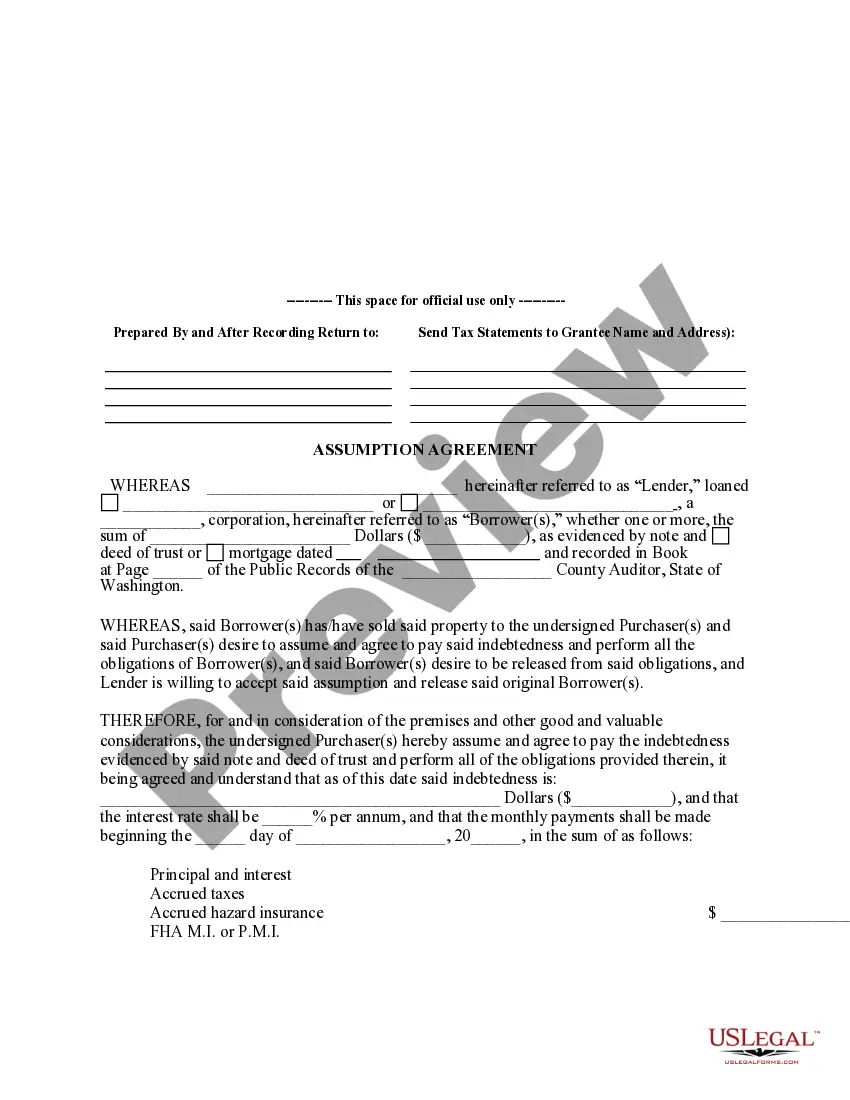

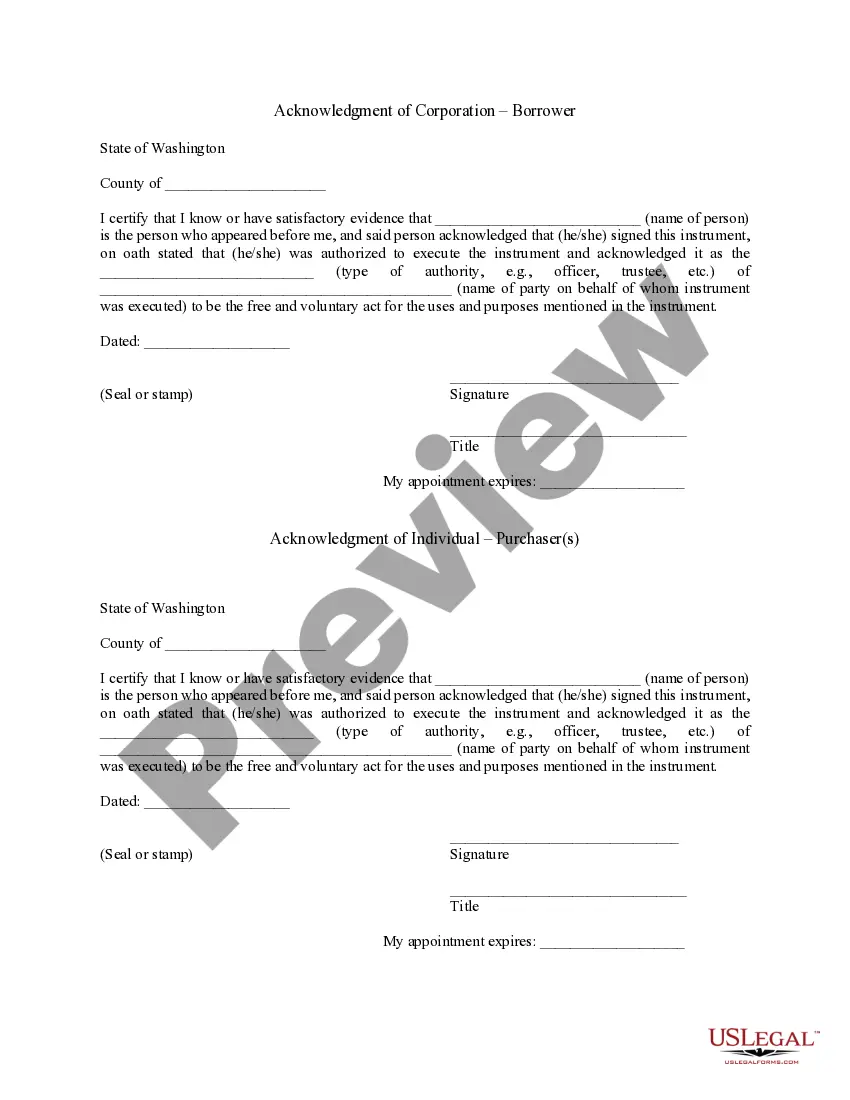

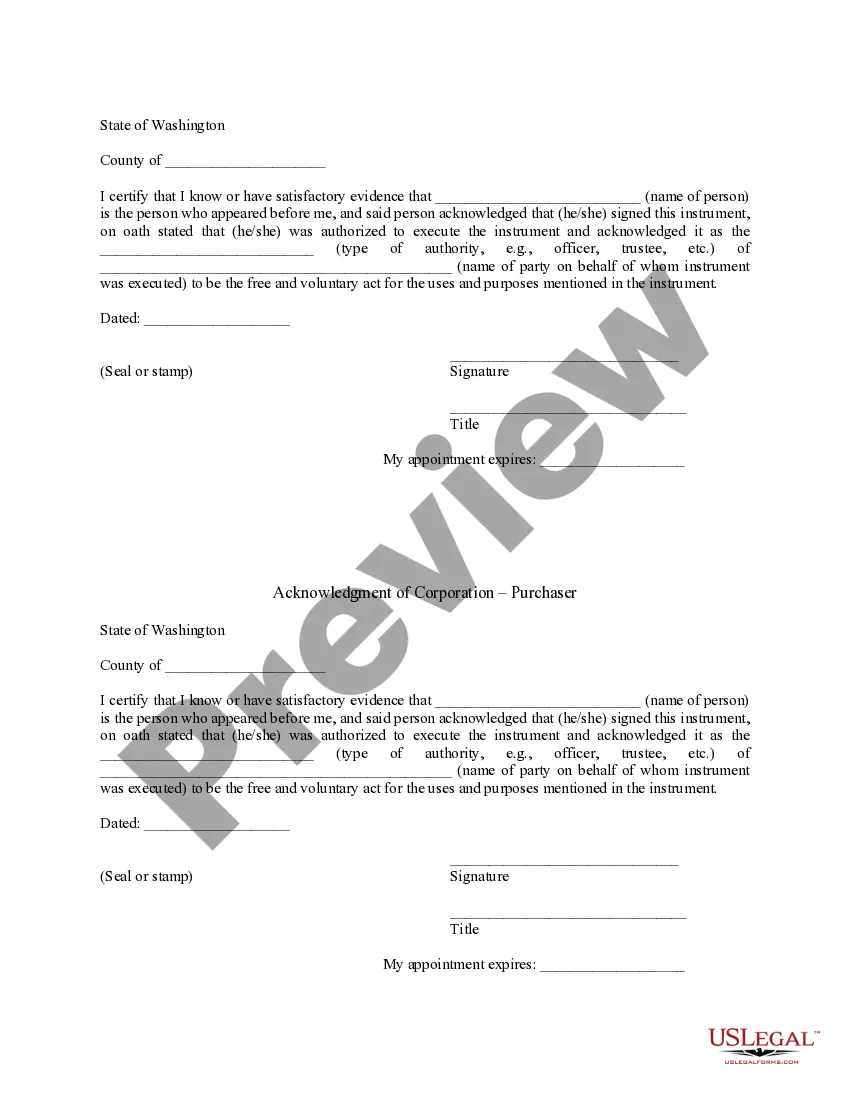

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Seattle Washington Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Washington Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

If you have previously utilized our service, sign in to your account and secure the Seattle Washington Assumption Agreement of Deed of Trust and Release of Original Mortgagors on your device by clicking the Download button. Ensure that your subscription is active. If not, renew it in accordance with your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You enjoy unrestricted access to every document you have purchased: you can find it in your profile within the My documents section whenever you wish to use it again. Take advantage of the US Legal Forms service to efficiently find and save any template for your personal or business requirements!

- Confirm that you have found a suitable document. Review the description and utilize the Preview feature, if available, to determine if it suits your requirements. If it does not, utilize the Search tab above to find the correct one.

- Procure the template. Click the Buy Now button and choose either a monthly or yearly subscription option.

- Create an account and complete the payment. Use your credit card information or select the PayPal choice to finalize the purchase.

- Receive your Seattle Washington Assumption Agreement of Deed of Trust and Release of Original Mortgagors. Choose the file format for your document and download it to your device.

- Complete your form. Print it out or use online editing tools to fill it out and sign it digitally.

Form popularity

FAQ

In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

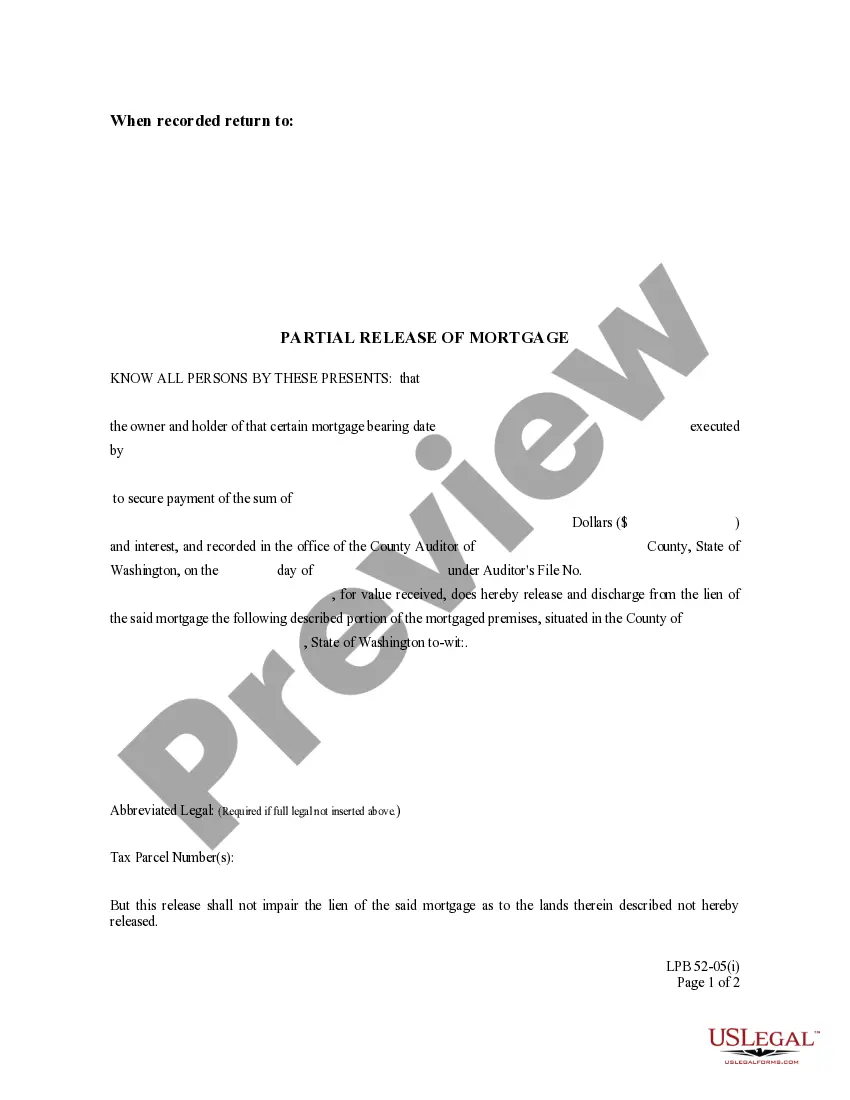

Either the beneficiary of the deed of trust must be located and asked to sign a request for reconveyance or the property owner must prove to the trustee that the obligation was satisfied and the property should be reconveyed.

Assumption and Release means the agreement to be entered into by ADI, the Subsidiary Borrower and the Administrative Agent pursuant to which the Subsidiary Borrower assumes all of the Obligations and becomes the ?Borrower?, in each case for all purposes of this Agreement and the other Loan Documents, and ADI is

In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

Once you've met all the mortgage payment terms or fully repaid your loan, your lender's legal team draws up the deed of release form and in it reports that: you've repaid the loan in full under the terms required; and. the lender has removed its charge or 'lien' and has transferred full title to you.

The three players involved in a deed of trust are: The ?trustor,? also known as the borrower. The ?trustee,? typically a title company with the power of sale, legal title to the real property, and the ability to hold a nonjudicial foreclosure. The ?beneficiary,? also known as the lender.

Removal of the deed of trust is usually done by a ?reconveyance? of the property affected by the deed of trust. In the typical case, when the money has been paid in full or the obligation has been fully performed, the beneficiary of the deed of trust makes a written request to the trustee to ?reconvey? the property.

The Trustee in a Deed of Trust is the party who holds legal title to the property during the life of the loan. Trustees will most often have one of two jobs. If the property is sold before the loan is paid off, the Trustee will use the proceeds from the sale to pay the lender any outstanding portion of the loan.

Promissory notes and deeds of trust are subject to Washington's six-year statute of limitations. Installment notes have two separate six-year limitations periods.

An attorney licensed to practice law in Ohio must prepare deeds, powers of attorney, and other instruments that are to be recorded. One exception is that a party to the transaction may prepare an instrument in which they are a party.