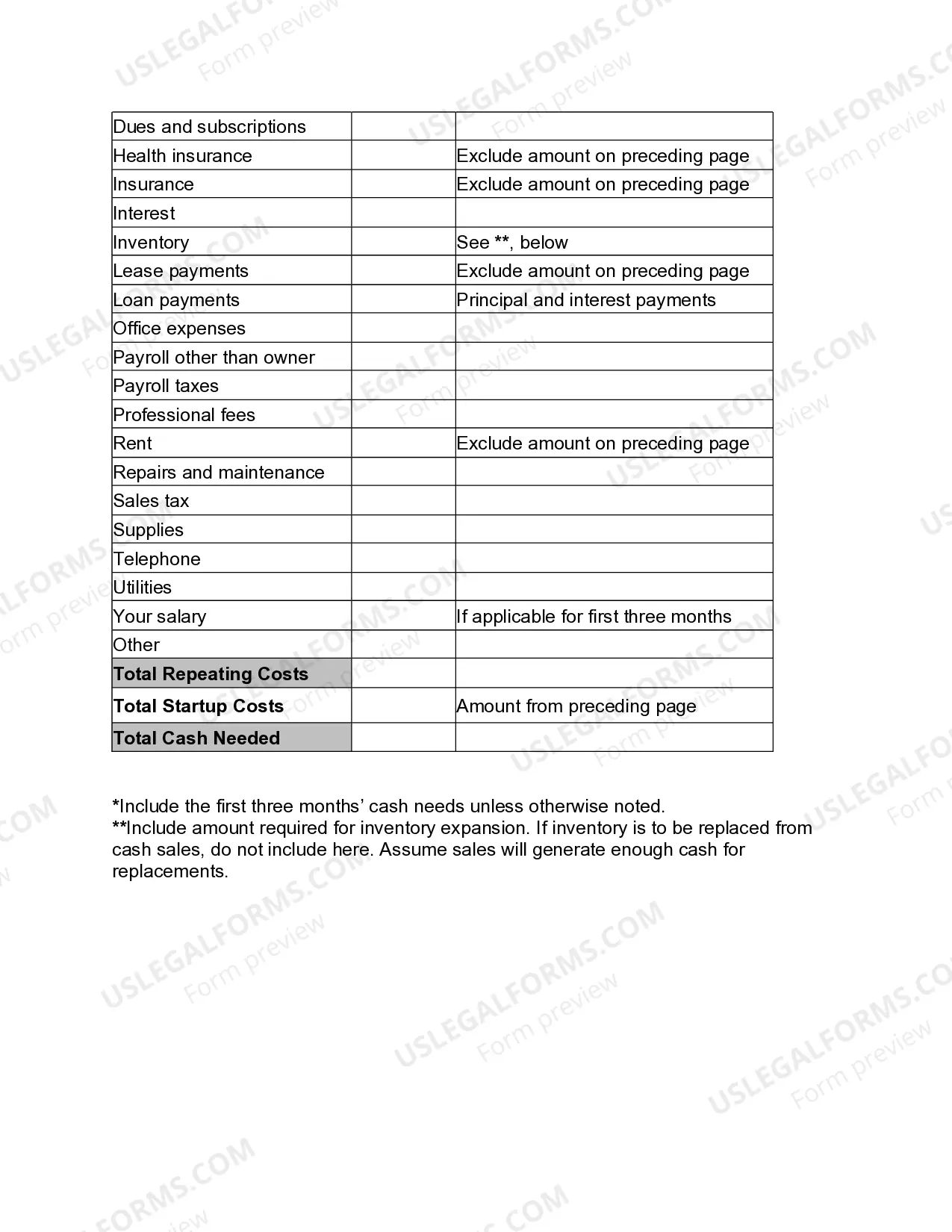

This form is an Excel spreadsheet that can be used to calculate startup costs for a new business. It includes itemized categories for funding and costs, and is a valuable tool to help plan the financial aspects of your new business.

Tarrant Texas Business Startup Costs

Description

How to fill out Business Startup Costs?

If you are searching for a trustworthy legal document provider to obtain the Tarrant Business Startup Costs Spreadsheet, your search ends here at US Legal Forms. Whether you are looking to establish your LLC business or oversee your asset allocation, we have you covered. You don't need to be an expert in law to find and retrieve the suitable template.

You can easily type in a search or explore the Tarrant Business Startup Costs Spreadsheet, either by a keyword or by the state/county for which the form is intended. Once you locate the required template, you can Log In and download it or store it in the My documents section.

Don't possess an account? It's straightforward to get started! Just find the Tarrant Business Startup Costs Spreadsheet template and review the form's preview and description (if available). If you're satisfied with the template’s wording, proceed and click Buy now. Create an account and select a subscription option. The template will be instantly available for download once the payment is processed.

Now you can complete the form. Managing your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive selection of legal documents makes these tasks less costly and more budget-friendly.

Establish your first business, organize your advance care planning, draft a real estate agreement, or finalize the Tarrant Business Startup Costs Spreadsheet - all from the comfort of your couch. Sign up for US Legal Forms today!

- You can choose from over 85,000 documents organized by state/county and circumstance.

- The intuitive interface, a range of supportive materials, and a committed support team make it simple to find and handle various documents.

- US Legal Forms is a dependable service delivering legal templates to millions of users since 1997.

Form popularity

FAQ

Startup costs are the expenses incurred during the process of creating a new business. Pre-opening startup costs include a business plan, research expenses, borrowing costs, and expenses for technology. Post-opening startup costs include advertising, promotion, and employee expenses.

In short, the steps to create an expense sheet are: Choose a template or expense-tracking software. Edit the columns and categories (such as rent or mileage) as needed. Add itemized expenses with costs. Add up the total. Attach or save your corresponding receipts. Print or email the report.

The less you need for your business startup, the sooner you can start making a profit. Step 1 - Plan for "Day One" of Your Business Startup. Step 2 - Estimate Monthly Fixed and Variable Expenses. Step 3 - Estimate Monthly Sales. Step 4 - Create a cash flow statement. Tips for Creating Your Business Startup Budget.

You can create a budget for your startup in seven simple steps: Determine all your essential one-time costs and capital expenditures. List all your fixed and variable monthly expenses. Estimate funding from investments, bank loans, and savings. Estimate your expected monthly revenue. Calculate a break-even point.

Your worksheet should list all the facilities costs, equipment, initial supplies and materials, advertising materials, and miscellaneous costs you need to open your business. Once you understand all of the cost categories involved, you can verify that your plan has captured all of the expenses needed to get started.

How to calculate startup costs Identify your expenses. Start by writing down the startup costs you've already incurred but don't stop there.Estimate your costs. Once you've developed a list of your business needs, note the average cost for each category.Do the math.Add a cushion.Put the numbers to work.

In other words, the money you spend for advertising, training employees, legal and accounting expenses and other pre-opening costs are accumulated into one lump-sum "startup costs" and recorded as an asset on your balance sheet.

Under Generally Accepted Accounting Principles, you report startup costs as expenses incurred at the time you spend the money. Some of your initial expenses, such as buying equipment, are not classified as startup costs under GAAP and have to be capitalized, not expensed.

According to the U.S. Small Business Administration, most microbusinesses cost around $3,000 to start, while most home-based franchises cost $2,000 to $5,000. While every type of business has its own financing needs, experts have some tips to help you figure out how much cash you'll require.

Examples of startup costs include licensing and permits, insurance, office supplies, payroll, marketing costs, research expenses, and utilities.