Raleigh North Carolina Form of Assignment and Assumption - Assumption by Borrower

Category:

State:

Multi-State

City:

Raleigh

Control #:

US-RE-A-101700-1

Format:

Word;

Rich Text

Instant download

Description

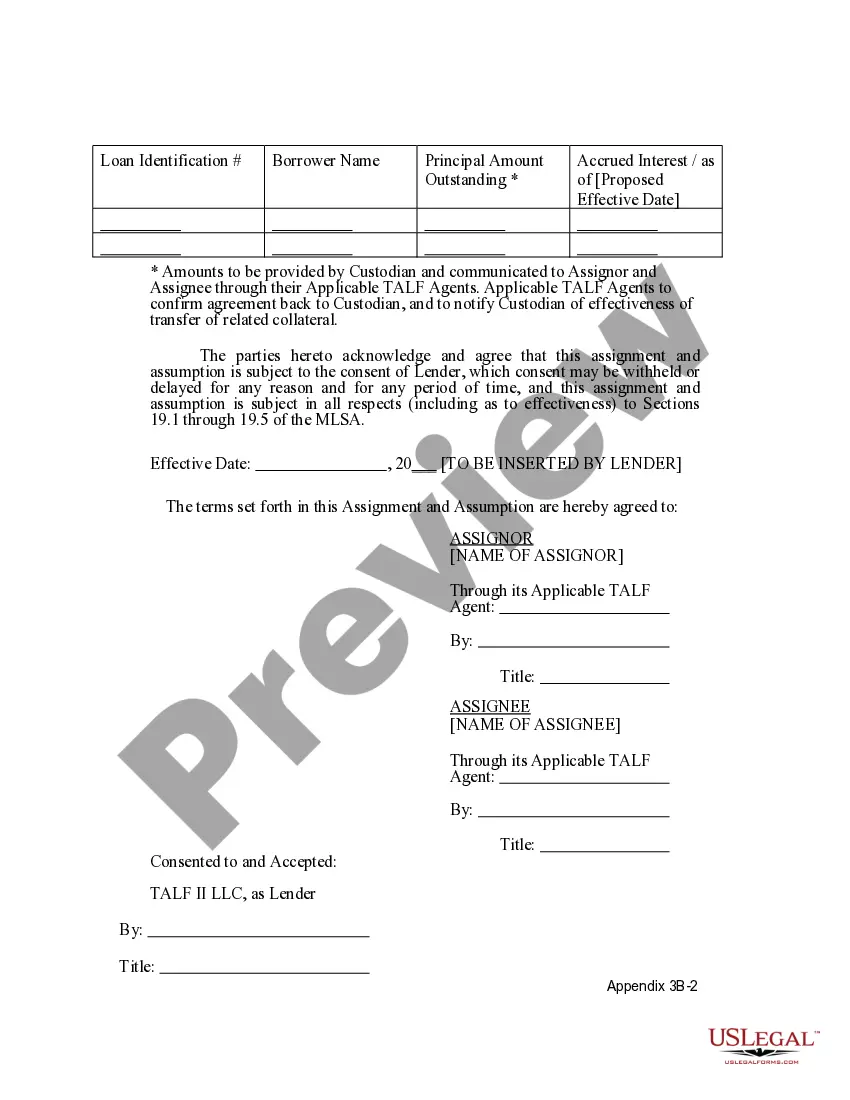

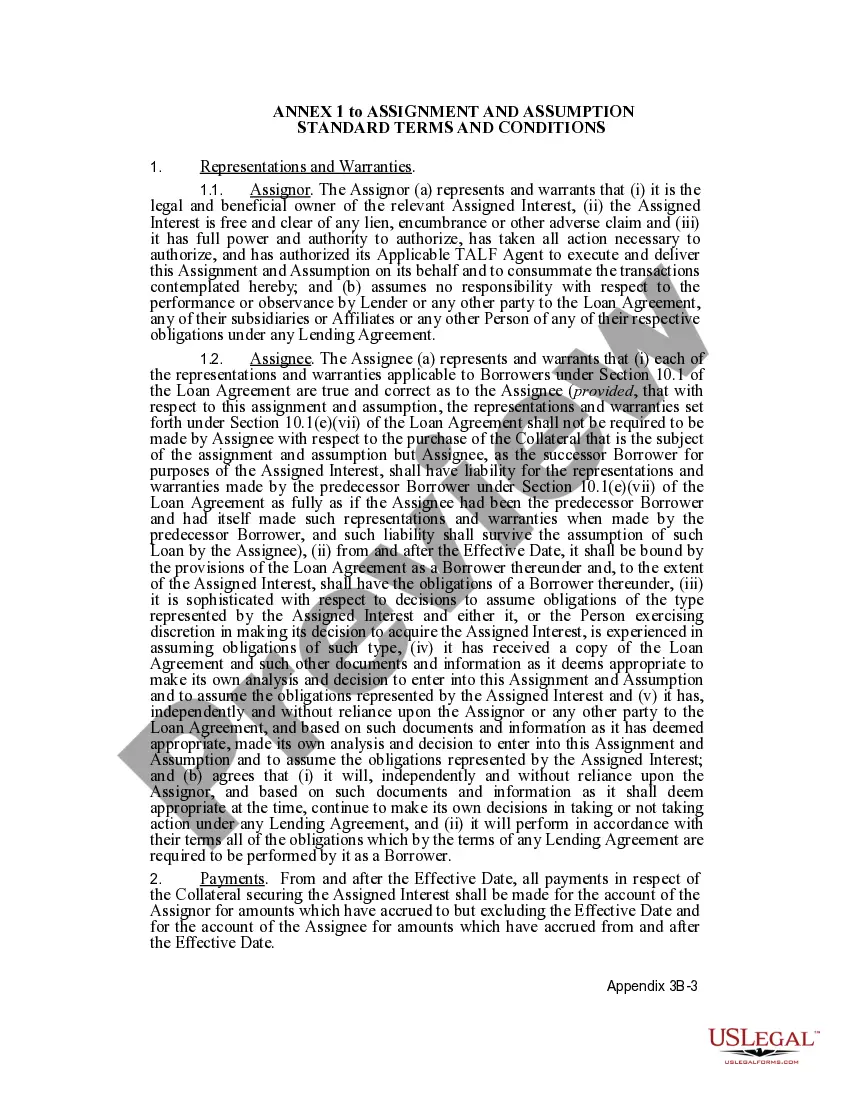

This is a sample Form of Assignment and Assumption - Assumption by Borrower. An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract. The form may be customized to suit your needs.

Free preview