What is Probate?

Probate refers to the legal process of settling a deceased person's estate. It involves distributing assets and paying debts. Explore our templates specific to Missouri for your needs.

Probate involves managing a deceased person's estate. Our attorney-drafted templates are quick and easy to complete.

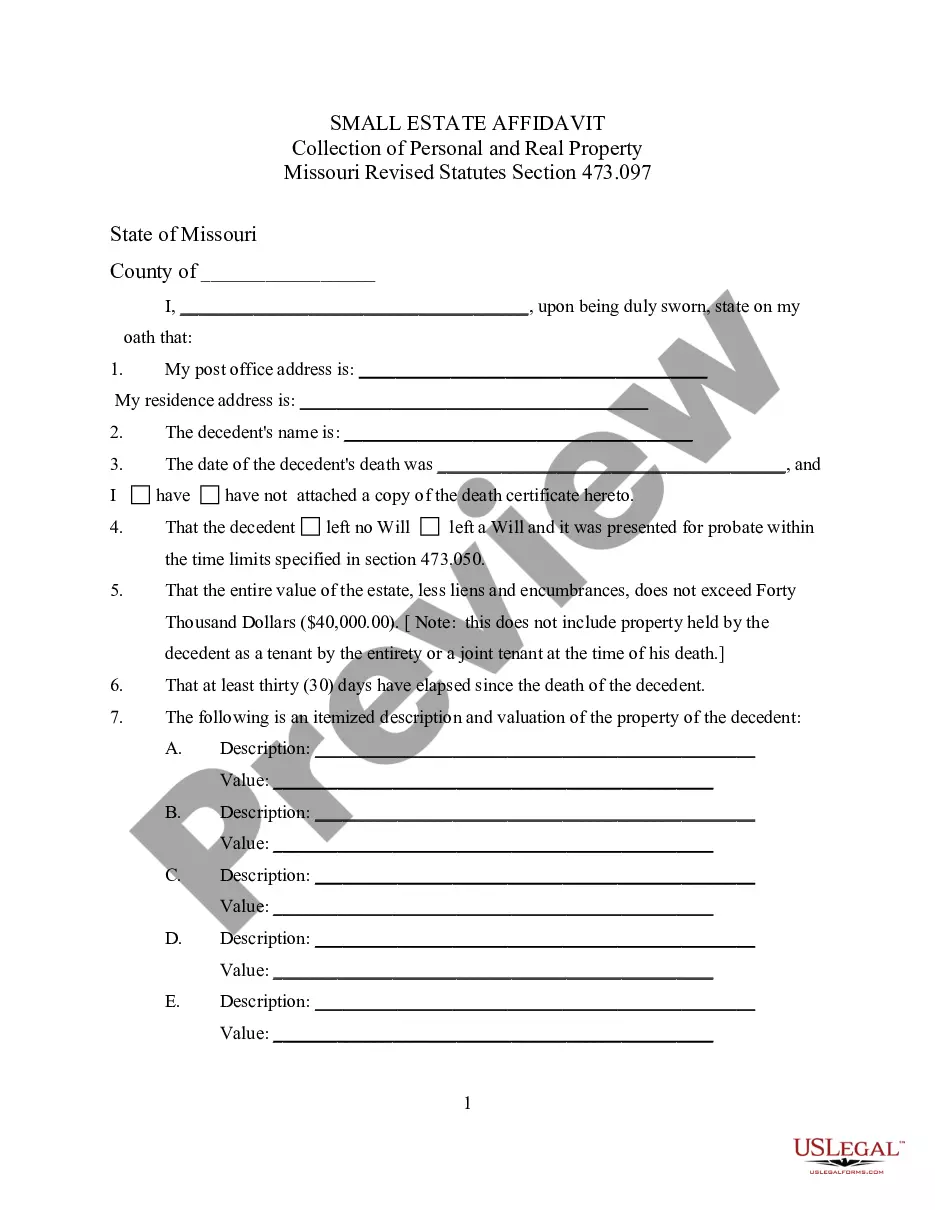

Use this document to efficiently claim a decedent's assets when the estate value is below $40,000, streamlining the probate process.

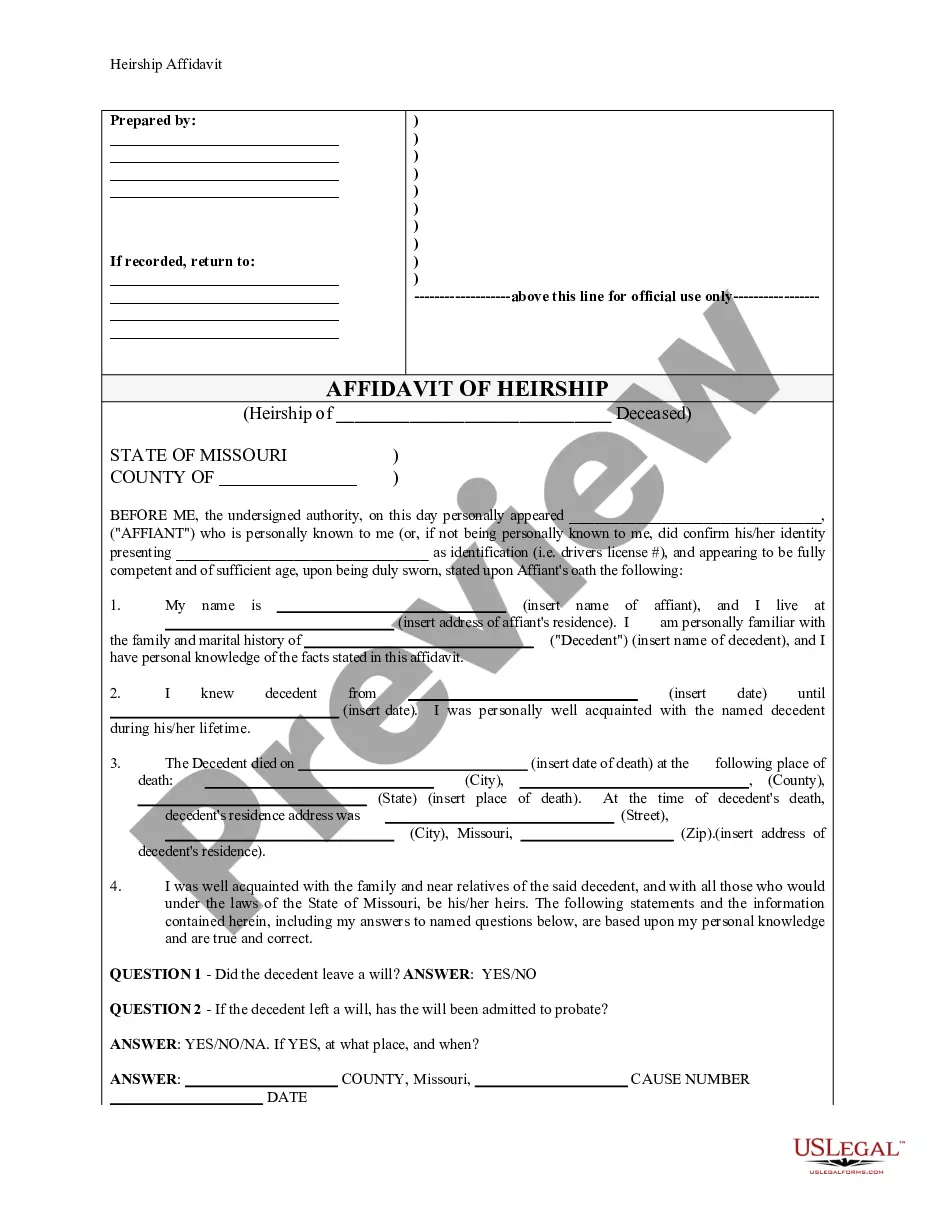

Establishes heirship for a deceased individual, vital for settling estates without a will.

Obtain a surety bond to secure the estate assets for distributees, ensuring compliance with legal obligations after a decedent's passing.

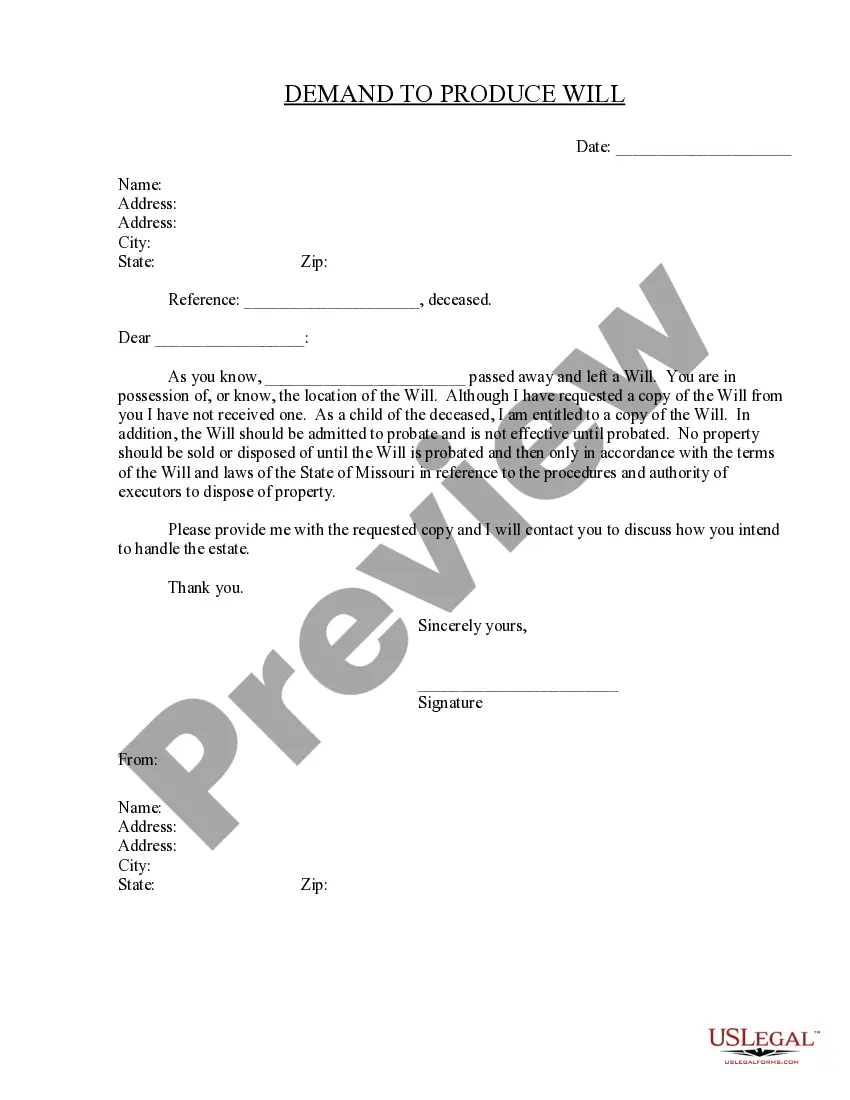

Request a copy of a deceased person's Will to ensure proper estate management and fulfillment of legal rights.

Used to request the termination of a conservatorship for a minor, allowing their property to be managed without a conservator.

Indicate the final settlement of an estate and facilitate distribution to heirs or beneficiaries after a person's death.

Request financial support for a surviving spouse and dependents after a loved one's passing. Ensure necessary living expenses are covered during estate settlement.

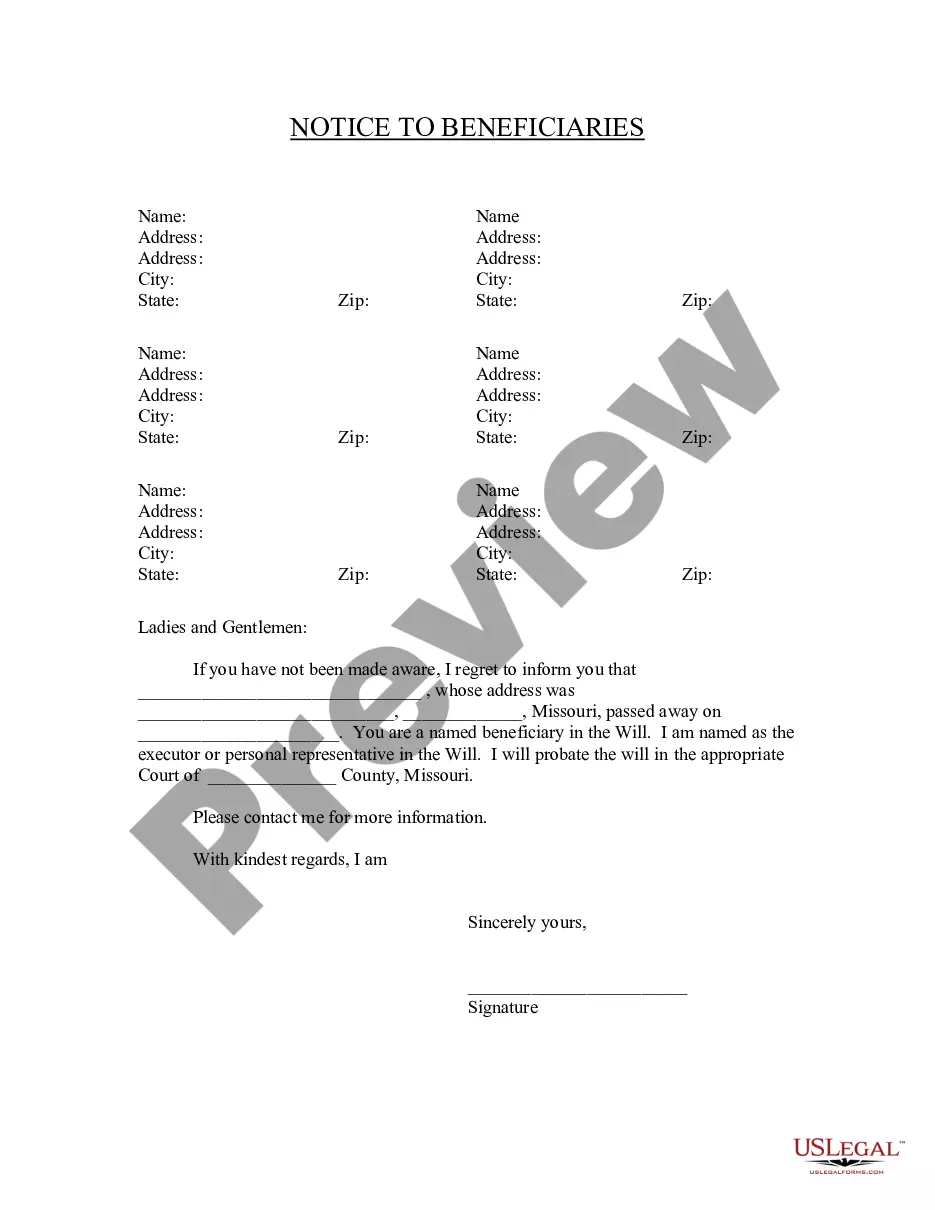

Notify beneficiaries of their status in a will after someone passes away, ensuring they receive essential information about their inheritance.

Designate an agent for service of process in Missouri probate matters to simplify communication regarding an estate.

Securely appoint a personal representative for an estate with a corporate surety bond, ensuring fiduciary responsibility.

Probate is necessary for distributing a deceased person’s estate.

Not all assets require probate, such as those in a trust.

Probate can involve court hearings and public records.

An executor or administrator is responsible for estate management.

Probate procedures may vary by state.

Begin quickly with these simple steps.

A trust can help avoid probate and manage assets more efficiently.

If no action is taken, the estate may go through probate automatically.

It's wise to review your estate plan every few years or after major life changes.

Beneficiary designations can override your will, directly transferring assets.

Yes, you can designate separate agents for financial and health care decisions.