This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Vancouver Washington Living Trust for Husband and Wife with One Child

Description

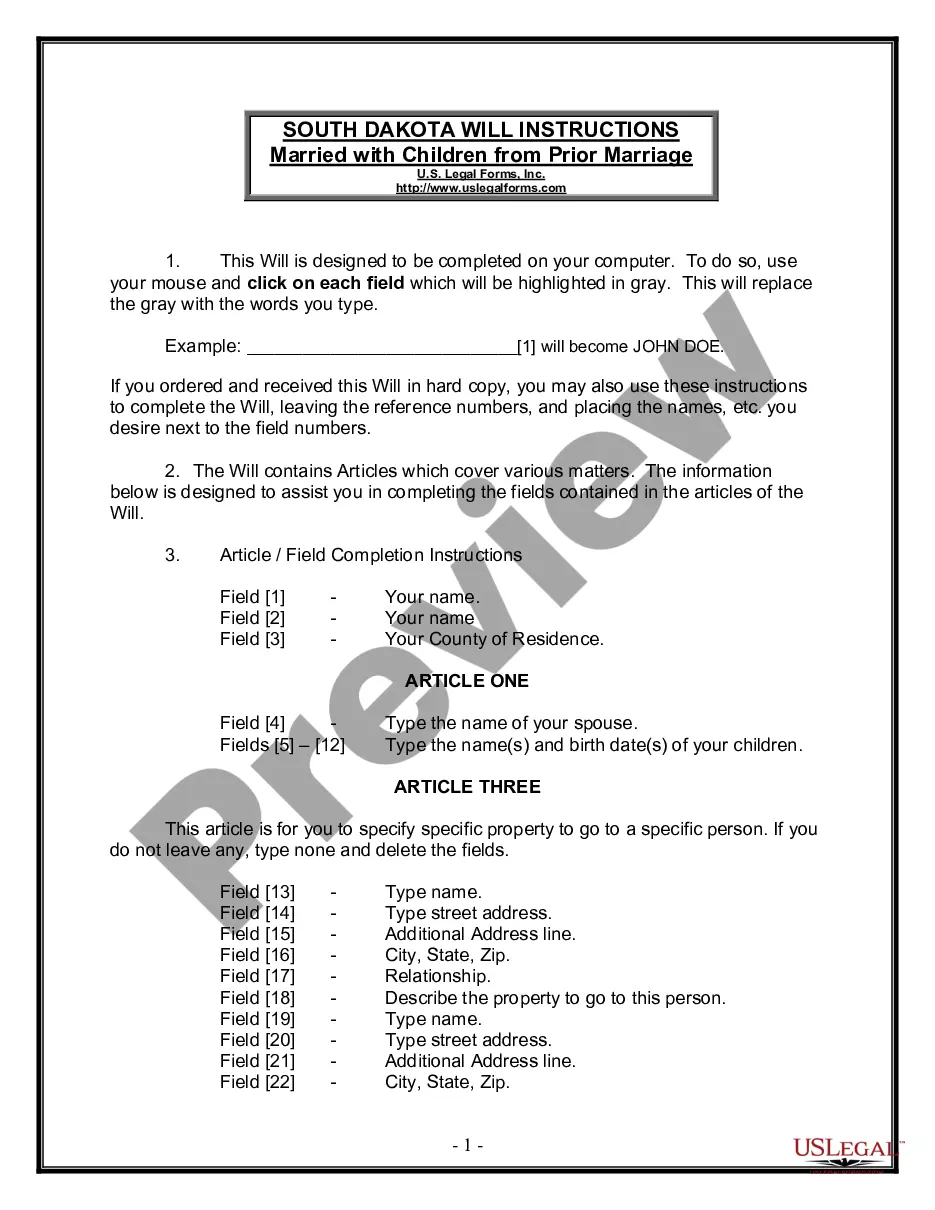

How to fill out Washington Living Trust For Husband And Wife With One Child?

If you have previously utilized our service, sign in to your account and download the Vancouver Washington Living Trust for a Husband and Wife with One Child onto your device by tapping the Download button. Ensure your subscription is active. If it is not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to quickly locate and save any template for your personal or professional requirements!

- Ensure you have found an appropriate document. Review the description and utilize the Preview option, if available, to verify if it aligns with your requirements. If it does not meet your expectations, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Vancouver Washington Living Trust for a Husband and Wife with One Child. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Yes, a married couple can have one living trust that covers both partners. This approach simplifies management and distribution of assets, making financial planning easier for families. With a Vancouver Washington Living Trust for Husband and Wife with One Child, you can designate your child as the beneficiary, ensuring a seamless transfer of assets in the future. Utilizing a service like UsLegalForms can help you create a trust that fits your specific needs.

The best type of trust for a married couple often depends on their specific financial situation and family dynamics. A revocable living trust usually provides flexibility and control for both spouses. By establishing a Vancouver Washington Living Trust for Husband and Wife with One Child, couples can efficiently manage community property, reduce estate taxes, and secure their child’s future.

The most common living trust is the revocable living trust. This trust allows individuals to retain control over their assets during their lifetime, while seamlessly transferring them to beneficiaries upon passing. When you create a Vancouver Washington Living Trust for Husband and Wife with One Child, you simplify the process of asset transfer, reduce probate costs, and ensure your child receives your assets as you intended.

The most popular form of marital trust is the Qualified Terminable Interest Property (QTIP) trust. This trust allows a husband or wife to leave property to their spouse while controlling how the property is distributed after the surviving spouse's death. A Vancouver Washington Living Trust for Husband and Wife with One Child can include QTIP provisions, offering peace of mind and protection for your child’s inheritance.

For remarried couples, a testamentary trust or a revocable living trust can be suitable options. These types of trusts can provide flexibility and help ensure that both spouses' wishes are honored. Specifically, a Vancouver Washington Living Trust for Husband and Wife with One Child can efficiently manage assets and provide for children from previous marriages, ensuring that all family members are considered.

A joint spousal trust is a type of trust that two spouses can create together, allowing them to manage their shared assets collaboratively. This trust helps ensure that both partners retain control while facilitating easier distribution to heirs. For couples considering a Vancouver Washington Living Trust for Husband and Wife with One Child, a joint spousal trust can be an effective way to safeguard family wealth for future generations.

The best living trust for a married couple often includes a joint trust, which combines both partners' assets into one trust. This approach can streamline management and ensure that both spouses are protected. For those in a Vancouver Washington Living Trust for Husband and Wife with One Child, a joint trust can facilitate a smooth transition of assets to your child, reflecting your family’s needs.

Placing your house in a trust can offer several advantages, such as avoiding probate and protecting your asset from potential creditors. In the context of a Vancouver Washington Living Trust for Husband and Wife with One Child, this can simplify the transfer of property to your child. It is a proactive step to ensure your home remains secure and accessible to your loved ones.

Yes, you can create your own living trust in Washington State. However, ensuring it meets legal standards and adequately covers your unique family situation is crucial. Utilizing a tool like USLegalForms can help you draft a comprehensive Vancouver Washington Living Trust for Husband and Wife with One Child, ensuring nothing important is overlooked.

A common mistake parents make when establishing a trust fund is failing to choose the right trustee. Selecting a trustee who does not understand the specific needs of the family can lead to mismanagement of the trust. Additionally, not clearly defining the terms of the Vancouver Washington Living Trust for Husband and Wife with One Child can cause confusion and disputes later on.