What is Power of Attorney?

A Power of Attorney allows someone to act on your behalf in legal and financial matters. These documents are essential when you cannot be present to make decisions. Explore our state-specific templates for Montana.

Power of Attorney documents help manage legal and financial matters. Attorney-drafted templates are quick and easy to complete.

Prepare for future needs with essential legal forms for health, finances, and estate planning—all conveniently in one package.

Get essential forms for managing health, finances, and family care, all in one convenient package.

Grant someone authority for your child's care and decisions, especially useful during extended absences or emergencies.

Authorize someone you trust to manage your property when you're unable to do so. This form creates a durable power of attorney that remains effective even if you become incapacitated.

Empower someone to manage your bank account matters, even if you become incapacitated. This ensures continuity in financial affairs when needed most.

Secure your healthcare wishes with multiple related legal forms, all conveniently gathered in one package.

Empower someone to handle your real estate sale, ensuring they can complete all necessary transactions and paperwork on your behalf.

Authorize someone to manage the sale of your vehicle, ensuring legal documents are signed on your behalf.

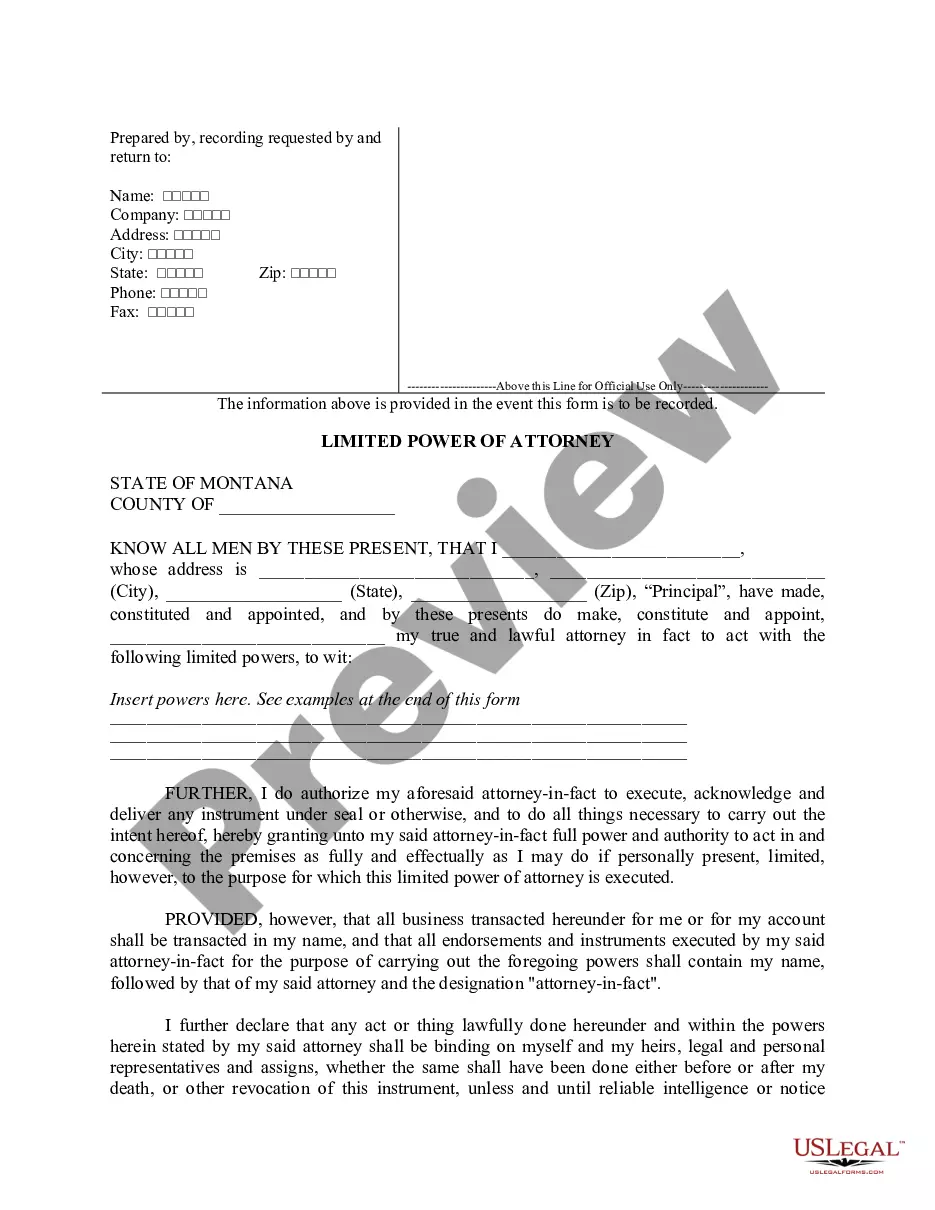

Grant specific powers to someone you trust for limited tasks, ensuring your interests are represented without full authority.

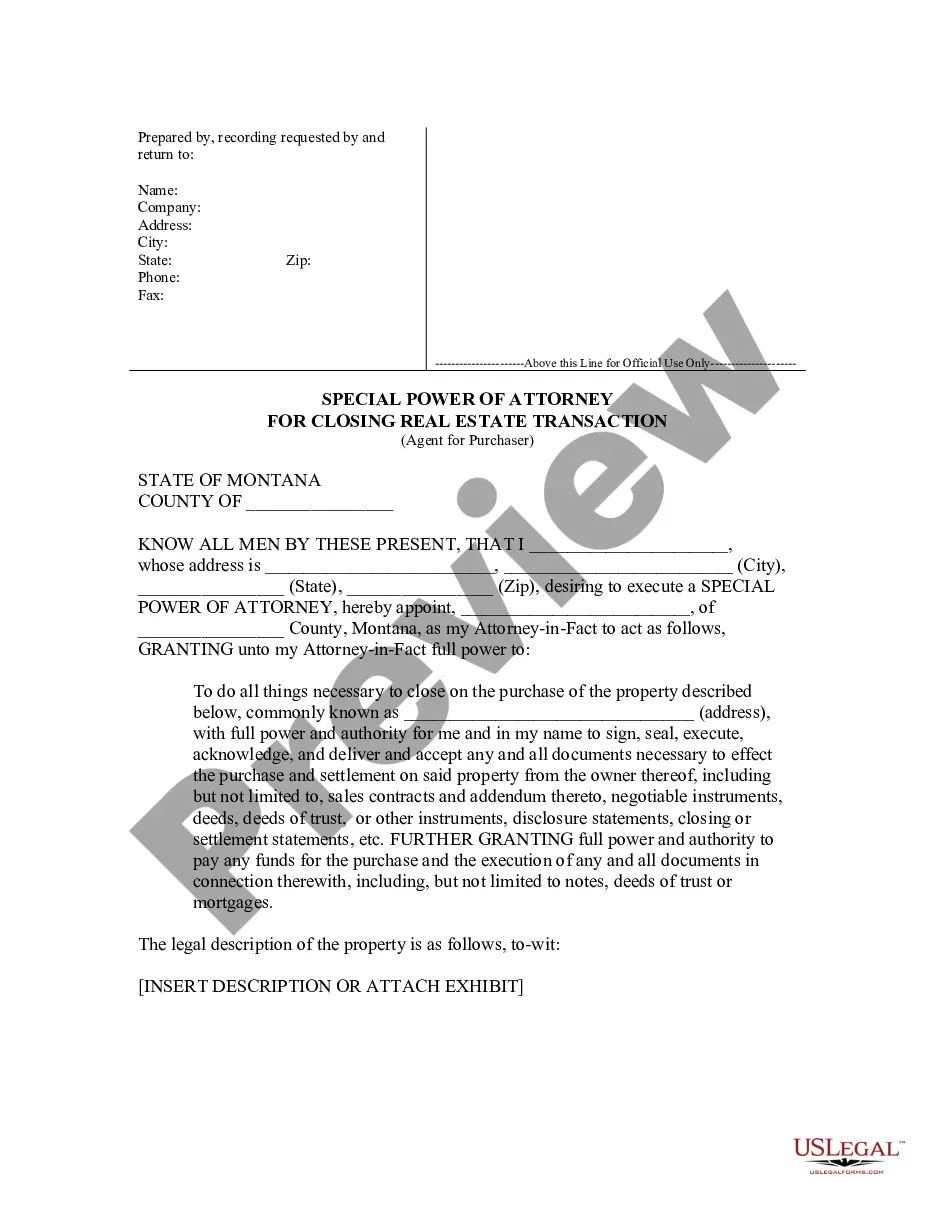

Authorize someone to handle real estate purchase transactions on your behalf, ensuring a smooth and legally binding process.

A Power of Attorney can be revoked at any time by the principal.

The agent's authority may vary based on the document type.

Documents often require signatures and may need notarization.

Choosing a trustworthy agent is crucial for effective management.

Specific forms exist for financial, medical, and general powers.

Begin in just a few steps to create your Power of Attorney.

A trust can provide additional control over your assets, but a will is sufficient for many.

Without a Power of Attorney, decisions may fall to the court if you become incapacitated.

It's wise to review your Power of Attorney every few years or after major life changes.

Beneficiary designations can override your estate plan, so keep them updated.

Yes, you can appoint separate agents for financial matters and healthcare decisions.