What is Probate?

Probate is the legal process for validating a will and settling an estate. It includes handling debts, distributing assets, and ensuring compliance with state laws. Explore Arkansas-specific templates to streamline your process.

Probate involves managing a person's estate after their death. With attorney-drafted templates, it’s quick and easy to complete necessary forms.

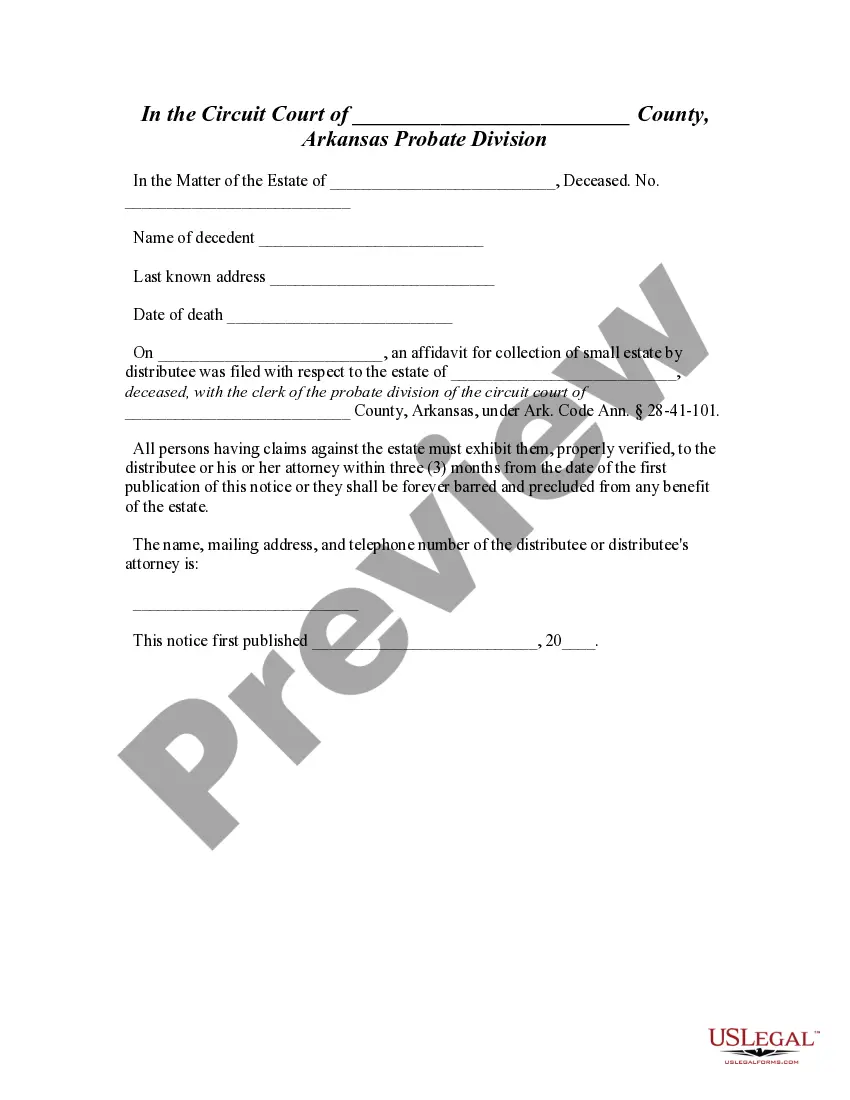

Notify interested parties after filing a small estate affidavit, ensuring claims are addressed promptly to avoid losing rights to the estate.

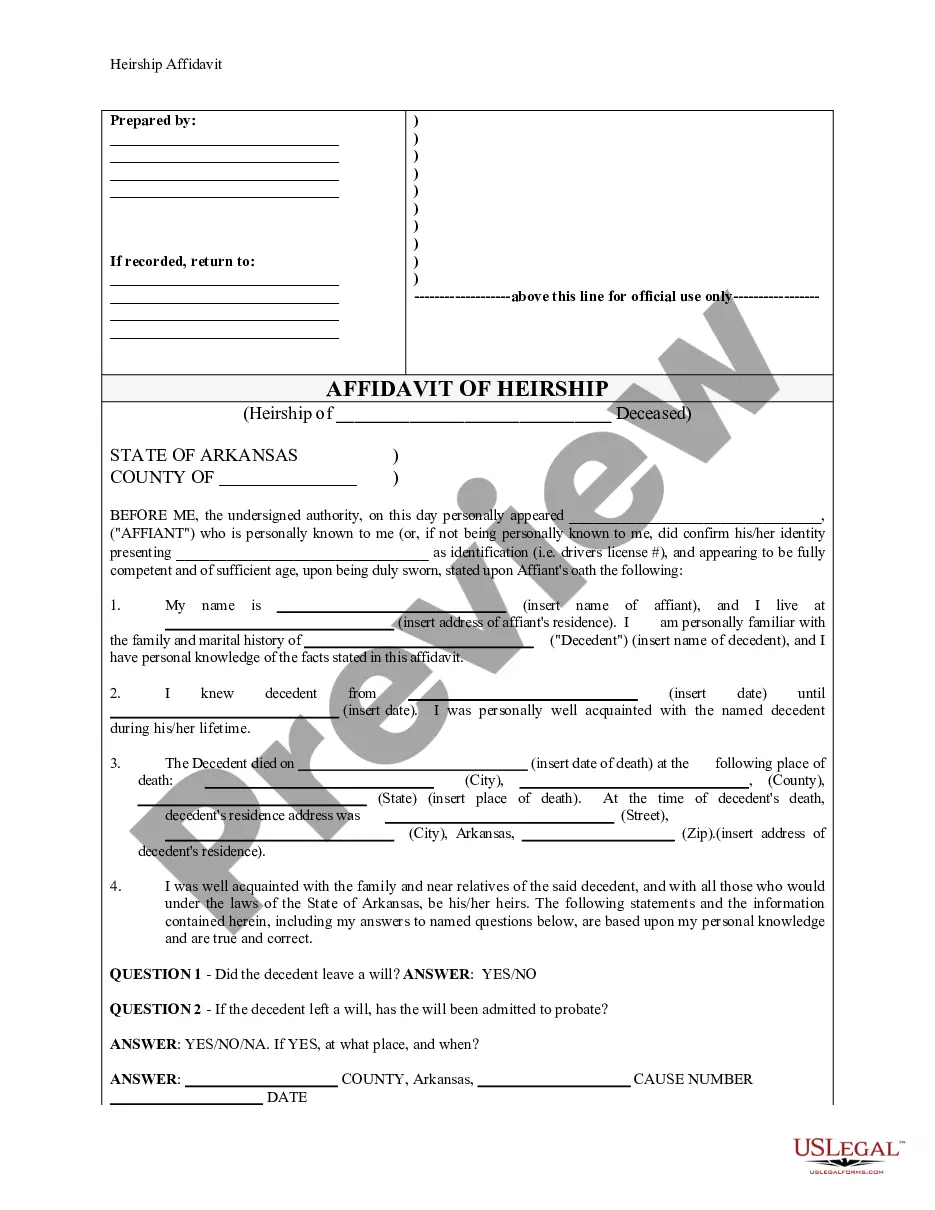

Use this affidavit to establish legal heirship for a deceased person's estate, especially when no will is available.

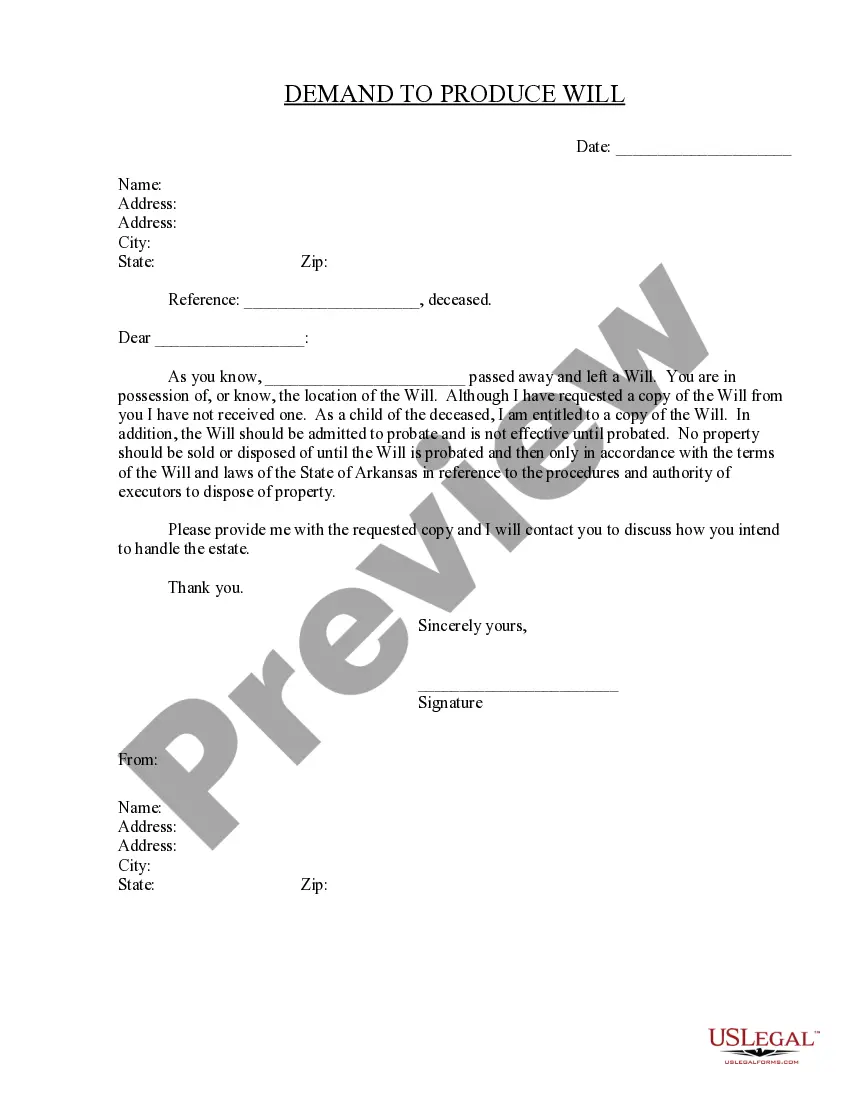

Request a copy of the deceased's will to ensure your rights as an heir are respected during the estate administration process.

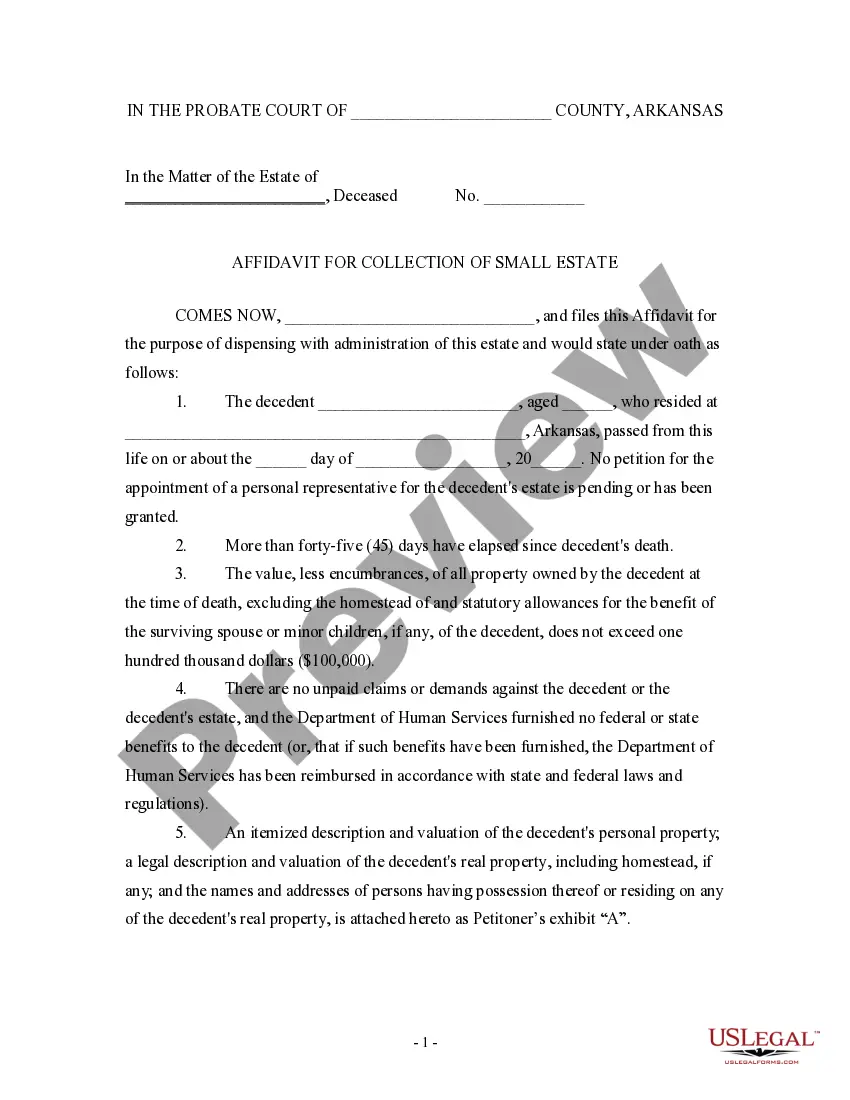

Use this affidavit to simplify estate settlement when the total value is under $100,000, avoiding complex probate procedures.

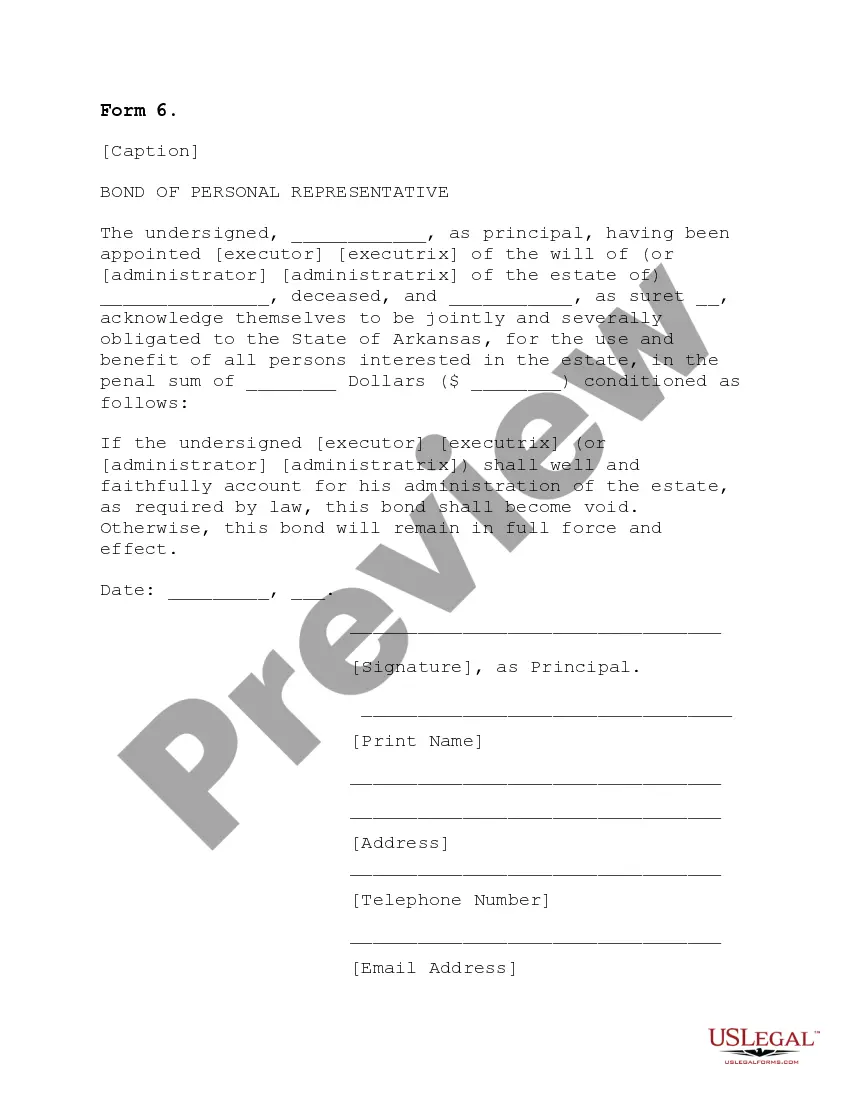

Ensure accountability in estate management by using this bond when serving as a personal representative.

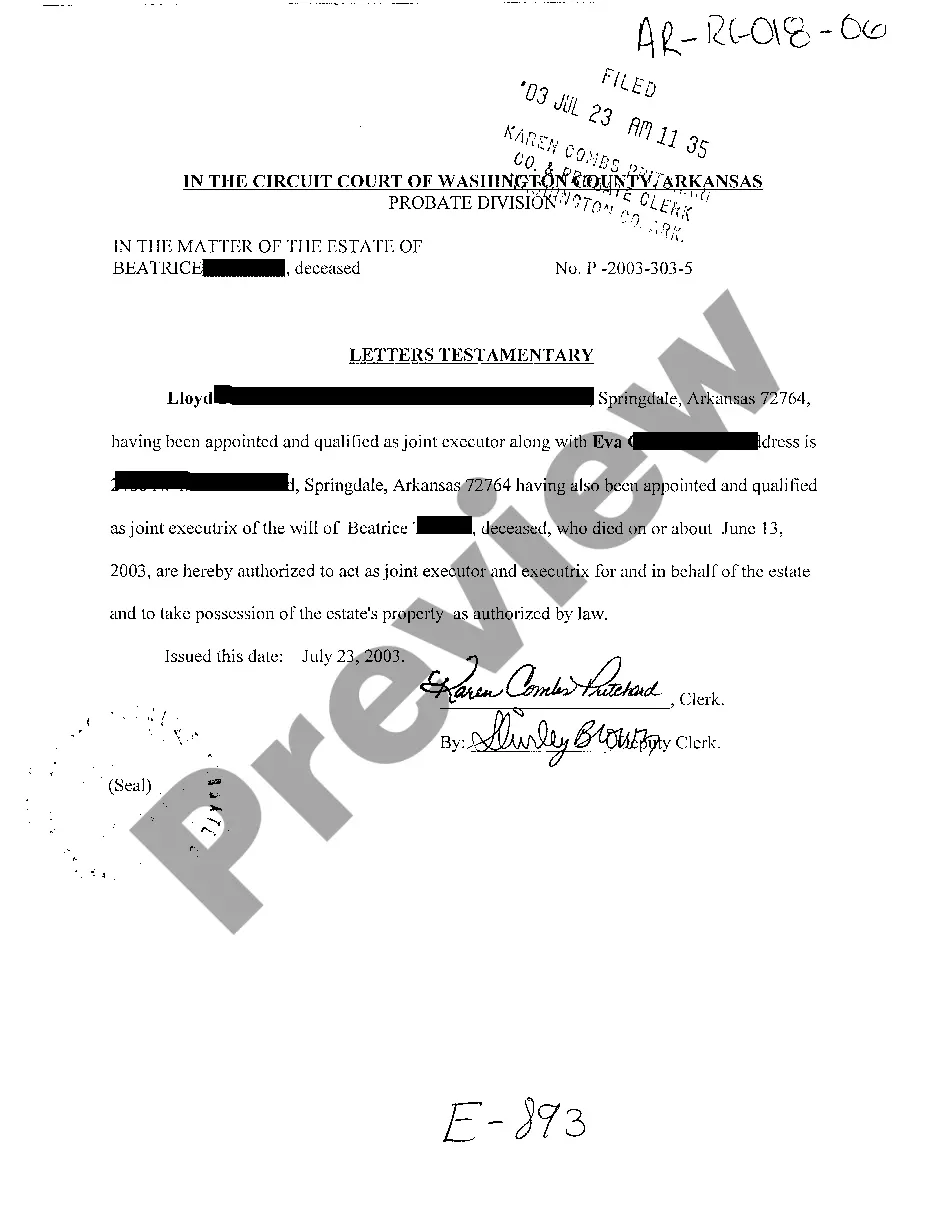

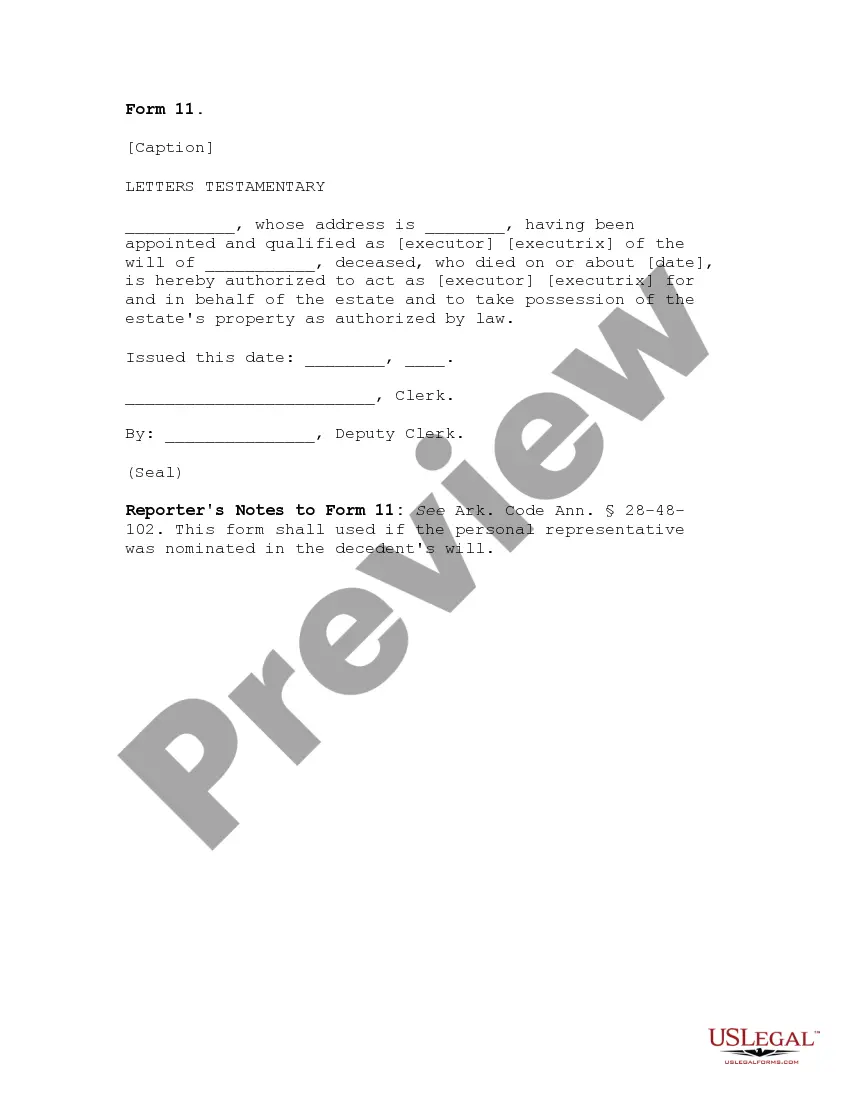

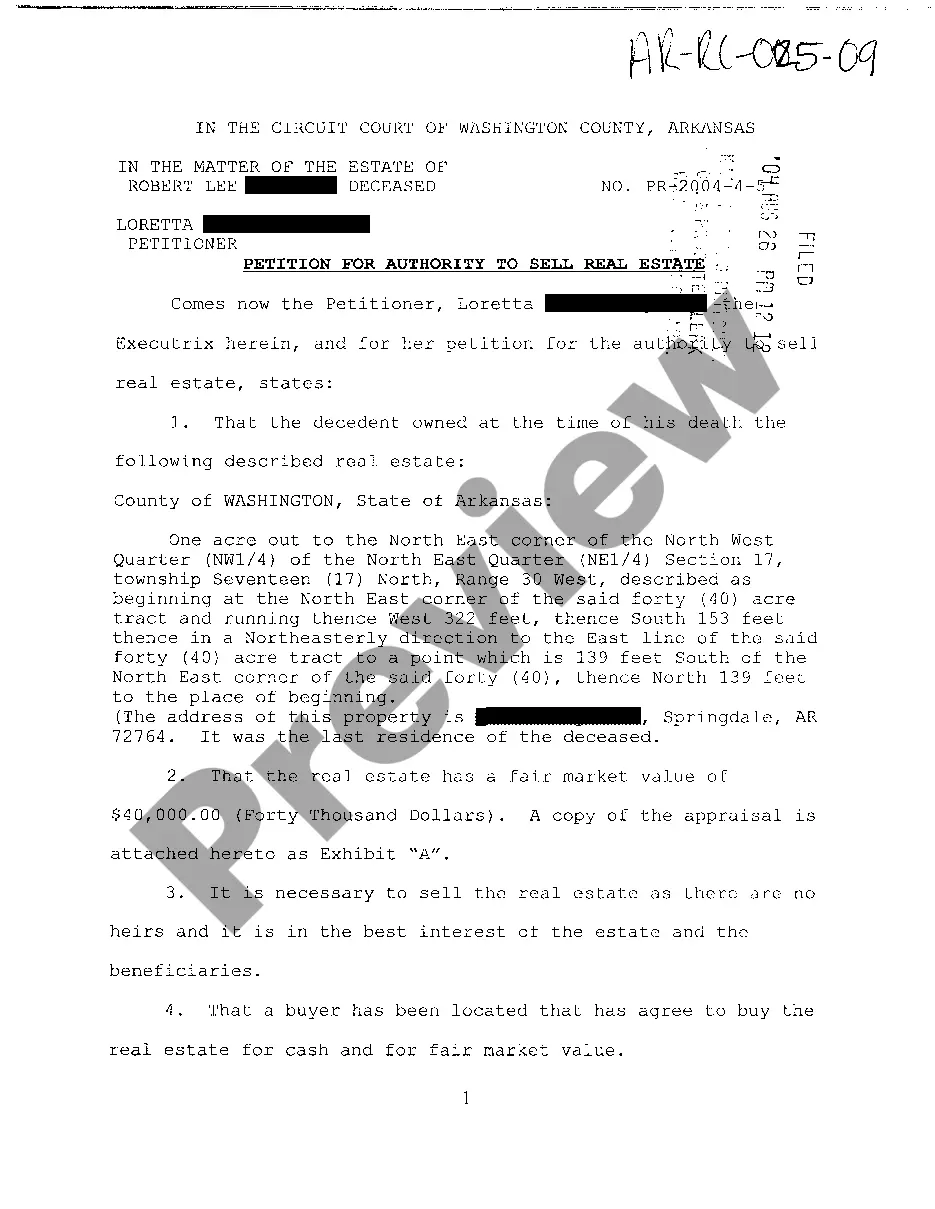

Establishes authority for an executor to manage a deceased person's estate as stated in their will.

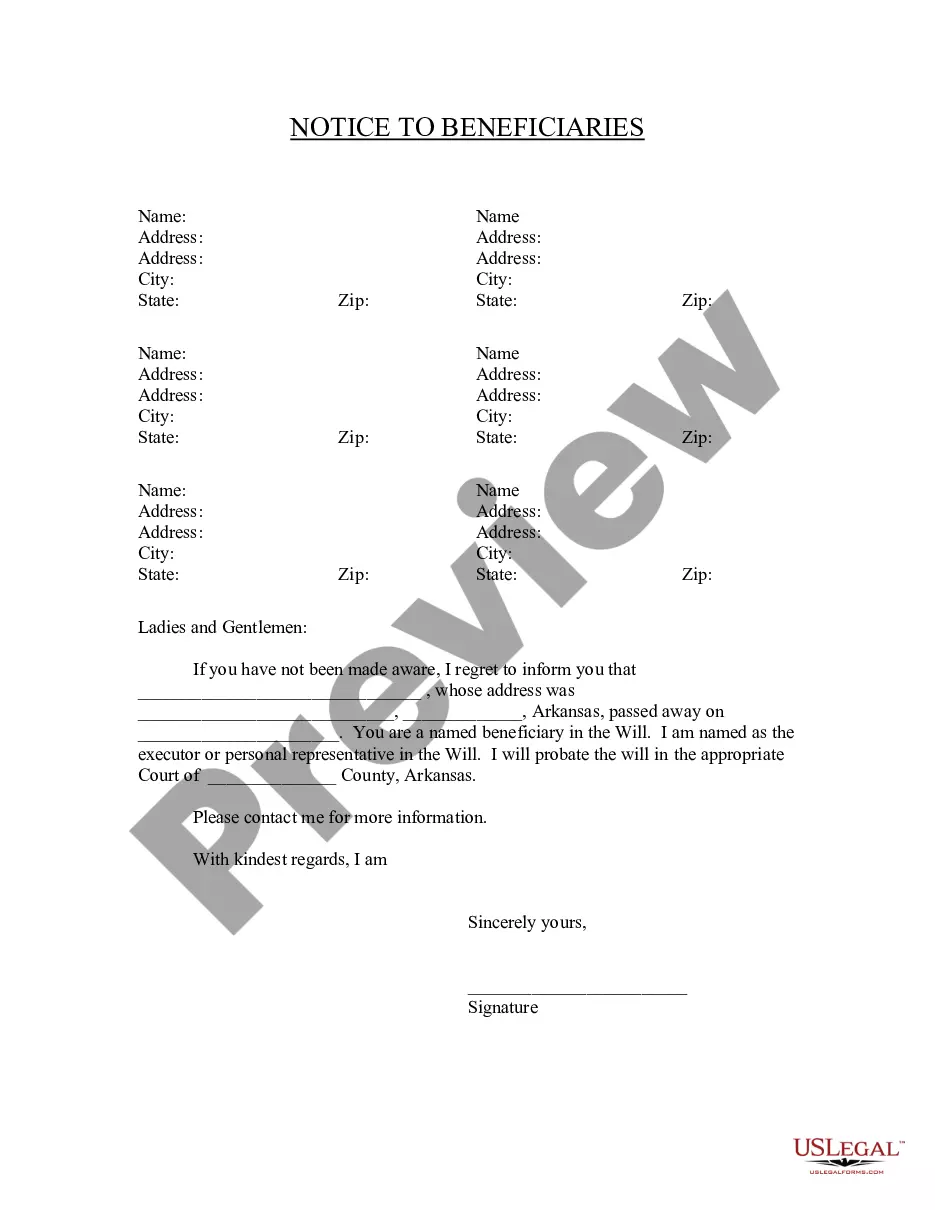

Notify beneficiaries named in a will about their entitlement and the probate process.

Obtain legal authority to manage an estate when there is no will or personal representative.

Probate is necessary for settling most estates after death.

Wills must be submitted to probate to be legally recognized.

Estates may incur debts that need to be settled before distribution.

Probate can take several months to complete.

Court supervision might be required for complex estates.

Begin your probate process in just a few steps.

A trust can provide additional control and privacy, but a will is sufficient for many.

If no plan is in place, the state will decide how your estate is distributed.

Review your estate plan regularly, especially after major life changes.

Beneficiary designations typically override wills and trusts for specific assets.

Yes, you can appoint different agents for financial and health matters.