What is Power of Attorney?

Power of Attorney documents grant someone the authority to make decisions for you. They are useful in various situations, like managing finances or healthcare. Explore state-specific templates for your needs.

Power of Attorney documents allow someone to act on your behalf. Attorney-drafted templates are quick and simple to complete.

Everything needed for planning your life and legacy in one place, including essential legal documents.

Appoint someone to manage your financial affairs, even if you become incapacitated. This power enables your agent to act without further consent.

Grant a trusted person authority to manage your finances if you become unable to do so. This essential document remains valid during incapacity.

Prepare and protect your health, finances, and personal affairs with multiple essential legal forms all in one package.

Designate someone to make important decisions regarding your child's care and custody when you're unable to do so.

Authorize someone to manage your bank account matters, even if you're unable to act on your own due to incapacity.

Get everything you need to manage your healthcare decisions and end-of-life wishes in one convenient package.

Empower an agent to manage the sale of your real estate. This form allows you to delegate critical responsibilities during a transaction.

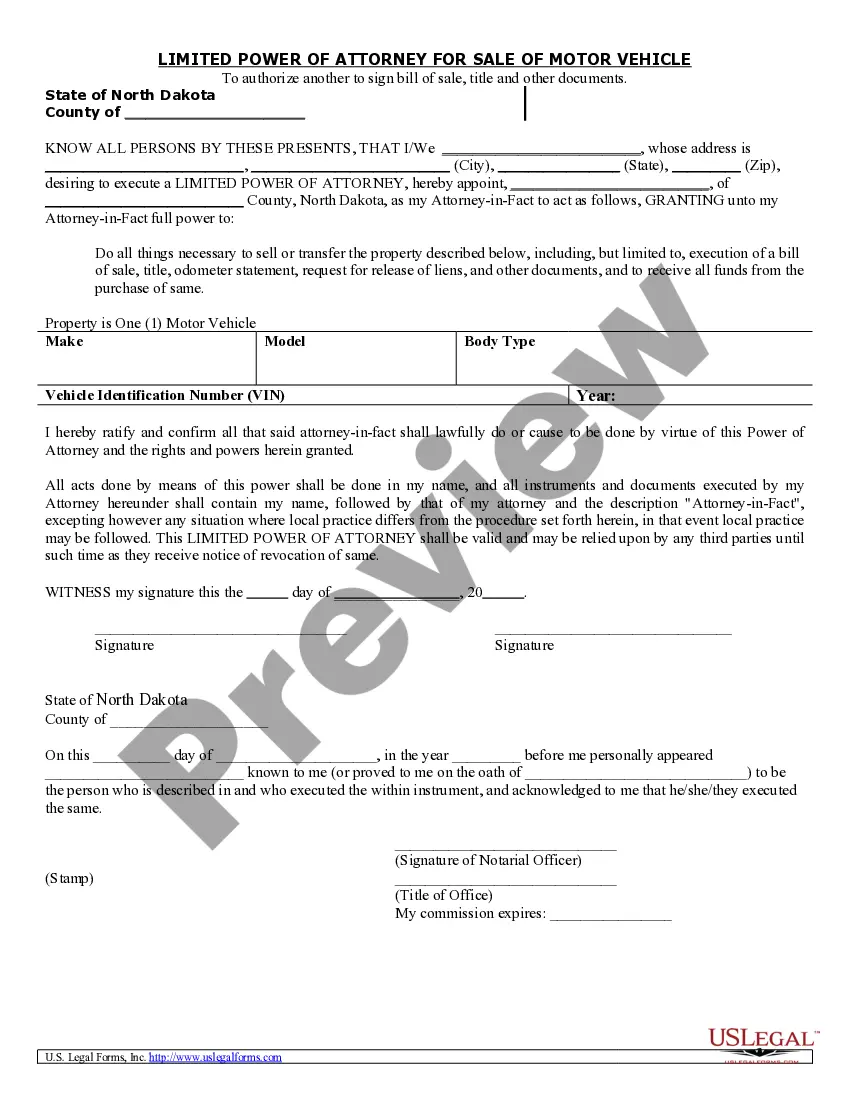

Authorize someone to handle the sale of your vehicle, including signing necessary documents and receiving payment, making the process smoother and legally binding.

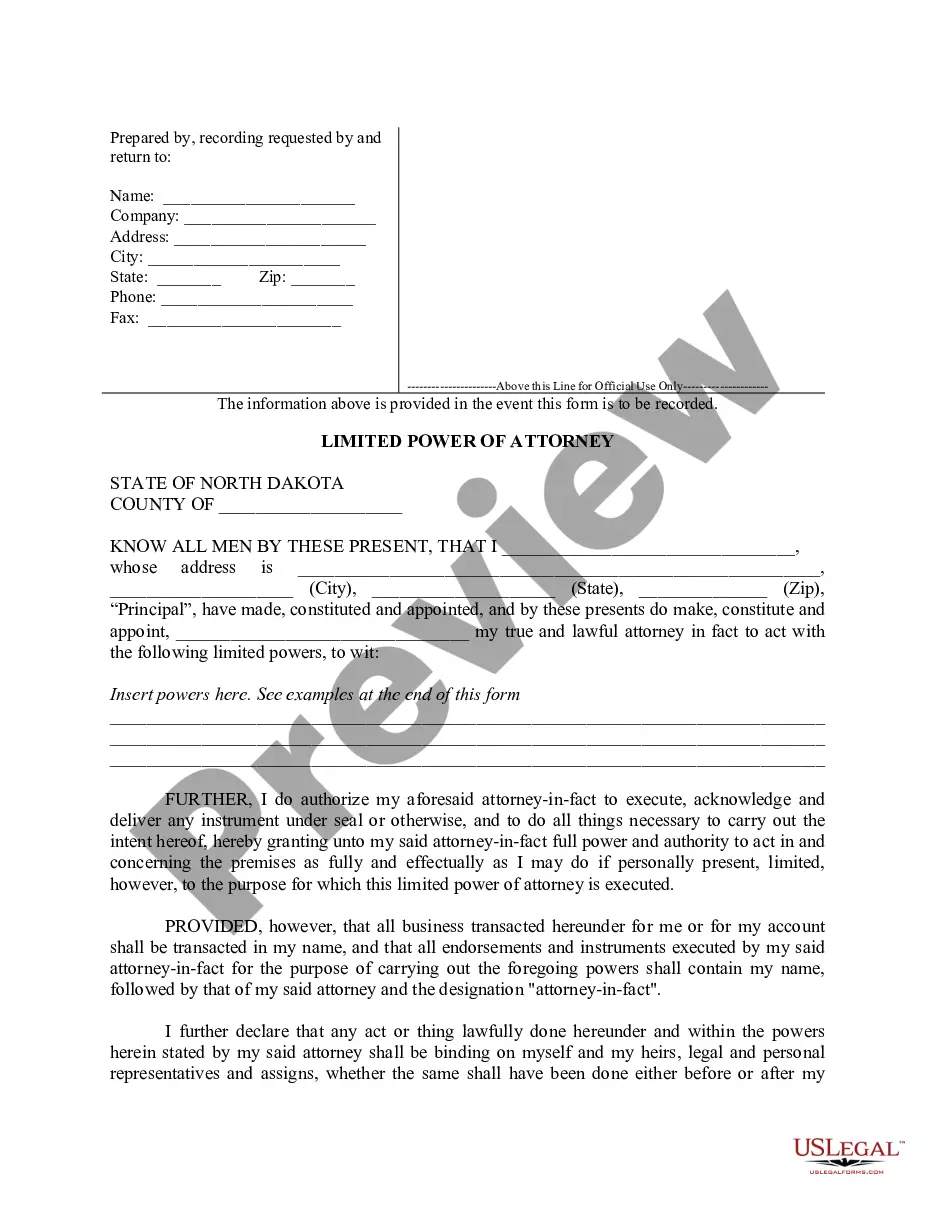

Grant limited authority to someone you trust to act on your behalf for specific tasks.

Power of Attorney can be used for financial, medical, or legal affairs.

The appointed person is called an attorney-in-fact or agent.

Documents often require notarization or witnesses in many states.

You can revoke Power of Attorney at any time if competent.

It’s important to choose a trustworthy agent for this responsibility.

Begin your process easily with these steps.

A trust can help manage assets during incapacity, unlike a will.

If you do not establish a Power of Attorney, decisions may default to a court.

It's wise to review your Power of Attorney regularly, especially after major life changes.

Beneficiary designations override wills and trusts for those specific assets.

Yes, you can appoint separate agents for financial and healthcare decisions.