What is Probate?

Probate is the legal process of settling an estate after someone passes away. It involves validating wills, distributing assets, and paying debts. Explore state-specific templates for your needs.

Probate in Florida involves managing a deceased person's estate. Our attorney-drafted templates are quick and straightforward.

Get a streamlined process for settling small estates valued under $75,000 in Florida, avoiding lengthy probate procedures.

Utilize this to handle small estates with minimal assets, ensuring a quick resolution of funeral and medical expenses without the need for formal administration.

Request a copy of a deceased person's Will to understand estate proceedings and your rights.

This document is crucial for health professionals providing detailed assessments of patients' medical conditions.

Notifying individuals named in a will about their status as beneficiaries is essential for legal transparency and inheritance processes.

Use this checklist to ensure you have all necessary documents when starting a formal estate administration process.

Use this form to claim the validity of a lost or destroyed will, ensuring that your loved one's intentions are honored.

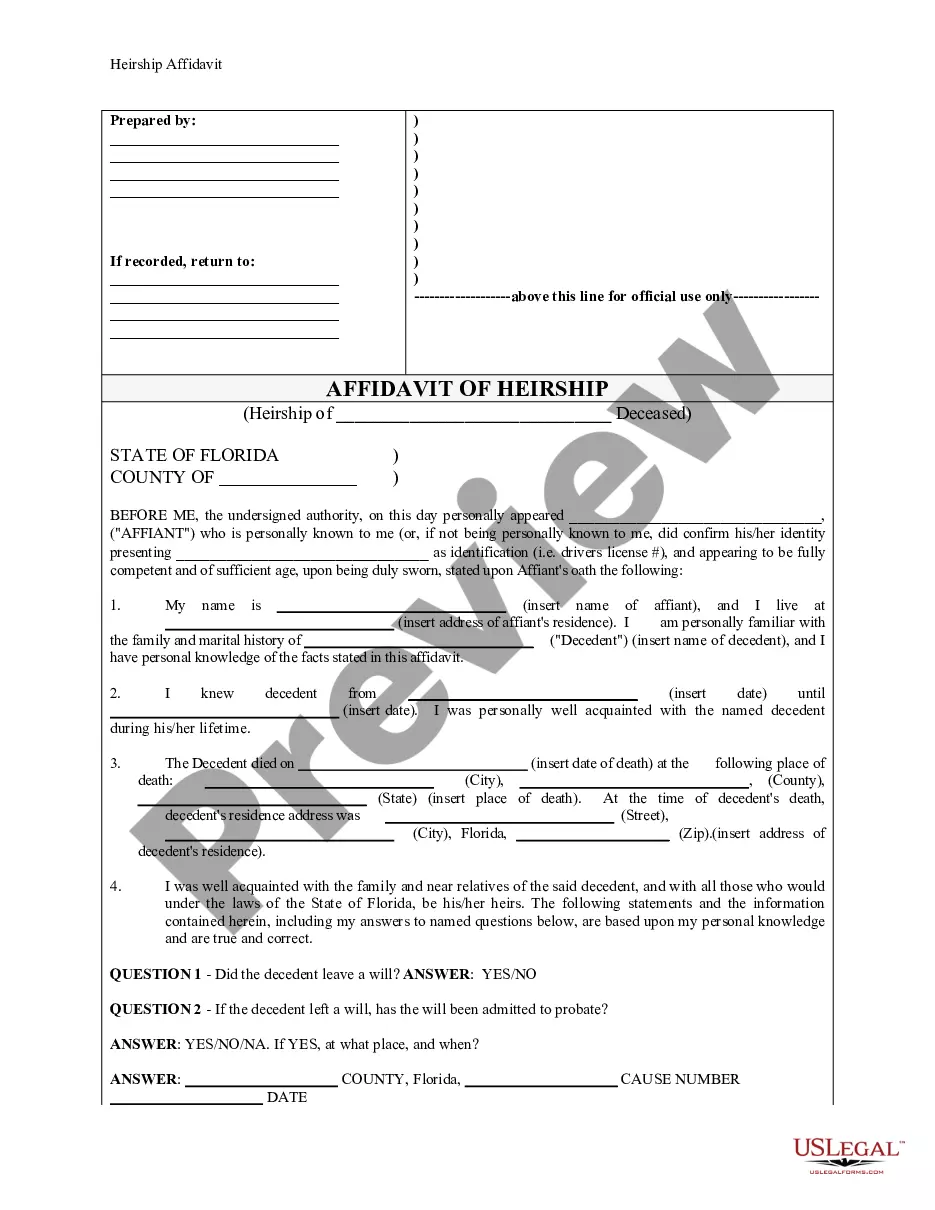

Use this affidavit to declare heirs of a deceased person, helping to clarify the distribution of their estate.

Used to assert a claim against an estate in probate, this document helps protect your financial interests.

Submit this to handle the distribution of an estate's personal property without full probate, ideal for small estates.

Probate is necessary for settling most estates after death.

Wills can simplify the probate process but are not mandatory.

Intestate succession laws apply when there is no valid will.

Probate can be contested, leading to delays.

Creditors may claim debts from the estate during probate.

Begin easily with these steps.

A trust is not mandatory if you have a will, but it can offer additional benefits.

If you do nothing, state laws will determine how your assets are distributed.

Review your estate plan every few years or after major life changes.

Beneficiary designations generally override wills, so consider them carefully.

Yes, you can appoint different individuals for financial and healthcare decisions.