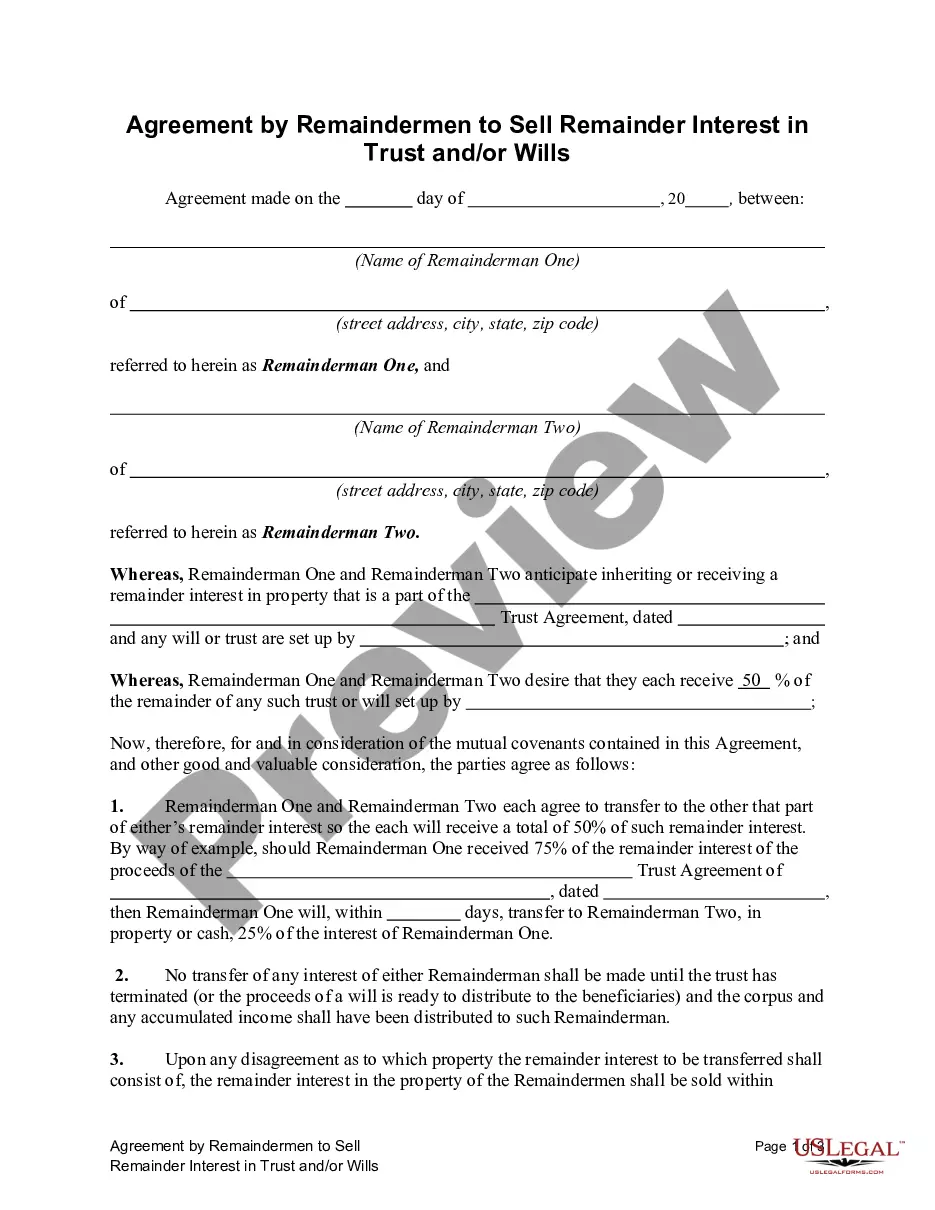

This form is an agreement between individuals who hold the status of remainderman in a trust and/or will to sell to each an amount of their interest in the asset so as to establish an agreed percentage of interest by each party.

Everett Washington Agreement by Remainderman to Sell Remainder Interest in Trust and/or Wills

Description

How to fill out Washington Agreement By Remainderman To Sell Remainder Interest In Trust And/or Wills?

We consistently aim to reduce or avert legal repercussions when engaging with intricate legal or financial matters.

To achieve this, we enlist legal assistance that is generally quite costly. Yet, not all legal challenges are equally intricate. Many can be handled independently.

US Legal Forms is an online repository of updated do-it-yourself legal templates covering a wide range of topics from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our collection empowers you to manage your matters independently without the need for a lawyer's services.

We offer access to legal document templates that are not always readily accessible. Our templates are tailored to state and regional requirements, significantly easing the search process.

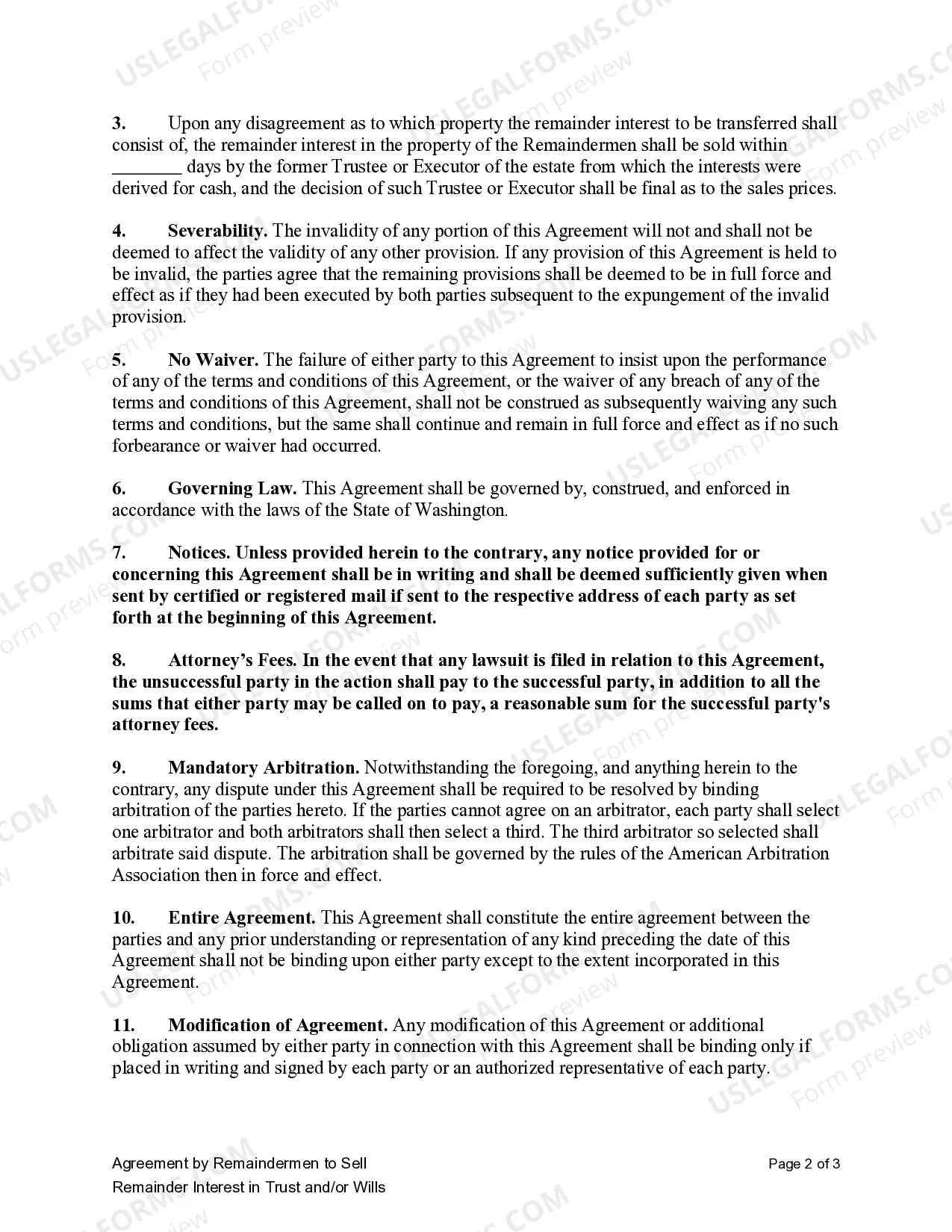

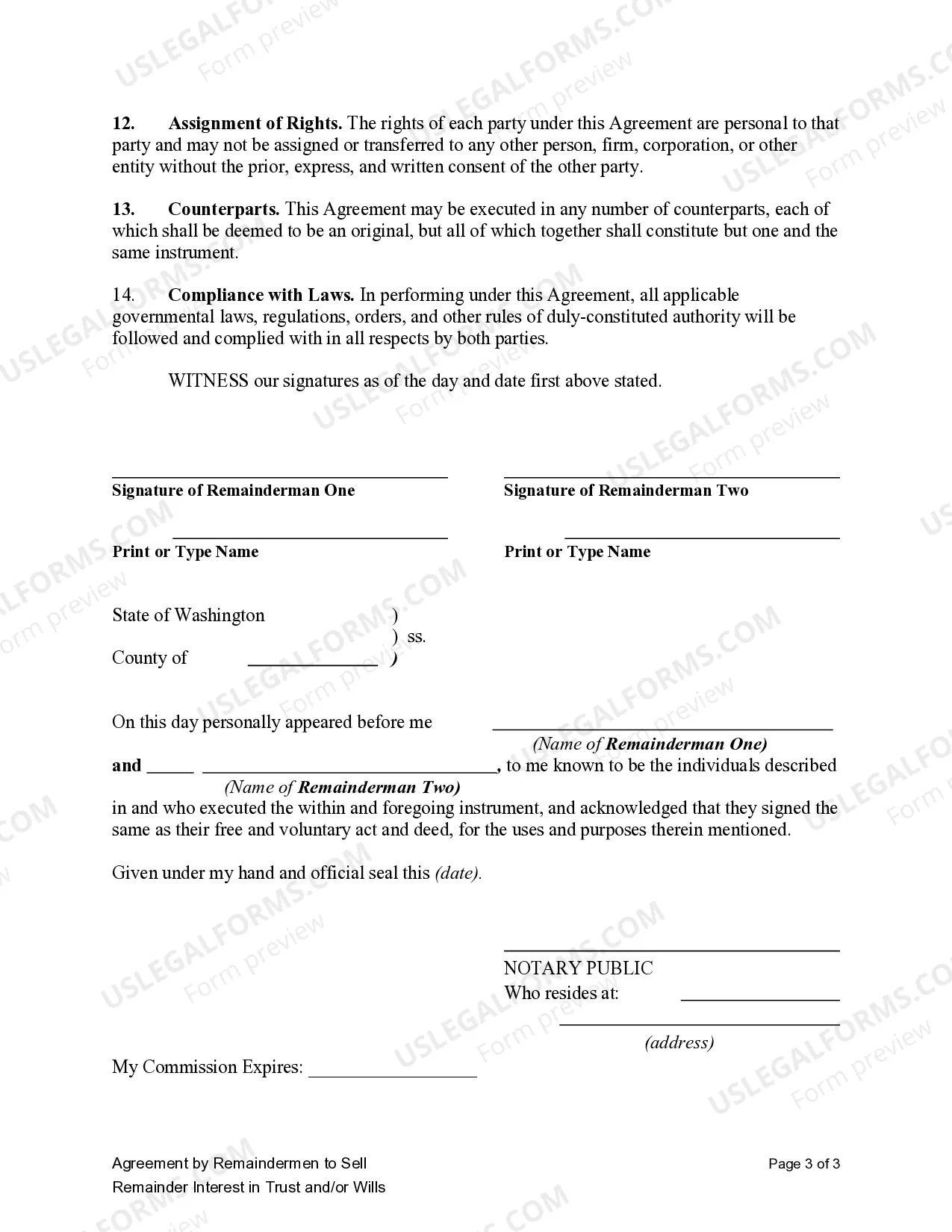

Ensure that the Everett Washington Agreement by Remainderman to Sell Remainder Interest in Trust and/or Wills complies with the laws and regulations of your specific state and area. It's also vital to review the form's outline (if it is provided), and if you find any inconsistencies with what you initially sought, look for an alternative form. Once you have confirmed that the Everett Washington Agreement would be suitable for your situation, you can select a subscription plan and proceed to payment. You can then download the document in any compatible format. Over the past 24 years, we have assisted millions by providing customizable and current legal forms. Make the most of US Legal Forms today to conserve time and resources!

- Take advantage of US Legal Forms whenever you need to locate and download the Everett Washington Agreement by Remainderman to Sell Remainder Interest in Trust and/or Wills or any other document with ease and security.

- Simply Log In to your account and click the Get button next to it.

- If you misplace the document, you can always retrieve it again from within the My documents section.

- Creating your account is just as simple if you're visiting the website for the first time!

Form popularity

FAQ

To calculate the charitable remainder trust deduction, you need to determine the present value of the charitable interest and the present value of the non-charitable remainder interest. The IRS provides guidelines for this calculation, often using life expectancy tables. Utilizing platforms like uslegalforms can simplify this process when drafting an Everett Washington Agreement by Remainderman to Sell Remainder Interest in Trust and/or Wills, making sure that the deduction is accurately reflected.

When valuing remainder interest in real estate, appraisers look at the property's current market value and the terms of the trust. They will also factor in the estimated lifespan of the income beneficiary. For those interested in an Everett Washington Agreement by Remainderman to Sell Remainder Interest in Trust and/or Wills, properly valuing the interest can lead to a smoother transaction.

Valuing remainder interest in a trust involves assessing several factors, including the current market value of the assets held in the trust and the life expectancy of the income beneficiary. You can use actuarial tables to estimate this based on life expectancy. This valuation is essential for documents like the Everett Washington Agreement by Remainderman to Sell Remainder Interest in Trust and/or Wills, as it provides clarity for potential buyers.

To remove a remainderman from a life estate, you may need to execute an Everett Washington Agreement by Remainderman to Sell Remainder Interest in Trust and/or Wills. This legal document allows you to transfer or eliminate the interest held by the remainderman in the property. It is crucial to follow legal procedures to ensure the change is valid and enforceable. You might also consider consulting with a legal professional or using platforms like US Legal Forms to simplify the process and ensure compliance with Washington laws.

To calculate the value of a remainder interest, one should consider the life tenant's age and the anticipated duration of their interest. This involves using present value formulas adapted for the uniqueness of each case. Implementing the Everett Washington Agreement by Remainderman to Sell Remainder Interest in Trust and/or Wills can offer guidance on how to approach this valuation effectively.

The value of the remainder interest in real estate is influenced by the property's potential future worth and the life expectancy of the current occupant. This assessment often requires professional appraisals and knowledge of market trends. Using the Everett Washington Agreement by Remainderman to Sell Remainder Interest in Trust and/or Wills can assist in establishing a clear understanding of this value in your transactions.

Calculating the value of a remainder interest requires assessing the life tenant's lifespan and the present value of the property. Financial experts often apply mathematical formulas to determine this value, taking into consideration other factors like market conditions. By consulting the Everett Washington Agreement by Remainderman to Sell Remainder Interest in Trust and/or Wills, you can obtain additional insights into this calculation process.

Yes, a remainderman can sell their interest in a life estate, but it is essential to navigate this process carefully. This sale typically requires the consent of the life tenant or involves specific legal procedures. Engaging with the Everett Washington Agreement by Remainderman to Sell Remainder Interest in Trust and/or Wills can provide the necessary framework for completing this transaction smoothly.

Valuing a remainder interest in a trust involves several factors, including the age of the life tenant and the expected duration of their life. Financial professionals often use tables and actuarial data to determine this value accurately. Utilizing the Everett Washington Agreement by Remainderman to Sell Remainder Interest in Trust and/or Wills can facilitate this valuation process, ensuring both parties understand the worth of the interest.

A remainder interest is the right to receive property after a certain event, typically the death of a life tenant. This type of interest allows someone to inherit or gain access to the asset once the life estate has concluded. Understanding remainder interests is crucial, especially when navigating an Everett Washington Agreement by Remainderman to Sell Remainder Interest in Trust and/or Wills, as it influences how you manage and transfer assets.