Aurora Colorado Mortgage Modification Agreement

Category:

State:

Multi-State

City:

Aurora

Control #:

US-RE-MOR-102

Format:

Word;

Rich Text

Instant download

Description

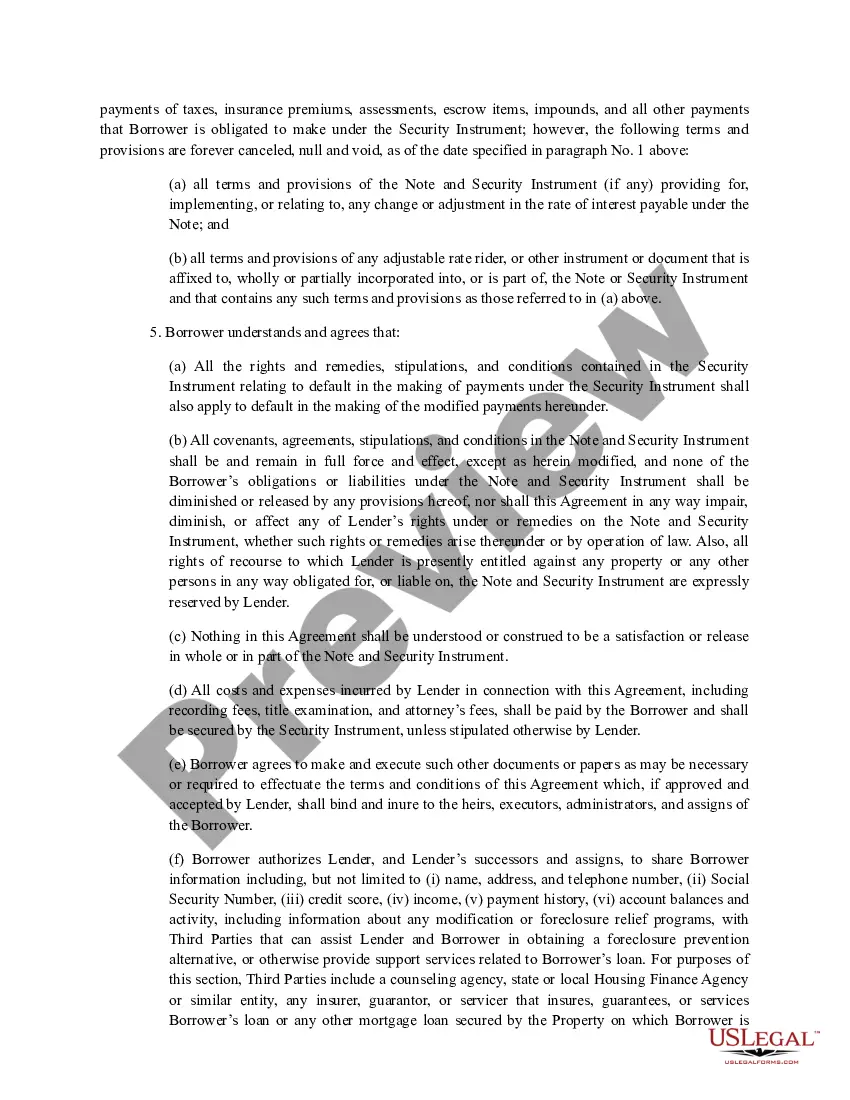

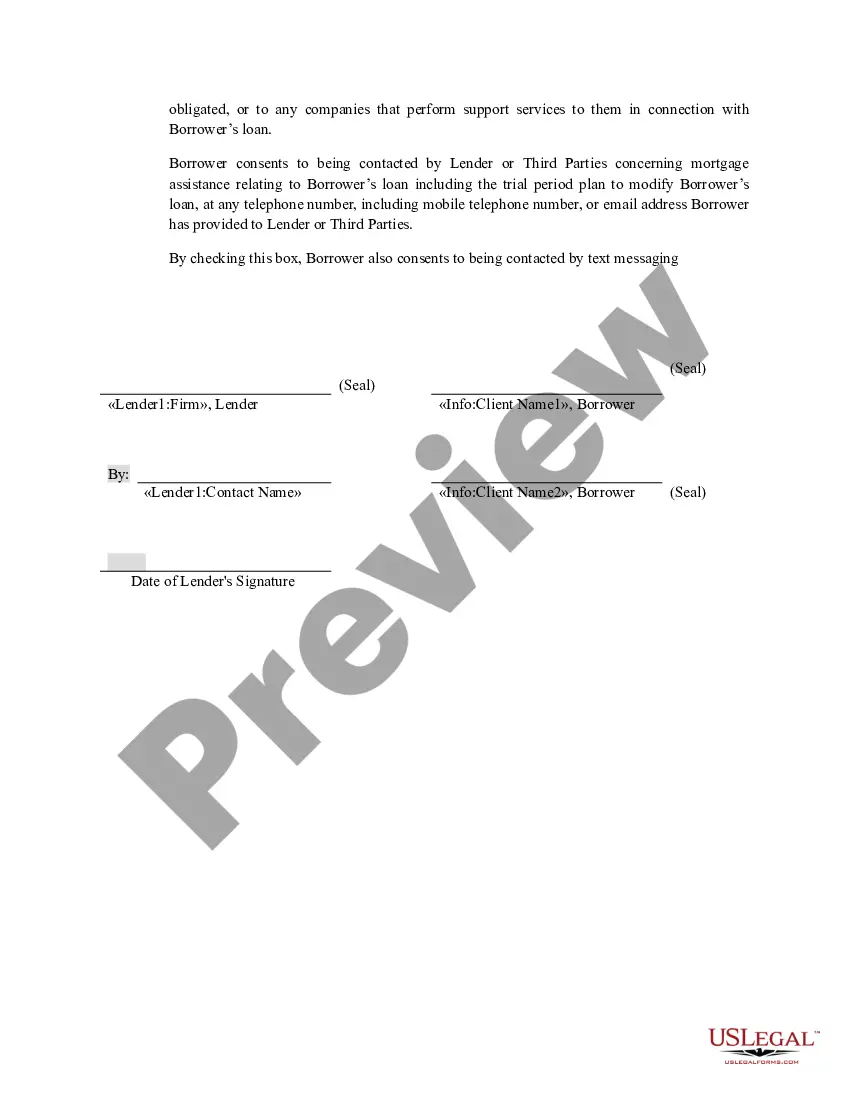

This document allows for the borrower and the lender to amend and supplement the mortgage, Deed of Trust or Deed to Secure Debt concerning the real and personal property described in the document.

Free preview