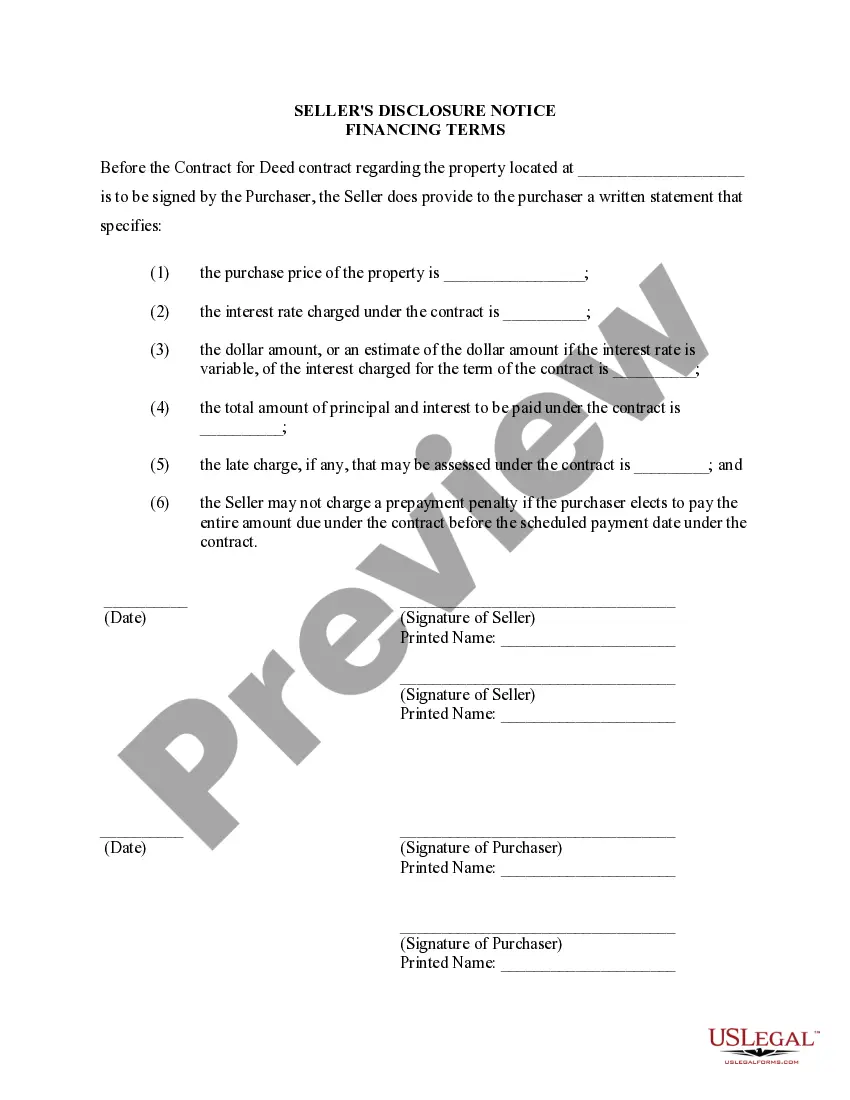

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Salt Lake Utah Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Utah Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

We constantly aim to reduce or evade legal complications when engaging with intricate law-related or financial issues.

To achieve this, we enroll in legal services that are typically very expensive.

However, not every legal trouble is necessarily intricate. Many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions. Our collection empowers you to handle your affairs independently without needing legal representation.

You can set up your account in just a few minutes.

- Utilize US Legal Forms whenever you need to locate and download the Salt Lake Utah Seller's Disclosure of Financing Terms for Residential Property related to Contract or Agreement for Deed a/k/a Land Contract or any other documentation swiftly and securely.

- Simply Log In to your account and select the Get button next to it.

- If you happen to lose the form, you can always retrieve it again from the My documents tab.

- The process is equally simple if you’re new to the website!

Form popularity

FAQ

The current list of non-disclosure states includes Alaska, Idaho, Kansas, Louisiana, Mississippi, Missouri (some counties), Montana, New Mexico, North Dakota, Texas, Utah, and Wyoming.

Must-have contract financing terms such as loan payment amounts, interest, taxes, insurance, and additional fees....Spell out the big numbers: How much are you willing to lend? The agreed-upon sales price. The non-refundable deposit amount. The remaining loan balance.

For a sale to close properly in Utah, the seller must, legally, disclose certain conditions about the home to the prospective buyer. No seller wants to face legal repercussions for inadequately disclosing property defects.

In Utah, sellers do not have to disclose up front if a felony crime or death, violent or natural, took place at the home.

Texas, Alaska, Missouri, Louisiana and Mississippi, in addition to Utah and Idaho, are considered non-disclosure states, potentially costing those states millions of dollars in property taxes and giving players in the real estate market a monopoly on information.

But, there are 12 states that are still considered ?non-disclosure:? Alaska, Idaho, Kansas, Louisiana, Mississippi, Missouri (some counties), Montana, New Mexico, North Dakota, Texas, Utah and Wyoming.

In Utah, a seller can get out of a real estate contract if the buyer's contingencies are not met?these include financial, appraisal, inspection, insurance, or home sale contingencies agreed to in the contract. Sellers might have additional exit opportunities with unique situations also such as an estate sale.

Any ongoing problems with neighbours, including boundary disputes. Any neighbours known to have been served an Anti Social Behaviour Order (ASBO) Whether there have been any known burglaries in the neighbourhood recently. Whether any murders or suicides have occurred in the property recently.