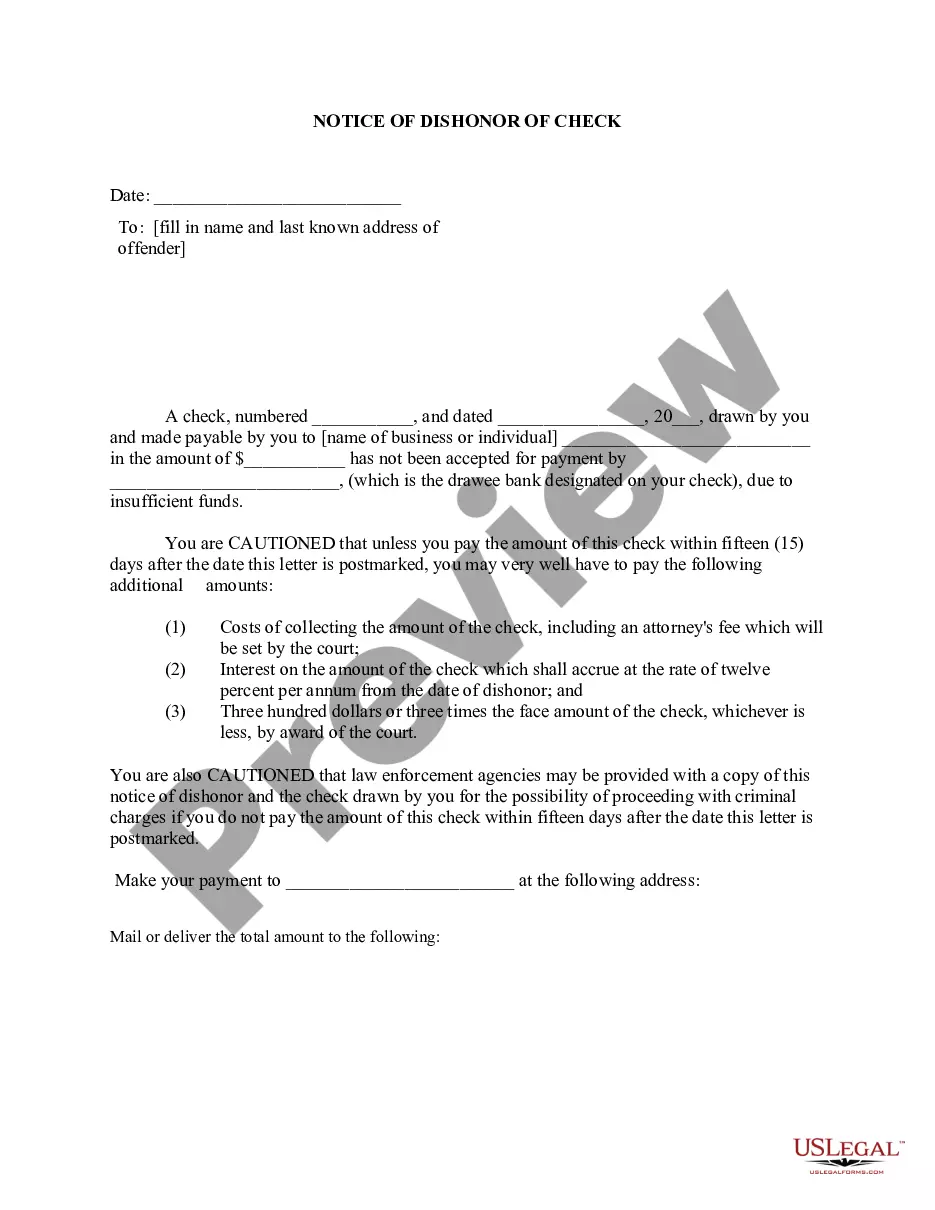

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

King Washington Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Washington Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Regardless of social or professional standing, filling out legal documents is a regrettable requirement in today’s society.

Frequently, it’s nearly unfeasible for an individual without formal legal training to create such paperwork independently, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms proves beneficial.

Make sure the template you select is appropriate for your area since the laws of one region do not apply to another.

Examine the document and review a brief overview (if accessible) of situations for which the paper may be utilized. If the form you chose does not fulfill your needs, you can start over and look for the proper form.

- Our platform provides an extensive array with more than 85,000 ready-to-use state-specific documents suitable for nearly any legal matter.

- US Legal Forms also serves as an outstanding resource for associates or legal advisors aiming to enhance their efficiency using our DYI documents.

- Whether you need the King Washington Notice of Dishonored Check - Civil - Keywords: bad check, bounced check or any other form that is valid in your locality, with US Legal Forms, everything is easily accessible.

- Here’s how to obtain the King Washington Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in minutes utilizing our reliable platform.

- If you are currently an existing customer, you can proceed to Log In to your account to download the required document.

- However, if you are new to our collection, ensure you complete these steps before downloading the King Washington Notice of Dishonored Check - Civil - Keywords: bad check, bounced check.

Form popularity

FAQ

If someone writes you a bad check, you have several options for recourse. First, you can contact the issuer to request payment; often, this can resolve the issue quickly. If that does not work, you may consider filing a King Washington Notice of Dishonored Check - Civil to formally document the bounced check. This step not only demonstrates your seriousness about the matter but also provides a path forward to recover your funds.

A check with insufficient funds is commonly known as a bad check or a bounced check. When someone writes a check that their bank cannot honor due to a lack of funds, it falls into this category. In such cases, the recipient may seek a King Washington Notice of Dishonored Check - Civil to address the situation. Utilizing this notice provides clarity on how to proceed and ensures that your rights are protected.

When a check bounces due to insufficient funds, the recipient is often notified that the funds were not available for withdrawal. This can lead to additional fees for both the sender and the recipient, possibly escalating to legal action if not resolved. Understanding the implications of a bounced check is crucial; utilizing resources from uslegalforms can help you address the situation effectively, especially concerning the King Washington Notice of Dishonored Check - Civil.

To write a bounced check letter, begin by clearly stating the date, the amount of the check, and its original recipient. Next, explain that the check bounced due to insufficient funds, and express your intent to resolve the matter promptly. Utilizing templates available through uslegalforms can ensure your letter is both professional and effective, aligning with the requirements surrounding King Washington Notice of Dishonored Check - Civil.

Yes, writing a check you know will bounce is considered illegal and can lead to criminal charges. Intentional issuance of a bad check could result in serious legal troubles, including fines and possible jail time. To avoid such issues, it is wise to ensure sufficient funds are available before issuing a check. If you face a bounced check situation, you may want to use resources like uslegalforms to navigate the King Washington Notice of Dishonored Check - Civil process.

Typically, a bank has up to six months to dishonor a check from the date it was written. Beyond this period, the bank may refuse to process the check due to various regulations. Knowing this timeframe is essential, especially if you encounter a bounced check situation. For guidance on handling these circumstances, consider reviewing options available through the King Washington Notice of Dishonored Check - Civil and consult the resources provided by US Legal Forms.

Disputing a bounced check involves gathering documentation that supports your case. First, collect the check, any correspondence with the payee, and records of the transaction. You can then formally reach out to the bank and present your dispute. Utilizing resources like US Legal Forms can aid you in understanding the proper procedures for filing a dispute and navigating the King Washington Notice of Dishonored Check - Civil process.

The terms bounced check and dishonored check are often used interchangeably, as both refer to a check that the bank does not honor. A bounced check usually implies a rejection due to insufficient funds, while a dishonored check might include other scenarios such as issues with signatures or closed accounts. Regardless of the terminology, both situations can lead to serious consequences. When faced with such issues, it's critical to understand your options under the King Washington Notice of Dishonored Check - Civil framework.