UCC1 - Financing Statement - Washington - This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

King Washington UCC1 Financing Statement

Description

How to fill out Washington UCC1 Financing Statement?

Regardless of social or work standing, completing legal documents is an unfortunate obligation in today's society.

Frequently, it's nearly unfeasible for an individual without legal training to create such documents from the beginning, mainly due to the intricate language and legal nuances they entail.

This is where US Legal Forms comes to the aid.

Verify that the template you selected is appropriate for your location, as the laws of one state or county may not apply to another.

Examine the form and read any brief description (if offered) regarding the situations for which the document can be utilized.

- Our service offers a vast collection of over 85,000 ready-to-use documents specific to each state that cater to virtually any legal situation.

- US Legal Forms also acts as an excellent resource for partners or legal advisors who wish to enhance their efficiency using our DIY forms.

- Regardless of whether you need the King Washington UCC1 Financing Statement or any other document suitable for your state or county, US Legal Forms has everything available.

- Here’s how you can obtain the King Washington UCC1 Financing Statement within minutes using our dependable service.

- If you are currently a subscriber, you can proceed to Log In to your account to retrieve the necessary form.

- However, if you are not familiar with our platform, be sure to follow these steps prior to obtaining the King Washington UCC1 Financing Statement.

Form popularity

FAQ

To file your UCC-1 statement, you usually go through the Secretary of State’s office or the equivalent agency in your state. For the King Washington UCC1 Financing Statement, make sure you submit it in the right jurisdiction to perfect your security interest. Many find US Legal Forms helpful, as it offers resources to simplify filing and ensure compliance with local laws. This can greatly ease your filing process and help you meet all necessary requirements.

When filing a UCC Financing Statement for a foreign entity, you must file it in the state where the entity is registered. Specifically for the King Washington UCC1 Financing Statement, ensure that the filing meets both state and federal guidelines. US Legal Forms can assist you in understanding these requirements and help ensure your documents are correctly prepared. This way, you can confidently navigate the complexities of financing statements for foreign entities.

You can file a UCC fixture filing in the appropriate state office that handles such documents, typically the Secretary of State's office. For King Washington UCC1 Financing Statement, ensure you check local filing requirements, as they can vary. If you are unsure where to begin, consider using US Legal Forms, which provides clear guidance and access to necessary forms to streamline your filing process. Proper filing is crucial to protect your interests and secure your claims.

Yes, a King Washington UCC1 Financing Statement can be assigned as long as the original obligations represented by the financing statement are legally transferable. This assignment typically involves a formal agreement between the parties involved, and it may require the filing of an amendment to the original UCC statement. By using platforms like US Legal Forms, you can find the necessary templates and guidance to assist in this process, ensuring compliance with all legal requirements. This facilitates the smooth transfer of rights under the financing statement.

To obtain a copy of a King Washington UCC1 Financing Statement, you can visit the Secretary of State's website for your state, where they often provide access to public records. Alternatively, you can request copies directly from the filing office, either online or in person. Using services like US Legal Forms can help streamline this process, allowing you to access UCC filings quickly and efficiently. This ensured access helps you stay informed about financing statements related to your interests.

The King Washington UCC1 Financing Statement is typically filed with the Secretary of State in the state where the borrower is located. Each state has its own procedures and regulations for filing, so it is important to check local guidelines. You can also file through various online platforms, such as US Legal Forms, which simplify the UCC filing process. This ensures your financing statement is properly recorded and publicly accessible.

The grantee on a King Washington UCC1 Financing Statement is the party to whom the security interest is granted, typically the lender or creditor. This party benefits from the collateral described in the statement if the debtor fails to meet their obligations. It is important for the grantee's details to be accurate on the form to ensure proper legal recognition of the interest. If this process seems complex, uslegalforms can help clarify roles and streamline the filing.

In Washington state, a King Washington UCC1 Financing Statement serves as a public notice of a secured interest in personal property. This document is essential for creditors, as it enables them to claim rights to the collateral in case the debtor defaults. By filing a UCC-1, you can protect your financial interests and secure your position in the event of disputes. Understanding this process is crucial for anyone engaging in secured transactions.

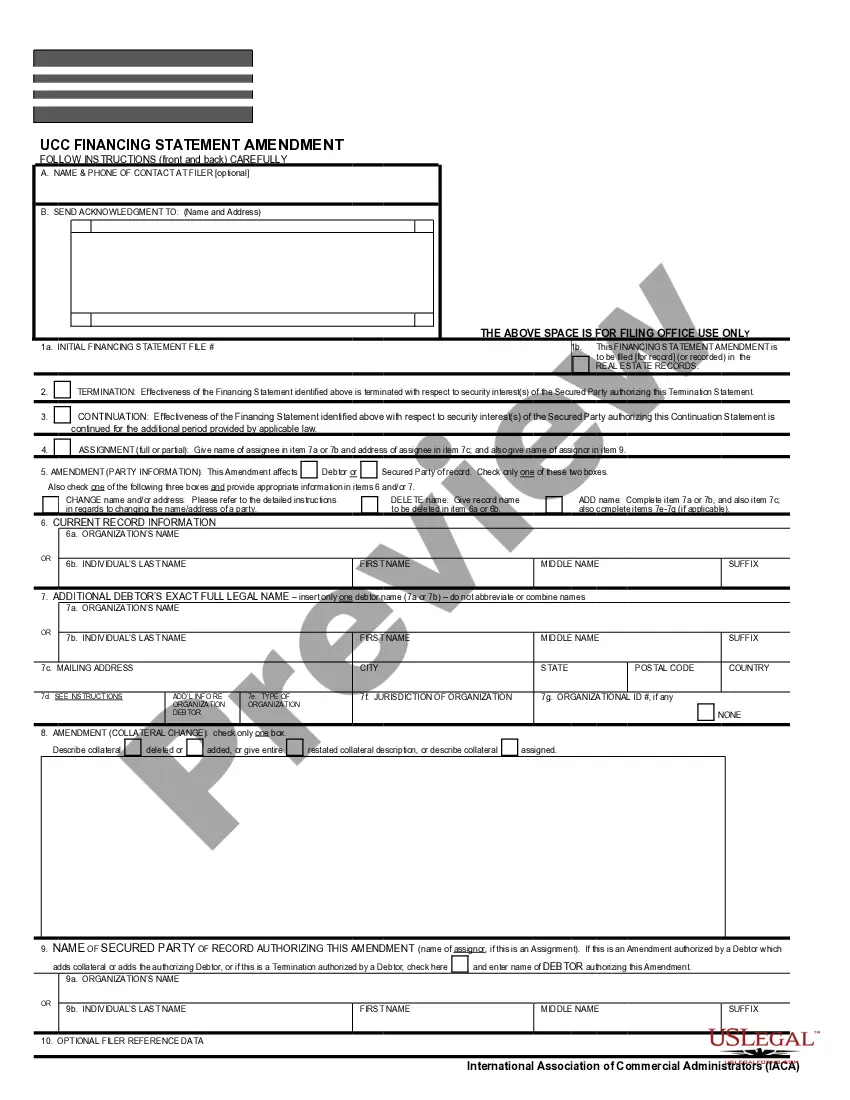

A King Washington UCC1 Financing Statement typically appears as a standardized form divided into sections for filing information. The top section includes the names and addresses of the debtor and the secured party. The body of the statement outlines the collateral description, making it clear what items are covered by the financing statement. This form is essential for establishing your security interest and protecting your rights.

Filling out a King Washington UCC1 Financing Statement requires you to provide accurate information about the debtor, secured party, and the collateral. Start by entering the debtor's name and address, ensuring they match official records. Next, include your name as the secured party and provide details about the collateral to establish your security interest. For a smooth process, consider using uslegalforms, which can guide you through the required steps.