What is Power of Attorney?

Power of Attorney documents grant authority to another person to make decisions for you. They are used when individuals cannot act for themselves. Explore state-specific templates for your needs.

Power of Attorney documents allow individuals to designate someone to act on their behalf. Our attorney-drafted templates are quick and easy to complete.

Get everything you need to plan for life’s later stages in one convenient package, including multiple essential legal forms.

Designate someone to manage your property and finances immediately, even if you become incapacitated, ensuring your financial matters are handled as you wish.

Empower someone to manage your property and finances if you become disabled or incapacitated.

Prepare for health, financial, and personal matters with a complete set of legal forms in one package.

Grant someone authority to make crucial decisions about your child's care, education, and health when you can't be there.

Authorize a trusted person to manage your property and financial decisions when you're unable to act for yourself.

Ensure your medical treatment decisions are honored with this convenient package of vital legal forms.

Assign an agent to manage your bank accounts, even if you're unable to do so yourself.

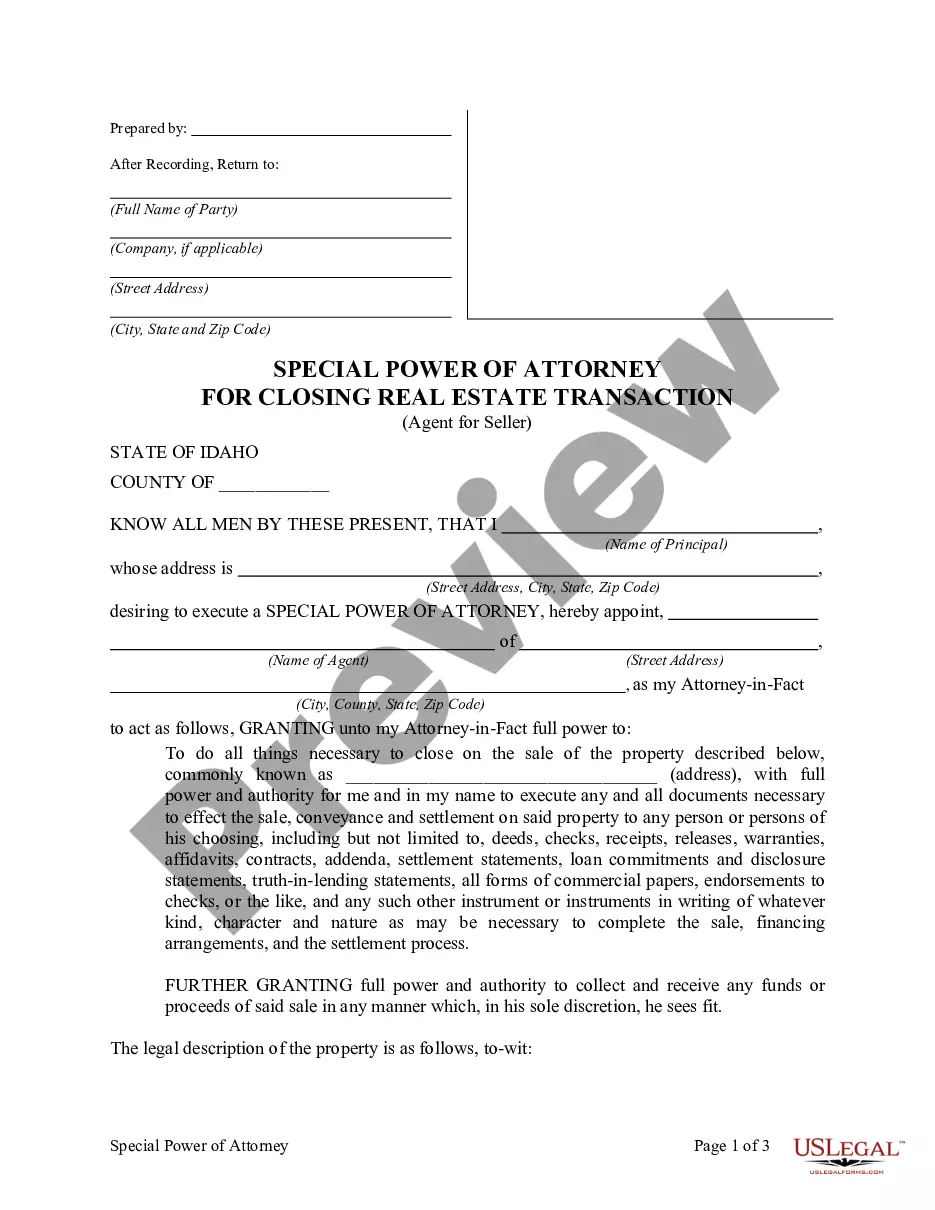

Authorize someone else to handle real estate sales on your behalf for streamlined transactions and peace of mind.

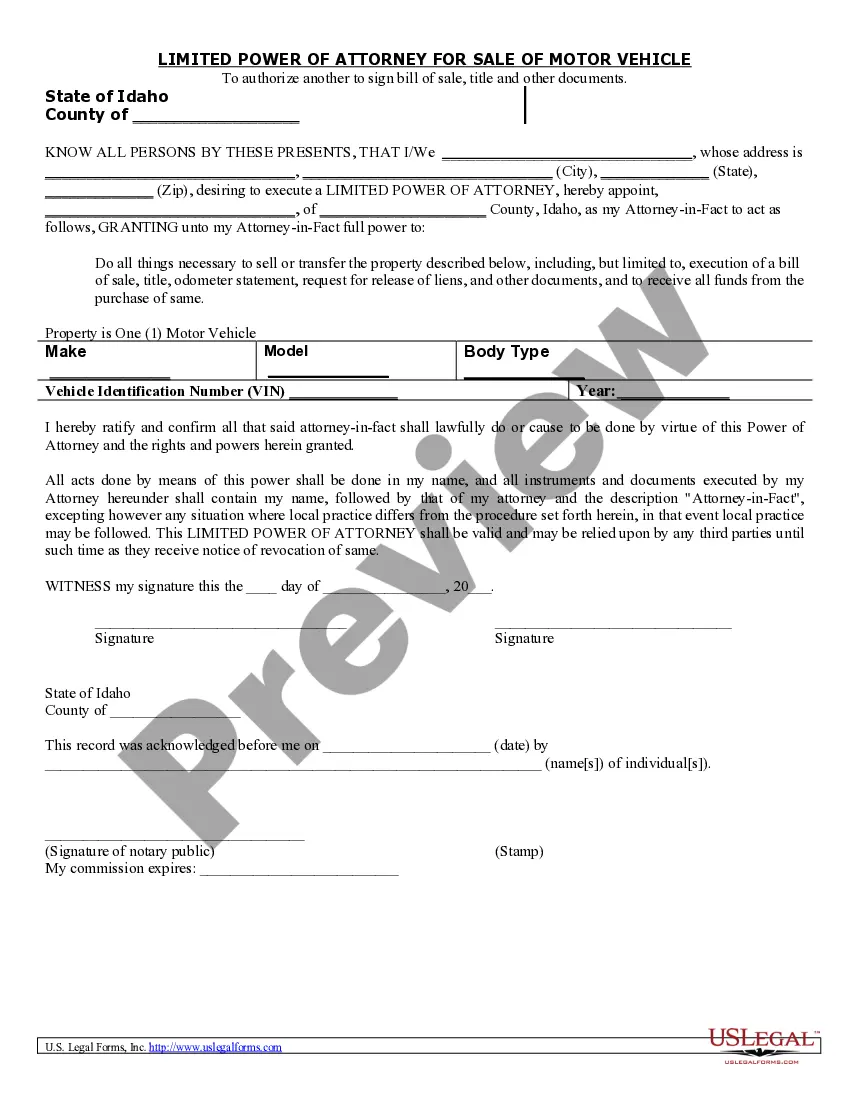

Authorize someone to manage the sale of your vehicle in your absence, ensuring quick and efficient transactions.

Power of Attorney can be tailored for financial, medical, or both needs.

The appointed person is known as the Attorney-in-Fact.

Documents often need notarization or witnesses to be valid.

Powers can be broad or limited based on your preferences.

You can revoke a Power of Attorney at any time.

Begin easily with these steps.

A trust can provide benefits that a will alone may not offer, like avoiding probate.

Without a Power of Attorney, decisions may fall to the court if you become incapacitated.

Review your Power of Attorney regularly, especially after major life changes.

Beneficiary designations can override other documents, so ensure they are aligned with your wishes.

Yes, you can appoint separate individuals for financial and medical decisions.