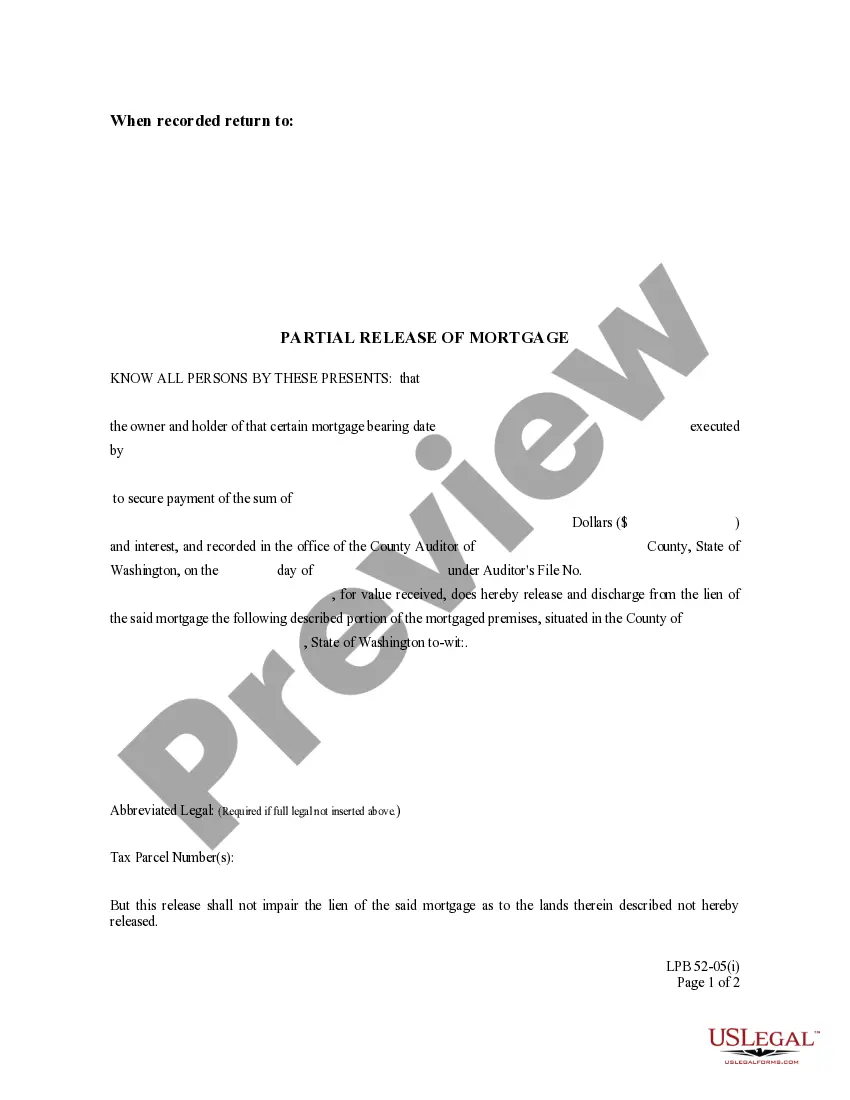

This is an official Washington court form, a Partial Release of Mortgage (with individual acknowledgment).

Tacoma Washington Partial Release of Mortgage with individual acknowledgment

Description

How to fill out Washington Partial Release Of Mortgage With Individual Acknowledgment?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It's a digital compilation of over 85,000 legal documents for both personal and business requirements as well as various real-world situations.

All the files are appropriately categorized by usage area and jurisdictional zones, making the search for the Tacoma Washington Partial Release of Mortgage with individual acknowledgment as straightforward as pie.

Maintaining documentation organized and within legal standards is critically important. Take advantage of the US Legal Forms library to always have vital document templates for any requirements right at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve selected the correct one that satisfies your requirements and aligns with your local jurisdictional criteria.

- Research for another template if necessary.

- If you discover any discrepancies, make use of the Search tab above to find the suitable one.

- If it meets your needs, proceed to the subsequent step.

Form popularity

FAQ

The duration for a Tacoma Washington Partial Release of Mortgage with individual acknowledgment can vary, but it typically takes a few weeks to complete. The timeline depends on several factors, including the lender's workload and the complexity of the property’s mortgage. Once you submit your request, your lender will review it and formulate the appropriate documents. While delays can happen, using resources from uslegalforms can help you streamline the process and ensure faster handling of your request.

A partial release is often included in real estate transactions where a homeowner wants to sell a portion of their property, such as a lot, while keeping the mortgage for the remaining area. This situation can arise in various scenarios, including refinancing or development purposes. Additionally, lenders may agree to a partial release if they see that the homeowner has made consistent payments and is in good standing. Utilizing uslegalforms can provide valuable resources for navigating these circumstances effectively.

The process of a Tacoma Washington Partial Release of Mortgage with individual acknowledgment involves the mortgage lender releasing a portion of the property from the mortgage obligation. Typically, this requires you to submit a formal request to your lender, providing information about the property and stating your reasons for the partial release. Once approved, the lender will prepare the necessary documentation to officially modify the mortgage. Using platforms like uslegalforms can help simplify this process, ensuring that you complete all necessary forms correctly.

A partial release is a legal action that allows a borrower to release some of the collateral securing a mortgage while keeping other portions intact. In Tacoma, Washington, this often involves specific documentation and the individual acknowledgment of all parties involved. Understanding how to navigate this process can help homeowners manage their assets effectively, and uslegalforms can assist you in creating the necessary legal documents.

A partial release clause is typically found in a mortgage agreement and outlines the conditions under which certain properties can be released from the mortgage obligation. In Tacoma, Washington, this clause details the specific terms that must be met for a collateral release to occur, including any necessary documentation and acknowledgment from involved parties. This ensures that both lenders and borrowers understand their rights and obligations prior to executing any releases.

You can back out of a home refinance, within a certain grace period, for any reason, but you may face a fees or penalty if you choose to cancel or otherwise can't refinance. When a refinance doesn't go through, you typically must cut your losses for certain up-front costs you paid during the refinance process.

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The total amount of the home loan. The down payment amount. Whether monthly or bimonthly payments are required.

If you decide not to proceed with an application for a particular loan, you don't need to do anything further. If you do not communicate further with the lender, the lender will most likely close out your application.

Only if the notary public is an attorney, supervised by an attorney (such as a paralegal), or prepares such documents as a licensed professional. Even then, a notary public must not be party to the transaction or have a direct beneficial interest in it.

?In California, a notary public is not prohibited from notarizing for relatives or others, unless doing so would provide a direct financial or beneficial interest to the notary public. With California's community property law, care should be exercised if notarizing for a spouse or a domestic partner.?