This memorandum offers an overview of the Initial Public Offering ("IPO") for a high-tech company. It addresses issues relating to the company, its disclosure policy, stock plans, insider trading policies and other "big picture" aspects of going public.

King Washington Comprehensive Pre-IPO Memo for High-Tech Companies

Description

How to fill out Comprehensive Pre-IPO Memo For High-Tech Companies?

How long does it generally require for you to draft a legal document.

Since each state has its own laws and regulations pertaining to every aspect of life, finding a King Comprehensive Pre-IPO Memo for High-Tech Companies that meets all local requirements can be exhausting, and hiring a professional lawyer is frequently expensive.

Various online platforms provide the most sought-after state-specific documents for download, but utilizing the US Legal Forms repository is the most beneficial.

Click Buy Now once you are certain about the selected document.

- US Legal Forms is the largest online directory of templates, organized by states and categories of use.

- Besides the King Comprehensive Pre-IPO Memo for High-Tech Companies, you can find any particular form to manage your business or personal matters, adhering to your local regulations.

- Professionals verify all samples for their accuracy, ensuring you can prepare your paperwork correctly.

- Employing the service is extremely straightforward.

- If you already possess an account on the platform and your subscription is active, you simply need to Log In, choose the required sample, and download it.

- You can retrieve the document in your account whenever in the future.

- If you are a newcomer to the platform, there will be several additional steps to finish before obtaining your King Comprehensive Pre-IPO Memo for High-Tech Companies.

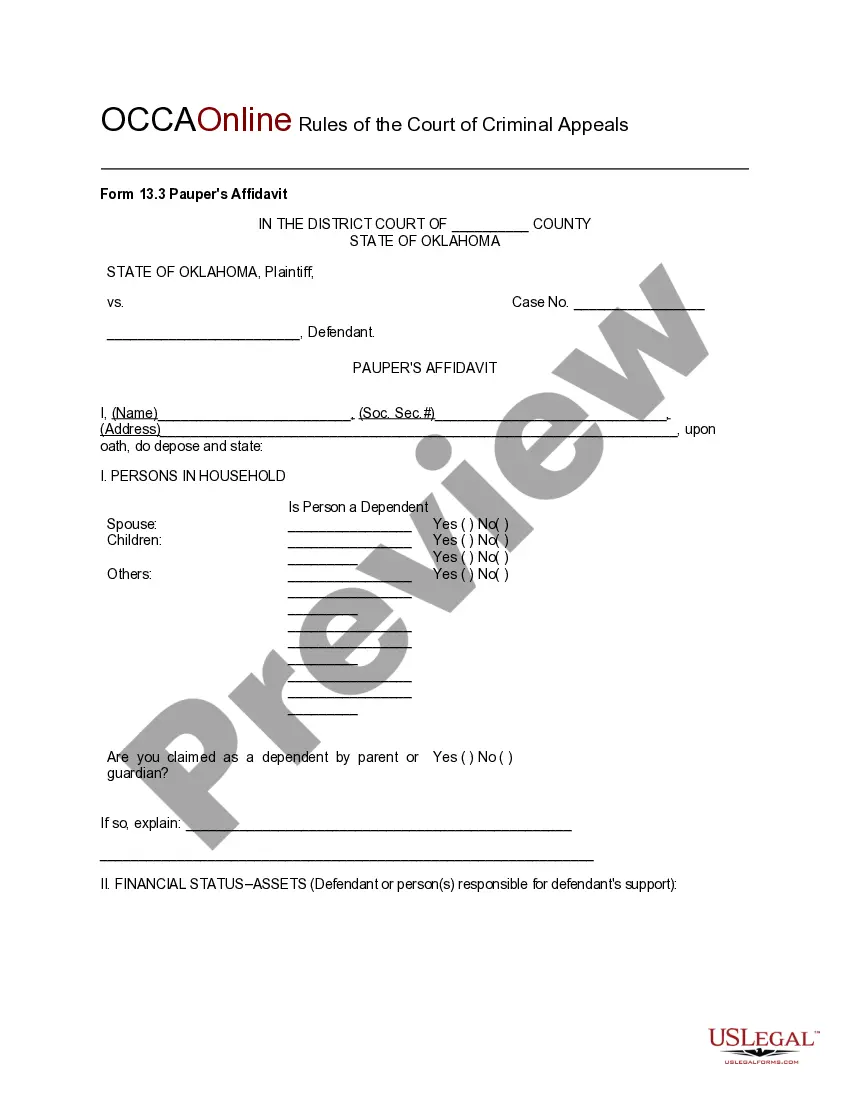

- Examine the contents of the page you are visiting.

- Review the description of the sample or Preview it (if available).

- Search for another form using the appropriate option in the header.

Form popularity

FAQ

Pre-applying for IPO shares can be beneficial, as it positions you to potentially gain shares before they become publicly available. However, it's essential to assess the company's performance and market conditions. The King Washington Comprehensive Pre-IPO Memo for High-Tech Companies offers valuable insights that can help you determine whether pre-applying aligns with your investment strategy.

Steps for buying an IPO stock Have an online account with a broker that offers IPO access. Brokers like Robinhood and TD Ameritrade offer IPO trading, so you'll need an account with them or another broker that offers similar access. Meet eligibility requirements.Request shares.Place an order.

Orders for new listings (IPO) and re-listed scrip's can be placed /modified /cancelled in the Call auction in Pre Open session. Exchange Call auction Pre Open session for IPOs (New listing) and Re-listed Scrips Order Matching & Confirmation Period.

Use a Specialized Broker Brokers and financial advisors often take part in pre-IPO trades. They may have acquired stocks that they are willing to sell or represent sellers who seek buyers. You can ask your current broker about pre-IPO stocks or use a broker that specializes in pre-IPO sales.

The day before the IPO, the underwriters and board of directors of the company set the final offering price. The underwriters and company agree on a final price by analyzing the offers received from institutional investors.

The pre-IPO transformation stage is a restructuring phase when a private company sets the groundwork for becoming publicly-traded. Since the main focus of public companies is to maximize shareholder value, the company should acquire management that has experience doing that.

IPO Process Steps: Step 1: Hiring Of An Underwriter Or Investment Bank.Step 2: Registration For IPO.Step 3: Verification by SEBI:Step 4: Making An Application To The Stock Exchange.Step 5: Creating a Buzz By Roadshows.Step 6: Pricing of IPO.Step 7: Allotment of Shares.

Can You Buy Pre-IPO Stock? Pre-IPO stocks are sold as private placements before the IPO is held. They are sold in large blocks of shares before the listing, so the average retail investor may not be able to buy pre-IPO stock.

IPO preparation process Develop a Strong Understanding of Your Index. Any equity index comes with its own requirements.Put Together Your IPO Team. A good team is as important for an IPO as it is for due diligence.Construct a Board of Directors.Get the Timing Right.Preparing the Roadshow.Ongoing Communication.

Following an IPO, the company's shares are traded on a stock exchange. Some of the main motivations for undertaking an IPO include: raising capital from the sale of the shares, providing liquidity to company founders and early investors, and taking advantage of a higher valuation.