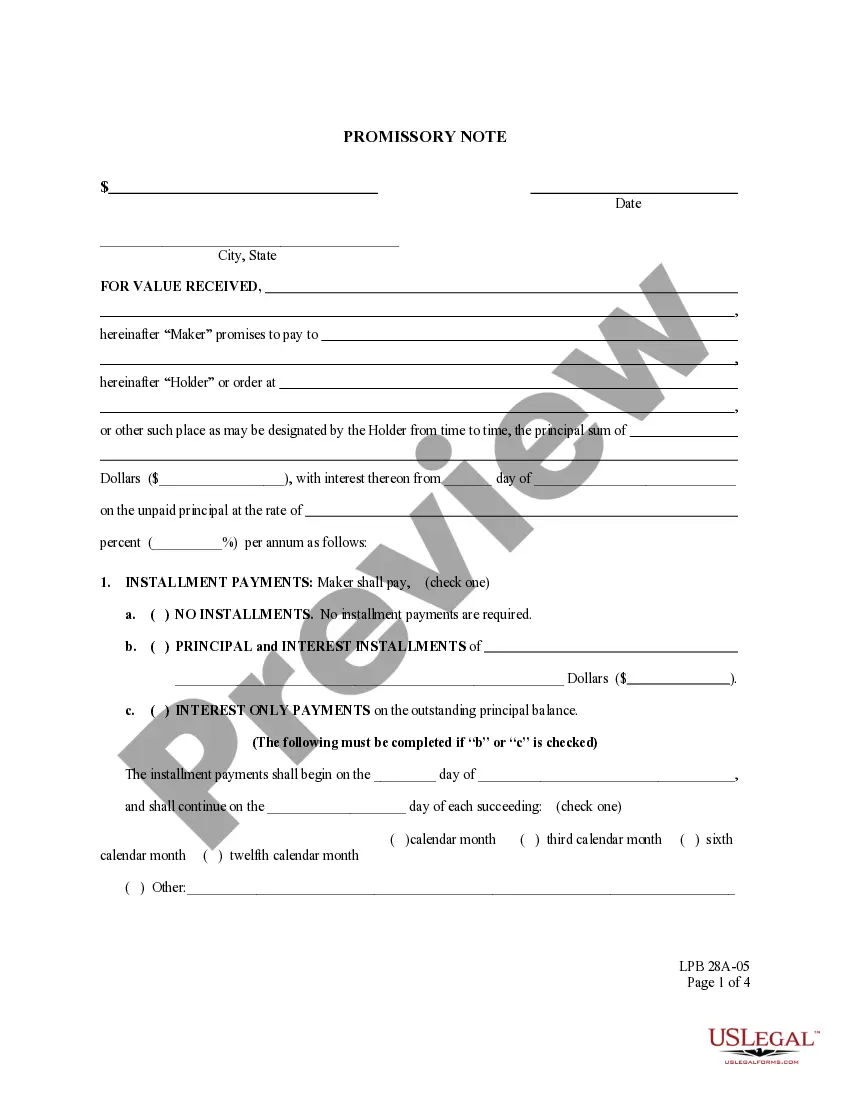

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

King Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Washington Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

No matter one’s social or occupational standing, finalizing legal documents is a regrettable requirement in the contemporary world.

Frequently, it’s almost impossible for an individual without any legal training to create such documents from the ground up, primarily due to the intricate jargon and legal nuances they involve.

This is where US Legal Forms proves to be beneficial.

Verify that the form you have found is appropriate for your locality since the laws of one state do not apply to another.

Review the form and check a brief summary (if available) of the scenarios in which the document can be utilized.

- Our service offers an extensive collection featuring over 85,000 ready-to-use state-specific documents applicable to nearly any legal matter.

- US Legal Forms also acts as a valuable resource for associates or legal advisors looking to save time by using our DIY forms.

- Whether you require the King Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate or any other relevant paperwork for your state or locality, with US Legal Forms, everything is readily available.

- Here’s how to quickly obtain the King Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate utilizing our trustworthy service.

- If you’re already a registered customer, you can simply Log In to your account to download the desired document.

- However, if you’re new to our collection, make sure you follow these instructions before downloading the King Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

Form popularity

FAQ

To effectively fill out a promissory note, start with the date and full names of the parties involved. Next, detail the borrowed amount, interest rate, and repayment schedule, and clearly mark it as a King Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Finally, both parties should sign to finalize the agreement.

Filling out a promissory note involves stating the principal amount, the interest rate, and repayment terms. You should also include identifiers for both the borrower and lender, making sure to indicate if it is a King Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Lastly, ensure all parties sign the document to acknowledge their agreement.

To fill out a promissory demand note, start by clearly stating the date, names of the borrower and lender, and the amount being borrowed. Then, include the interest rate and payment schedule, ensuring to specify that it is a King Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Finally, both parties should sign and date the document to make it legally binding.

To file a promissory note like the King Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you typically submit it with the county clerk or recorder's office where the property is located. This process ensures that your note is officially recognized and provides public notice of the obligation. It's crucial to keep a copy for your records as well. If you need assistance with the filing process, consider using the uslegalforms platform, which offers resources to help you navigate this procedure smoothly.

Yes, promissory notes can indeed be backed by collateral. When you consider the King Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you see an example of how collateral enhances the security of the note. This arrangement often provides peace of mind for both lenders and borrowers, as the commercial real estate serves as a safety net. To learn more about how you can structure such agreements, explore the resources available on the uslegalforms platform.

Yes, a promissory note can indeed be secured by real property. This arrangement typically involves collateralizing the note with the real estate asset, giving the lender a claim to the property in case of default. In this way, the King Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate offers an added layer of security and reinforces the financial commitment of the borrower.

The promissory note journal entry is recorded by debiting the account that receives value, commonly the cash account, and crediting the notes payable account.

When the borrower signs the promissory note, the lender records the written promise in a Notes Receivable account, which appears under Assets on the lender's balance sheet. At the same time, the borrower records the obligation in a liabilities account such as Notes Payable, Bank Loans Payable, or something similar.

A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust. If the collateral is personal property, there will be a security agreement.