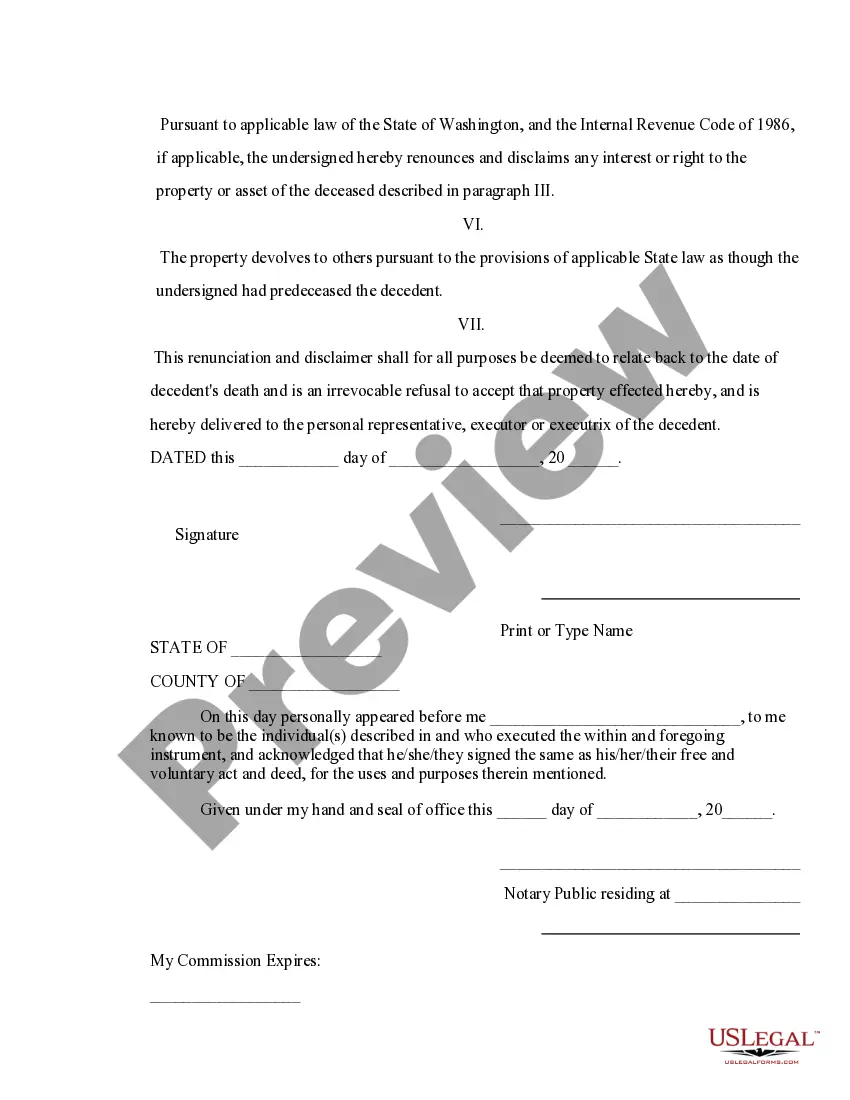

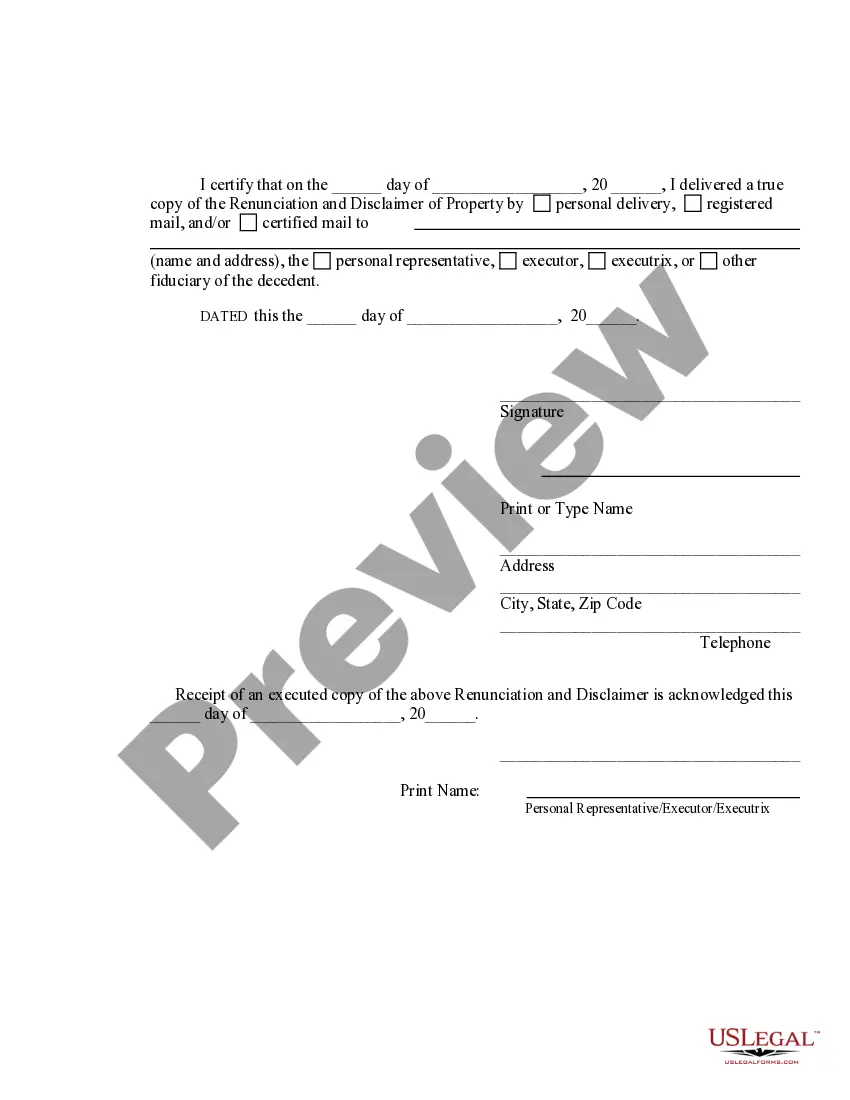

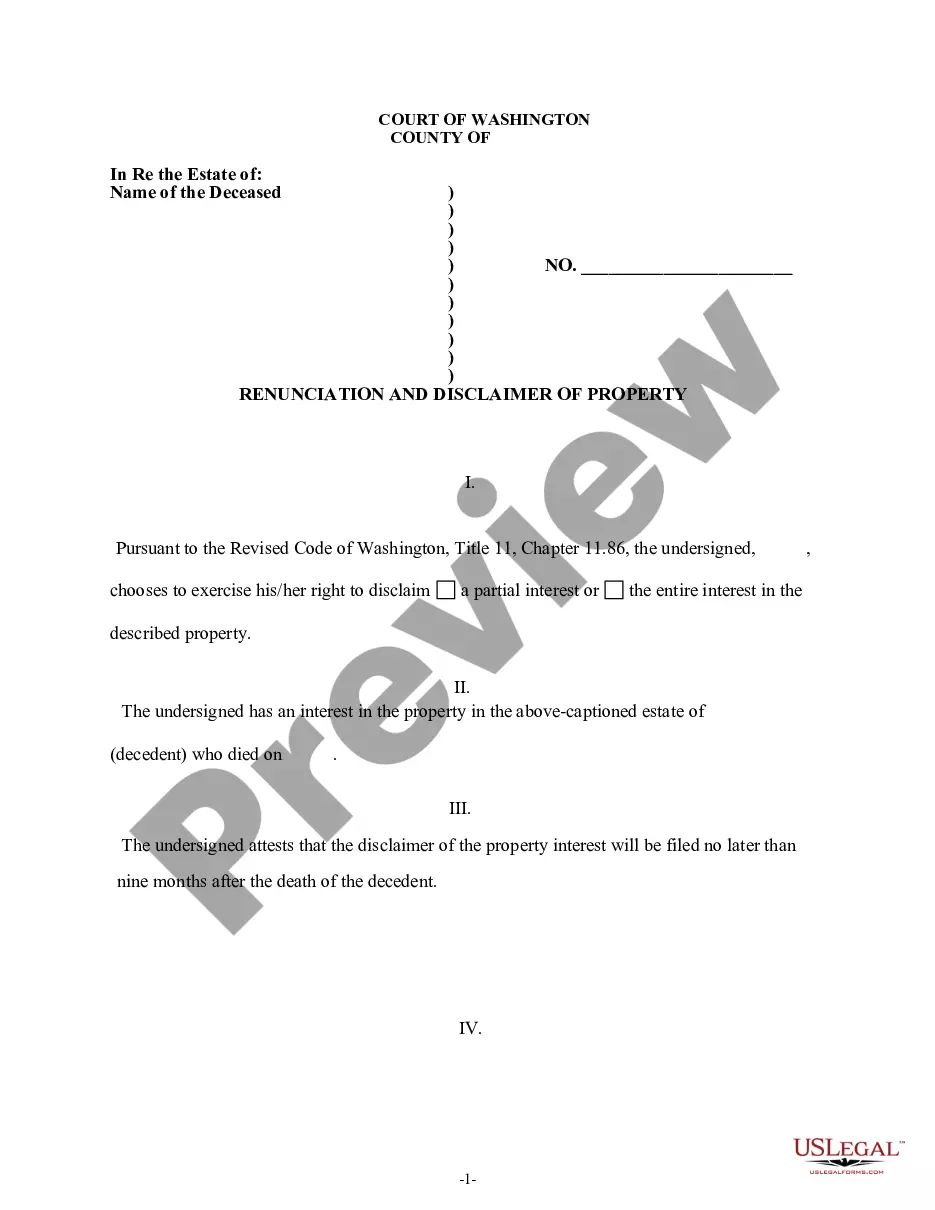

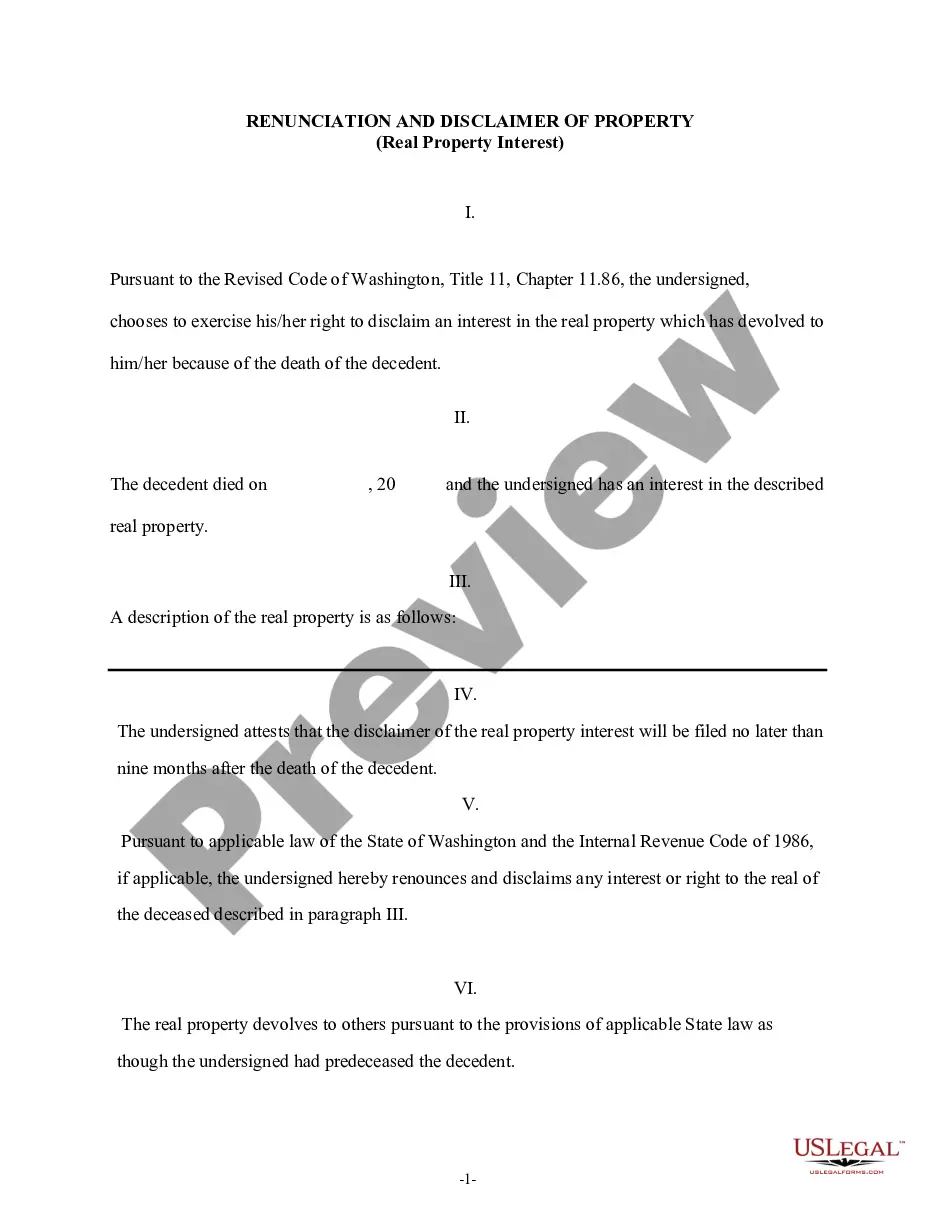

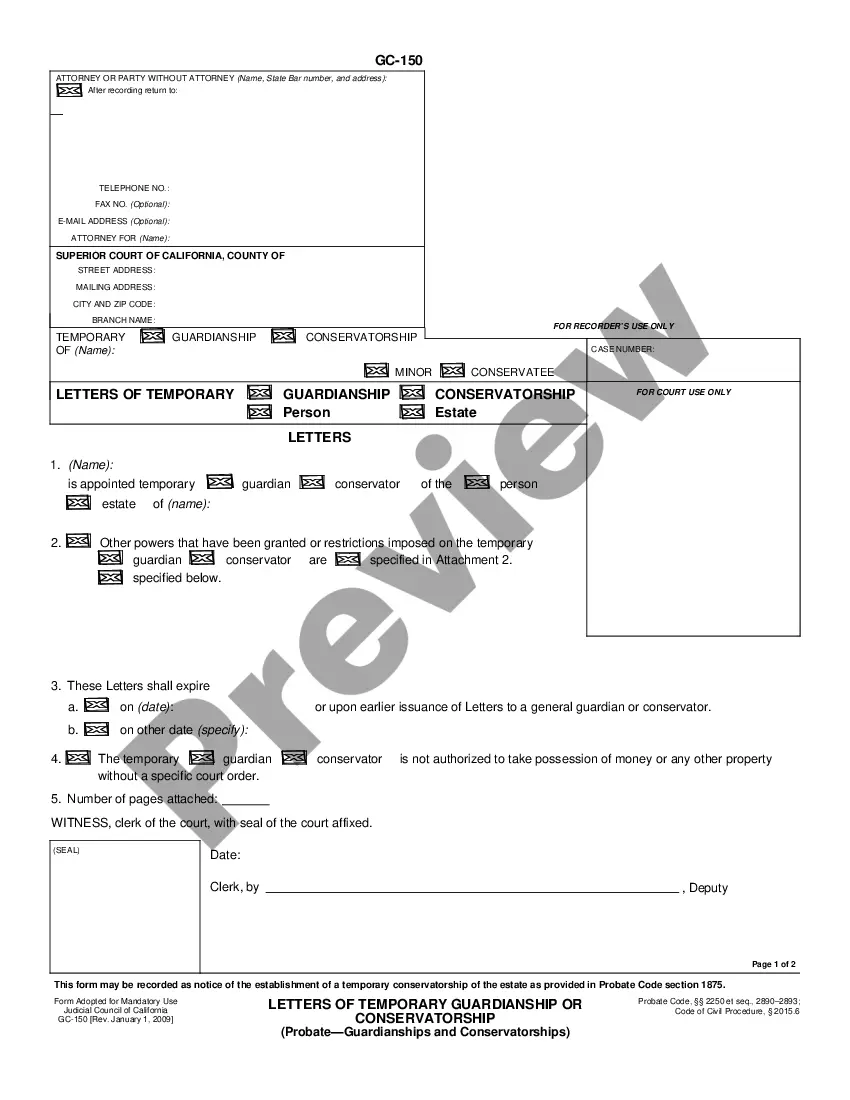

This form is a Renunciation and Disclaimer of Property acquired by Intestate Succession, where the decedent died intestate and the beneficiary gained an interest in the property, but, has chosen to disclaim a portion of or the entire interest in the property pursuant to the Revised Code of Washington, Title 11, Chapter 11.86. The disclaimer will be filed no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate to verify the delivery of the document.

King Washington Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Washington Renunciation And Disclaimer Of Property Received By Intestate Succession?

Regardless of your social or professional standing, completing legal documentation is a regrettable obligation in today’s society.

Frequently, it's nearly impossible for individuals lacking a legal background to generate such documents independently, primarily due to the intricate terminology and legal nuances involved.

This is where US Legal Forms proves to be beneficial.

Confirm that the template you have found is appropriate for your region, as the laws of one state or region do not apply to another.

Examine the form and review a brief summary (if available) of the scenarios for which the document can be utilized.

- Our service provides an extensive assortment of over 85,000 ready-to-use forms specific to each state that are suitable for nearly any legal circumstance.

- US Legal Forms serves as a valuable resource for associates or legal advisors looking to save time with our DIY documents.

- Whether you require the King Washington Renunciation And Disclaimer of Property received by Intestate Succession or any other document that is valid in your state or locale, with US Legal Forms, everything is easily accessible.

- Here’s how to swiftly obtain the King Washington Renunciation And Disclaimer of Property received by Intestate Succession using our reliable service.

- If you're an existing customer, simply Log In to your account to acquire the necessary form.

- If you are unfamiliar with our library, please follow these steps before retrieving the King Washington Renunciation And Disclaimer of Property received by Intestate Succession.

Form popularity

FAQ

To renounce an inheritance means to voluntarily decline the acceptance of assets passed down from a deceased person. This decision can be influenced by various factors, such as the potential burden of debts associated with the inheritance. In the context of the King Washington Renunciation And Disclaimer of Property received by Intestate Succession, renouncing can lead to a clear path for the distribution of the estate without complications.

An affidavit of renunciation of inheritance is a sworn statement used to formally renounce an inheritance. This document must be notarized and includes key details about the person renouncing the inheritance and the estate in question. Utilizing this affidavit can simplify the process of King Washington Renunciation And Disclaimer of Property received by Intestate Succession while strengthening its validity.

Intestate succession in Washington probate Code refers to the legal process that determines how a deceased person's property is distributed when they die without a will. This process ensures that assets are allocated according to established laws, thereby preventing confusion among heirs. Understanding the implications of intestate succession is key in considering the King Washington Renunciation And Disclaimer of Property received by Intestate Succession.

A statement of renunciation of inheritance is an official document affirming an heir's choice to refuse their inheritance. It outlines the details of the estate and the specific property being renounced. This statement is crucial in the King Washington Renunciation And Disclaimer of Property received by Intestate Succession process as it ensures all parties involved understand the heir’s decision.

The letter of renunciation serves as a formal declaration where an heir indicates that they do not wish to accept the inheritance. This letter helps clarify intentions and prevents any future disputes regarding the property, particularly under the King Washington Renunciation And Disclaimer of Property received by Intestate Succession. It is an important legal tool to facilitate the clear transfer of assets.

Renunciation of inheritance refers to the legal act of refusing an inheritance. This means you voluntarily give up your rights to inherit property from a deceased person, which is especially relevant in the context of the King Washington Renunciation And Disclaimer of Property received by Intestate Succession. This process is often used when accepting the inheritance may lead to undesirable financial obligations.

When writing a letter to renounce your inheritance, begin by addressing the estate administrator or executor. State your decision to renounce the inheritance, and provide details about the property you are renouncing. Using a clear format is crucial; this ensures your intentions regarding the King Washington Renunciation And Disclaimer of Property received by Intestate Succession are well understood.

To write a disclaimer of inheritance in King Washington, it’s essential to start with a formal written document. Clearly state your intention to renounce the inheritance and include specifics such as your name, the decedent’s name, and a description of the property involved. This document must be signed and delivered to the appropriate parties, ensuring compliance with local laws for the King Washington Renunciation And Disclaimer of Property received by Intestate Succession.

In Washington State, there is no state inheritance tax; however, federal estate taxes may apply if the estate exceeds a certain value. As of now, individuals can inherit significant amounts without incurring any taxes, thanks to adjustments in federal exemption limits. The King Washington Renunciation and Disclaimer of Property received by Intestate Succession doesn't affect your tax liability directly, but understanding your limits can help you make informed decisions about your inheritance. It's always wise to consult tax professionals to navigate these regulations effectively.

To disclaim an inheritance in Washington, you must file a written disclaimer with the local probate court. The King Washington Renunciation and Disclaimer of Property received by Intestate Succession requires that you act promptly, typically within nine months of when the inheritance becomes yours. This process confirms your decision to refuse the property or asset, ensuring it is transferred properly to the next rightful heir. For added clarity, you can utilize platforms like uslegalforms to guide you through the necessary paperwork.