This form is used as a method for a lienholder of property to avoid a lengthy and expensive foreclosure process. With a deed in lieu of foreclosure, a foreclosing lienholder agrees to have the ownership interest transferred to the bank/lienholder as payment in full. The debtor simply deeds the property to the bank as a substitute for foreclosure.

King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation

Description

How to fill out Washington Deed In Lieu Of Foreclosure - Husband And Wife To Corporation?

Do you require a reliable and economical provider of legal documents to obtain the King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation? US Legal Forms is your preferred option.

Whether you need a simple contract to establish guidelines for living with your partner or a bundle of forms to facilitate your separation or divorce process in court, we've got you covered. Our platform offers over 85,000 current legal document templates for both personal and business purposes. All templates we provide are not generic; they are tailored according to the specifications of specific states and counties.

To acquire the form, you must Log In to your account, find the required template, and click the Download button adjacent to it. Please note that you can retrieve your previously purchased document templates at any time from the My documents section.

Is this your first visit to our site? No problem. You can easily set up an account, but before you do, ensure to follow these steps.

Now you can register your account. Choose a subscription plan and move on to payment. Once the payment has been finalized, download the King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation in any available format. You can revisit the website at any time to redownload the form without incurring additional costs.

Locating current legal forms has never been simpler. Try US Legal Forms today, and leave behind the hassle of spending your valuable time searching for legal documents online.

- Verify that the King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation meets the requirements of your state and locality.

- Review the form’s description (if provided) to understand who and what the form is intended for.

- Initiate the search again if the template does not fit your legal situation.

Form popularity

FAQ

Processing a King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation involves several steps. First, you should contact your lender to discuss the deed in lieu option and obtain their requirements. Next, prepare the necessary documentation, including financial statements and proof of hardship. Finally, work with a legal professional or the uSlegalforms platform to ensure all paperwork is completed accurately and submitted to your lender.

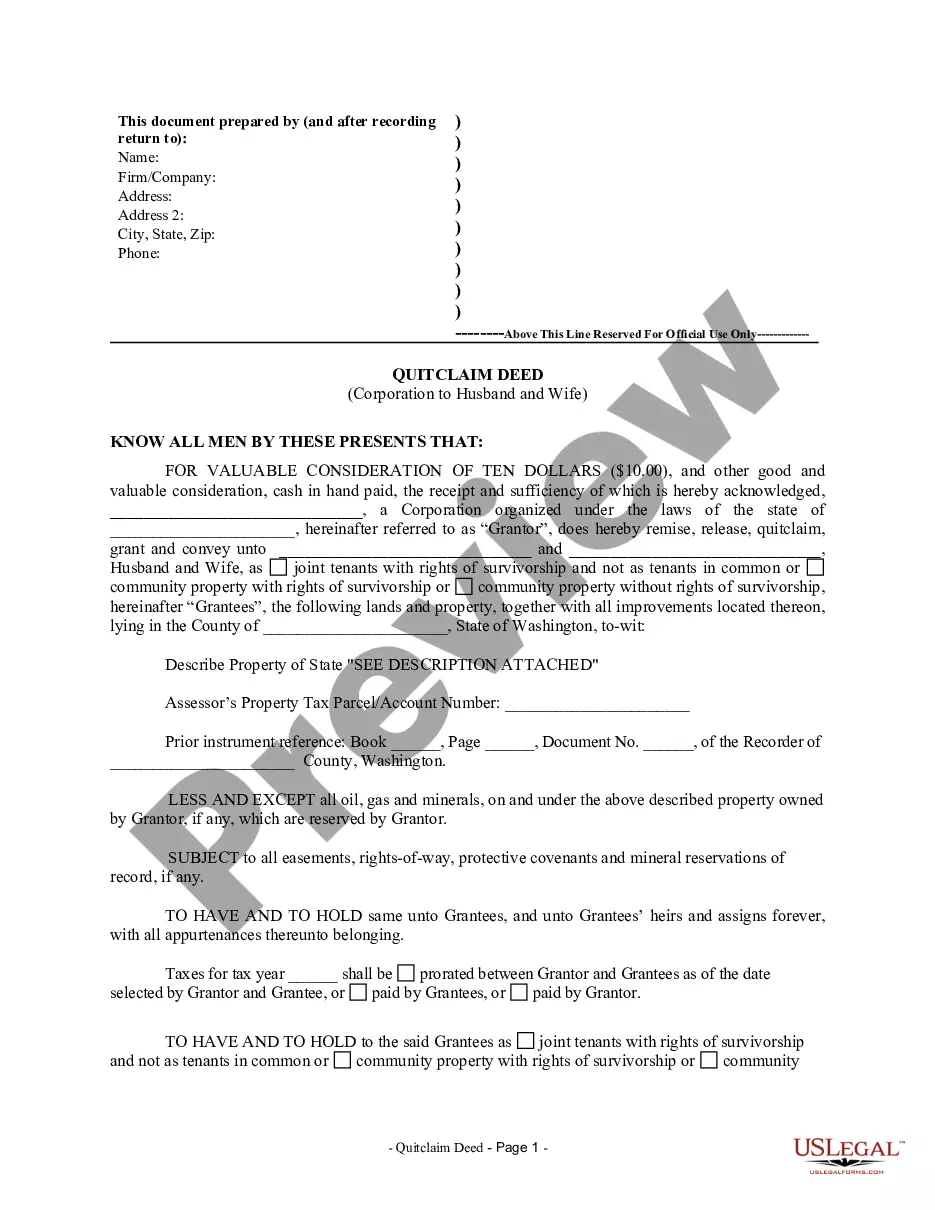

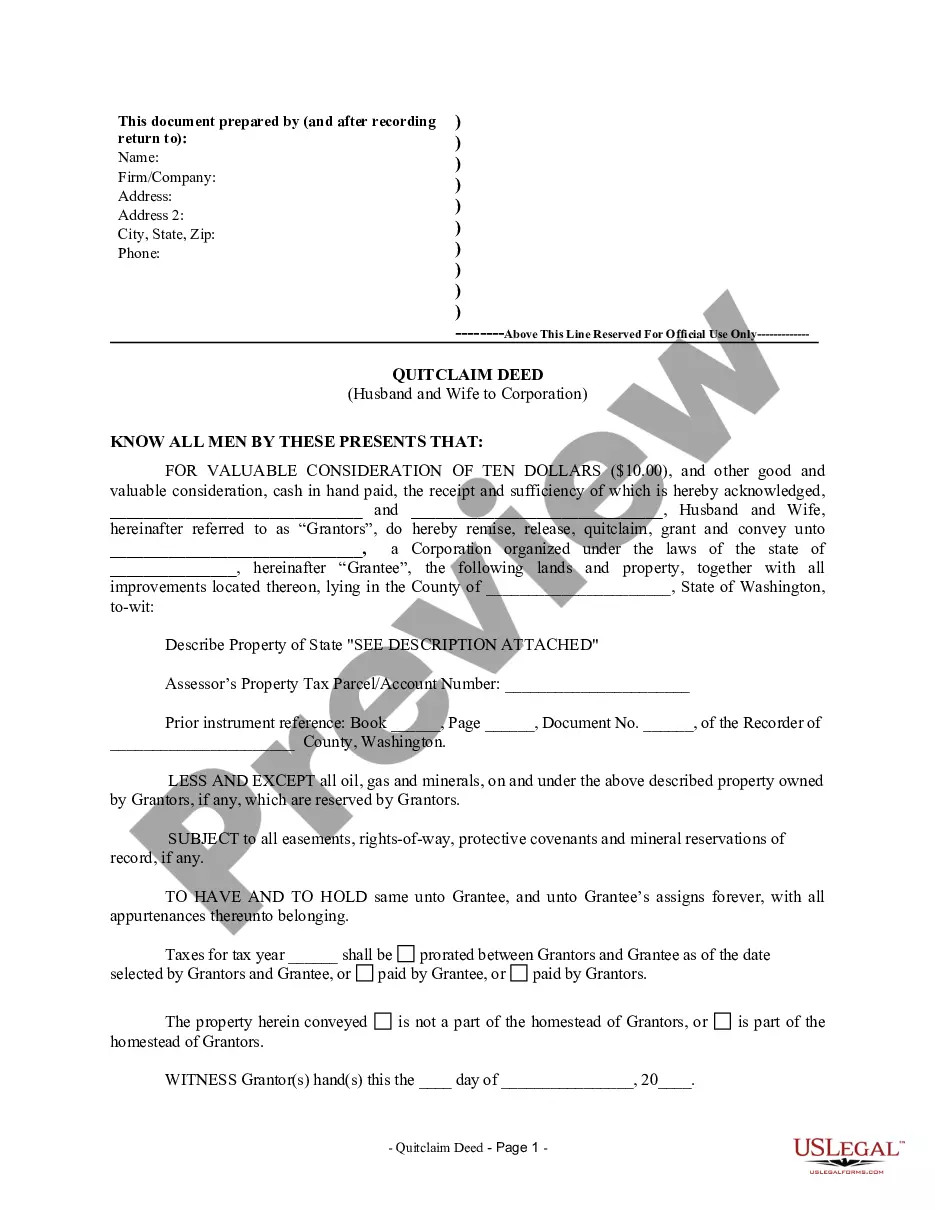

When opting for a King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation, sellers should gather several important documents. This includes the original mortgage agreement, a title report, proof of ownership, and any correspondence with the lender regarding the deed in lieu. Having these documents organized can facilitate the process and help ensure a smoother transaction.

Writing a letter for a King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation requires clarity and professionalism. Begin by stating your intent to transfer the property to the corporation due to financial hardships. Include pertinent property information and express your request for the lender's consent. It may be wise to consult a legal professional or utilize resources like uslegalforms to ensure proper wording and compliance.

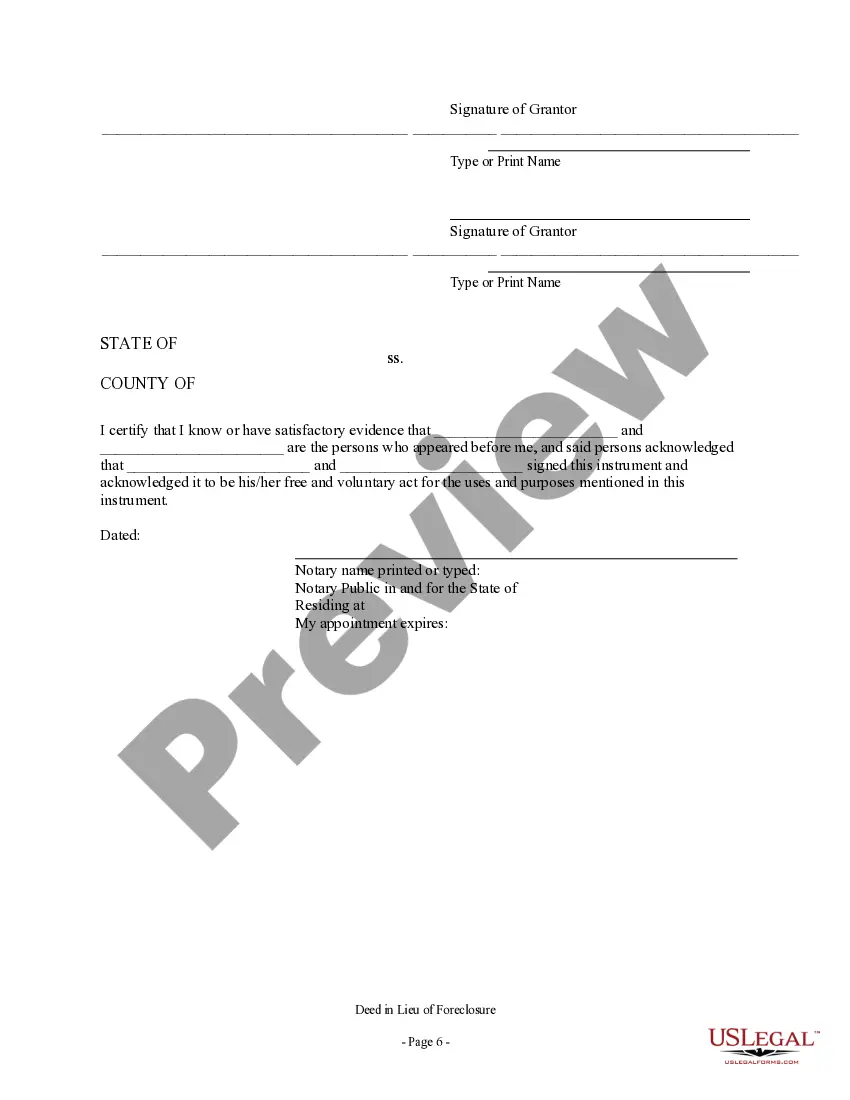

To file a King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation, start by preparing the necessary documents, including the deed itself. Next, ensure both parties sign the deed in front of a notary. Finally, submit the signed and notarized deed to your local county recorder's office to make the transfer official in public records.

While a King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation can simplify the process of avoiding foreclosure, it does come with some disadvantages. Transfer of ownership may still impact your credit score, although typically less than a foreclosure. Additionally, if there are liens exceeding the property value, the lender may not accept the deed in lieu, putting you in a challenging position.

Executing a King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation involves several key steps. First, confirm the property's title and ensure there are no existing liens or encumbrances that could complicate the process. You and your spouse must then prepare and sign the deed, followed by filing it with the appropriate local authorities to complete the transfer.

To execute a King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation, you need to start by drafting the deed. Both the husband and wife must agree to transfer the property to the corporation, ensuring you have the correct documentation. After signing, you will need to record the deed with your local county recorder's office to finalize the transaction.

While a King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation offers a quicker resolution for homeowners, it also comes with several disadvantages. Homeowners may find themselves losing any remaining equity they have in the property. Furthermore, this option can negatively affect their credit score, making it harder to secure future loans. Lastly, the process may not extinguish all debts tied to the property, leaving the former owners with lingering financial obligations.

A significant disadvantage for lenders accepting a King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation is the potential loss of recovery. When lenders accept this option, they often have to take on properties that may not sell for their full market value. This situation can lead to financial strain, especially if the property requires costly repairs. Additionally, lenders may face challenges in reselling the property, further impacting their financial recovery.

When you add a spouse to a property deed, such as in a King Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation, it can be treated as a gift under tax laws. The IRS may view this transfer as a gift, which could have capital gains implications if the property is sold later. Understanding these nuances helps couples navigate property ownership effectively.