What is Power of Attorney?

Power of Attorney allows individuals to designate someone to make decisions on their behalf, usually for financial or medical matters. Explore state-specific templates to suit your needs.

Power of Attorney documents let you appoint someone to act on your behalf. Attorney-drafted templates are quick and easy to complete.

Get essential legal forms to manage your health, finances, and affairs during important life stages—all in one convenient package.

This package provides essential legal forms for managing health, finances, and child care, all in one convenient location.

Empower a trusted individual to make key decisions about your child's care, health, and education during your absence.

Grant broad powers to an appointed individual to manage your affairs, particularly useful for financial decisions.

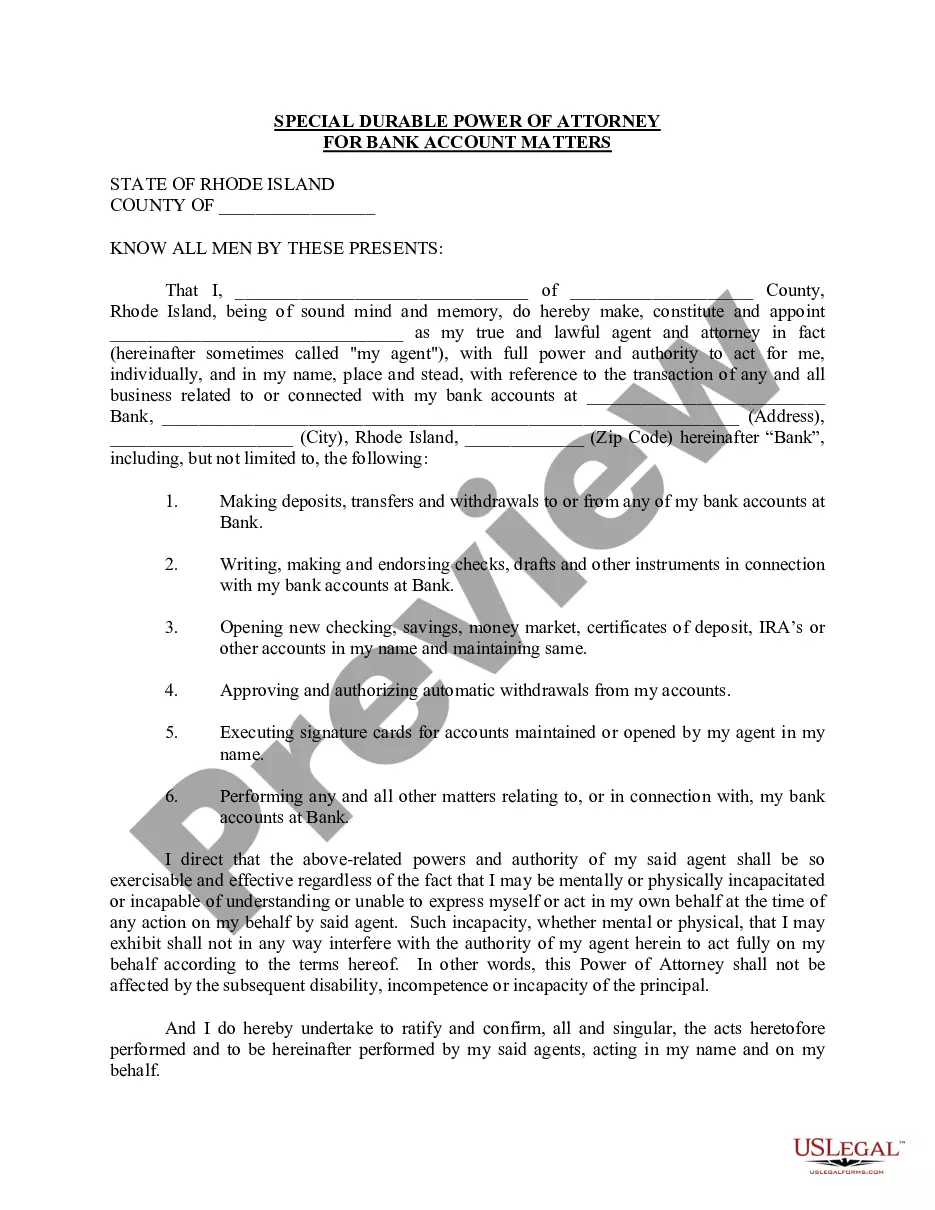

Authorize someone to manage your bank accounts, even if you become incapacitated. This ensures your finances are handled according to your wishes.

Ensure your medical wishes are respected with this convenient package of related legal forms for advance healthcare planning.

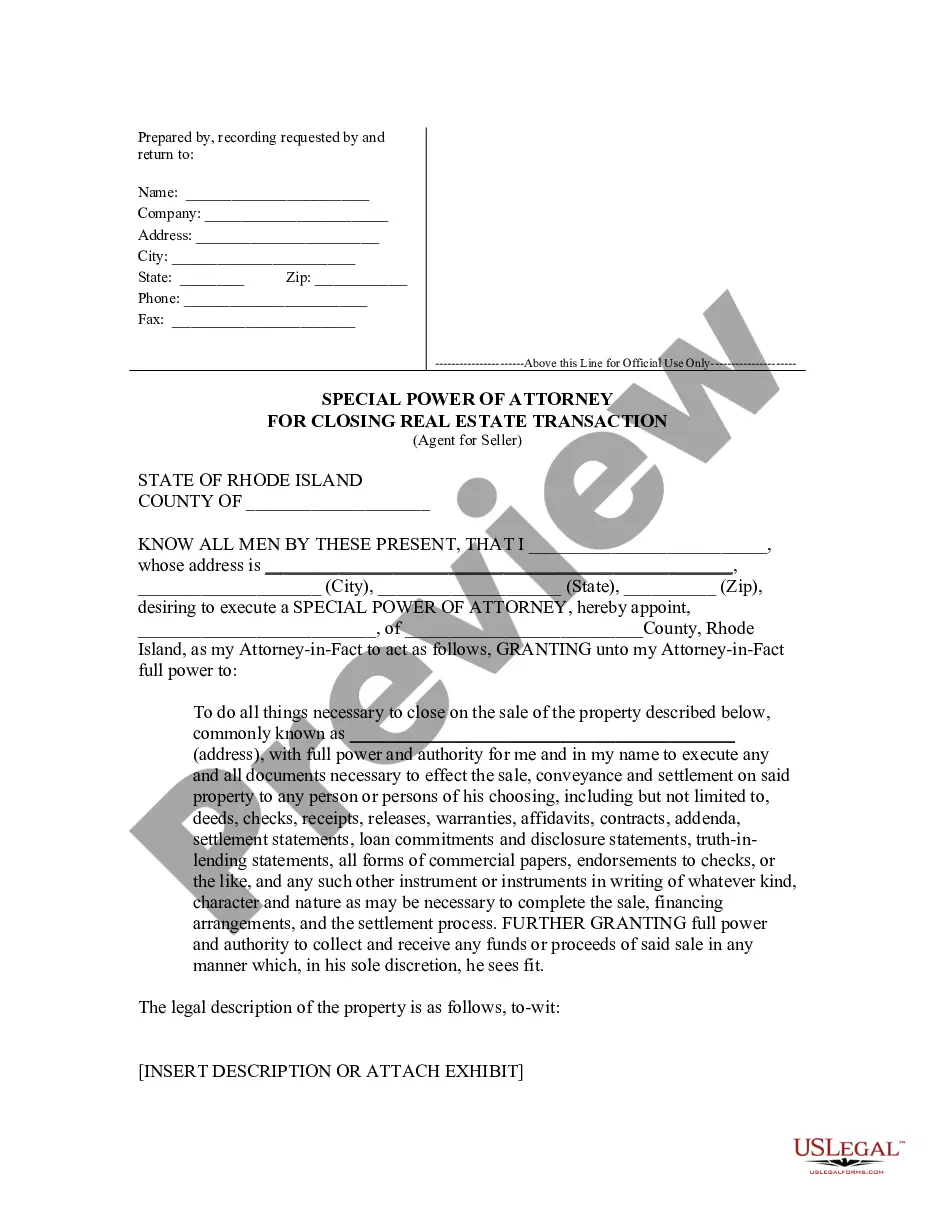

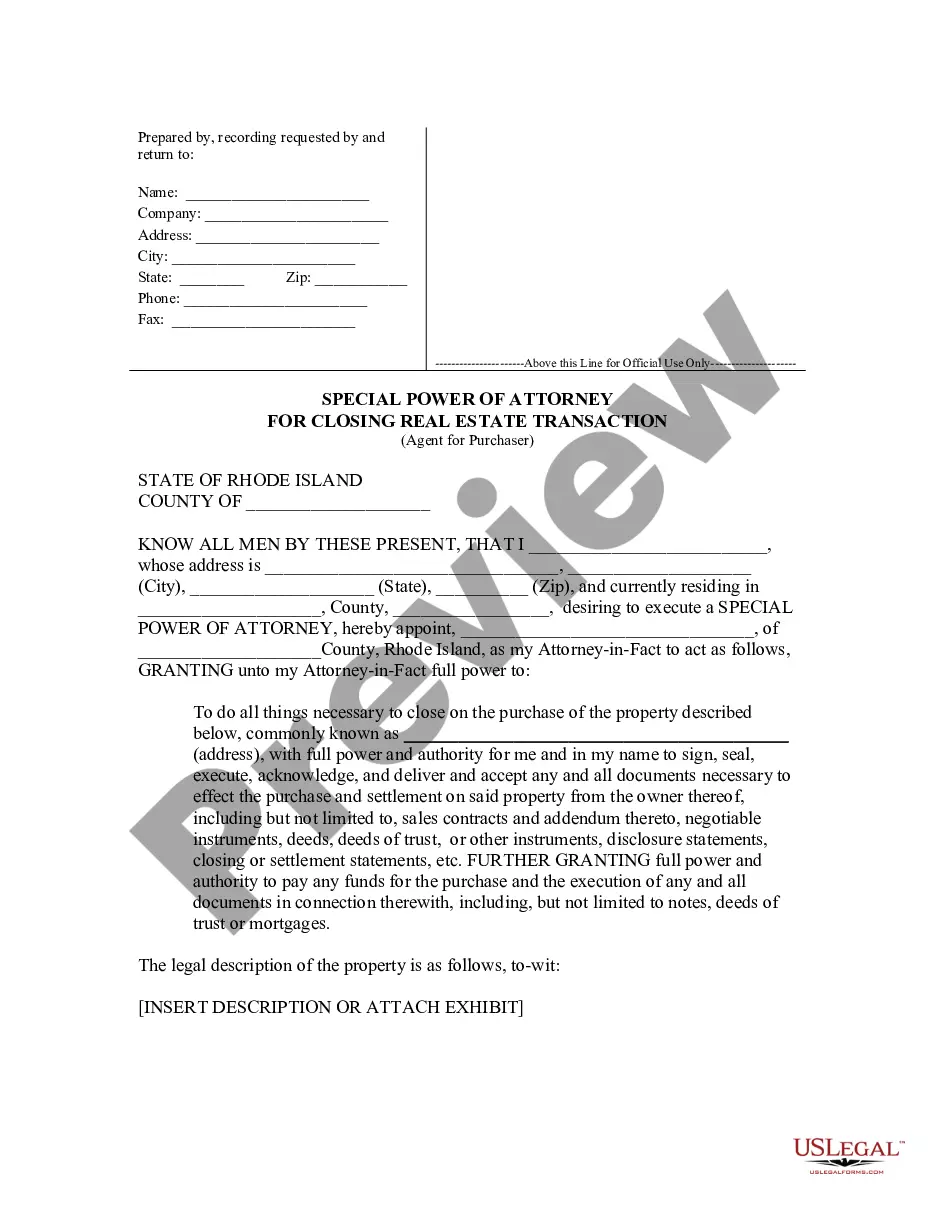

Empower a designated agent to handle real estate sales on your behalf, ensuring smooth transactions and compliant document execution.

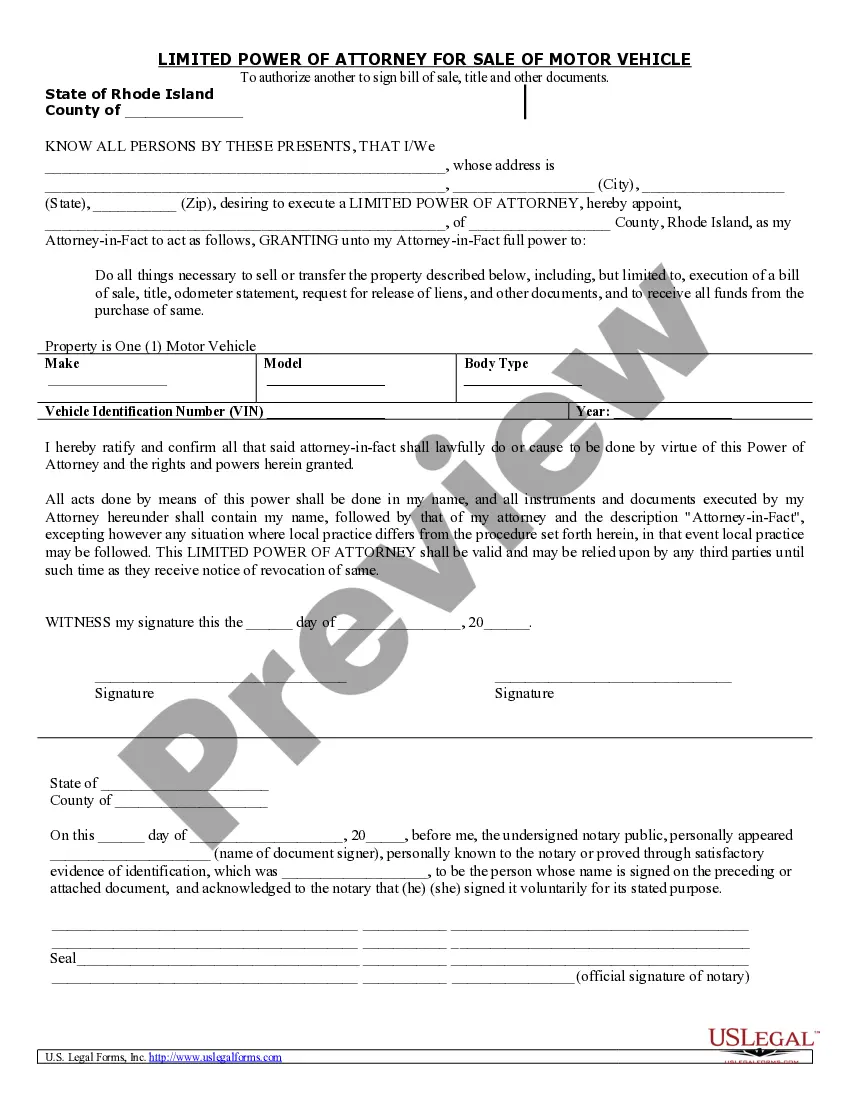

Authorize another person to manage the sale of your vehicle, ensuring all necessary documents are signed efficiently.

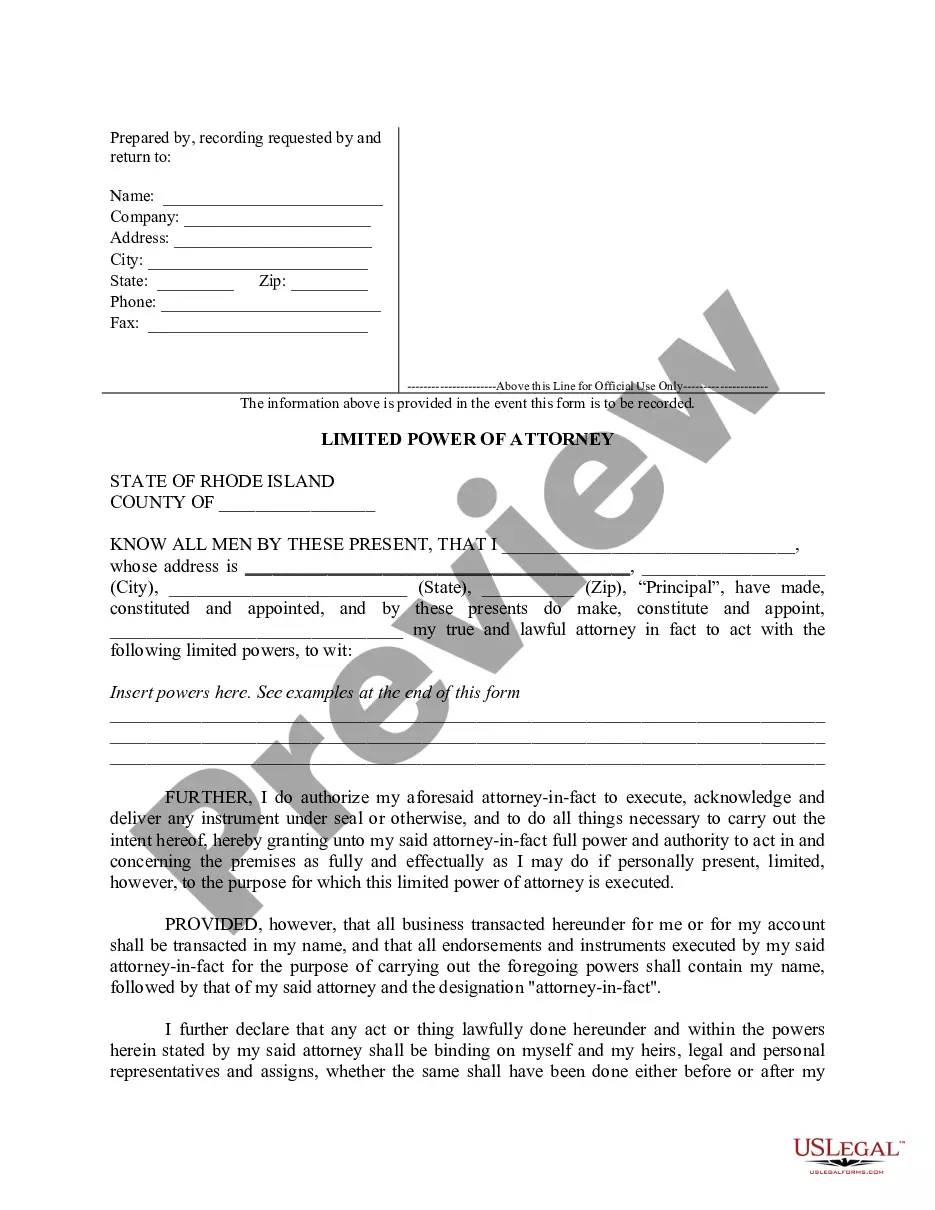

Authorize someone to handle specific matters on your behalf, ensuring your interests are managed even if you're unavailable.

Empower someone to act on your behalf in a real estate purchase, ensuring a smooth closing process without your physical presence.

A Power of Attorney can be revoked at any time if you are competent.

Different types of Power of Attorney serve distinct purposes.

An agent must act in your best interest at all times.

Many States require notarization or witnesses for Power of Attorney documents.

Powers can be broad or limited based on your specifications.

Begin in just a few minutes with these steps.

A trust may provide additional benefits, but a will alone is sufficient.

If you don't create a Power of Attorney, decisions may be made without your input.

Review your plan at least every few years or after major life changes.

Beneficiary designations can override your plan, so ensure they align with your intentions.

Yes, you can appoint different agents for financial and healthcare matters.