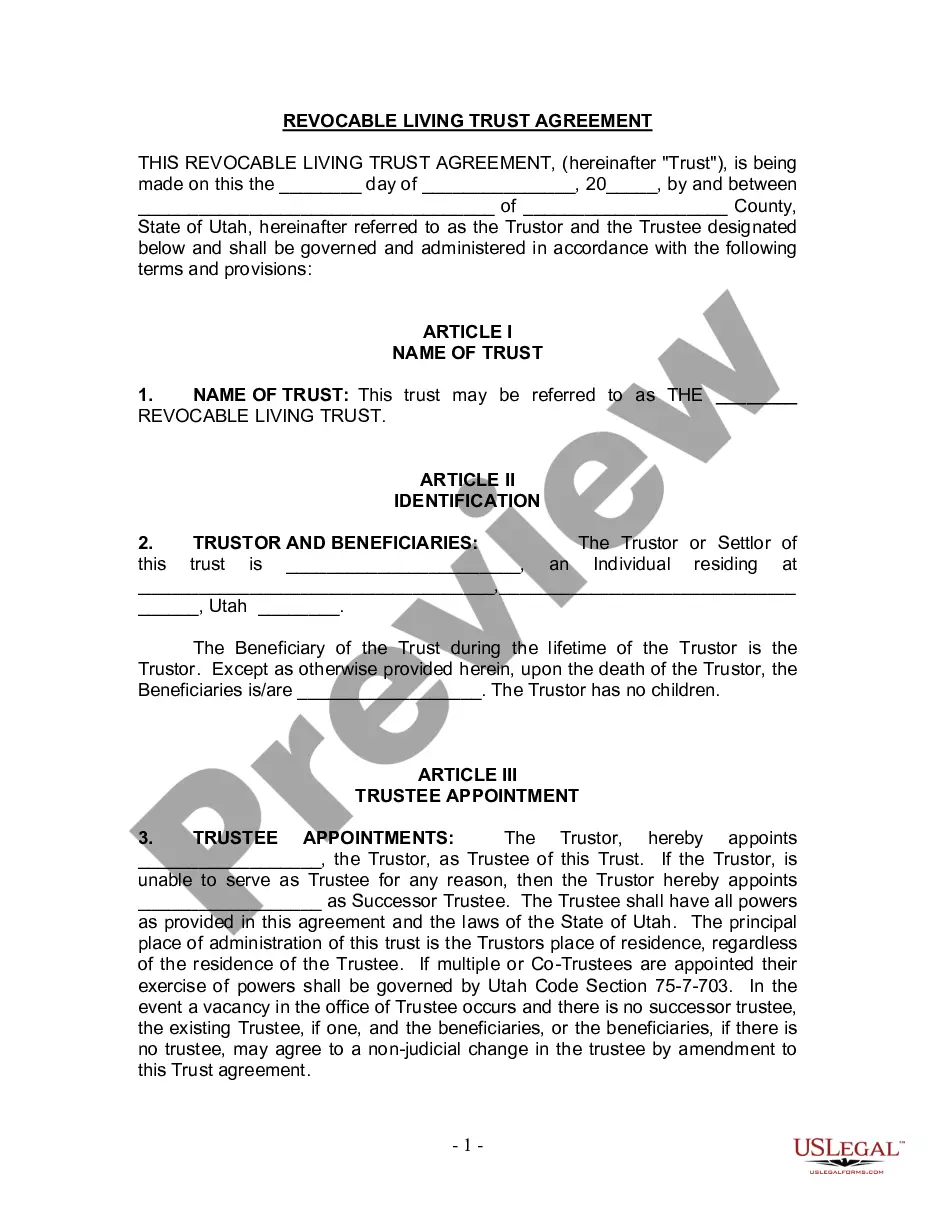

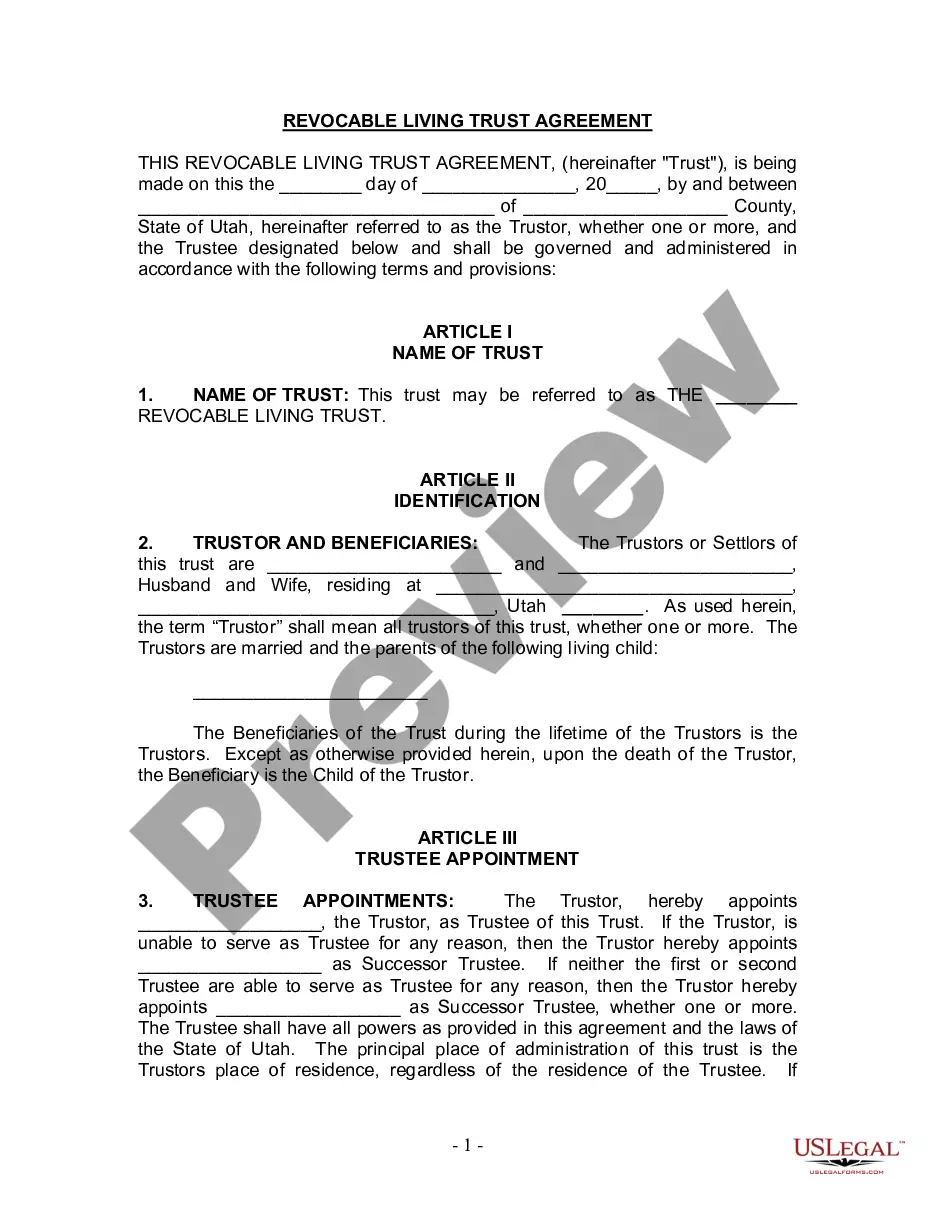

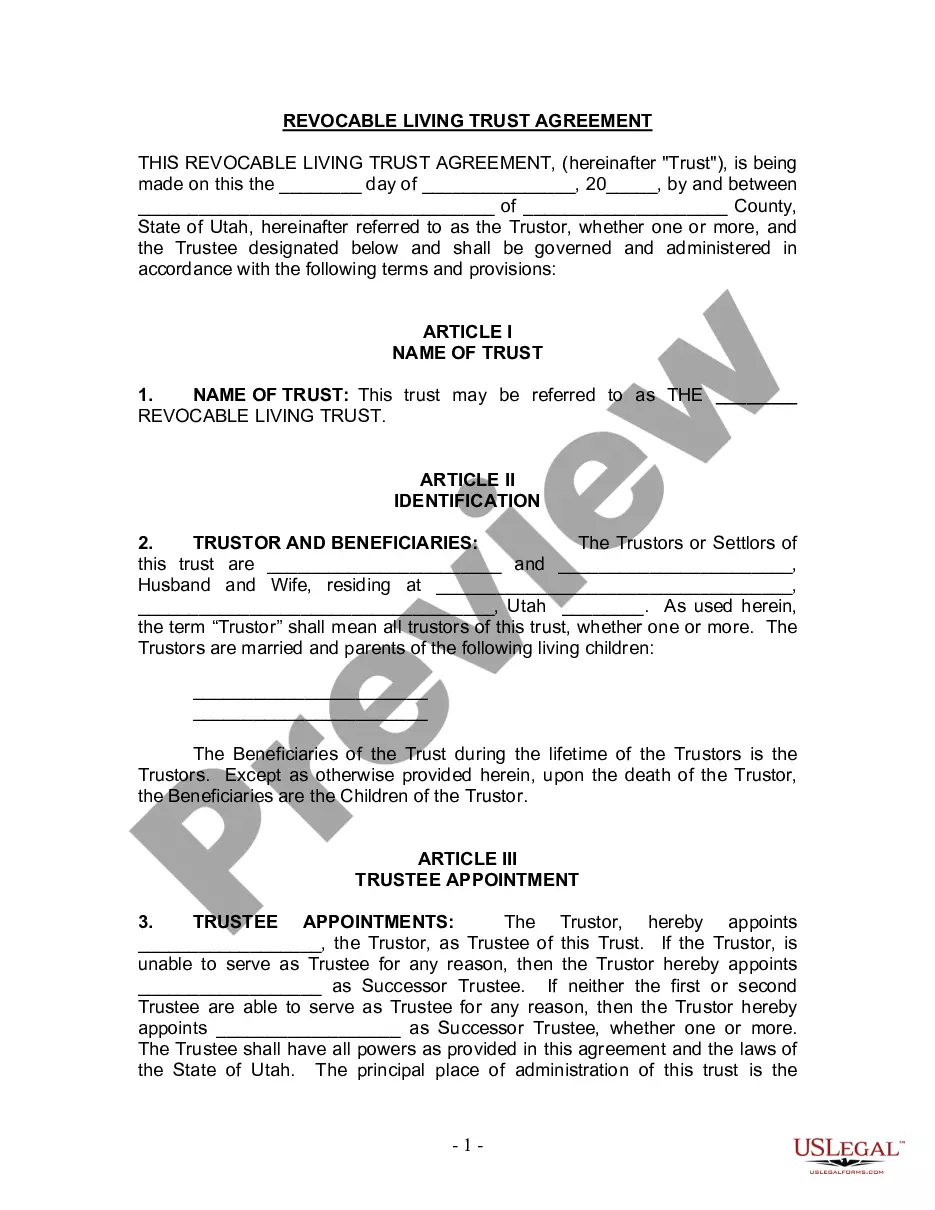

This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children

Description

How to fill out Utah Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With Children?

We consistently endeavor to diminish or avert legal repercussions when addressing intricate legal or financial issues.

To achieve this, we enlist legal services that are typically quite expensive.

Nevertheless, not every legal concern is equally complicated; many can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. Should you misplace the document, you can always re-download it from the My documents section. The procedure is just as simple if you are not familiar with the site! You can set up your account in just a few minutes. Ensure to verify if the Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children meets the laws and regulations of your state and locality. Additionally, it is essential to review the form's outline (if available), and if you notice any inconsistencies with what you originally sought, look for an alternative template. Once you've confirmed that the Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children is suitable for you, you can select a subscription plan and proceed to payment. Afterward, you can download the document in any format that is available. For over 24 years in the industry, we have assisted millions of individuals by providing customizable and current legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- Our collection empowers you to manage your affairs without the need for a lawyer.

- We offer access to legal form templates that may not always be readily available to the public.

- Our templates are tailored to specific states and regions, significantly streamlining the search process.

- Benefit from US Legal Forms whenever you require to locate and download the Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children or any other form swiftly and securely.

Form popularity

FAQ

The 5 year rule typically refers to the timeframe for certain tax implications associated with trusts. Specifically, this rule can impact how distributions affect Medicaid eligibility or tax liabilities. Understanding these guidelines is crucial when establishing a Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children to ensure you plan effectively for your financial future.

Filling out a living trust requires gathering essential documents and information about assets. You’ll need to list each asset, name beneficiaries, and appoint a trustee. Using a resource like uslegalforms can simplify the process, providing templates and guidance specifically designed for a Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children.

One of the biggest mistakes parents often make when establishing a Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children is failing to clearly outline their wishes. This can lead to confusion among beneficiaries and disputes down the line. It's crucial to be specific about how assets will be distributed and to keep the trust updated as circumstances change.

While placing your home in a trust offers benefits, there are some disadvantages to consider. For instance, transferring your property into a Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children may incur costs and require legal paperwork. Furthermore, the trust may affect eligibility for certain financial assistance programs, as it can be viewed as an asset. It's advisable to consult with a legal expert to understand these implications.

The primary purpose of a living trust is to manage your assets during your lifetime and dictate their distribution after your death. By creating a Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children, you can ensure that your children receive your assets without the delays of probate. This trust also allows you to maintain control over your assets should you become incapacitated. Essentially, it provides peace of mind and clarity for your loved ones.

Some individuals may choose not to set up a trust due to the associated costs and time. For example, creating a Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children requires legal fees and ongoing management. Additionally, a trust might not be necessary if your assets are minimal or if you have straightforward estate plans. It's essential to evaluate your unique situation before deciding.

In Utah, trusts must comply with state laws, which include specific requirements for creation, modification, and termination. Trusts must be in writing, and the settlor must have the legal capacity to create one. If you are considering a Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children, understanding these rules will help you navigate the process effectively.

Yes, you can create your own trust in Utah, but it is crucial to understand the legal requirements involved. While there are many resources available, working with a professional can help ensure that your Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children is created correctly. Platforms like uslegalforms can provide templates and guidance to streamline this process.

A marital trust is designed to provide benefits to a surviving spouse, allowing them to access the trust assets during their lifetime. In contrast, a survivor's trust typically holds assets for the benefit of children or other beneficiaries after the death of the individual. Understanding these differences is essential, especially if you are considering a Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children.

A widow's trust is a specific type of estate planning tool designed to provide financial support and security for a widow or widower. This trust allows the individual to manage their assets and provide for their children while ensuring that their estate is distributed according to their wishes. If you're exploring a Provo Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children, a widow's trust can be a valuable solution.