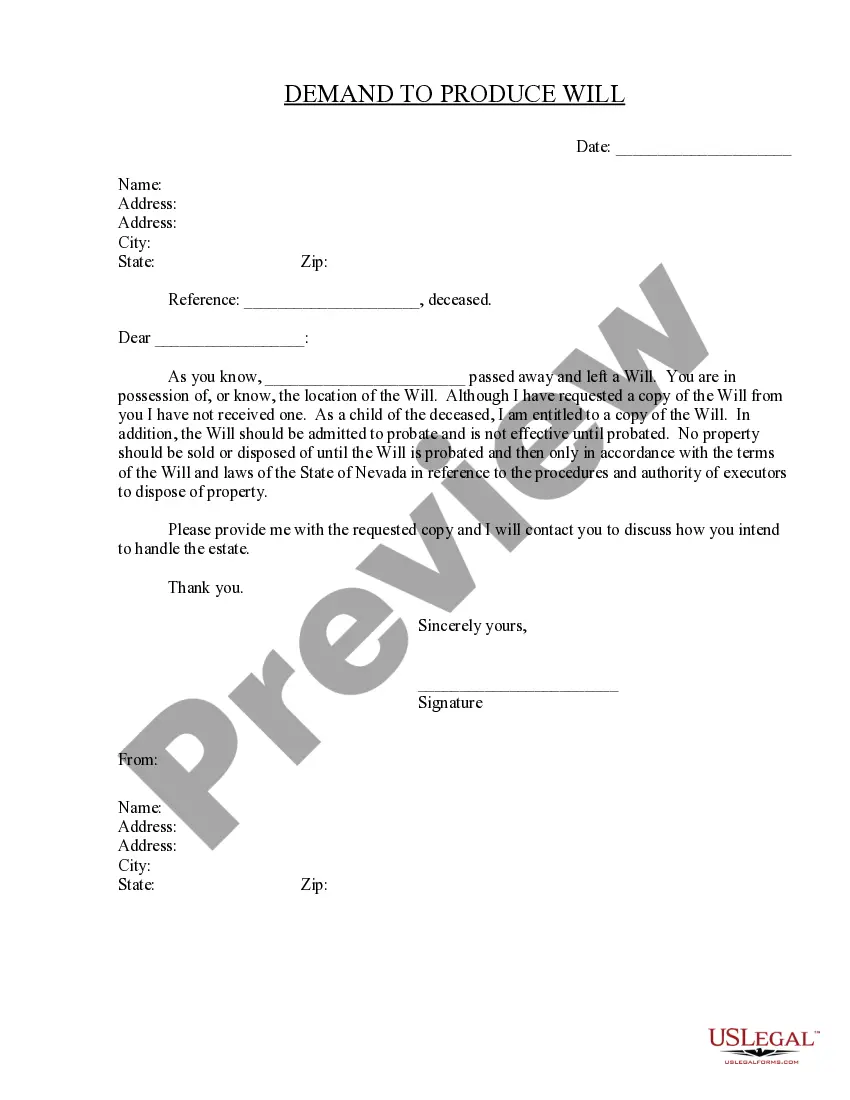

Request a copy of a deceased person's will when you're an heir and haven't received it yet.

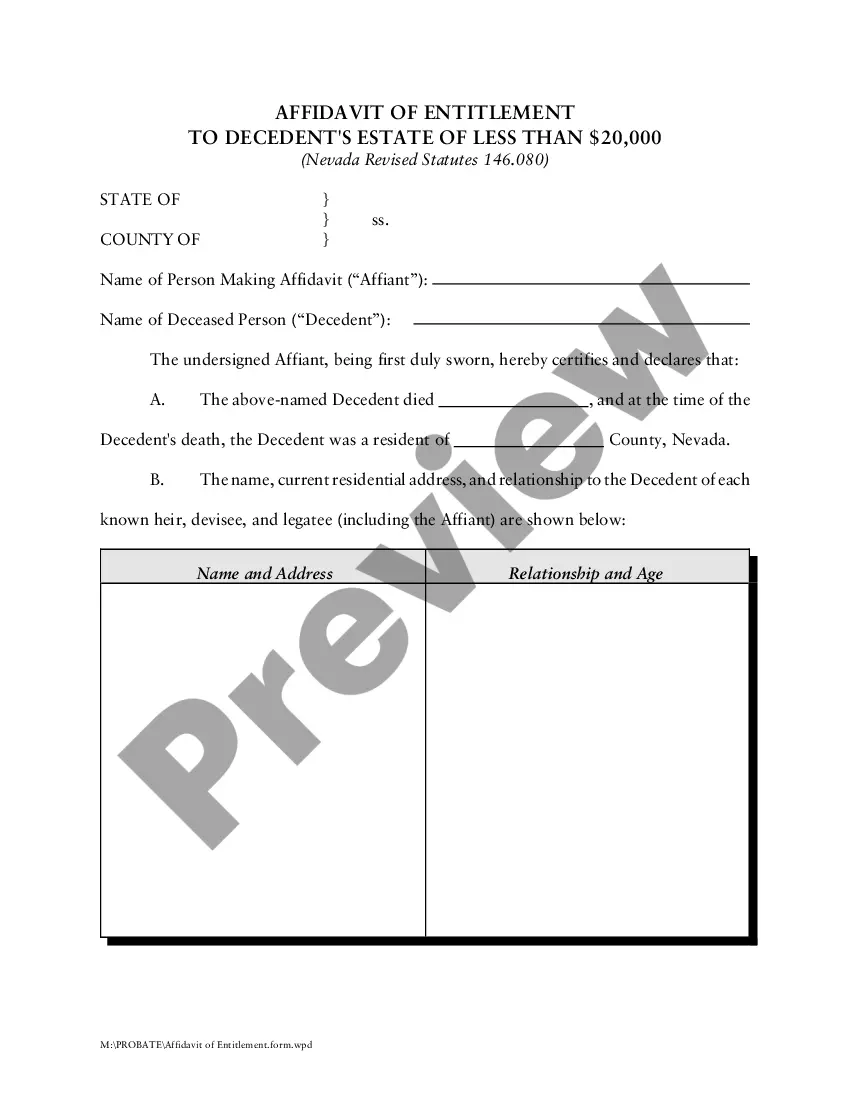

Use this affidavit to claim personal property from a deceased person's estate valued at less than $20,000, without needing a formal probate process.

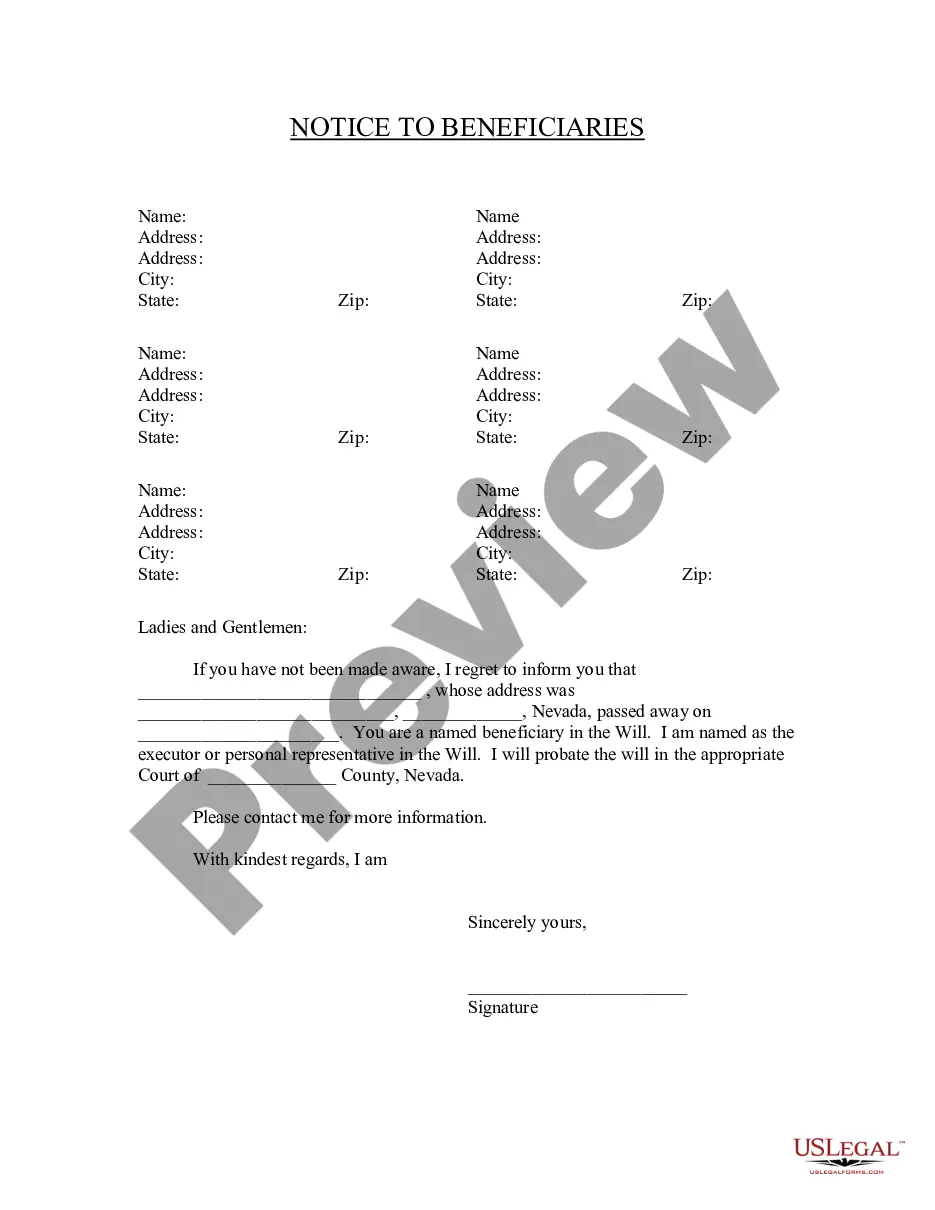

Notify identified beneficiaries about their status in a will after someone's passing to ensure they receive pertinent information.

Probate is necessary for estate settlement in most cases.

Not all assets require probate to transfer ownership.

Wills must be filed with the court for validation.

Heirs may contest a will during the probate process.

Probate can take several months to complete.

An executor manages the estate according to the will.

Court oversight ensures fair distribution of assets.

Begin your probate process in just a few minutes with these simple steps.

A trust can provide additional benefits, like avoiding probate for certain assets.

If no action is taken, the estate will go through probate according to state laws.

Review your estate plan periodically or after major life changes.

Beneficiary designations can override will provisions for certain assets.

Yes, you can appoint separate individuals for financial and medical decisions.