Columbus Ohio Bankruptcy Assessment Survey

Instant download

Description

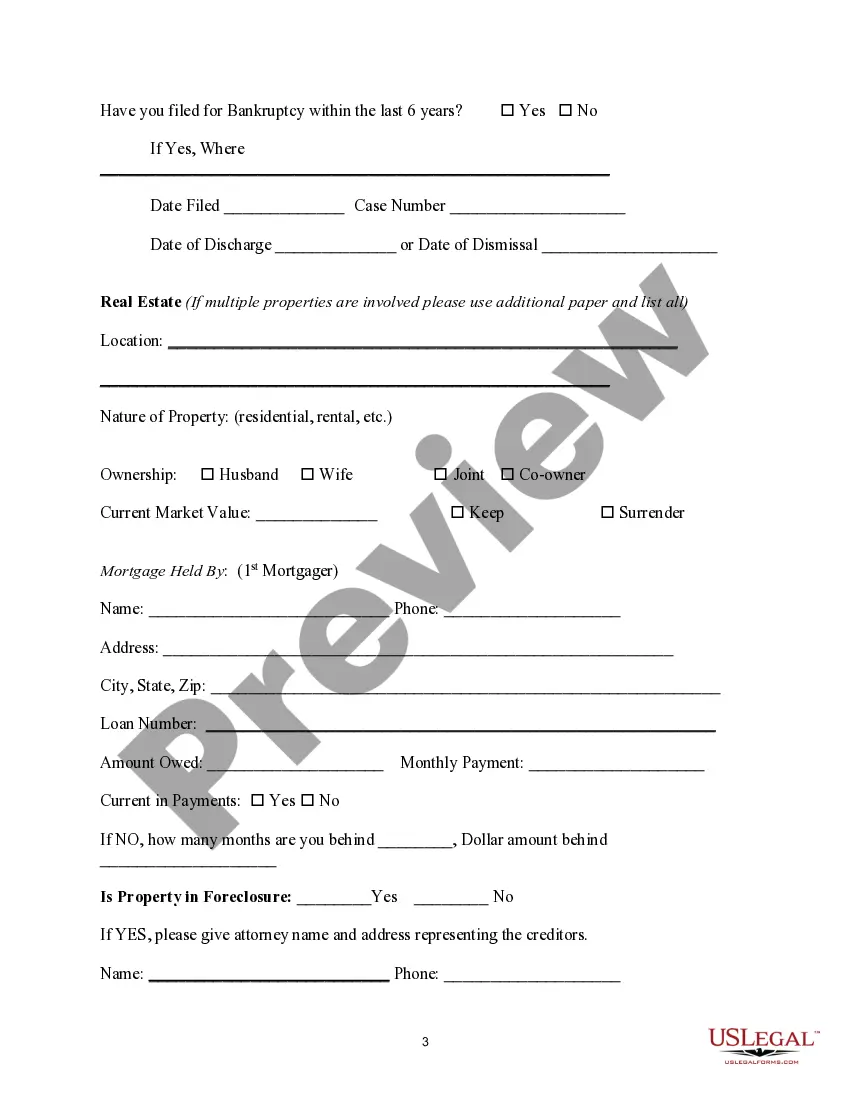

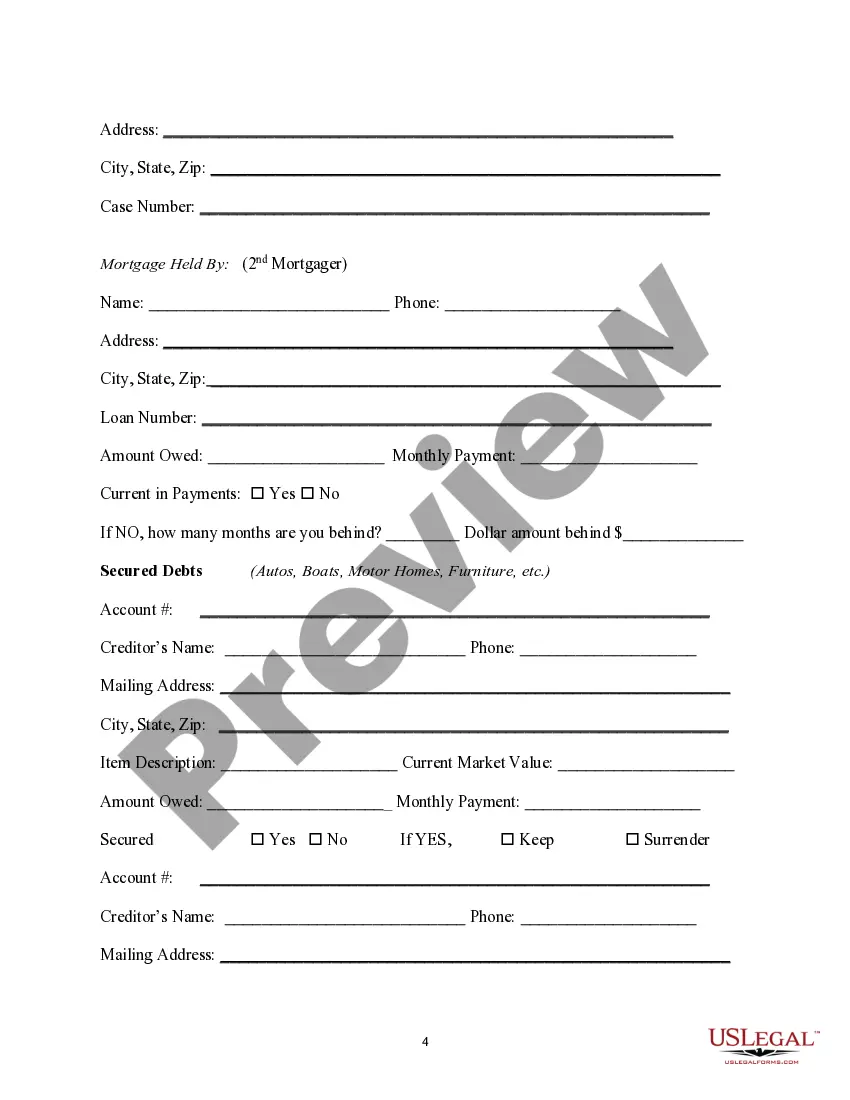

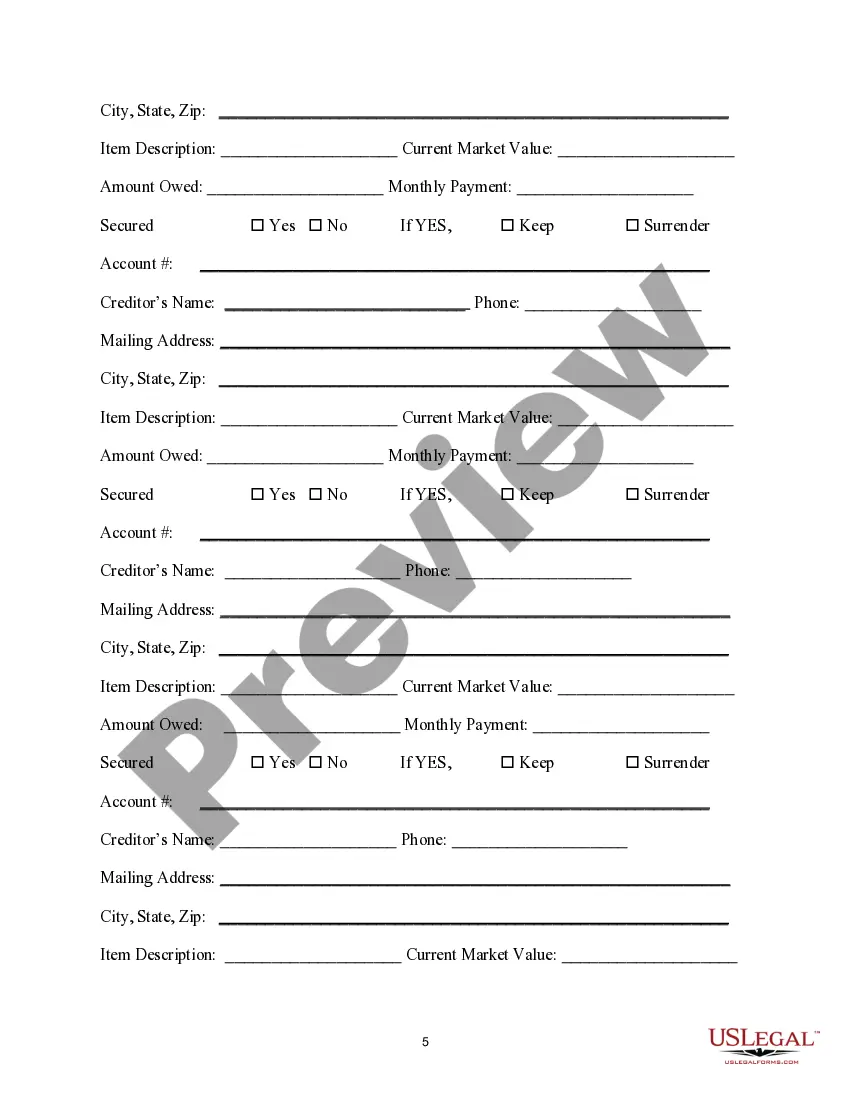

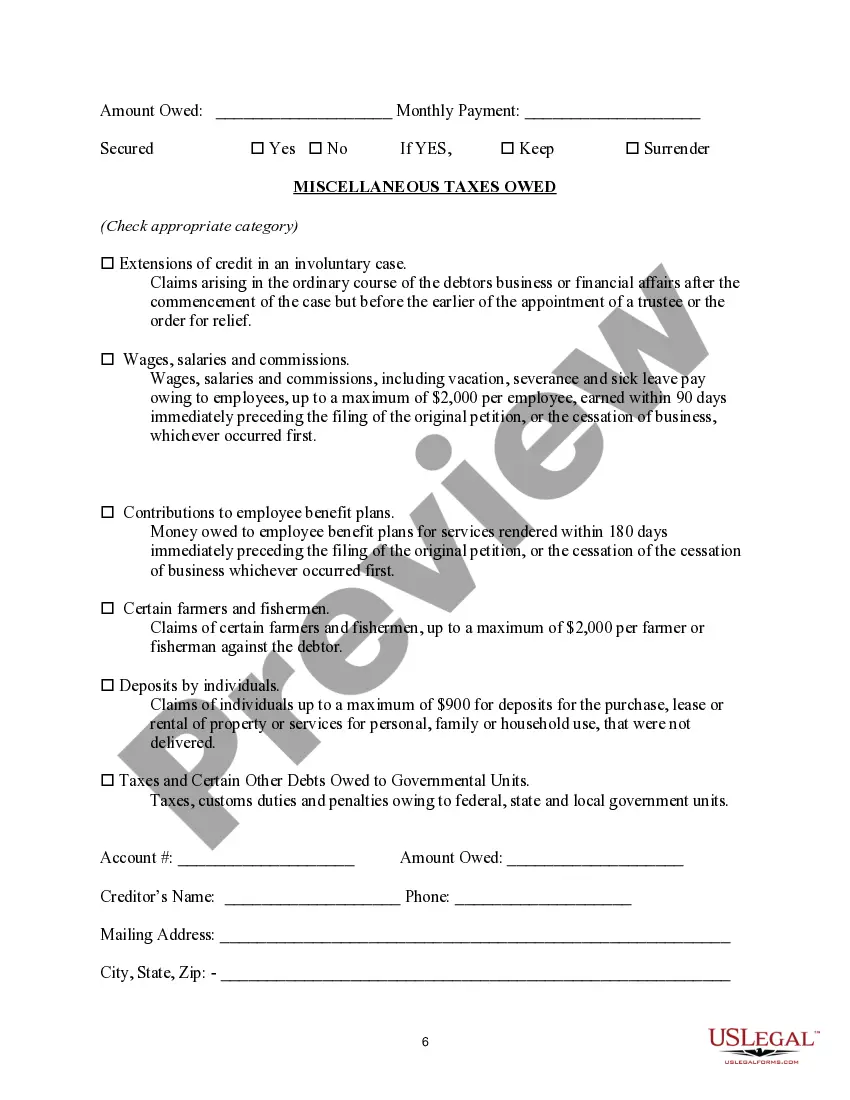

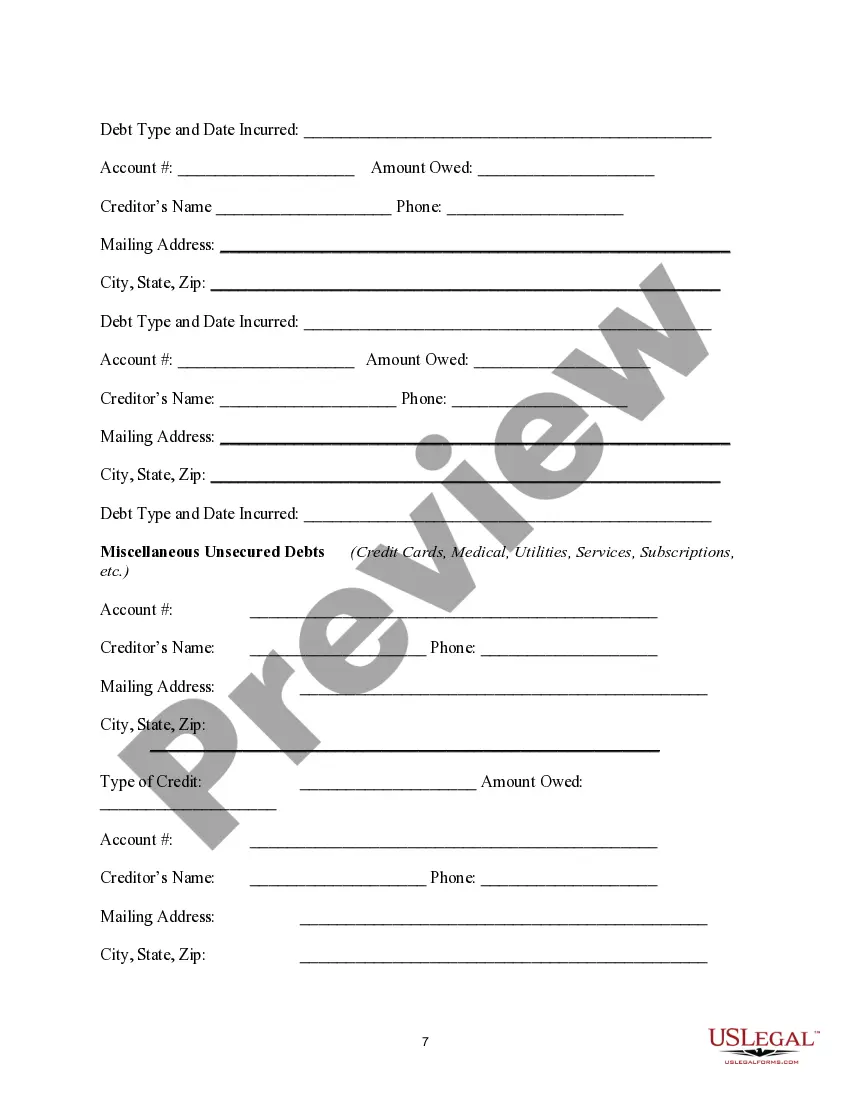

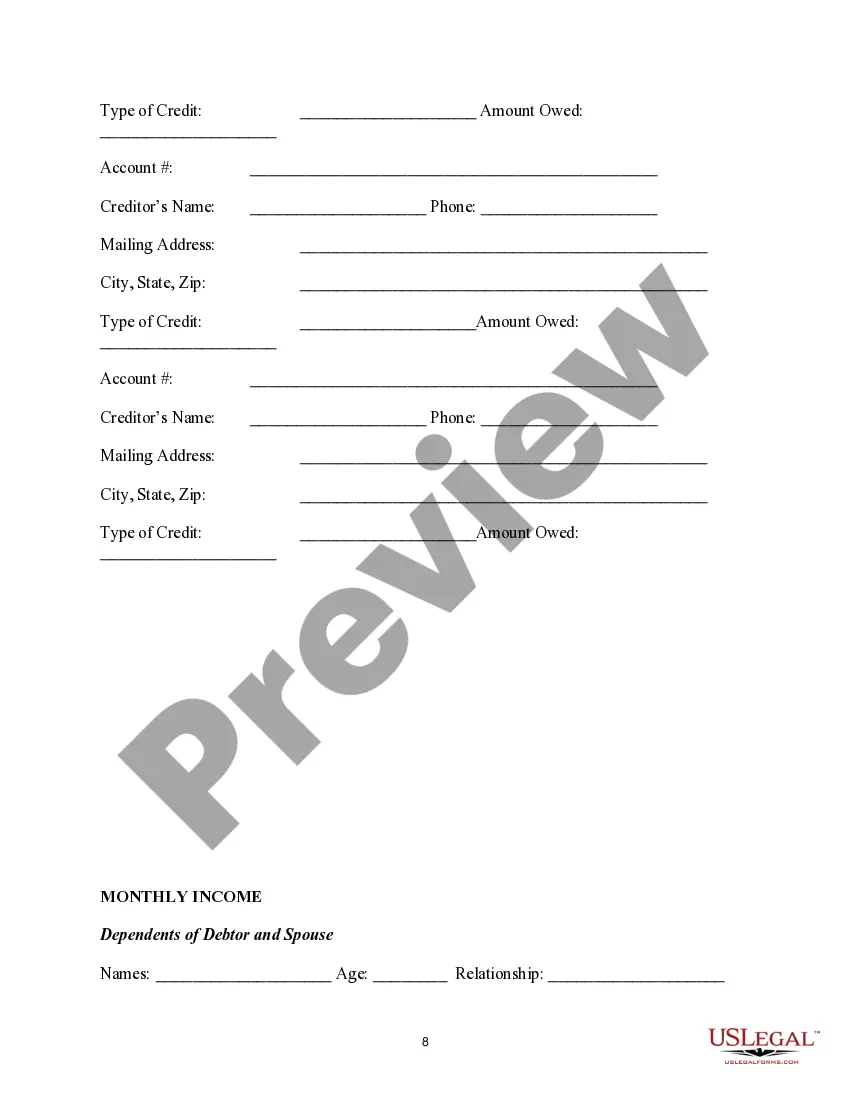

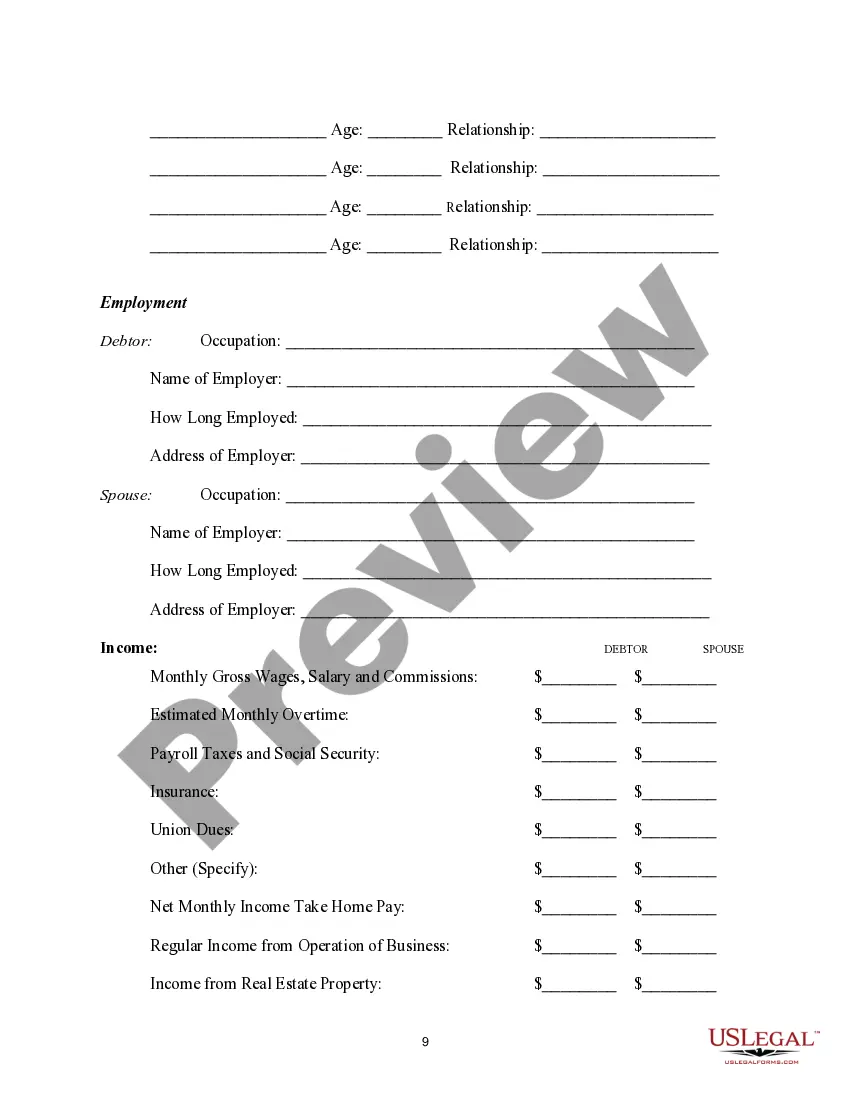

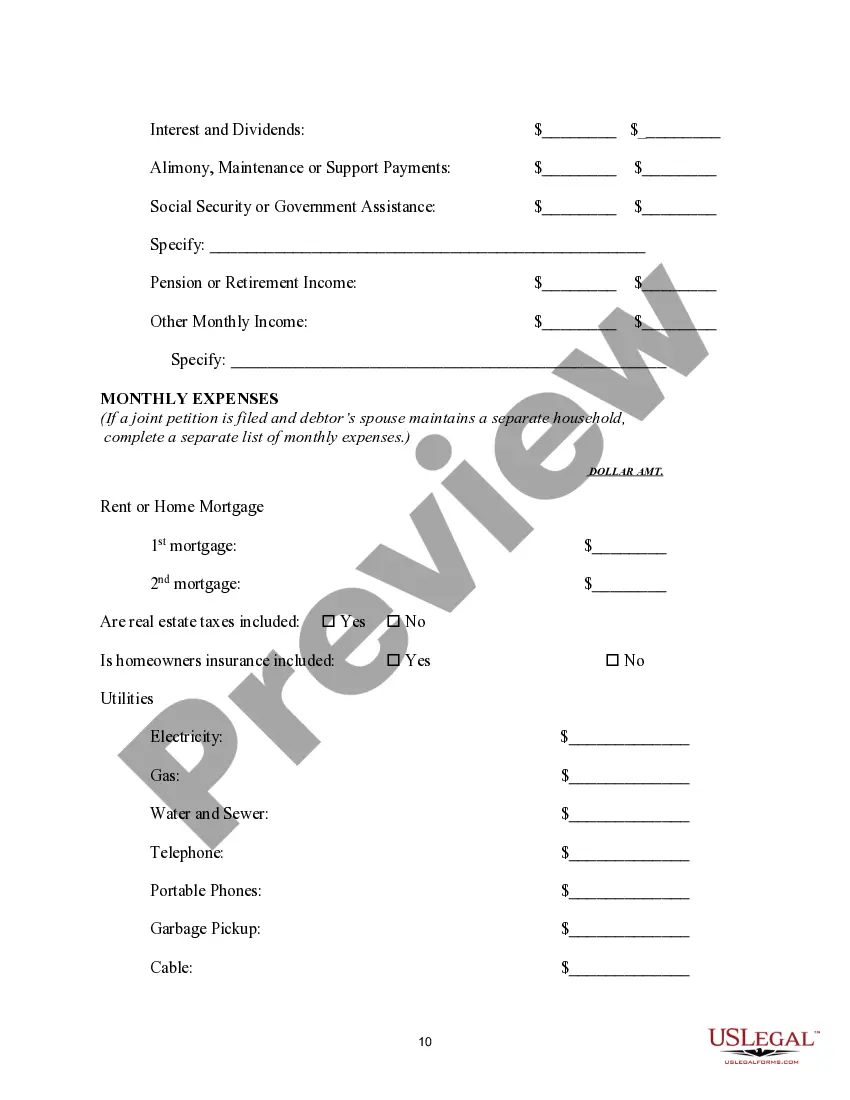

This form is an initial screening questionnaire for the purpose of trying to catch some of the problems that might make a bankruptcy more difficult for you.

Free preview